HealthInvest 2024: The biotech sector looks in rude health, judging by these five ASX innovators

Pic via Getty Images

- Stockhead joined with IR Department and Morgans for HealthInvest 2024 in Sydney last week

- The event highlighted some of ASX’s leading and up-and-coming biotech and life sciences companies

- Imricor Medical Systems, Race Oncology, Clarity Pharmaceuticals, Percheron Therapeutics and ImpediMed all presented

Special Report: The biotech/life sciences sector is in good shape in 2024 and looks primed to enter a period of strong growth. At HealthInvest 2024, five of the ASX’s most innovative companies spoke to why they believe they’re set to take advantage of potentially healthy market conditions.

Morgans senior analyst Scott Power kicked off the HealthInvest 2024 proceedings, held in Sydney last Wednesday evening, delivering a broad overview of the space to gathered guests including professional and retail investors. Power spoke to the health of the biotech/life sciences space – both locally and globally.

“The life sciences sector has seen a solid calendar 2024 so far,” said Power, “with the Bioshares Index up 8% in the first half, and $1.2 billion worth of capital raised already. That is, in fact, more than the entire raising that occured in 2023.”

That said, Power also noted there is plenty of room for growth within the local sector broadly, with “only a third of the companies across the sector achieving share price gains” this year.

Turning to the US, too, and Power pointed out that its healthcare market is up 14% YTD, with IPO activity on the increase.

“A cut in interest rates [from the US Federal Reserve] will likely see investor interest continue to grow in the life science sector both in the US and Australia,” added the Morgans expert.

And to Stockhead, he also commented:

“If we’re right with this US interest rate cut we might see more interest coming back into the space and there will be plenty of upside for the sector over the rest of the year.”

Here then, are why some of the most promising Australian companies believe they will thrive in this market environment…

Imricor Medical Systems (ASX:IMR)

Vice president of corporate strategy with Imricor, Nick Corkhill was first to grab the mic from the event’s hosts.

Before joining IMR earlier this year, Corkill spent 15 years in asset management initially as an equity analyst at Perpetual Investments followed by portfolio manager at BlackRock and more recently Lennox Capital Future Leaders Fund.

IMR is focused on development and manufacture of MRI compatible devices for performing a cardiac ablation, where a catheter is guided into the heart with the purpose of burning/ablating the tissue responsible for causing an arrhythmia (irregular heartbeat).

“An irregular heartbeat doesn’t sound that bad until you have it,” said Corkhill. “Arrhythmias are very common, to the point where one in four adults over the age of 75 are expected to have one at some point.”

If not treated, the condition can lead to blood clots and increase the chance of stroke and cardiac arrest.

Cardiac ablations are currently undertaken with X-Ray guidance to identify the location in the heart requiring treatment but IMR is succeeding in the long desire of clinicians to do the procedure under the superior imaging capabilities of MRI.

However, as Corkhill explained, as an imaging tool X-Ray has limitations as it does not show the soft tissue of the heart and exposes the patients and physicians to repeated radiation.

Corkhill noted that the company’s cardiac ablation devices are the only ones in the world that have been proven to be safe and effective inside the magnetic field generated by an MRI. And this, he said, comes on the back of “18 years, a lot of research, a lot of development, a lot of clinical trials”.

