Check Up: Earnings season is almost here. Here’s how ASX biotech investors should read the 4C Report

Investors should become familiar with the Appendix 4C report. Picture Getty

- Earnings season is upon us, and ASX biotechs will be reporting

- Investors should become familiar with the Appendix 4C report

- And here are the recent ASX healthcare stocks winners

Investors are about to head into one of the most important periods of the calendar – the September – December earnings season.

In Australia, the ASX 200’s strong finish in 2023 has set a positive tone for the season.

Focus will be on the banks’ performance, the miners’ response to rising iron ore prices, and the potential growth of the Energy and Health Care sectors.

What specific things should investors look for?

Well, first, consistent earnings are probably the most important driver of individual stock performance.

When a stock reports increasing sales / earnings, investors tend to feel more confident about the stock’s prospects. Conversely, when earnings are declining below expectations, it can be a warning sign of potential trouble ahead.

How to read the Appendix 4C report

What about stocks with no current earnings, such as the dozens of pre-revenue biotech stocks on the ASX?

In their case, the one thing to focus on is the Appendix 4C report, or what’s formerly called the Quarterly cash flow report for entities subject to Listing Rule 4.7B.

ASX companies that are yet to turn a profit or achieve positive operating cash flow, must submit these reports to the market every three months.

This quarterly report details a company’s financial position through its cash flow during the period.

This along with the accompanying activity report provide a basis for informing the market about the company’s activities for the past quarter, how it has been financed, and the effect this has had on its cash position.

