Could immunotherapy replace chemo? Here’s one stock that could rise 5x according to broker

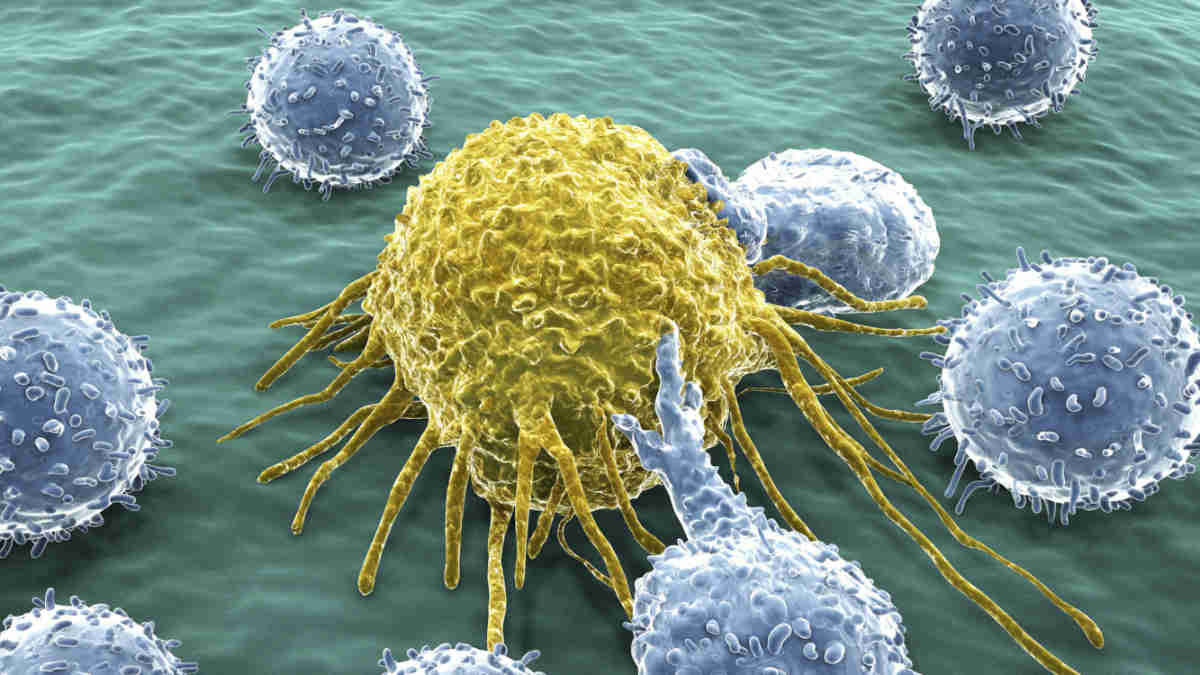

Could immunotherapy replace chemotherapy? We speak to Immutep CEO, Mark Voigt. Picture Getty Image

- Immunotherapy could replace chemotherapy in the front line battle against cancer

- Immutep’s LAG-3 program is the world’s leading program for LAG-3 immune inhibotors

- Stockhead reached out to Immutep CEO Mark Voigt

- Petra Capital’s said IMM’s share price could go 5x higher

Chemotherapy has been used to treat cancer for over 70 years, and despite the known toxic side effects, it is still the primary treatment for the majority of tumours today.

The track record for chemo varies depending on the type of cancer being treated, but overall the effectiveness has improved over time due to advancements in chemo drugs.

But we all know chemos can also cause unwanted side effects – including nausea, vomiting, hair loss, fatigue, and an increased risk of infection.

What some may not know is that high doses of chemo drugs can also cause heart disease, and sometimes even irreversible heart failure.

A recent study shows that cancer survivors who underwent chemotherapy have a 42% greater risk of heart failure and other cardiovascular diseases later in life than those without cancer.

ASX-listed Race Oncology (ASX:RAC) is one company that’s developing a drug that could protect heart muscle cells from chemo drugs-induced cell death.

Studies showed that Race’s lead drug Zantrene was able to protect primary human heart muscle (cardiomyocyte) cells from doxorubicin-induced cell death in breast cancer patients, while at the same time improve the killing of the cancer cells.

The results demonstrated high level of effectiveness when Zantrene was combined with the standard of care chemo therapeutic, doxorubicin.

The emergence of Immunotherapy

Chemotherapy is not the only treatment available, there are also several alternatives being performed on patients.

Surgery, for example, has always been one option, and that involves removing the cancerous tumour and surrounding tissues.

Hormone therapy, which is mostly used in treating breast and prostate cancer, uses a technique that uses hormones to grow and is most often used in combination with other cancer treatments.