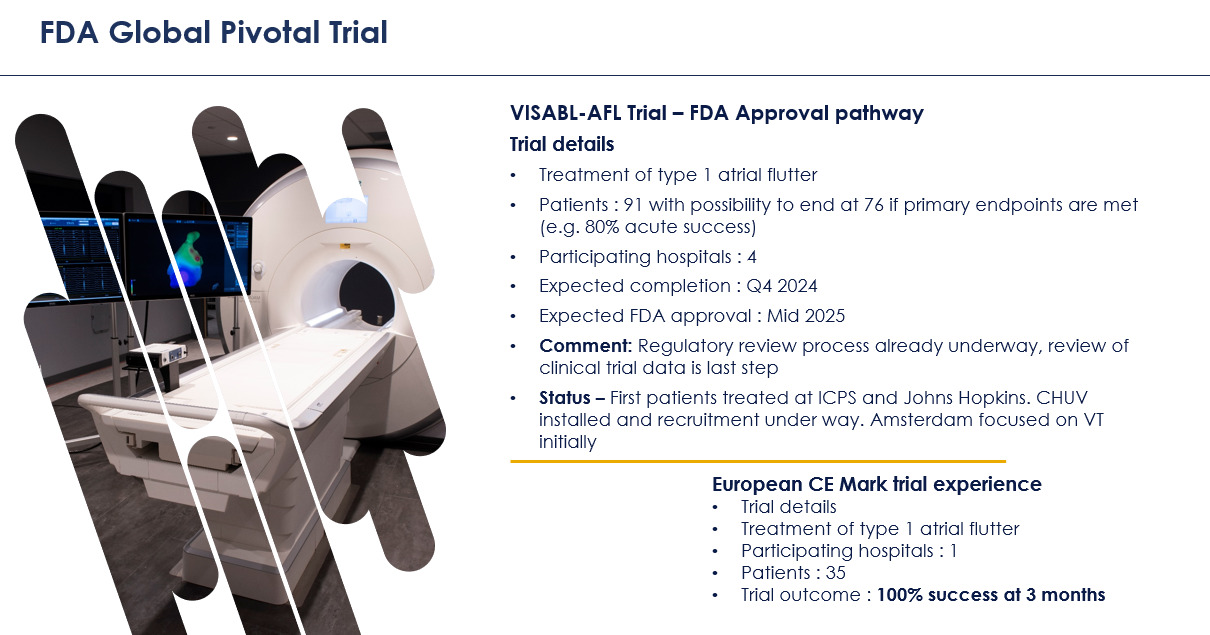

The company is currently undertaking its Vision-MR Ablation of Atrial Flutter (VISABL-AFL) pivotal clinical trial supporting US Food and Drug Administration (FDA) approval of its products, which it hopes to achieve in 2025 (see approval pathway, below).

In Europe, where the company has already received regulatory approval for atrial flutter, it’s about to start the VISABL-VT clinical trial for its second indication, ventricular tachycardia (VT).

Corkill noted in his presentation that as it’s such a difficult procedure there are a lot of cardiologists globally watching the VT trial, with MRI having potential to add significant value as doctors can see the heart in real time.

Race Oncology (ASX:RAC)

When he wasn’t grabbing the mic to ask fellow presenters pertinent questions or fielding ones from the likes of Stockhead, Race Oncology’s executive chair Peter Smith delivered one of the best presentations and most intriguing stories of the HealthInvest evening.