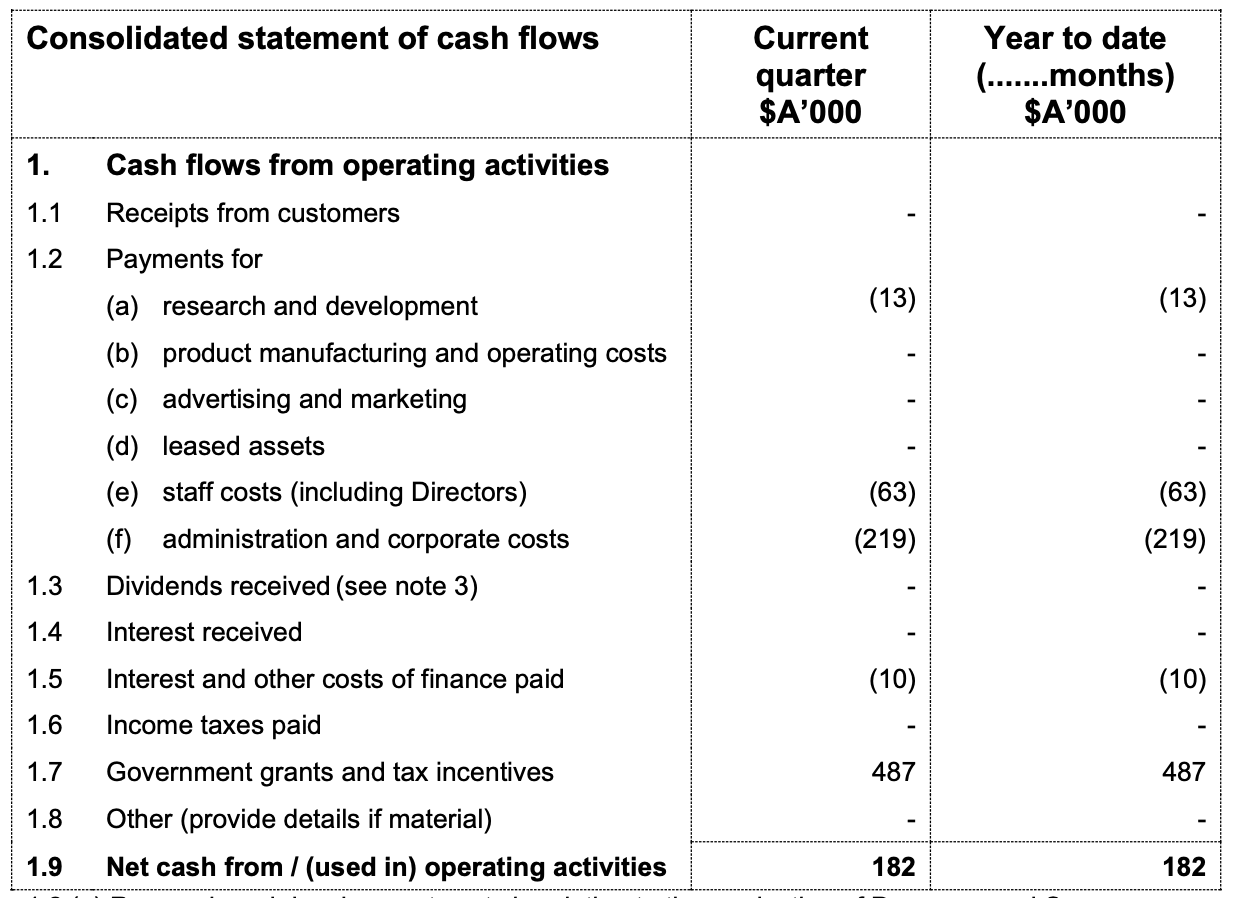

Cash Flow From Operating Activities

One of the most important things in the report is tracking how a company spends its funds.

“If a company ‘burns’ through cash quickly, that will shape its future growth and funding prospects,” said trading platform, Selfwealth.

“You should also audit whether expenditure is in line with the company’s forecast in the prior quarterly cash flow report.”

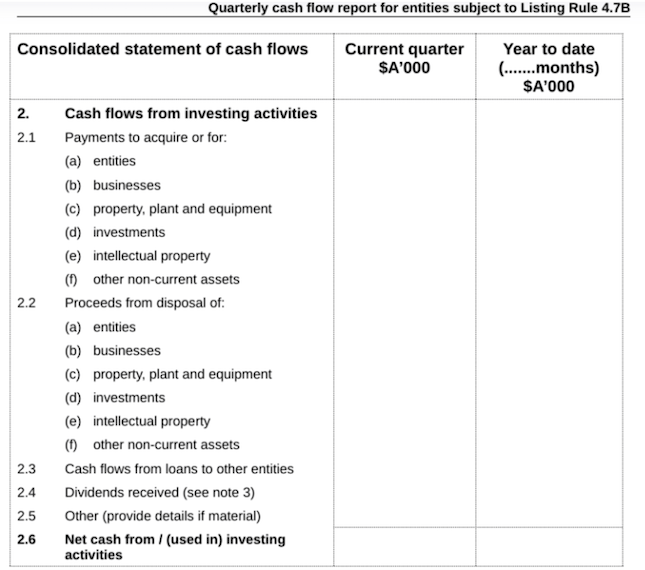

Cash Flow From Investing Activities

Where a company acquires or disposes of assets that are integral to its operations, all associated cash flow will be displayed in this section.

“If a company has sufficient capital to fund its acquisitions, a cash outflow from investing activities should not necessarily raise a red flag in its own right,” noted Selfwealth.

