Health might be another overnight success in 2020

Pic: Oscar Wong / Moment via Getty Images

In 2019 the culmination of decades worth of work turned several biotechs and life sciences companies into overnight successes.

As investors look to defensive growth stocks to compensate for a sluggish economy and with expectations of more health companies filing sales, regulatory approvals and trial successes, 2020 may deliver more of the same.

Morgans health analyst Scott Power said some of the better performers in the sector, such as CSL (ASX:CSL), Cochlear (ASX:COH) and ResMed (ASX:RMD) benefited from a weak Australian dollar as they derived a considerable portion of their income from the US. They are forecast to continue performing through 2020.

He named Opthea (ASX:OPT), Avita (ASX:AVH), Clinuvel (ASX:CUV), PolyNovo (ASX:PNV), Pro Medicus (ASX:PME) and Volpara (ASX:VHT) as second tier companies for which company-specific factors, such as regulatory approvals or good trial results, have been recognised by the market.

As far as the sector goes, a weak outlook for the economy, and the anticipated drag it will have on the market, means defensive sectors such as health have been popular and likely will remain so.

Power said Sonic Healthcare (ASX:SHL) and CSL were two examples of companies delivering consistent growth in earnings in a sluggish economy.

2019 was a good year

2019 was a very good year for investors in the right life sciences, health or biotech companies.

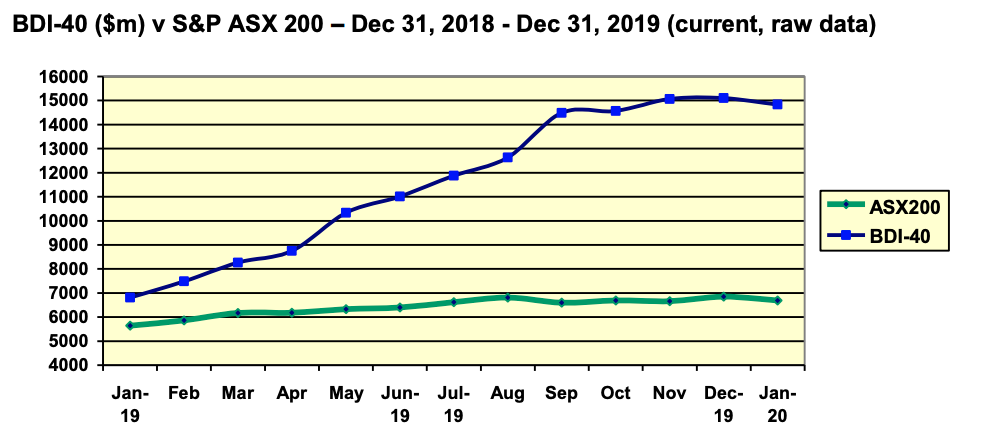

Biotech Daily’s top-40 index, the BDI-40, closed the year up 117.8 per cent, compared to the ASX200 which moved a still respectable 18.4 per cent. It does not include CSL, Cochlear or ResMed.

Biotech Daily editor David Langsam says this movement, which kicked up around April, was due to organic success at a number of different companies.

“It’s a standout year for the raw index itself,” he told Stockhead.

“It’s the culmination of a number of companies that started a very long time ago, having success.”

His list of standouts included Pro Medicus, Clinuvel, Compumedics (ASX:CMP), PolyNovo, Volpara, Nanosonics (ASX:NAN) and Avita.

Pro Medicus spent last year signing contracts in the US for its 3D imaging software.

Clinuvel was underestimated until it got US FDA approval to sell its treatment for erythropoietic protoporphyria (EPP), a genetic condition that can lead to liver disease, and was on track for the same in Australia.

“To be brutally honest about Clinuvel, lots of people had been saying the story doesn’t add up, the medical demand for EPP isn’t there… what we didn’t expect is how incredibly successful and well targeted Philippe Wolgen and the team at Clinuvel were. There was real money in it,” Langsam said.

Sleep disorder rectifier Compumedics, disinfection tech Nanosonics, and CSIRO spin-out, wound treatment business PolyNovo, were other companies which used 2019 to secure contracts and make sales.

Avita was a standout biotech in 2019, with a market cap that rose 919.4 per cent over the year.

“From a germ of an idea in Perth they’ve gone to a $1.4 billion company… in 15 years,” Langsam said.

