Compumedics returns to profit in FY25 on record revenue and sales orders

Compumedics returns to profitability in FY25 with record sales orders and revenue. Pic via Getty.

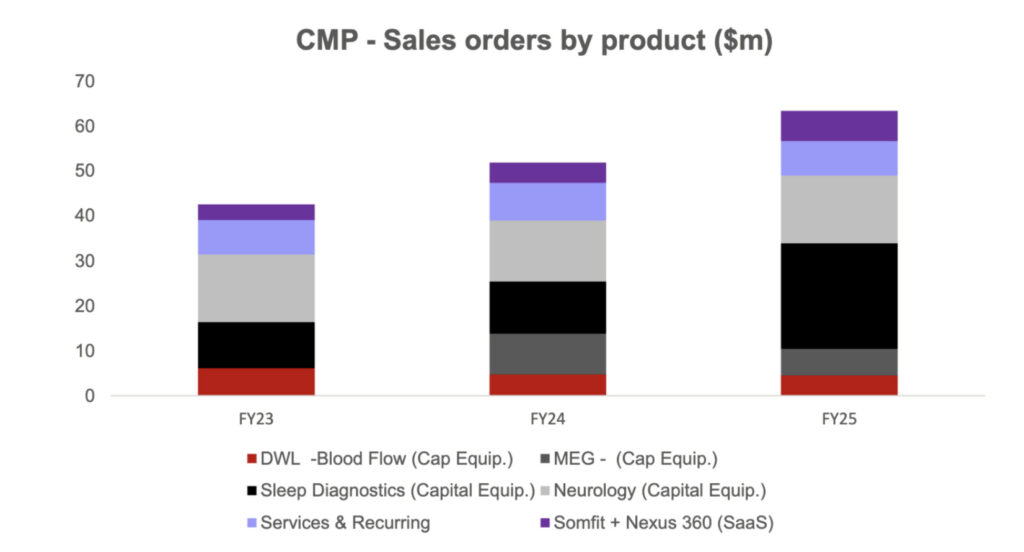

- Compumedics achieves record revenue of $51 million and sales orders of $63.4 million in FY25

- Company returns to profitability, with EBITDA of ~$3 million and sleep and neurology segment orders up 439%

- Compumedics reaffirms FY26 guidance of revenue of at least $70 million and EBITDA ~$9 million

Special Report: Compumedics has delivered a breakout performance in FY25, with record revenue and sales orders, a return to profitability, and accelerating growth in the US and SaaS segments.

Compumedics (ASX:CMP) said the last financial year laid a stronger more scalable business model for FY26 and beyond with record sales orders of $63.4 million, up 22% on FY24.

EBITDA increased to ~$3m, returning the company to profitability and supporting top line growth.

Compumedics is a global medical device company that develops, manufactures and commercialises diagnostic technology for sleep, brain, and ultrasonic blood flow monitoring.

Its sleep and neurology segment orders rose 39% to $53m in FY25, led by US sleep diagnostics growth up 102% to $23.5m.

Strong growth in the Somfit wearable sleep monitoring device designed for home-based sleep diagnostics and Nexus 360 – its cloud-based platform that enables remote data access, analysis, and clinical reporting – helped drive the turnaround.

Somfit and Nexus 360 SaaS orders increased to $6.7m, up +49%, with US Somfit sales orders rising 675% from $400,000 to $3.1m.

Compumedics said its Neuroscan Orion LifeSpan magnetoencephalography (MEG) orders totalled $5.9m, with three systems in progress for reported revenue in FY26 valued at ~$15m.

MEG is an advanced brain imaging technique that maps neural activity by detecting the tiny magnetic fields produced by electrical currents in the brain.

Unlike other imaging methods, MEG captures real-time brain function with millisecond accuracy, making it especially valuable for diagnosing and studying neurological conditions such as epilepsy, brain tumours and developmental disorders.

Compumedics’ Neuroscan Orion LifeSpan MEG system offers enhanced precision and full integration with its CURRY software, which records and analyses EEG, MEG, and ERP for comprehensive brain function insights.

Record reported revenue of $51m as US leads growth

Compumedics reported record revenue of $51m, up 4% on FY24 with sleep and neurology segment revenue growing 16% to $46.3m.

Somfit and Nexus 360 (SaaS) segment revenue contributed $6m, an increase of 41% on FY24

Geographically, the US continued to lead growth, with FY25 sales orders up 115% on FY24. Asia increased 71%, while Europe was up 12%.

Margin uplift was attributed to product mix optimisation, scaling SaaS, and stable overheads.

A modest $4.1m capital raise covered expanded working capital for the gap between sales and revenue.

Source: Compumedics

Focus higher-margin recurring revenue in FY26

Compumedics reaffirmed its FY26 guidance of revenue of at least $70m and EBITDA of ~$9m.

SaaS and connected platforms (Somfit + Nexus 360 segment) are expected to contribute more than 20% of group revenue, delivering high margins and scalability.

The company said the disposable Somfit (Somfit D) launch in the US was expected to increase penetration of the 3–4 million unit per annum Home Sleep Test market, representing a $150m to $300m opportunity.

Three MEG systems are on track for FY26 revenue, with paediatric market expansion increasing opportunity in the space to ~$120m.

Compumedics said it was now focused on capital efficiency and driving higher-margin, recurring revenue streams through product innovation and global expansion, including MEG system deliveries and a major push into the US sleep diagnostics market.

Step-change underway

Compumedics executive chairman Dr David Burton said the FY25 performance marked a pivotal shift, setting the stage for accelerated global growth and a more profitable, recurring revenue model.

“This result reflects the step-change underway at Compumedics,” Burton said.

“We are building a more predictable, higher-margin business model and seeing consistent revenue growth, expanding margins, and meaningful traction in the US and across our connected platforms.

“FY26 will see us scale into a more focused, cash-generative global business underpinned by recurring revenues from Somfit and clinical innovation, with MEG deliveries and growing demand in China providing further upside.”

This article was developed in collaboration with Compumedics, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.