Finally some good news for MMJ as it doubles its money on Canada pot deal

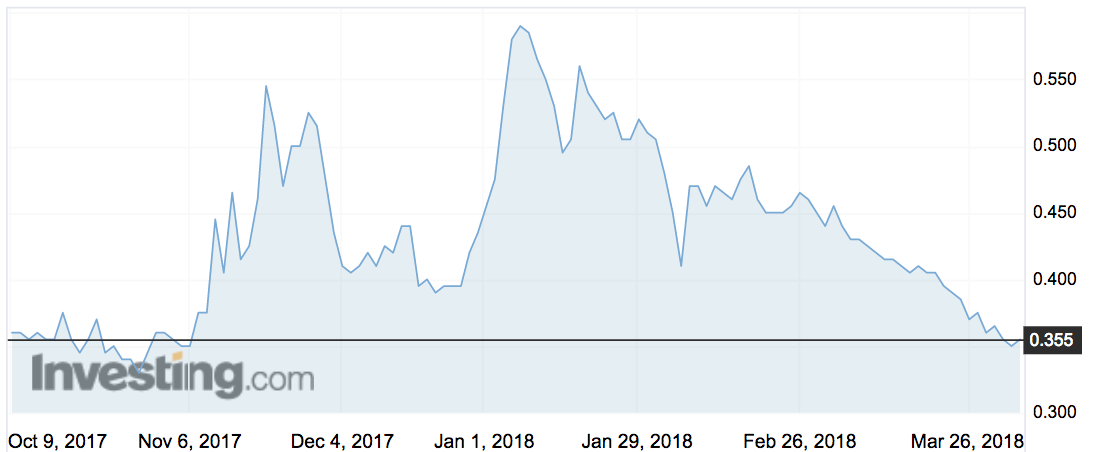

This year medical cannabis play MMJ Phytotech has lost half the value of its investment in eSense Lab — and been forced to look for a new CEO — but things are looking up with a nice return on a Canadian pot deal.

Canada-listed Cannabis Wheaton Income Corp has offered $C38 million ($38.6 million) for MMJ’s part-owned Canadian medical cannabis developer Dosecann.

The deal is entirely scrip.

MMJ (ASX:MMJ) bought into Dosecann in January, when it took up a $C2.5 million convertible note as part of a capital raising.

That cap raise valued the company at $C19 million.

The convertible note allows MMJ to acquire 2.5 million Dosecann shares at $C1 each, before interest.

MMJ also holds warrants in Dosecann that allow it to buy another 1.25 million Dosecann shares at $C1.20 each. It says it’s yet to decide whether to exercise the warrants or exchange them for warrants in Cannabis Wheaton.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

This year several people have left MMJ to focus on another of MMJ’s Canadian pot dealers, Harvest One Cannabis.

Managing director and CEO Andreas Gedeon stepped down, director Jason Bednar jumped ship, and CFO Lisa Dea has also quit. All are now working for Harvest One.

MMJ’s stake in that company has decreased from 59 per cent in January to 34.5 per cent.

Last week, MMJ’s strategic $500,000 investment in eSense Lab (ASX:ESE) was shaken as shareholders approved the shares owed for the investment, but not the options.

eSense shares have lost half their value this year, from about 30c to 16.5c on Thursday morning.

MMJ says Israel-based eSense owes it $199,999 in lieu of options, as per an investment term sheet it signed.

MMJ’s shares were up 1.4 per cent to 35.5c on Thursday morning.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.