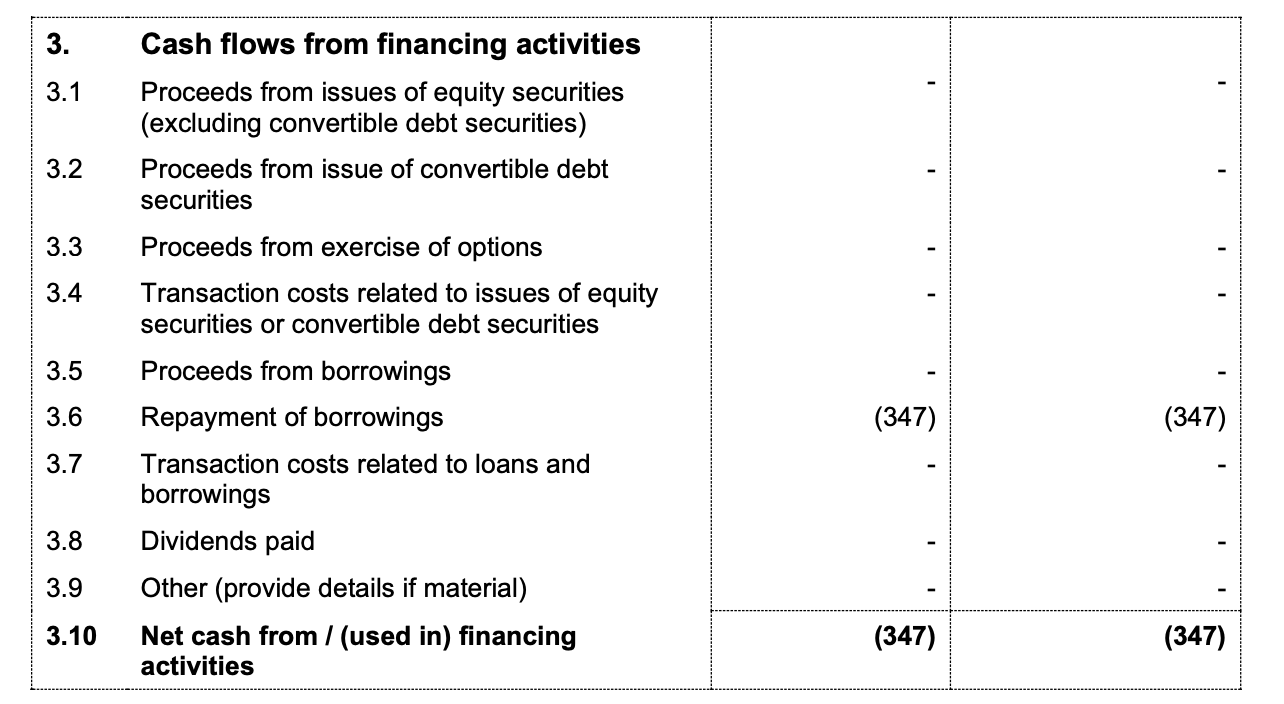

Cash Flow From Financing Activities

When it comes to funding, the market will typically favour small-cap stocks that use existing cash reserves in place of debt or new equity.

“With that said, there are instances where these forms of funding have a distinct benefit, particularly if there are immediate opportunities available to fund growth,” said Selfwealth.

“In any case, investors should pay attention to the details of this section to establish whether a company is dependent on debt or issuing financial instruments in order to stay afloat.

“This could be the sign of an unsustainable business, or at least one that is taking longer to grow than management may have expected, especially if cash flow from operating activities is not showing growth.”

