Check Up: The future of telehealth, and the best and worst performing ASX health stocks for the month

Pic: Getty

Telehealth was already a growing space even before the pandemic, but COVID had launched it into the mainstream.

At the height of the pandemic in 2020, data from Research and Markets showed that 76% of hospitals in the US were using telehealth technologies to connect doctors to patients.

In Australia, ePrescriptions and new MBS (Medicare Benefit Schedule) items were quickly added by the government to support remote care when hospitals were shut down temporarily.

As remote digital care became more prevalent however, medical practitioners lament the growing problems caused by fragmented patient records, along with the mounting tech expenses required to stay competitive.

What’s the future of telehealth?

As we emerge out of the pandemic, could telehealth still become a permanent feature of primary healthcare?

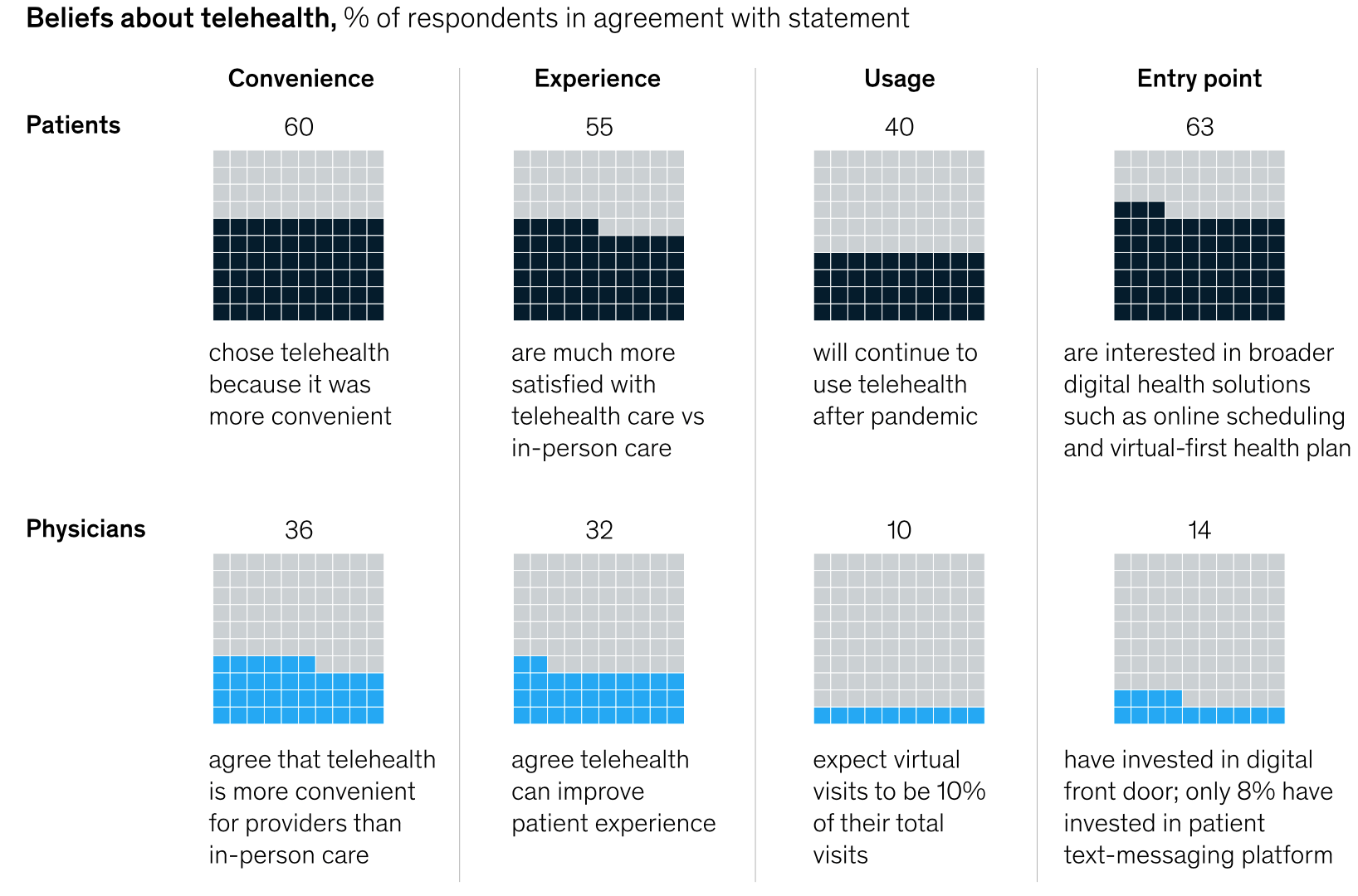

A recent survey by McKinsey shows that while patients love telehealth, physicians are not so sure.