Meanwhile, immunotherapy is a new form of therapy that has been gaining support recently.

Immunotherapy uses a person’s own immune system to fight cancer, boosting or changing how the patient’s immune system works so it can find and attack cancer cells.

Immutep (ASX:IMM) is one company on the ASX which owns one of the most unique immuno-oncology programs out there.

Immutep CEO Mark Voigt said the the limited success of chemotherapy over the last five decades has brought about a significant amount of side effects, and that new therapies are needed today to improve the patient’s quality of life.

“One of the most promising treatments these days is to use the patient’s own immune system to actively fight cancer,” Voigt told Stockhead.

“Cancer is effectively a malfunction of our immune system, suppressing it so it is not able to detect or kill rapidly dividing cells.

“But the older we get, the less effective the immune system becomes, and the more mistakes our body makes in terms of replicating cells.

“So the immune system needs to be brought up to the right activity level, and this is what we’re trying to achieve with cancer immunotherapies or immuno oncology,” added Voigt.

Immutep’s LAG-3 program

According to Voigt, around 20-30 years ago, immunotherapy was thought of as an obscure treatment by the medical community.

But over the past decade, the so called immune checkpoints have largely been approved, focusing on two immune checkpoint pathways of CTLA-4 and PD-1.

Merck’s blockbuster cancer drug Keytruda (or pembrolizumab) for example, is a PD-1 checkpoint inhibitor and has been the top selling drug in oncology, generating over US$20 billion last year.

Voigt explained that despite Keytruda’s success, the drug is only working well in about a third of the patients – meaning that about 70% of patients are still underserved.

Over the past several years there has been no new breakthroughs, but in 2021 the US FDA approved a new type of immune checkpoint inhibitor called a LAG-3 following Bristol Myers Squibb’s Phase II/III RELATIVITY-047 clinical trial on advanced melanoma.

LAG-3 stands for lymphocyte-activation gene, and studies have shown that repeated exposure to tumour antigens causes an increase in the expression of LAG-3, which in turn leads to T-cell exhaustion and suppression of its anti-tumour activities.

Voigt says that since 2013, there has always been a big question as to what will be the next immune checkpoint, and LAG-3 has now filled that void.

“Immutep has become the global leader in terms of LAG-3, and is the only LAG-3 pure play. We have more programs around LAG-3 than anyone else,” he said.

Immutep’s clinical trials

Voigt explained that LAG-3 could be described as the next step in immunotherapy.

The company’s lead asset, Eftilagimod Alpha (Efti), is at the centre of this evolution as a soluble LAG-3 protein that uniquely activates antigen-presenting cells (e.g., dendritic cells, monocytes) leading to a broad immune response to fight cancer.

“So our soluble LAG-3 is activating dendritic cells, which are known as the generals of the immune system, to inform the T-cells forces on who to attack,” said Voigt.

“In effect, it is responsible for creating and drafting more of those soldiers because Keytruda and other drugs will not work if there are not enough soldiers.”

Voigt explained that in oncology, most indications are treated via a combination of different drugs in order to achieve the best outcome.

Right now, Efti is being trialled in combination with Keytruda as a frontline treatment for patients with various conditions such as Head and Neck Squamous Cell Carcinoma, 1st Line Non-Small Cell Lung Cancer (1L NSCLC) and Metastatic Breast Cancer.

In February, Immutep announced that it has enrolled 20 patients with 1st line non-small cell lung cancer in the first triple combination therapy study of Efti with standard of care including Keytruda.

“In the past, we would have given two chemotherapies to these patients with 1L NSCLC,” said Voigt.

“Since immunotherapies are approved, and depending on the patient, we could now give either immunotherapy alone, or immunotherapy plus chemotherapy.

“For some patients, we could also lower the dosage of chemotherapy, but whether chemotherapy can be entirely replaced is a question that depends on the type of cancer.”

Could IMM share price rise 5x?

Stockhead reached out to Tanushree Jain, a healthcare analyst at Petra Capital, who analyses Immutep as part of her coverage.

Jain said Petra has a target price of $1.28 for IMM (vs current share price of $0.26).

She said that the multi-billion-dollar immunotherapy drugs targeting PD-1 work well for those who respond to them, but the question is how can you make them better and widen their reach?

She said that drug combinations are taking centre stage again, as are subcutaneous formulations to combat patent expiry.

“IMM’s efti is very well positioned in both these thematics, with 2023 a critical year for clinical data read outs and business development discussions on efti across 3 indications,” Jain said.

“Our target price for IMM is largely unchanged at $1.28 per share, and we re-iterate our Buy recommendation.”

Immutep share price today:

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.