Confusion and selloff as Credit Suisse pulls plug on US cannabis stocks

Credit Suisse will no longer execute stock trades on US-based cannabis companies. Picture:Getty Image.

There was shock and confusion in the North American cannabis industry last week, after news broke that the international banking firm, Credit Suisse Group, had announced to customers that it will no longer be executing stock transactions for US-based cannabis companies.

At this point it is still unclear what the overall impact of this decision will be, however according to Reuters — which initially broke the story — the move may have directly influenced a significant number of pot stock selloffs that occurred in recent weeks.

“[When] Credit Suisse pulled custodian [services] on cannabis stocks, a number of large investors in the space lost their ability to custodian the stocks. That led to a significant selloff,” Ascend Wellness Holdings CEO Abner Kurtin said.

The fallout of this decision can already be seen in the performance of the US-focused cannabis exchange traded fund, AdvisorShares Pure US Cannabis ETF (NYSE:MSOS), which has seen its share price dive by more than 20% since February 2021.

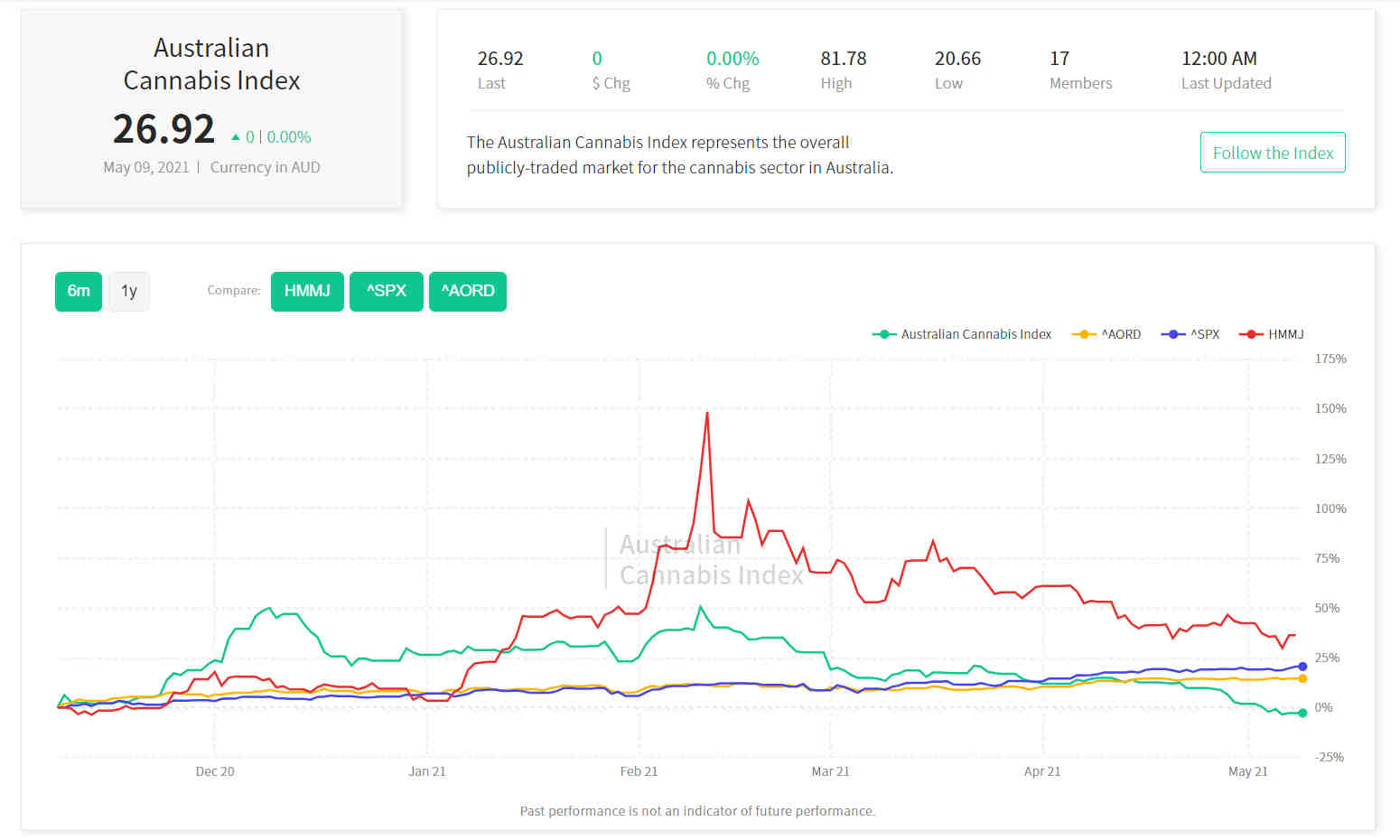

Similarly, the outlook of the ‘Horizons Marijuana Life Sciences Index ETF’ (HMMJ) also experienced a sharp decline on Thursday, plummeting to just 29.92% on the six-month performance chart, while the Australia Cannabis Index also fell to -2.75%.

In contrast, the S&P 500 and Australia’s All Ordinaries continued to maintain their upward momentum when compared to December 2020, recording gains of 20.61% and 14.55%, respectively.

There was big news from bio-pharma developer MGC Pharmaceuticals (ASX:MXC) last week, after the company announced that it had received a $1 million purchase order from Swiss PharmaCan AG (SPC) for its anti-inflammatory drug, ArtemiC Rescue.

“Receiving a second order on such a large scale from Swiss PharmaCan demonstrates the increasing demand for our product ArtemiC Rescue, and its associated benefits. Our team in Slovenia has been working tirelessly to ramp up production to ensure rapid deployment of this order, and any subsequent orders that may be received,” MGC Pharma managing director Roby Zomer said.

This marks the second wholesale purchase order made by SPC under its three-year supply and distribution agreement with MGC Pharma, which has a minimum shipment quantity of 40,000 units per quarter.

The company has also confirmed that it is currently seeking approval for ArtemiC Rescue — which can be used to alleviate the inflammatory symptoms of COVID-19 — as a healthcare supplement in a number of additional markets.

The Green Fund’s Australian Cannabis Index allows investors to benchmark top players in the Aussie cannabis space against the S&P500, the AORD, and HMMJ, giving them an overview of the health of the industry Down Under.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.