Even as the number of telehealth players keeps increasing, the survey revealed that doctors and patients have starkly different opinions about telehealth and the broader digital engagement.

Take convenience: while two-thirds of physicians and patients said they agreed that virtual health is more convenient than in-person care for patients, only 36% of physicians find it more convenient for themselves.

Most physicians said they preferred and expected to return to the pre-Covid in-person delivery model over the next year, while a third expect telehealth to account for one-third less of their visits a year from now.

Best and worst performing ASX health stocks

To the ASX, here are the worst and best performing stocks this week.

| Code | Company | Price | %Week | %Month | %Year | Market cap |

|---|---|---|---|---|---|---|

| IHL | Incannex Healthcare | 0.735 | 31.3% | 61.5% | 241.9% | $809,713,762 |

| CGS | Cogstate Ltd | 2.07 | 26.2% | 15.0% | 106.0% | $357,070,096 |

| CDX | Cardiex Limited | 0.5 | 25.0% | 8.7% | -39.0% | $56,626,156 |

| PTX | Prescient Ltd | 0.1875 | 25.0% | -10.7% | 89.4% | $120,267,243 |

| AHK | Ark Mines Limited | 0.255 | 24.4% | 27.5% | 650.0% | $8,494,076 |

| VLS | Vita Life Sciences.. | 2.44 | 19.9% | 29.1% | 156.8% | $128,998,899 |

| RHY | Rhythm Biosciences | 1.255 | 19.5% | -11.0% | -23.0% | $251,541,954 |

| MVP | Medical Developments | 4.36 | 19.5% | -5.6% | -19.9% | $243,064,994 |

| BIT | Biotron Limited | 0.074 | 17.5% | 7.2% | 5.7% | $44,923,694 |

| PAB | Patrys Limited | 0.027 | 17.4% | -6.9% | 4.3% | $55,532,243 |

| NEU | Neuren Pharmaceuticals | 4.11 | 14.2% | 4.3% | 205.6% | $512,680,301 |

| ADR | Adherium Ltd | 0.011 | 10.0% | -15.4% | -45.0% | $26,499,013 |

| PSQ | Pacific Smiles Grp | 2.49 | 9.2% | -4.6% | -7.8% | $397,359,026 |

| IMM | Immutep Ltd | 0.365 | 9.0% | -9.9% | 0.0% | $298,942,980 |

| IBX | Imagion Biosys Ltd | 0.061 | 8.9% | -10.3% | -66.1% | $67,273,112 |

| IRX | Inhalerx Limited | 0.087 | 8.8% | 3.6% | -33.1% | $13,477,357 |

| AHC | Austco Healthcare | 0.135 | 8.0% | 3.8% | 42.1% | $36,944,564 |

| AVE | Avecho Biotech Ltd | 0.014 | 7.7% | 7.7% | -36.4% | $25,729,375 |

| CTE | Cryosite Limited | 0.45 | 7.1% | 4.7% | 125.0% | $21,964,303 |

| PNV | Polynovo Limited | 1.155 | 6.9% | -14.4% | -53.8% | $727,856,848 |

| JTL | Jayex Technology Ltd | 0.016 | 6.7% | -20.0% | -66.7% | $3,987,657 |

| PAA | Pharmaust Limited | 0.1 | 6.4% | 1.0% | 0.0% | $31,374,326 |

| TRP | Tissue Repair | 0.425 | 6.3% | -7.6% | 0.0% | $18,279,214 |

| BNO | Bionomics Limited | 0.071 | 6.0% | -22.8% | -80.3% | $97,441,254 |

| CAJ | Capitol Health | 0.37 | 5.7% | -1.3% | 7.2% | $380,409,392 |

| M7T | Mach7 Tech Limited | 0.75 | 5.6% | -2.6% | -48.3% | $181,150,596 |

| ATH | Alterity Therap Ltd | 0.02 | 5.3% | -4.8% | -44.4% | $45,730,617 |

| NC6 | Nanollose Limited | 0.105 | 5.0% | -8.7% | 0.0% | $15,633,069 |

| MVF | Monash IVF Group Ltd | 1.12 | 4.7% | 10.9% | 43.6% | $436,391,021 |