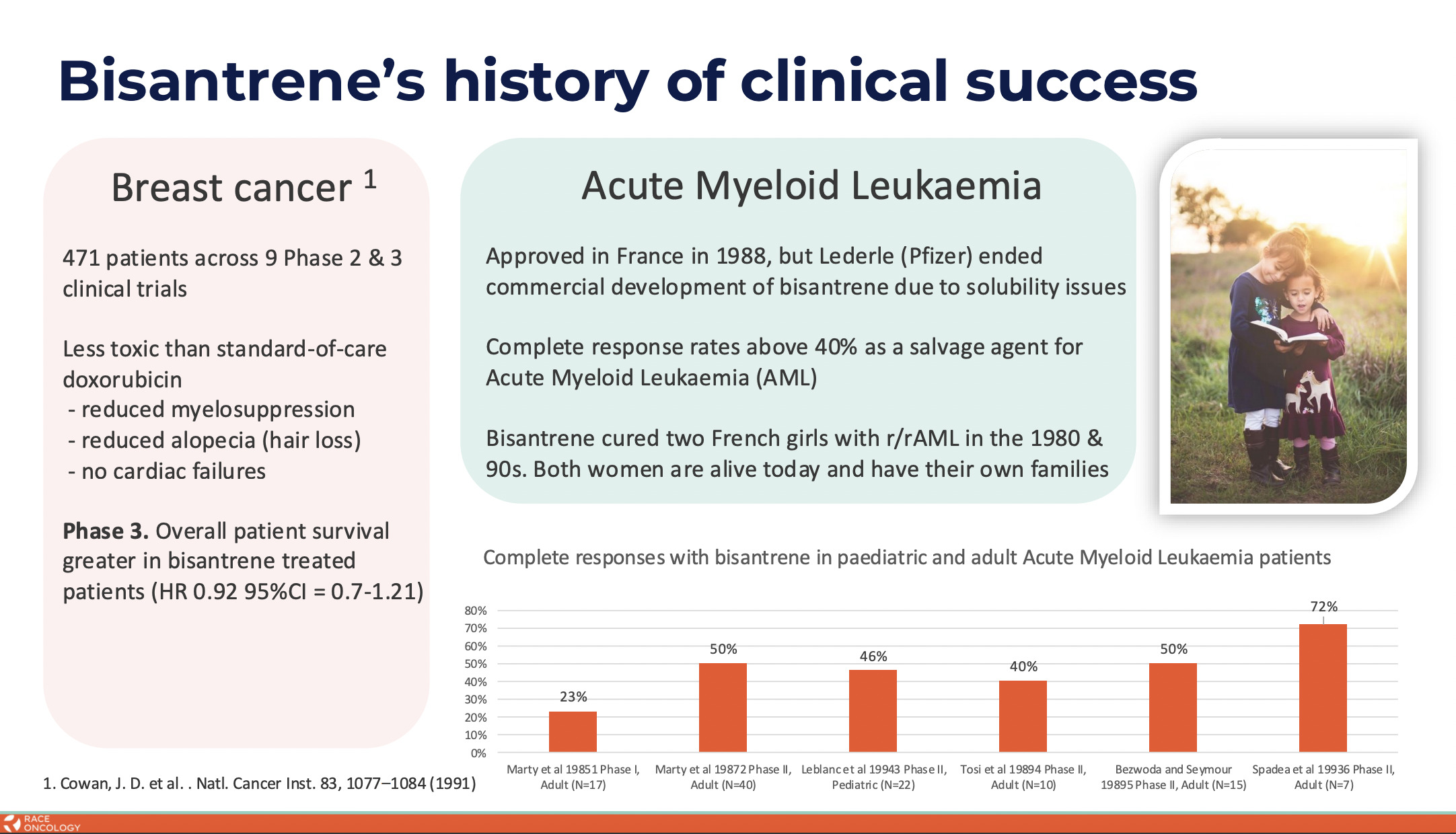

RAC is at the heart of cancer care and in doing so has resurrected an old anticancer drug – bisantrene – via reformulation and repurposing.

Bisantrene was originally developed in the 1970s and ’80s by a small French pharmaceutical company called Lederle Laboratories as a lower cardiotoxic alternative to the anthracycline class of chemotherapeutics and with the aim to treat a type of leukaemia.

“It was never launched, as the original drug itself had issues in terms of how it was delivered,” Smith told Stockhead.

The original Lederle formulation of bisantrene is highly insoluble in blood, making the use of bisantrene complex and difficult.

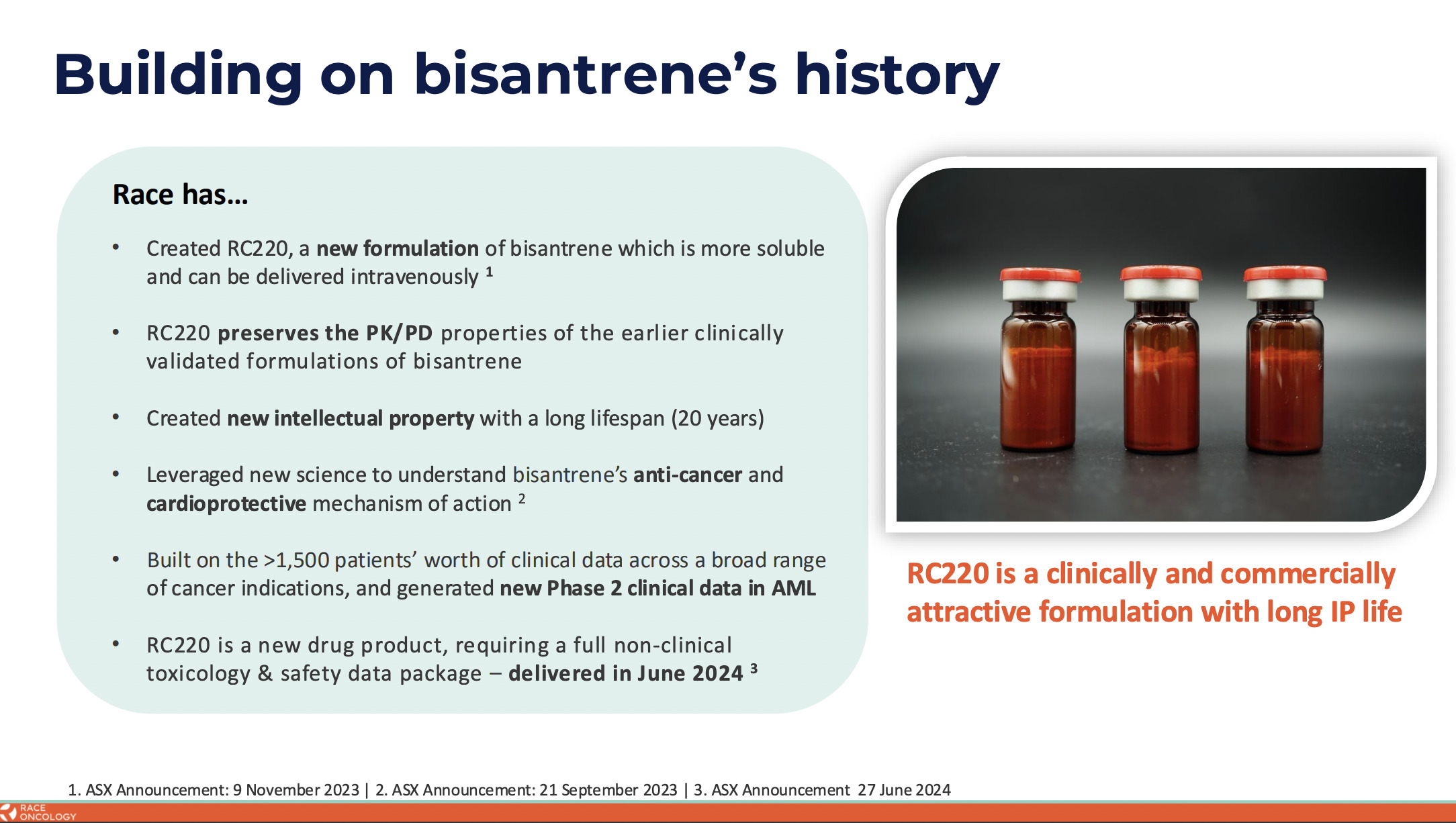

However, after identifying the potential of bisantrene, RAC scientists were able to solve the solubility issue through reformulation, thus “making it a lot easier to use”, noted Smith, adding:

“And so we’re going back into the clinic with the new formulation and we’ll be testing that in an upcoming clinical trial.”

