Resonance Health just went from wallflower to overnight wonder: here’s why

That was some makeover. Pic: Getty

Artificial intelligence’s dumber sibling, machine learning, is behind a major change of strategy at Resonance Health which has propelled its fortunes into the stratosphere.

CEO Alison Laws says they’re training new neural networks to do their bidding as we speak, hoping one will be smart enough to give the company the next leg up in the realm of liver testing.

Resonance (ASX:RHT) cornered the global market on measuring iron concentrations in the liver.

High iron levels in the liver is actually pretty serious and is a result of a range of illnesses, from the debilitating anaemia of thalassemia to blood transfusions, as was comprehensively explained by Tim Boreham in this column.

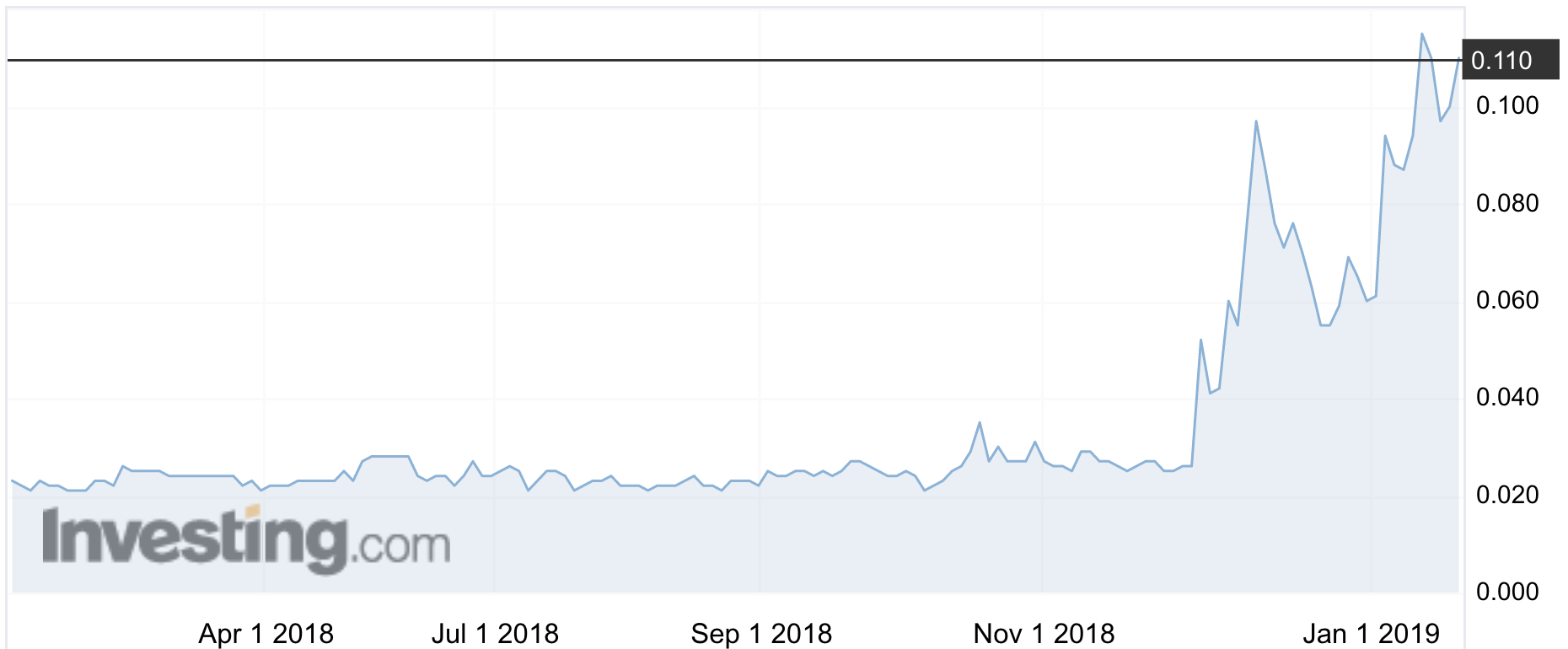

But while Resonance was plugging away, keeping cashflow positive and making increasing amounts of cash, it wasn’t exciting and its share price reflected that monotony.

That is until November, just before the FDA approved its new AI product Ferrismart for the US (which this week also found a distributor).

The stock price shot up and in spite of some stomach-churning dips, has so far remained up, touching annual highs of 12.2c yesterday.

“The performance of the company was predictable and I don’t think there was any speculation. I think there was a significant change of strategy for the company and change of management,” Ms Laws told Stockhead.

She says that change of strategy — an expansion into AI and selling through channel partners and distributors such as the Blackford Analysis platform and EnvoyAI in the US — was the foundation behind the rise.

Rating the new kid

Ferrismart is an AI-based version of their existing Ferriscan system, which via an MRI measures iron concentrations in the liver.

Where a Ferriscan, analysed by people in a lab and a report that also picks up non-iron problems, takes two days, Ferrismart’s AI will only tell you whether your iron or high or not and do so in seconds.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

But there is a problem: making sure the new kid doesn’t start eating the other’s lunch.

Ms Laws says cheaper Ferrismart is aimed at emerging markets such as India, Malaysia, Pakistan, Egypt, and second tier hospitals in the US.

“This tool for us is to massively expand our reach,” she said.

They’ve made it impossible to compare a Ferriscan with a Ferrismart reading, as one keeps a patient history and the other just gives a single readout. And while the latter is cheaper because it cuts out the scientists, the radiologists also have the do the MRI image analysis themselves rather than outsourcing it to Resonance’s technicians.

Swapping exercise for big pharma

The future is not in iron concentrations however. It’s in fatty liver AI analysis.

Resonance licensed a raft of patents from Wisconsin Alumni Research Foundation (WARF) in early January to develop AI-backed ‘proton density fat fraction’ (PDFF) measurement software.

These are the new neural networks the company is training.

And they’ve already got one system on the market, Hepa-Fat, which offers one of two kinds of analysis.

The problem is that fatty liver, while affecting a massive 10-30 per cent of the global population and according to the World Health Organisation is likely to be the leading cause of liver transplants by 2020, it’s not really a condition the pharmaceutical industry is interested in.

To date the treatment has been diet and taking more exercise, so calls from the pharma industry to diagnose more people with it haven’t exactly been fierce.

So Resonance is tying their colours to the promise of companies like Pharmaxis (ASX:PXS) which are having some success in clinical trials for fatty liver treatments.

Ms Laws hopes to have a prototype for an alternative to Hepa-Fat done and dusted within six months.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.