Here’s what biotech Imugene needs to do before it can become a multibagger again

When will Imugene hit the pay dirt for investors? Picture Getty Image

- The Imugene share price surged 20x to 71c before plunging to 25c in 2022

- Here’s what the experts predict will happen to the Imugene share price in the next 12 months

- We discuss the opportunities and risks in Imugene’s pipeline

Imugene (ASX:IMU) had a breakout year in 2021, earning a spot in the benchmark ASX 200 index for the very first time.

Its share price surged over 20x in less than 24 months – from 3c in early 2020 to 67c by November 2021 – taking the valuation to an eye-watering $3.3 billion and earning the company ‘unicorn’ status.

It also made Imugene the second-biggest ASX drug developer by market cap, behind only CSL.

The company has managed to achieve that without a single cent of revenue to its name, so when the share price started tanking in 2022, investors were understandably concerned if this biotech could ever live up to its hyped up reputation.

Imugene share price today:

Fact is, along with names like Flight Centre, JB-HiFi and Kogan, Imugene has been one of the most shorted stocks on the ASX. It’s even gained a dubious reputation of being a meme stock.

But despite all that, Imugene is still one of the most sought-after biotech names for both retail and institutional investors.

The biggest question now is: what will it take for Imugene to hit the real big pay dirt for investors and more importantly, when will that be?

The case for Imugene

Boutique investment bank Roth Capital reckons that time will come within the next 12 months, predicting that IMU’s share price will almost triple during this period to 71c (from the current 25c).

Roth doesn’t expect to see any revenue for Imugene up until the end of FY23, but what it does see is potential success in the clinic for many of its drug candidates.

Jonathan Aschoff, senior research analyst at Roth, said he based the 12-month price target on a 6x multiple of a projected operating income of about $1.47 billion.

“We arrive at this valuation by projecting future revenue from CHECKvacc in TNBC, HER-Vaxx in advanced HER2+ gastric cancer, and PD1-Vaxx in NSCLC,” Aschoff said.

“Commercial success outside these financially modelled programs would also serve as potential upside to our valuation,” he added.

Robert LeBoyer, research analyst at Noble Capital, has a more subdued outlook and reckons the Imugene share price will double over the next 12 months.

According to LeBoyer, the existing drug that Imugene will potentially replace or compete with will have billions of dollars in annual sales.

“Based on the valuations of similar companies developing drugs in these fields of therapy, we believe Imugene has a fair value of about $3 billion or 50c per share,” said LeBoyer.

Market expert Tim Boreham says that while Imugene’s Phase 2 programs are bubbling along, it has a long way to go, so the issue for investors boils down to valuation.

“With cash of $99.9 million as of June 30 2022, Imugene is well placed to further its trial, notably for its flagship HER-Vaxx program,” Boreham told Stockhead.

“The company burnt through $30 million in the 2021-22, which once again shows that drug development involves large licks of cash.

“Imugene could go all the way but given the global interest in immuno-oncology, a partnership for Phase 3 development and ultimate regulatory approval is a likely scenario,” added Boreham.

Imugene’s pipeline

To recap, Imugene is an immuno-oncology company developing a range of immunotherapies that seek to activate the immune system of cancer patients to treat tumours.

The company has a strong pre-clinical and clinical trial pipeline, and its assets boil down to three candidates:

– Multiple immunotherapy B-cell vaccine candidates

– An oncolytic virotherapy (CF33)

– Emerging CAR-T’s for solid tumours (onCARlytics)