“Reformulation is no small process,” Dr Smith told Stockhead when we asked what was stopping other companies from utilising such an old drug.

“Our new formulation, we can patent that,” Smith clarified, “but that wouldn’t stop anyone else from reformulating bisantrene. They would then, however, have to clinically develop that themselves. And doing so isn’t trivial.

Even so, we are also looking at additional areas we can patent to provide even further protection to get as strong an IP position as we possibly can. But no one’s going to start clinical development until they see how we’re doing clinically. So at an absolute minimum, we’ve got many many years head start on any potential competitor.”

The company is advancing a reformulated bisantrene (RC220) to address high, unmet needs across multiple oncology indications, with a clinical focus on anthracycline combinations, where it hopes to deliver cardioprotection and enhanced anti-cancer activity in solid tumours.

Race is also exploring RC220 bisantrene as a low-intensity treatment for acute myeloid leukaemia.

Percheron Therapeutics (ASX:PER)

Managing director and CEO of Percheron Therapeutics, James Garner, is a highly experienced life sciences exec heading a company, formerly known as Antisense Therapeutics, focused on development and commercialisation of novel therapies for “orphan” diseases.

These, Garner explains, are diseases that “are a bit less common than, say, Alzheimer’s or type 2 diabetes, but which, nevertheless have a big, unmet medical need… and usually very severe diseases that require some very careful medical intervention.”

When summing up the commercial opportunities within the orphan diseases sub-sector, Garner described them in his presentation, and to Stockhead, as “very attractive”. And that’s because, he notes, there is usually a “paucity of available treatments”, the cost of developing these drugs is usually much lower than a disease like diabetes, and often the pricing is very competitive as well.

The company’s lead program is ATL1102, an antisense oligonucleotide in “late-stage human trial” targeting the CD49d receptor.

