Dimerix leading race to find treatment for slowing progression of kidney disease

Dimerix is leading the race to find an effective treatment for kidney disease. Pic:Getty Images

Finding effective treatments for kidney disease has become a hot area among pharmaceutical companies globally and Aussie clinical stage biotech Dimerix has become a leader in the race.

With growing rates of kidney disease and the burden on health systems, governments are looking to find a solution.

ASX listed biotech Dimerix (ASX:DXB) is a leading contender with its lead drug candidate DMX-200 to help slow progression of kidney disease.

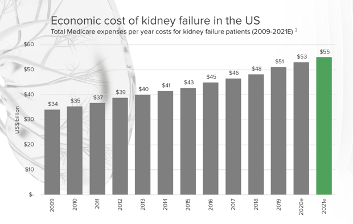

In 2021 kidney disease cost the US health system $88 billion with $55 billion of that spent on dialysis treatment.

White House says slow kidney disease

Dimerix CEO and managing director Dr Nina Webster said in 2019 the White House issued an executive order instructing physicians to do everything they can to delay patient progression to renal failure and needing dialysis.

“As a result, physicians are very much incentivised to treat patients with products like DMX-200 if it comes to market,” Webster said.

“There are a lot of companies actively seeking kidney assets at the moment,” she said.

One of those company’s is Australian healthcare giant CSL (ASX:CSL) which purchased Swiss based Vifor Pharma, a global specialty pharmaceuticals company in the treatment areas of iron deficiency, dialysis and nephrology.

“Vifor are big and one of the biggest kidney players across Europe, now known as CSL Vifor, and I believe CSL bought them because they have a large European footprint and kidney disease treatments are hot right now,” Webster said.

“There is a huge change in public policy and every incentive for doctors to bring the healthcare costs down.”

DMX-200 in Phase 3 trial

DMX-200 is already in Phase 3 pivotal clinical trial for the treatment of focal segmental glomerulosclerosis (FSGS) disease, a rare type of kidney disease.

The ACTION 3 Phase 3 study is being performed across 75 sites with part one data outcome expected to be known by mid-2023.

“We already have orphan drug designation in US, Europe and the UK and that comes with advantages including an accelerated pathway for approval and extended exclusivity period affecting all patents,” she said.

“We’re within 12 months of a major outcome for a Phase 3 clinical study and that will provide us with confidence we are on track for our final endpoint.“

Webster said the second analysis is expected to be about 12 months later where, if the data looks good with 144 total patients, they can go to the FDA and potentially to market.

“The benefit of that orphan drug designation is that we could get accelerated market approval, still market halfway through the study and in the background the study continues to the final endpoint, a great outcome for patients” Webster said.

“It also means you can get revenue while you wait for the final endpoint.”

No treatment for FSGS

Webster said there are no approved treatments for FSGS right now but because hypertension is a key issue in kidney disease, the standard of care is treatment with an angiotensin receptor blocker (ARB).

“ARBs are given to patients who present with cardiovascular hypertension as well and that blocks the AT1R receptor,” she said.

“Our drug is what is known as a CCR2 receptor blocker, which works on the inflammatory pathway, and what we have found is how they interact together.”

She said certain kidney cells express both receptors so using only one compound does not block signal activation and results in only a partial response.

“When you block both receptors at the same time you get a far more complete response, so that’s why patients stay on the standard of care of the ARB, and we add DMX-200 to block the CCR2 that second receptor,” she said.

“Across all our clinical studies we see that more complete response and that is the fundamental crux of the two drugs working together.”

Who else is in the race?

Webster said there are only two products in phase 3 development now for kidney disease.

“One is us and the other is a drug called Sparsentan which is being developed by a US company and is a dual angiotensin receptor blocker,” she said.

“We have data that demonstrates if you interchange any of the other ARBs with Sparsentan and then add DMX 200 on top, you will likely see the same added benefit of DMX-200 in that instance, which is a great outcome for both companies because they are likely to be complementary and not competitive.

“It is also a great outcome for patients because this could really have a massive impact on their kidney disease progression.”

She said DMX-200 is a single capsule given one in the morning and one in evening and a straightforward treatment.

Clinical studies to date have shown consistent efficacy data but also a strong safety profile, which Webster said was pleasing given patients are likely to be on the drug long-term.

“Our studies have shown so far that 86% patients saw a benefit on DMX-200, and 29% of patients demonstrated more than 40% reduction in proteinuria that means they’re in partial remission and kidney disease may have stopped progressing,” she said.

Webster said DMX-200 is showing the potential to add years to the life of a kidney which is both better in terms of quality of life for a patient but also reducing burden on the healthcare system.

“Dialysis is really awful and requires 12 hours minimum a week hooked up to a machine, and it really doesn’t last forever as patients often end up with other medical complications,” she said.

Huge potential market

“It is estimated that 60% of all diabetics have kidney disease, so as diabetes itself is growing so too is the diabetic kidney diease market,” Webster said.

Furthermore ~40,000 people in the US are diagnosed with FSGS with more than 5400 diagnosed annually and 50% progressing to kidney failure.

In the US ~1000 FSGS patients receive a kidney transplant each year. For reasons science is yet to explain 60% have recurring FSGS after their first kidney transplant.

“Australia is actually one of the fastest growing markets for FSGS and it’s not because you necessarily have more patients here; but rather it is diagnosed by biopsy and we have greater access to those biopsies,” Webster said.

While there can be a genetic link there is also FSGS of unknown cause, which is why the transplant is such an issue.

“You get recurrent FSGS in the transplanted kidney and no one knows why,” Webster said.

“It’s a very poor prognosis now and it affects children as young as two, so it affects any age.

“We do know FSGS affects men more than women and black more than white.”

Dimerix has also entered into an agreement with The Australian Centre for Accelerating Diabetes Innovations (ACADI).

The key agreement will progress its lead drug asset DMX-200 into a new clinical trial in patients with diabetic kidney disease.

The diabetic kidney disease has an addressable market of US $1.1 billion.

Licensing opportunities

DMX has no current plans for an internal sales and marketing team for DMX-200, but instead is looking into licensing opportunities.

“We are in Phase 3 trials, so naturally we are also attractive to a number of pharma companies right now and those discussions are active,” she said.

Dimerix presented at the BIO International Convention in June, the largest pharma partnering conference in the world and will also be present at BIO Europe later this month.

“Again, all the pharma companies from around the world will be in the same city so it’s a good opportunity to meet everybody in a short space of time,” Webster said.

“What we are looking for in a partner will be those key competencies to deliver on this product for the best outcome for patients as well as our investors.”

This article was developed in collaboration with Dimerix, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.