| ILA | Island Pharma | 0.25 | 4.2% | 0.0% | 0.0% | $10,811,582 |

| ICR | Intelicare Holdings | 0.075 | 4.2% | -13.8% | -69.1% | $6,478,520 |

| BOT | Botanix Pharma Ltd | 0.059 | 3.5% | 1.7% | -43.8% | $56,442,240 |

| ACW | Actinogen Medical | 0.097 | 3.2% | -25.4% | 340.9% | $174,326,966 |

| PGC | Paragon Care Limited | 0.38 | 2.7% | 5.6% | 40.7% | $243,463,647 |

| ADO | Anteotech Ltd | 0.195 | 2.6% | -13.3% | -11.4% | $367,317,455 |

| HGV | Hygrovest Limited | 0.051 | 2.0% | 10.9% | -59.2% | $11,727,653 |

| UBI | Universal Biosensors | 0.925 | 1.6% | 7.6% | 120.2% | $161,969,539 |

| CYP | Cynata Therapeutics | 0.415 | 1.2% | -12.6% | -35.2% | $59,459,787 |

| CYC | Cyclopharm Limited | 1.53 | 0.7% | -13.3% | -41.4% | $140,062,235 |

| ALT | Analytica Limited | 0.002 | 0.0% | 0.0% | -33.3% | $9,227,602 |

| OCC | Orthocell Limited | 0.405 | 0.0% | -9.0% | -22.9% | $82,793,723 |

| AMT | Allegra Orthopaedics | 0.165 | 0.0% | 10.0% | -55.4% | $17,235,768 |

| SCU | Stemcell United Ltd | 0.014 | 0.0% | 0.0% | -51.7% | $14,696,981 |

| MEB | Medibio Limited | 0.004 | 0.0% | 0.0% | -60.0% | $9,004,401 |

| ICS | ICSGlobal Limited | 0.575313 | 0.0% | 0.0% | 10.6% | $6,054,605 |

| FFC | Farmaforce Ltd | 0.035 | 0.0% | -35.2% | -64.6% | $4,573,834 |

| MEM | Memphasys Ltd | 0.067 | 0.0% | -8.2% | -31.6% | $53,868,127 |

| ALC | Alcidion Group Ltd | 0.205 | 0.0% | -19.6% | -14.7% | $266,294,501 |

| SDI | SDI Limited | 0.84 | 0.0% | -9.2% | 6.3% | $99,847,045 |

| BPH | BPH Energy Ltd | 0.037 | 0.0% | 0.0% | -78.2% | $24,602,017 |

| NSB | Neuroscientific | 0.285 | 0.0% | -5.0% | 23.9% | $40,889,418 |

| VBS | Vectus Biosystems | 1.375 | 0.0% | -1.4% | 10.0% | $48,119,731 |

| PAL | Palla Pharma Ltd | 0.295 | 0.0% | 0.0% | -54.7% | $47,764,383 |

| 1AD | Adalta Limited | 0.075 | 0.0% | -9.6% | -54.1% | $23,563,856 |

| LCT | Living Cell Tech. | 0.005 | 0.0% | 0.0% | -69.2% | $5,141,819 |

| GSS | Genetic Signatures | 1.19 | -0.8% | -13.8% | -29.2% | $170,321,720 |

| IMU | Imugene Limited | 0.2525 | -1.0% | -23.5% | 152.5% | $1,549,393,834 |

| PCK | Painchek Ltd | 0.04 | -1.2% | -16.7% | -47.4% | $45,272,192 |

| TLX | Telix Pharmaceutical | 5.05 | -1.6% | -28.7% | 27.5% | $1,596,881,005 |

| OPT | Opthea Limited | 1.005 | -2.0% | -12.6% | -36.4% | $371,295,940 |

| RCE | Recce Pharmaceutical | 0.98 | -2.0% | -20.3% | -4.4% | $170,557,090 |

| AN1 | Anagenics Limited | 0.047 | -2.1% | -7.8% | -44.5% | $10,830,044 |

| RAC | Race Oncology Ltd | 2.74 | -2.1% | -10.2% | -28.3% | $444,850,942 |

| SOM | SomnoMed Limited | 1.81 | -2.2% | -14.2% | -3.5% | $149,794,360 |

| EXL | Elixinol Wellness | 0.044 | -2.2% | -37.1% | -78.5% | $13,268,269 |

| PIQ | Proteomics Int Lab | 1.21 | -2.4% | 12.0% | -8.7% | $130,018,226 |

| OSL | Oncosil Medical | 0.039 | -2.5% | 2.6% | -61.0% | $30,901,388 |

| KZA | Kazia Therapeutics | 0.955 | -2.6% | -0.5% | -25.4% | $126,095,535 |

| HXL | Hexima | 0.38 | -2.6% | 0.0% | 153.3% | $60,700,725 |

| NYR | Nyrada Inc. | 0.19 | -2.6% | -11.6% | -40.6% | $29,641,653 |