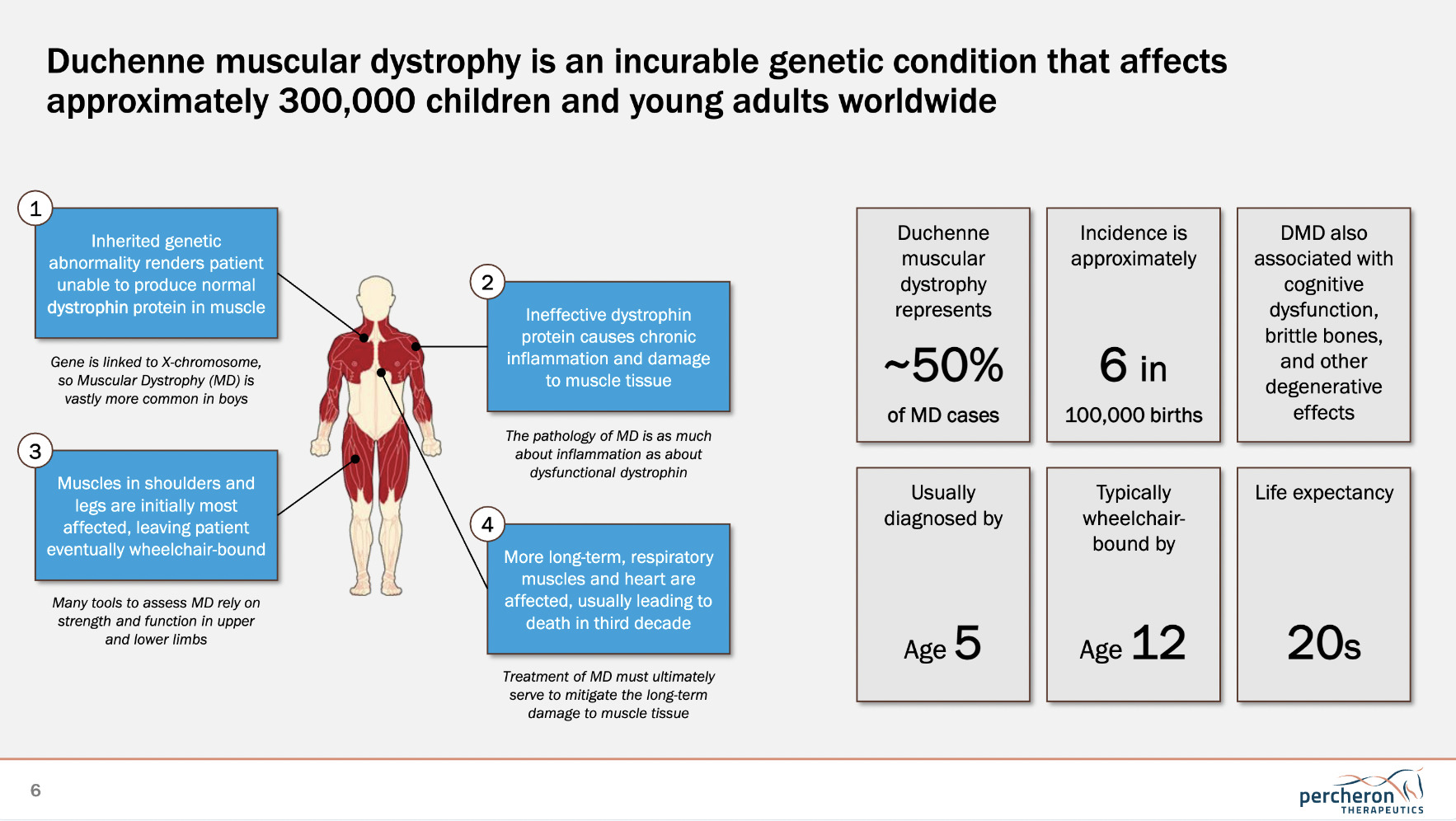

“What we’re specifically focused on at the moment,” said Garner, “is a disease called Duchenne muscular dystrophy (DMD). It’s a genetic disease of kids, specifically of boys. These kids lack a protein in their muscles – a genetic abnormality that stops them from making this protein. That causes progressive muscle weakness, starting at about the age of four or five.”

As you can see from the Percheron graphic below, life expectancy for DMD tends to top out somewhere in the 20s, so it’s clearly a devastating disease for families to have to deal with.

In May, PER announced successful completion of recruitment to its ongoing international Phase 2b study of ATL1102 in the treatment of Duchenne muscular dystrophy (DMD).

Mid last year PER kicked off recruitment to the international phase 2b randomised controlled trial in the treatment of non-ambulant (unable to walk unassisted) boys with DMD.

The study is now fully enrolled, with 48 boys randomised to the study across 16 hospitals in five countries.

The primary endpoint of the study is the change in PUL2.0 score at six months with data expected in H2 CY24.

