Health-tech Alcidion splashes $12m on patient-tracker; shares jump 22pc

Pic: REB Images / Tetra images via Getty Images

Small cap health tech Alcidion jumped 22 per cent this morning after it unveiled plans to buy patient-tracker MKM Health for $12 million.

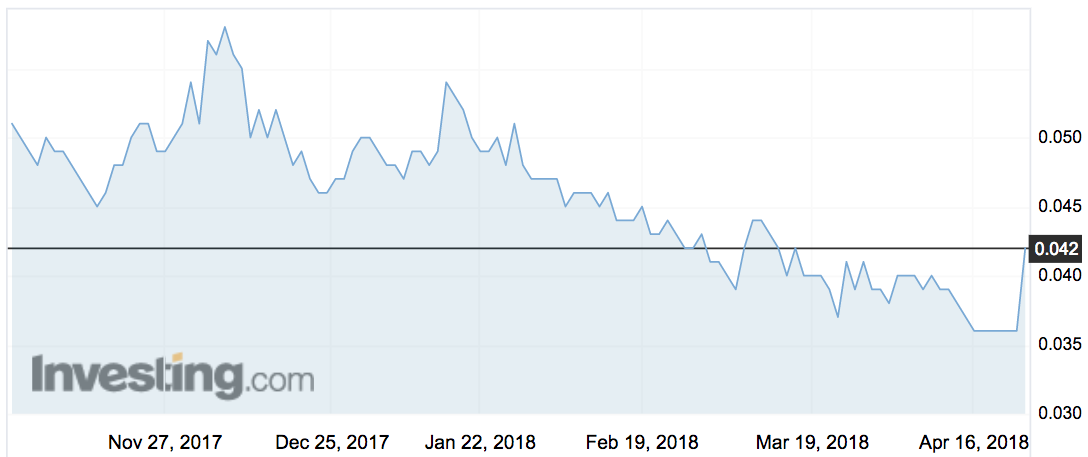

The stock surged 22 per cent to trade at 4.4c before falling back to 3.7c by 11am AEST.

Alcidion (ASX:ALC) said the deal to buy MKM Health and its UK affiliate Patientrack was a “transformative” move to create a next-generation analytics tool for hospitals and healthcare providers.

It’s a bounce back for the company, which has been trading at its lowest points since 2016.

The company’s existing products target emergency rooms, in-patient and out-patient departments. Under the acquisition it now adds patient observation and clinical document tracking.

Most notably, the move will see the group expand internationally to a customer base of 20 national health service hospitals (NHS) in the UK, adding to 50 Australian and 30 New Zealand public and private hospitals.

“We are expanding our technology capabilities and our product offering, and the combined group will also have the specialist health IT sales, advisory and service delivery capabilities that are required to sell and deliver complex healthcare IT platforms,” chair Ray Blight said.

The acquisition was expected to increase Alcidion’s earnings within the first full year of ownership – forecasting combined revenue for the past financial year to about $13 million.

Health care consolidation

The deal comes as the health care sector experiences a period of consolidation, with mergers and acquisitions dominating the space since the start of the year.

Fellow small cap Paragon Care (ASX:PGC) also released a trading update this morning, detailing seven out of nine completed acquisitions after raising $70 million earlier this year.

Focusing domestically, and especially on the growing market of Queensland, it has broadened its services by buying up medical product distributors, medical engineers, supplier of red blood cell products and lab equipment sellers.

The directors told the market to expect a busy April-June quarter, forecasting earnings of between $18 and $19 million.

“These acquisitions align with our strategic plan to increase Paragon’s presence in the diagnostics and laboratory market… Paragon’s new acquisitions all represent existing brands of established value in their respective markets,” chief Andrew Just told the market.

Shares in PGC were up 5 per cent at open to trade at 75.5c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.