Far-sighted investors way ahead on Ellex’s vision

Pic: sinology / Moment via Getty Images

Here’s an eye-opener: a biotech with a 32-year history — 16 as a listed ASX stock — with an enduring earnings track record (at least in underlying terms) and global sales in more than 100 countries.

Ellex Medical Lasers (ASX:ELX) also wins some kind of novelty award for having its global headquarters in Adelaide, a township more known for kinky murders, pie floaters and (for those with a longer memory) the once-proposed multi-function polis.

Ellex’s lasers and other devices help eye surgeons treat glaucoma, diabetes-related retinal disease, secondary cataracts, vitreous opacities and age-related macular degeneration (AMD) — pretty much the A-to-Z chart of optical woes.

Bearing devices with funky names such as the Tango Reflex and Itrack (glaucoma), 2RT (early AMD), Ellex boasts a circa 15 per cent global share of the core ophthalmic device market.

Ultra Q Reflex is a minimally invasive treatment for cataract-related floaters (not to be confused with the pie floaters). Ellex 2RT facilitates retinal rejuvenation therapy, a pioneering laser treatment that may slow the progression of AMD.

“Based on results to date, 2RT is demonstrating that it has the potential to be the world’s first interventionist treatment for early to intermediate AMD,” Ellex says.

The Tango Reflex is an alternative laser treatment for glaucoma, obviating the need for a regimen of daily drops.

Much of the company’s growth prospects revolve around Itrack, a single-use micro catheter for minimally invasive glaucoma surgery (MIGS). Ellex currently has the honour of being the only MIGS device approved in China — a land of 1.4 billion people and (roughly) 2.8 billion eyes.

Of Ellex’s $72 million of sales last year, 35 per cent was derived from the US and 25 per cent from Europe and the Middle East. Japan at 15 per cent is also an important market and China is a growing one. Local sales account for about 12 per cent.

In the US, Ellex has a direct-sales subsidiary based in Minneapolis. Elsewhere, Ellex deploys both direct sales and third party arrangements across 50 distributors.

Hot property

With justifiable pride, CEO Tom Spurling and his management team paraded analysts around Ellex’s new HQ and manufacturing centre at Mawson Lakes in the city’s north.

The building and land was only acquired in March 2016, with the Therapeutic Goods Administration approving the digs in February last year.

The 4000 square metre premises — which augments a leased CBD centre and more than doubles Ellex’s capacity — is now the base for Ellex’s design, manufacturing and marketing of its ophthalmic laser and ultrasound devices.

‘Looking’ at the financials

The polite way of describing Ellex is that it is a company investing in growth at the expense of short-term earnings.

In the 2016-17 year Ellex posted an $894,000 net loss compared with a $3.027m profit previously, on revenue of $71.6 million (2 per cent lower)

Adjusted for pesky forex differences and “abnormal expenses”, underlying ebitda was $3.2m.

Tellingly, the core laser and ultrasound division made a decent $7.3 million of ebitda, while the Itrack and 2RT arms lost a collective $1.7 million. Corporate costs accounted for a further $4.1 million deficit.

Encouragingly, the full-year revenue numbers showed that Ellex had overcome a first-half production bottleneck, with unfulfilled demand for the Tango Reflex.

Management had also guided to second-half ebitda being higher than the first and indeed that occurred, at least on an adjusted basis.

At the company’s November AGM, management said first (September) quarter sales grew 71 per cent to $2 million, with core laser and ultrasound sales up 2 percent.

This makes Itrack the growth engine, with five quarters of consecutive growth in the US for a cumulative growth rate of 70 per cent.

In May last year, Ellex said it would buy back the royalties for its Itrack device for $US2.15 million ($2.9 million). This removes the need to pay royalties to Itrack’s original vendor, ISCI Holdings, over the next five years.

In doing this, Ellex obviously believes the royalties are worth more than the $US2.15 million over the period.

A capital idea

In early November, Ellex passed the hat around for $23.2 million in a placement at $1.05 apiece, attracting local and global institutions.

The raising, the biggest in the the company’s history, was aimed mainly at accelerating the growth of Itrack on global markets.

The company also raised $577,500 in a share purchase placement that had targeted up to $5 million. But don’t worry folks: such shortfalls are common when retail investors are called on to stump up the readies.

Dr Boreham’s diagnosis

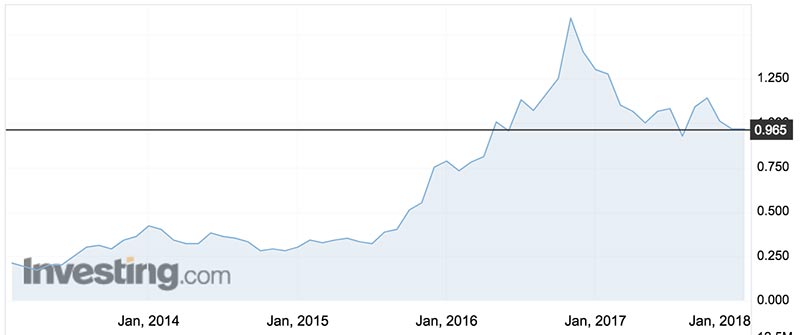

Ellex shares have taken a breather after whizzing up to $1.62 in late November. Five years ago the shares were trading at around 11c, proving a long-sighted investment for the early birds.

The shares may have come off their dizzying peak, but the current valuation still factors in a generous dollop of upside.

Globally, there’s no shortage of patients: the company estimates the global glaucoma market at $US4.6 billion (82 million patients), retinal disease $US1.9 billion (107 million patients), early AMD $US5.1 billion (122 million patients) and cataracts $US3.3 billion (25.3 million patients).

As any experienced bio-watcher knows, the real metric is: ‘How much of such a gi-normous market a minnow from Adelaide can snare?’

Ellex competes against bigger and more monied providers. But on its track record to date, the company has shown enviable vision in developing differentiated offerings.

Investors who bought into an earlier $10 million placement in December 2016 at $1.47 a share may be feeling less charitable.

It’s a moot point whether Ellex shares present value, but we would rather be buying them below $1 than at $1.60.

Boring metrics aside, there’s always the local feel-good angle: with the last Holden Commodore having rolled off the production line at nearby Elizabeth and the Crows flogged in the Grand Final, Adelaidians still have something to be proud of.

Disclosure: Dr Boreham is not a qualified medical practitioner and does not possess a doctorate of any kind. Still, he hopes he has crossed the Ts and dotted the eyes.

The content of this article was not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.