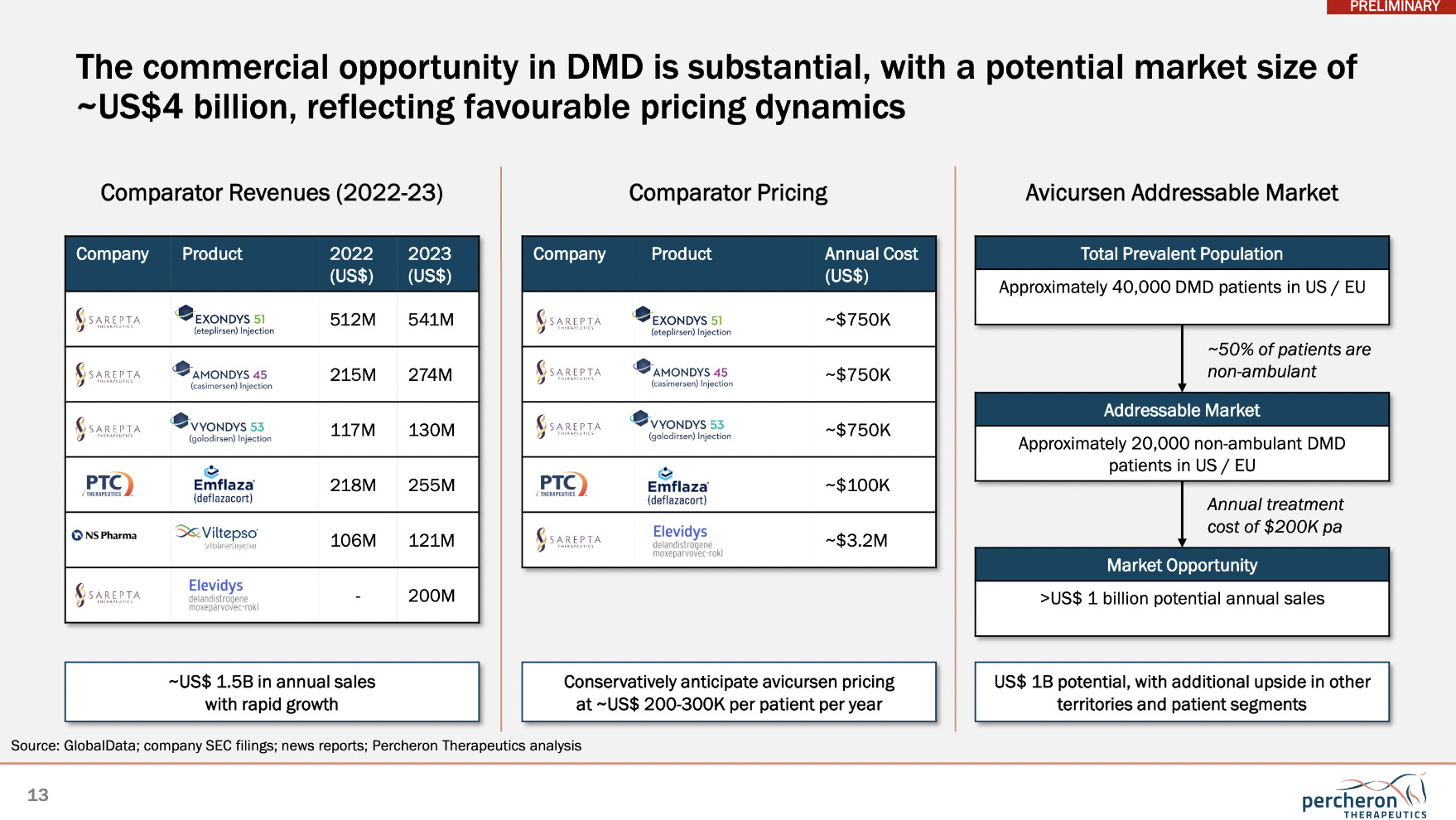

As you can see from the graphic above, shown at HealthInvest, the commercial opportunity for Percheron in DMD is indeed substantial with an estimated potential market size of US$4 billion. And just look at the annual costs of some of the drugs currently designed to treat this disease, which Garner told Stockhead “really reflects the demanding nature of these illnesses and the cost of all the supportive care involved”.

“If a new drug comes along which can reduce that need for any of the supportive treatment, the value of that to the healthcare system is enormous,” Garner told Stockhead at HealthInvest.

None of these drugs currently on market, according to Garner, are really a “perfect solution” to the problem. Very broadly speaking, he says, there are two approaches to treatment. One is to try to replace the missing protein. “The clinical benefit we see from that (in existing drugs) is not that great.”

The other approach is a whole class of drugs that target the inflammation associated with the disease. Percheron’s drug is an anti-inflammatory drug that isn’t a steroid and therefore contains none of the toxicity associated with steroids, therefore placing it in a unique position in the market, believes Garner.

Clarity Pharmaceuticals (ASX:CU6)

The radiopharmaceuticals space has emerged as one of the hottest in biotech right now and front and centre on the ASX is Clarity Pharmaceuticals.

A blazing biotech success story so far this year, CU6 has risen more than 360% YTD, now sporting a market cap of ~$2.78 billion.

Presenting for the company at HealthInvest was the company’s executive chair Dr Alan Taylor, who holds a PhD in medicine from the Garvan Institute of Medical Research in Sydney and has been with Clarity since 2013, having been instrumental in its strong growth.

The radiopharmaceutical-focused biotech stands out for a few reasons, says Taylor – “one being that it has come up from the benchtop of Australian science, which I’m very passionate about.”