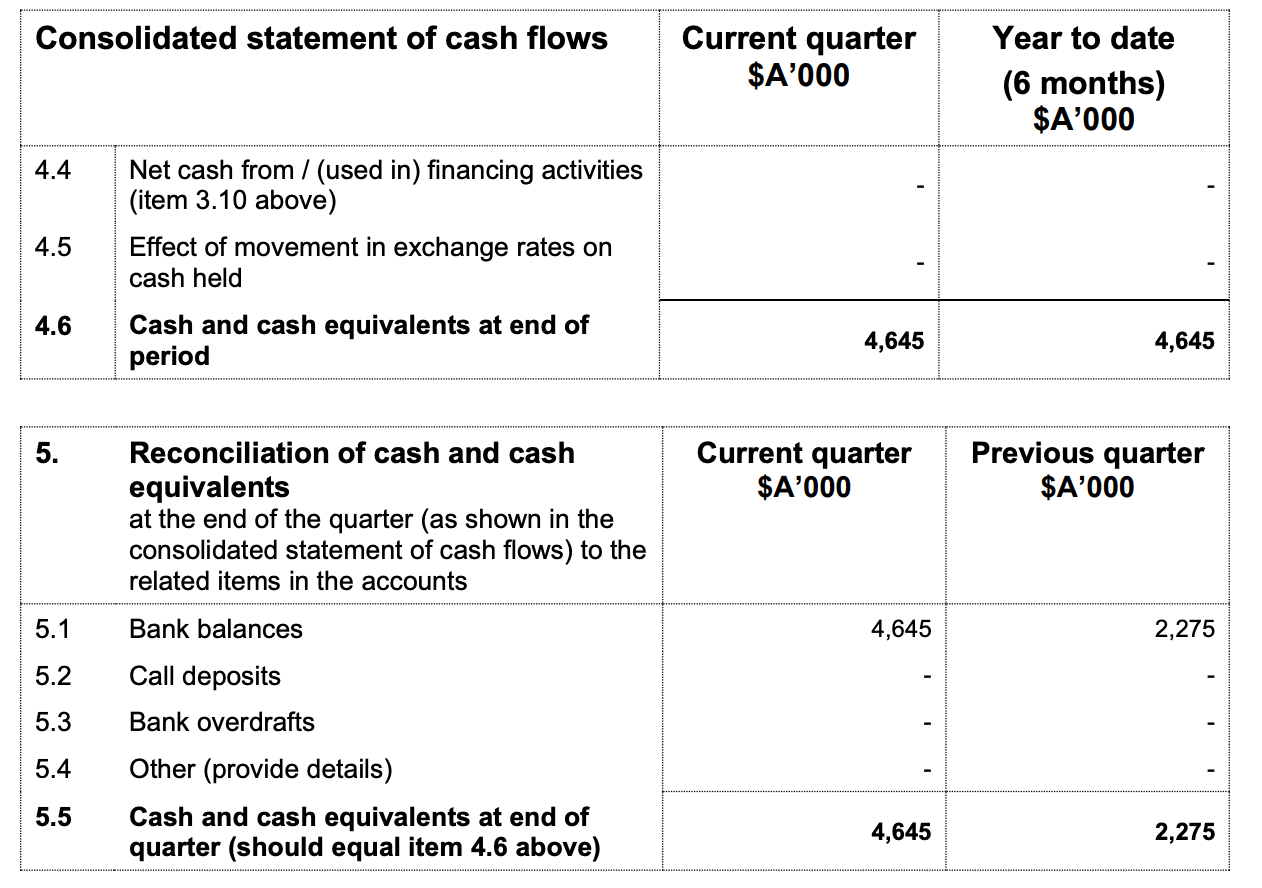

Consolidated statement of cash flows

This provides a snapshot as to the overall change in cash and cash equivalents across the quarter.

“It is not uncommon to see companies holding call deposits or bank overdrafts as opposed to bank balances,” said Selfwealth.

“The key thing here to look at is whether the company has sufficient funds to at least sustain current operations for subsequent quarters, if not ramp up operations in pursuit of growth.”

Best performing ASX biotechs over the past month

Swipe or scroll to reveal the full table. Click headings to sort

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| EYE | Nova EYE Medical | 0.280 | 2 | 124 | 10 | -8 | $52,422,946 |