| CMP | Compumedics Limited | 0.36 | -2.7% | -2.7% | -15.3% | $60,235,402 |

| OSP | Osprey Med Inc | 0.35 | -2.8% | -23.1% | -80.6% | $8,980,490 |

| RAP | Resapp Health Ltd | 0.067 | -2.9% | -9.5% | 17.5% | $58,425,401 |

| IIQ | Inoviq Ltd | 0.935 | -3.1% | -11.8% | -68.3% | $84,657,206 |

| PXS | Pharmaxis Ltd | 0.089 | -3.3% | -11.0% | 8.5% | $51,049,854 |

| ATX | Amplia Therapeutics | 0.145 | -3.3% | -14.7% | -44.7% | $29,078,100 |

| ANP | Antisense Therapeut. | 0.145 | -3.3% | -17.1% | -19.4% | $100,319,097 |

| EZZ | EZZ Life Science | 0.41 | -3.5% | -8.9% | 0.0% | $5,231,600 |

| PBP | Probiotec Limited | 2.15 | -3.6% | -6.1% | -3.6% | $181,351,195 |

| OIL | Optiscan Imaging | 0.13 | -3.7% | -13.3% | -46.9% | $77,398,200 |

| MXC | Mgc Pharmaceuticals | 0.024 | -4.0% | -22.6% | -70.7% | $67,960,807 |

| VTI | Vision Tech Inc | 0.68 | -4.2% | -20.0% | -62.2% | $15,835,785 |

| BDX | Bcaldiagnostics | 0.11 | -4.3% | -4.3% | 0.0% | $14,472,927 |

| RAD | Radiopharm | 0.31 | -4.6% | -11.4% | 0.0% | $37,949,812 |

| RAD | Radiopharm | 0.31 | -4.6% | -11.4% | 0.0% | $37,949,812 |

| PYC | PYC Therapeutics | 0.1 | -4.8% | -23.1% | -31.0% | $308,549,832 |

| IMC | Immuron Limited | 0.1 | -4.8% | -25.9% | -52.4% | $23,918,826 |

| DVL | Dorsavi Ltd | 0.02 | -4.8% | 5.3% | -41.2% | $7,077,626 |

| ALA | Arovella Therapeutic | 0.04 | -4.8% | -4.8% | -9.1% | $24,947,771 |

| IDT | IDT Australia Ltd | 0.19 | -5.0% | -32.1% | 0.0% | $47,884,033 |

| ARX | Aroa Biosurgery | 0.755 | -5.0% | -10.1% | -37.6% | $260,145,061 |

| PAR | Paradigm Bio. | 1.19 | -5.2% | -20.7% | -49.1% | $286,770,702 |

| BXN | Bioxyne Ltd | 0.017 | -5.6% | -15.0% | 41.7% | $10,882,472 |

| NOX | Noxopharm Limited | 0.335 | -5.6% | -25.6% | -54.4% | $94,977,334 |

| CAN | Cann Group Ltd | 0.25 | -5.7% | -10.7% | -58.3% | $85,535,264 |

| GLH | Global Health Ltd | 0.33 | -5.7% | -16.5% | -17.5% | $16,994,818 |

| IVX | Invion Ltd | 0.016 | -5.9% | -15.8% | 77.8% | $109,080,732 |

| ONE | Oneview Healthcare | 0.235 | -6.0% | -4.1% | 173.3% | $129,211,439 |

| MDC | Medlab Clinical Ltd | 0.1175 | -6.0% | -13.0% | -64.4% | $41,061,081 |

| VHT | Volpara Health Tech | 0.705 | -6.0% | -26.6% | -48.5% | $182,652,934 |

| NTI | Neurotech Intl | 0.045 | -6.3% | -6.3% | -36.6% | $31,396,461 |

| RGS | Regeneus Ltd | 0.066 | -7.0% | -18.5% | -40.0% | $20,224,836 |

| CU6 | Clarity Pharma | 0.65 | -7.1% | -11.0% | 0.0% | $116,956,319 |

| EYE | Nova EYE Medical Ltd | 0.24 | -7.7% | -18.6% | -29.4% | $36,024,563 |

| IPD | Impedimed Limited | 0.16 | -8.6% | -15.8% | 28.0% | $293,204,276 |

| RSH | Respiri Limited | 0.042 | -8.7% | -17.6% | -67.7% | $31,082,154 |

| LBT | LBT Innovations | 0.082 | -8.9% | -11.8% | -21.9% | $27,031,680 |

| TSN | The Sust Nutri Grp | 0.15 | -9.1% | -6.3% | -61.5% | $17,487,926 |

| TD1 | Tali Digital Limited | 0.019 | -9.5% | 11.8% | -59.6% | $17,706,210 |

| SHG | Singular Health | 0.19 | -9.5% | -28.3% | -71.2% | $13,057,814 |