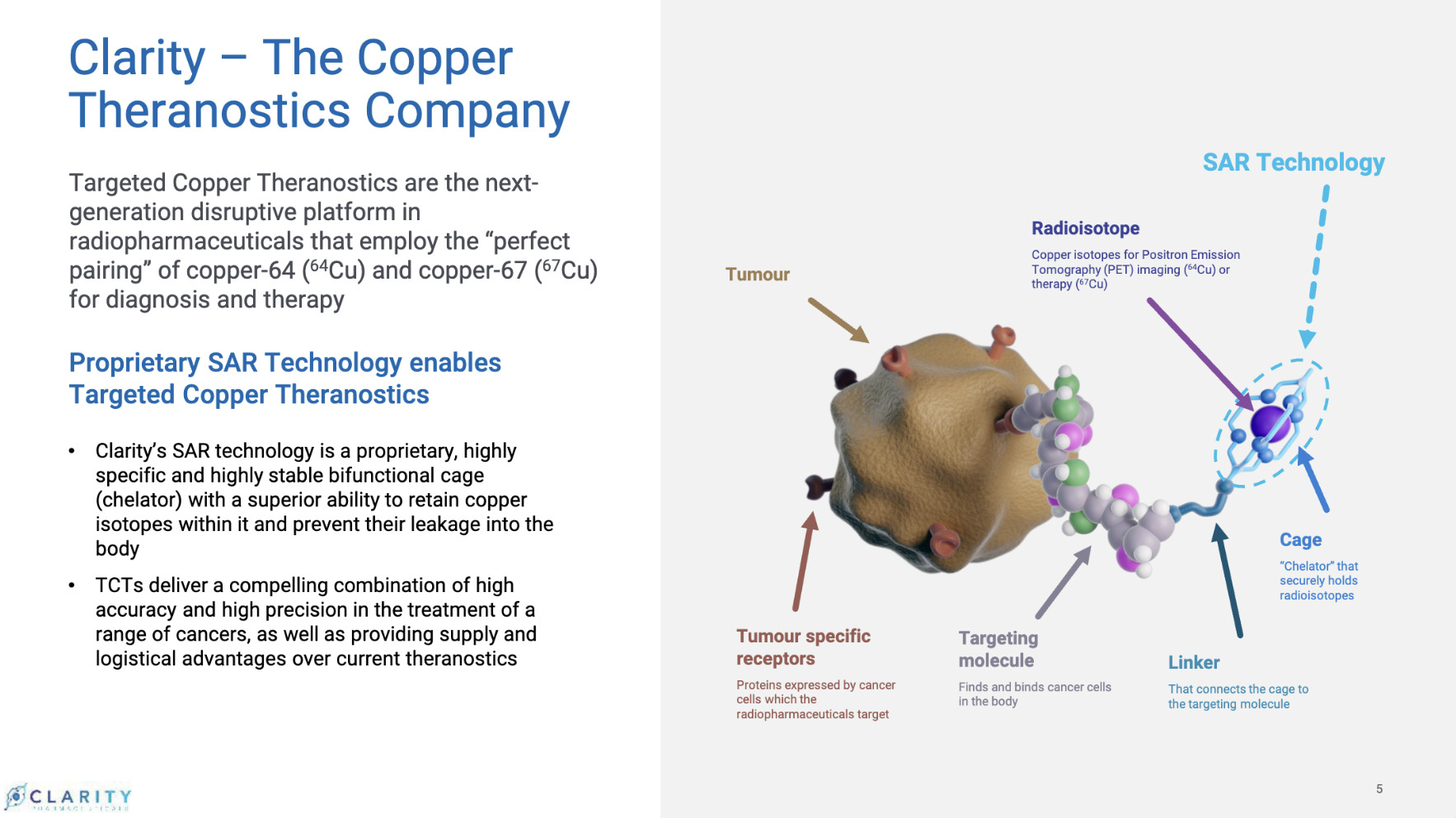

And speaking further to the tangible side of science, the company differentiates itself in the development of its unique products, which Taylor describes as “best in class”, and he’s talking chiefly here about what’s dubbed SAR-bisPSMA.

Through this asset, the company has developed a wholly unique proprietary program for prostate cancer diagnosis and therapy involving the use of copper isotopes.

SAR-bisPSMA is a next generation theranostic radiopharmaceutical with dual PSMA-targeting agents linked to Clarity’s SAR chelator technology. It utilises the isotopes of copper for both imaging (64Cu or Cu-64) and therapy (67Cu or Cu-67).

“What we have and no one else has, is copper theranostics – a combination of copper diagnostics and copper therapy,” explained Taylor, who describes it as a “perfect pairing of copper isotopes” for targeted treatment.

Importantly, an FDA Fast Track Designation was announced just recently for 64Cu-SAR-bisPSMA – specifically for the use of “positron emission tomography (PET) imaging of prostate-specific membrane antigen (PSMA) positive prostate cancer lesions with suspected metastasis who are candidates for initial definitive therapy” – per a company announcement from late August.

Taylor noted that it was “great recognition from the FDA, they’ve seen our data to date and we’re really excited about it”.

The designation will essentially speed up the development and regulatory review process for the drug, allowing Clarity to submit parts of its application as they are completed and to communicate more frequently with the FDA. The expedited process could shorten the time needed to bring the diagnostic tool to market.

The company is in the midst of a Phase 3 clinical trial, which Taylor notes will be completed over the next couple of years with the aim for achieving better diagnosing of men with prostate cancer.

The product’s dual-targeting structure and longer half-life offer advantages over existing diagnostics, such as better tumour uptake and longer shelf-life, which could improve accuracy and accessibility in prostate cancer management.

“We believe that 64Cu-SAR-bisPSMA could be a game changer in prostate cancer diagnosis,” said Taylor.

ImpediMed (ASX:IPD)

Presenting for Impedimed, CEO and managing director Dr Parmjot Bains was appointed to the role in January this year as part of a leadership shake-up the company believes will see it move into a new period of positive growth.

A medical doctor, Dr Bains was joint CEO and COO of Neuren Pharmaceuticals and CEO of Perseis Therapeutics. She has also held commercial roles at Pfizer and the management consultancy McKinsey.