“[CEO Dr Mike Perry] put a new broom through the place.

“He’s focused on commercialisation and he’s done it better than anyone else at Avita ever has.”

| Code | Name | Price Jan 9 2020 ($) | Total Return Jan 1-Dec 31 2019 (%) | Market Cap |

|---|---|---|---|---|

| AVH | AVITA MEDICAL LTD | $0.65 | 6.96 | $1.3B |

| OPT | OPTHEA LTD | $2.90 | 4.14 | $767.1M |

| RHT | RESONANCE HEALTH LTD | $0.24 | 2.75 | $98.4M |

| ANP | ANTISENSE THERAPEUTICS LTD | $0.09 | 2.46 | $39.6M |

| OCC | ORTHOCELL LTD | $0.47 | 2.38 | $83.0M |

| PNV | POLYNOVO LTD | $1.99 | 2.31 | $1.2B |

| PAR | PARADIGM BIOPHARMACEUTICALS | $3.13 | 1.86 | $594.6M |

| TLX | TELIX PHARMACEUTICALS LTD | $1.58 | 1.38 | $400.2M |

| NAN | NANOSONICS LTD | $6.55 | 1.24 | $1.9B |

| PME | PRO MEDICUS LTD | $23.84 | 1.07 | $2.3B |

| MVP | MEDICAL DEVELOPMENTS INTERNA | $8.94 | 1.01 | $576.0M |

| CMP | COMPUMEDICS LTD | $0.81 | 0.98 | $141.7M |

| LBT | LBT INNOVATIONS LTD | $0.17 | 0.8 | $37.7M |

| MSB | MESOBLAST LTD | $2.31 | 0.79 | $1.2B |

| IMU | IMUGENE LTD | $0.03 | 0.78 | $150.5M |

| NEU | NEUREN PHARMACEUTICALS LTD | $2.58 | 0.77 | $261.0M |

| VHT | VOLPARA HEALTH TECHNOLOGIES | $1.80 | 0.67 | $388.6M |

| KZA | KAZIA THERAPEUTICS LTD | $0.65 | 0.64 | $46.9M |

| CUV | CLINUVEL PHARMACEUTICALS LTD | $28.98 | 0.57 | $1.4B |

| DXB | DIMERIX LTD | $0.14 | 0.46 | $24.5M |

| GSS | GENETIC SIGNATURES LTD | $0.93 | 0.29 | $134.6M |

| ELX | ELLEX MEDICAL LASERS LTD | $0.78 | 0.12 | $109.1M |

The double-digit gainers in the BDI-40.

2020 might be a better year if you pick right

Langsam has a soft spot for Alterity (ASX:ATH), Amplia (ASX:ATX) and brain cancer biotech Patrys (ASX:PAT), but warns that investors need to do their homework.

Morgans’ Power is factoring in Brexit to his calculations for 2020. He told Stockhead he was hearing reports that regulatory approvals in Europe were being delayed because of Brexit.

He and colleague Derek Jellinek say Sonic, ResMed, Volpara and Pro Medicus are the buys of 2020.

Power says Pro Medicus is working within an AI digital healthcare space which is very attractive.

Volpara, the breast density mapper, is another pick. He says the company, which also derives most of its revenue from the US, is coming into a seasonally strong part of the year and he expects a strong cash flow report at the end of January.

Power expects the company to “comfortably” beat annual recurring revenue guidance of $17m when it releases its full year figures for 2019 (it operates on a calendar basis).

A proposed FDA rule to tell every woman who has a mammogram in the US what her breast density is likely to benefit Volpara as well; breast density is a risk factor for breast cancer.

Jellinek said in the duo’s podcast on Wednesday that Sonic was backed by defensive earnings, and as the third largest global pathology player makes 60 per cent of its earnings offshore.

He’s forecasting double digit growth for the next three years as the ageing population and chronic disease themes underpin the pathology sector.

Sleepmaker ResMed ticks his boxes for focusing on improving clinical outcomes, driving efficiencies for customers, and lowering healthcare costs for government — the gatekeeper to the health sector.

Like for Sonic he’s forecasting double digit growth over the next three years as 95 per cent of revenue comes from offshore yet 86 per cent of costs are priced in Australian dollars, meaning it is a particular beneficiary of the low dollar.

Although its shares are hitting all time highs, “the historical valuation fails to capture what this company is growing into”, he said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.