| NXS | Next Science Limited | 0.93 | -9.7% | -27.3% | -24.4% | $178,278,699 |

| MDR | Medadvisor Limited | 0.315 | -10.0% | -16.0% | -14.9% | $120,936,517 |

| CBL | Control Bionics | 0.36 | -10.0% | -16.3% | -47.8% | $18,119,126 |

| RHT | Resonance Health | 0.13 | -10.3% | -16.1% | -31.6% | $59,910,758 |

| ACR | Acrux Limited | 0.094 | -10.5% | -2.1% | -44.7% | $28,425,546 |

| AGH | Althea Group | 0.17 | -10.5% | -20.9% | -68.5% | $53,510,485 |

| MX1 | Micro-X Limited | 0.17 | -10.5% | -27.7% | -57.5% | $73,651,087 |

| DXB | Dimerix Ltd | 0.19 | -11.6% | -26.9% | -24.0% | $57,757,260 |

| AT1 | Atomo Diagnostics | 0.1225 | -12.5% | -45.6% | -46.7% | $53,129,744 |

| EPN | Epsilon Healthcare | 0.053 | -13.1% | -19.7% | -76.4% | $11,803,468 |

| HCT | Holista CollTech Ltd | 0.033 | -13.2% | -28.3% | -52.9% | $9,086,520 |

| TRU | Truscreen | 0.063 | -13.7% | -10.0% | -24.1% | $22,860,574 |

| AC8 | Auscann Grp Hlgs Ltd | 0.067 | -14.1% | -5.6% | -55.3% | $30,838,298 |

| 4DX | 4Dmedical Limited | 0.695 | -14.2% | -32.2% | -59.8% | $140,000,361 |

| OVN | Oventus Medical Ltd | 0.048 | -14.3% | -36.0% | -76.0% | $11,602,874 |

| GTG | Genetic Technologies | 0.005 | -16.7% | 11.1% | -54.5% | $46,169,826 |

| S66 | Star Combo | 0.205 | -18.0% | -30.5% | -29.3% | $27,573,111 |

| ZLD | Zelira Therapeutics | 0.021 | -19.2% | -27.6% | -70.4% | $36,852,243 |

| OSX | Osteopore Limited | 0.165 | -19.5% | -29.8% | -62.5% | $23,453,648 |

| CHM | Chimeric Therapeutic | 0.155 | -19.6% | -30.1% | -48.1% | $42,194,657 |

| ZNO | Zoono Group Ltd | 0.225 | -21.1% | -21.1% | -69.4% | $34,946,458 |

| DOC | Doctor Care Anywhere | 0.295 | -22.4% | -41.6% | -76.5% | $58,963,995 |

| RNO | Rhinomed Ltd | 0.185 | -22.9% | -32.7% | 60.9% | $51,961,826 |

| CPH | Creso Pharma Ltd | 0.059 | -23.4% | -29.8% | -71.9% | $74,922,703 |

| 1ST | 1St Group Ltd | 0.009 | -25.0% | -34.0% | -68.3% | $4,987,384 |

| BWX | BWX Limited | 2.38 | -31.6% | -29.8% | -45.9% | $390,568,403 |

| LDX | Lumos Diagnostics | 0.43 | -32.8% | -54.0% | 0.0% | $69,357,410 |

| ONT | 1300 Smiles Limited | 0 | -100.0% | -100.0% | -100.0% | $168,827,115 |

Pain relief specialist Medical Development International (ASX:MVP) surged 30% on Wednesday after announcing that the US FDA has unconditionally lifted the agency’s clinical hold on its lead product, Penthrox.

Commonly known as the “green whistle”, Penthrox is an analgesic used by paramedics and ambulances to administer emergency pain relief.

The latest FDA move means that MVP can immediately begin preparing for its Phase III US clinical trial, a critical step towards bringing Penthrox closer to licensure in the US market.

As anticipated, the two-year trial will be conducted on a targeted trauma and associated pain patient group, with recruitment expected to commence in late 2022.

CEO Brent MacGregor said: “We are thrilled with this news which allows us to move forward quickly with preparations for our clinical trial.”