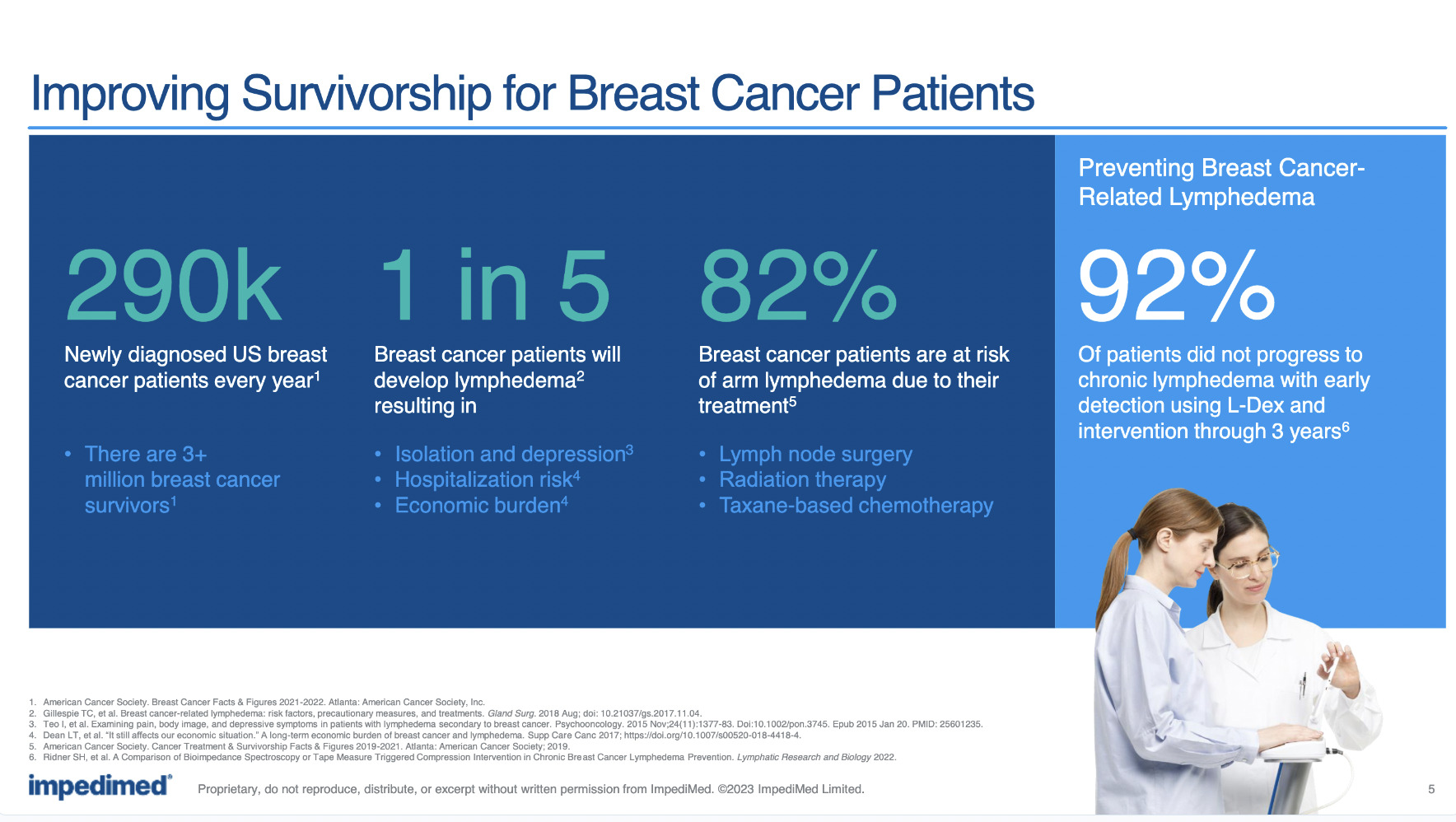

Bains explained in her presentation that the medtech’s wireless, SOZO digital health platform is the company’s main game, and that Impedimed has a “two-year strategy” to building a sustainable business, prioritising sales and marketing and key US states, as well as adjacent markets.

SOZO is an accurate and non-invasive means of detecting and measuring lymphoedema, caused by the removal of armpit lymph nodes leading to limb-swelling in breast cancer survivors (because of excess fluid), along with the detection of other bodily fluid build-ups.

It does this, Bains said, by incorporating its trademarked L-Dex technology and bio-impedance spectroscopy (BIS) to non-invasively, accurately, and quickly measure and monitor fluid status.

In fact, SOZO is the only US FDA-cleared BIS device clinically validated for early assessment of, and for managing, breast cancer-related lymphoedema.

BIS works by passing low-frequency currents through the cells (whether they be fluid, fat, bone or muscle) and the SOZO device gathers data from 256 bodily sources.

Bains emphasised that SOZO is also CE-marked, and ARTG-listed for multiple indications, including lymphoedema, heart failure, and protein calorie malnutrition and is sold in select markets globally.

BIS for prevention of breast cancer-related lymphoedema is now also included in the globally referenced National Comprehensive Care Network guidelines and the Multinational Association of Supportive Care in Cancer guidelines.

At Stockhead, we tell it like it is. While Imricor and Race Oncology are Stockhead advertisers, the companies did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.