Elixinol goes big in Japan, takes control of local biz

Health & Biotech

Health & Biotech

Hemp grower Elixinol Global is seeking to take control of its Japanese division, while eyeing that market as the next big thing in hemp.

The company has lifted its interest in Elixinol Japan to 50.5 per cent for $2.2 million, from 35 per cent, after restructuring the business.

Elixinol, whose main revenue-generating operations are in the US, operates via a variety of international subsidiaries.

Currently the parent company owns its stake via Elixinol USA (10 per cent in Elixinol Japan) and Hemp Foods Australia (25 per cent in Hemp Foods Japan). Those will be combined into a single shareholding via EXL International.

The investment will provide working capital to grow Japan’s cannabidiol (CBD), hemp foods and skincare markets.

In the first six months of calendar 2018 Elixinol Japan made $600,000 in revenue and broke even.

The investment is funded out of Elixinol’s $14.2 million cash bank.

CEO Paul Benhaim says the signs point to Japan being poised for growth. Those signs have been conversations with distribution partners.

“Sales have continued to grow, albeit slowly, but the slow revenue growth is because the products are only in super high end distribution,” he told Stockhead.

“Some of those partners have suggested whether we would consider putting them in more mainstream locations.”

Mr Benhaim said this deal is the culmination of a long process, when asked why it took place now rather than as part of the pre-IPO restructuring last year.

“Japan works in quite a different way to most places in the world, it’s very much built on respect and hierarchy. It’s been a long journey to get us to become known as the number one brand [in hemp],” he said.

“In the last year we’ve ticked a few boxes, such as meeting with first lady [Akie Abe] and having her picture taken with our product, we got permission to get a billboard at Tokyo’s Omotesando train station, we got a feature with Vogue Japan.”

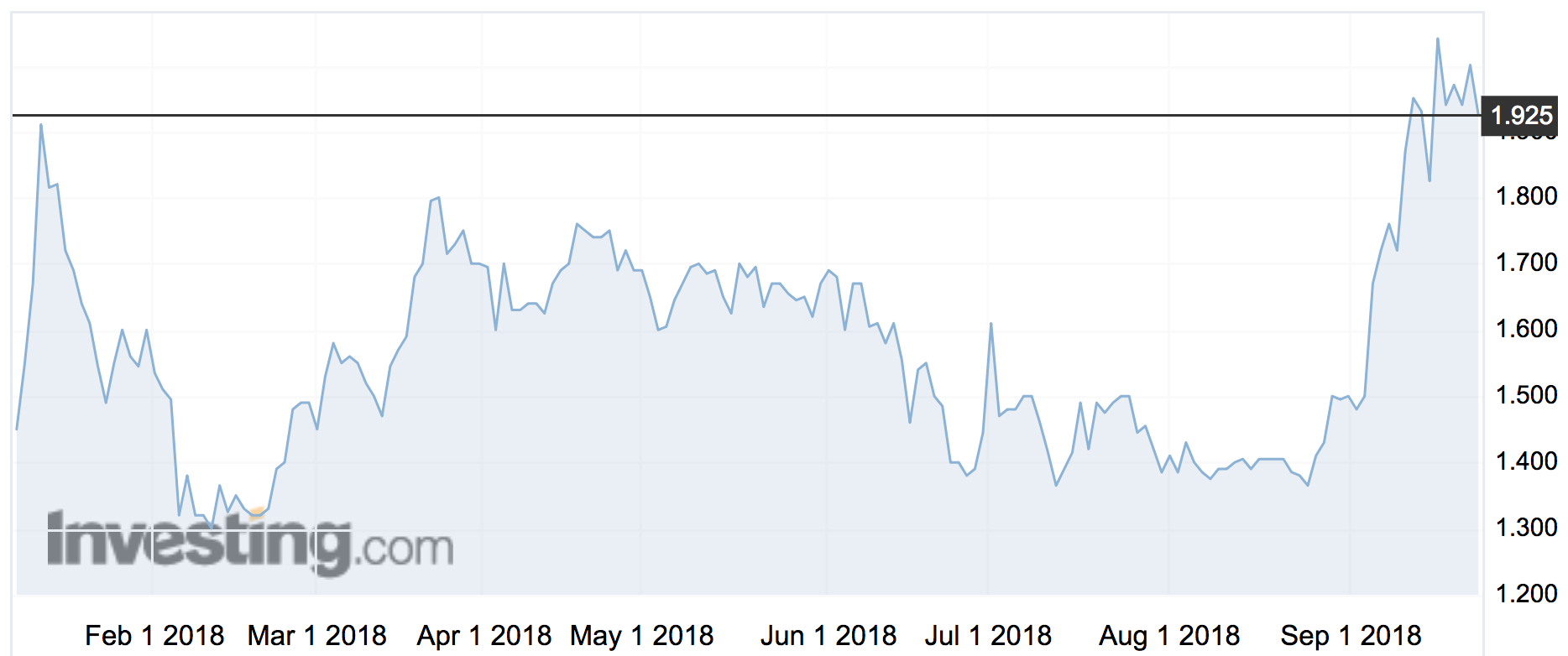

Elixinol’s share price surged during August on the back of news that it’s the first Aussie pot stock to turn a profit, and on a constant stream of positive comments on online investor forums.

The news today was not enough to sustain a run that saw the share price rise 50 per cent in the month after August 24.

It dipped 4 per cent to $1.93.