“After years of hard work, our team is buoyed by the prospect of bringing the many benefits of Penthrox to the US market. This will strongly complement our growing Penthrox success in Europe, and fully supports our further investment in the product.”

Another stock leading the pack during the month was clinical-stage medical cannabis and psilocybin treatment company Incannex Healthcare (ASX:IHL), which continues to attract investor attention.

The stock closed above 60c on February 28 to bring its annual gains north of 200%, after it announced that American Depositary Shares representing ordinary IHL stock have begun trading on the US Nasdaq index.

“By achieving a dual listing on Nasdaq, the company is now more accessible to a wider audience of investors with sophisticated understandings of medicinal cannabinoids, psychedelic therapies, and pharmaceutical development,” IHL said.

Australian clinical stage cell technology company Cynata Therapeutics (ASX:CYP) has received a notice of Decision to Grant from the patent office of China for its proprietary Cymerus mesenchymal stem cell (MSC) technology.

The patent, fully owned by Cynata, will extend the already strong IP protection of the Cymerus manufacturing platform, which already has patents in crucial markets including Japan, Europe and the US.

CEO Dr Ross Macdonald says China is an enormously important market given its growing economy and its government’s focus on the adoption of sophisticated and innovative medicines.

Highlights from first half earnings results

Revenue of $38.7m, up 199% on pcp.

NPAT loss of $7.7m.

Despite the loss, the company signed key deals during the half which could build into future revenues.

It signed a five-year deal with Australian Pharmaceutical Industries (Priceline), as well as a deal with US giant Walmart.

In the Walmart deal, MedAdvisor will provide a full suite of its adherence solutions (including digital, in-pharmacy print and direct mail) to Walmart customers.

Revenue $5.977m vs $3.546m in the pcp.

Loss before income tax -$48.7m vs loss of $50.89m in the pcp.

Mesoblast has recorded a loss as it conducted ongoing activities to commercialise a range of drugs to the market, which includes a drug to treat GVHD (graft versus host disease).

GVHD is a severe inflammation in the bloodstream caused by complications of bone marrow transplants.

Mesoblast has a strong and extensive global intellectual property portfolio with patent protection extending through to at least 2041 in major markets.

Record revenue of $23.1m, up 67% on pcp.

NPAT of $6.1m, up from loss of $0.4m in the pcp.

CGS says clinical trials sales contracts executed during the half reflect the continued increase in investment in Alzheimer’s disease research by large pharmaceutical companies.

The company has forecast FY22 revenue to come in the range of $44-$47m, with operating expenses to remain in the range of 31%-33% of revenue.

This will take its FY22 EBIT margins to a range of 20%-24%, up from previous guidance of 15%-18%.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.