| Platform | Candidate | Progress |

|---|---|---|

| B-cell vaccines | HER-Vaxx | Phase 2 trial |

| B-cell vaccines | PD1-Vaxx | Phase 1 trial |

| Oncolytic virus | Vaxinia (CF33 + hNIS) | Phase 1 trial |

| Oncolytic virus | Checkvacc ((CF33 + hNIS + PD-L1) | Phase 1 trial |

| onCARlytics | CD-19 CAR-T | Pre-clinical |

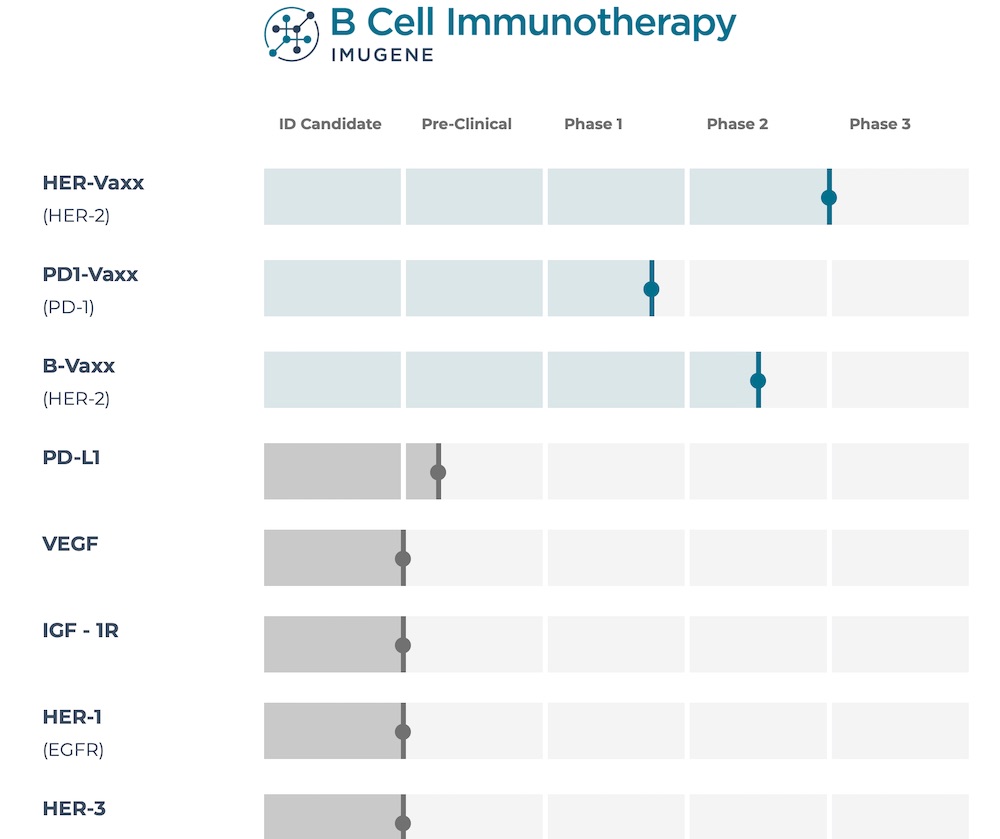

Multiple immunotherapy B-cell vaccine pipeline

B-cell immunotherapies generally look at ways to produce a B-cell cancer vaccine that induces the body to produce antibodies against the normal self-proteins such as HER2 or PD-1.

The use of B-cell immunotherapies has advantages over synthetic antibodies, which include reducing the risk of the tumour becoming resistant to the therapy.

B-cell immunotherapies are also much cheaper to manufacture than MAB (monoclonal antibodies) drugs.

Imugene is running multiple studies on this platform, but the two most advanced are the HER-Vaxx and PD1-Vaxx trials.

The Phase 2 HER-Vaxx trial

Of all Imugene’s pipelines, the HER-Vaxx is the most progressed in the clinical trial and possibly the closest to commercialisation.

The HER-Vaxx immunotherapy was designed to treat tumours that over-express the HER-2/neu receptor, such as gastric, breast, ovarian, lung and pancreatic cancers.

HER-Vaxx uses Imugene’s B-Cell Immunotherapy technology to stimulate an immune response against the HER2 surface marker.

Final analysis results from the Phase 2 study was presented in June, showing a 41.5% survival benefit for patients treated with HER-Vaxx combined with standard chemo, compared to chemo alone.

Full Phase 2 data is expected later in 2022.

The Phase 1 PD1-Vaxx trial

The PD1-Vaxx is a B-cell immuno-therapy which aims to induce the body to produce polyclonal antibodies that block PD-1 signalling.

The goal is to produce an anticancer effect similar to Keytruda, Opdivo and other monoclonal antibodies.

A couple of weeks ago, data from this trial (Phase 1 IMPRINTER trial) was presented as a poster presentation at the IASLC 2022 World Conference on Lung Cancer.

The results showed there were no dose-limiting toxicities as well as preliminary signs of efficacy.

The CF33 oncolytic virus pipeline

Imugene is developing two vaccines from its oncologic virus platform – CF-hNIS Vaccinia and CHECKVacc – that deliver a genetically modified poxvirus to infect cancer cells.

The virus takes over the cell functions, reproducing inside the cell.

This causes the cancer cell to die and burst, releasing new viral particles that infect other cancer cells and stimulating an immune response against the cancer antigens.

This platform revolves around a chimeric Vaccinia (pox) virus known as CF33, developed by Professor Yuman Fong at the prestigious City of Hope Comprehensive Cancer Center in Los Angeles.

City of Hope is one of the largest cancer research and treatment organisations in the US.

Vaccinia has a track record of safe use in millions of humans as it was the active constituent of the vaccine that eradicated smallpox, one of the most devastating diseases known to humanity.

The Phase 1 Vaxinia (CF33 + hNIS) trial

In June, the Phase 1 Vaxinia clinical trial kicked off off by injecting the virus into the veins of people who have solid tumours, and have had at least two prior types of treatment.

This trial now aims to recruit 100 cancer patients across the US and Australia over a period of two years.

The Phase 1 Checkvacc (CF33 + hNIS + PD-L1) trial

Earlier this week, Imugene dosed the first patient in Cohort 3 in the Phase I clinical trial of CheckVacc, which is basically Vaxinia “armed” with anti PD-L1 genes.

The study is recruiting patients with triple negative breast cancer (TNBC), which at the moment has no meaningful treatments.

“We expect that the final Phase 1 dose tested will be given to an expanded cohort of 12 patients, and ultimately be selected as the Phase 2 dose,” said Aschoff.

The onCARlytics platform pipeline

The Chimeric antigen receptor (CAR) T cells or CAR-T are a type of treatment in which a patient’s T cells (a type of immune system cell) are changed in the laboratory so they will attack cancer cells.

These T cells are taken from a patient’s blood, modified in the lab, and re-injected into the patient.

CAR T cells directed against CD-19 (a B-lymphocyte antigen) work very well against B cell malignancies or liquid (blood) cancers.

Imugene believes the combination immunotherapy (onCARlytics) combined with its CF33 oncolytic virus works more effectively in targeting solid tumours that are otherwise difficult to treat with CAR-T therapy alone.

Risks ahead

Factors that could impede shares of Imugene from achieving its path to revenue include any of its three modelled immuno-oncology products failing to succeed clinically.

“Imugene’s clinical staged products could fail to deliver statistically significant results in late-stage clinical trials, substantially reducing the value of Imugene’s product candidates and therefore our target price,” said Aschoff.

Also, the FDA and foreign regulatory authorities could fail to approve Imugene’s products even if their respective pivotal clinical trials succeed.

“Even if successful in the clinic, Imugene’s products could fail to be approved by domestic and foreign regulatory bodies, which would reduce Imugene’s value and therefore our target price.

“Loss of key management personnel could also impede achieving our Imugene price target, as could the significant delay of clinical progress from, for example, lasting Covid-19 headwinds,” Aschoff added.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.