| ADR | Adherium | 0.061 | -2 | 91 | 36 | 2 | $20,006,399 |

| SHG | Singular Health | 0.078 | 100 | 86 | 86 | -29 | $11,304,821 |

| RGS | Regeneus | 0.007 | 17 | 75 | -30 | -84 | $2,145,058 |

| MDR | Medadvisor | 0.290 | 4 | 55 | 29 | 14 | $159,461,104 |

| RNO | Rhinomed | 0.032 | 7 | 45 | -48 | -71 | $9,143,030 |

| EMV | Emvision Medical | 2.150 | 5 | 43 | 81 | 26 | $162,930,364 |

| CMP | Compumedics | 0.385 | 43 | 43 | 108 | 97 | $69,093,550 |

| NTI | Neurotech Intl | 0.077 | 5 | 40 | 75 | 13 | $66,880,443 |

| RAD | Radiopharm | 0.094 | 4 | 36 | -10 | -26 | $33,555,520 |

| ALA | Arovella Therapeutic | 0.135 | 4 | 35 | 187 | 463 | $123,800,342 |

| NEU | Neuren Pharmaceut. | 22.860 | -2 | 33 | 68 | 158 | $3,018,741,835 |

| PEB | Pacific Edge | 0.100 | -9 | 33 | -47 | -80 | $81,127,134 |

| NXS | Next Science | 0.370 | -1 | 32 | -33 | -46 | $97,717,860 |

| EBR | EBR Systems | 0.730 | 12 | 30 | -20 | 24 | $227,195,361 |

| LBT | LBT Innovations | 0.013 | 18 | 30 | -29 | -73 | $16,375,801 |

| CU6 | Clarity Pharma | 2.150 | -4 | 30 | 134 | 143 | $555,948,353 |

| UBI | Universal Biosensors | 0.230 | 10 | 28 | -8 | -21 | $48,844,970 |

| PAB | Patrys | 0.010 | 25 | 25 | -17 | -68 | $16,459,579 |

| BOT | Botanix Pharma | 0.180 | 3 | 24 | 29 | 190 | $273,601,540 |

| CSX | Cleanspace Holdings | 0.360 | 16 | 24 | 50 | -35 | $31,314,075 |

| PAA | Pharmaust | 0.135 | 13 | 23 | 69 | 59 | $50,045,528 |

| MVP | Medical Developments | 0.955 | -2 | 22 | -36 | -43 | $86,305,219 |

| PSQ | Pacific Smiles Grp | 1.450 | -1 | 21 | -6 | -5 | $232,989,629 |

| ACR | Acrux | 0.058 | -2 | 21 | 23 | -15 | $17,377,859 |

| HMD | Heramed | 0.024 | 4 | 20 | -70 | -83 | $7,710,341 |

| ONE | Oneview Healthcare | 0.275 | 15 | 20 | 34 | 175 | $180,739,751 |

| IMM | Immutep | 0.380 | 10 | 19 | 19 | 29 | $451,757,132 |

| PBP | Probiotec | 2.860 | -1 | 19 | 6 | 30 | $233,398,175 |

| DOC | Doctor Care Anywhere | 0.070 | -7 | 19 | 56 | 27 | $24,931,673 |

| LDX | Lumos Diagnostics | 0.083 | -3 | 19 | 30 | 89 | $42,354,404 |

| DXB | Dimerix | 0.195 | -13 | 18 | 167 | 28 | $84,490,920 |

| CBL | Control Bionics | 0.047 | 2 | 18 | -39 | -68 | $6,808,967 |

| TLX | Telix Pharmaceutical | 11.025 | 17 | 17 | -7 | 69 | $3,496,248,176 |

| AGN | Argenica | 0.605 | 25 | 16 | 75 | 32 | $65,935,297 |

| BIT | Biotron | 0.100 | -9 | 15 | 194 | 233 | $90,227,551 |

| CTE | Cryosite | 0.745 | 20 | 15 | 15 | 1 | $34,166,694 |

| AVE | Avecho Biotech | 0.004 | 33 | 14 | -20 | -75 | $12,677,188 |

| AVH | Avita Medical | 4.370 | 8 | 14 | -24 | 105 | $276,898,590 |

| AHX | Apiam Animal Health | 0.305 | 2 | 13 | -40 | -51 | $54,901,661 |

| FCG | Freedomcarehold | 0.175 | -3 | 13 | $4,179,684 | ||

| SOM | SomnoMed | 0.460 | 0 | 12 | -54 | -63 | $49,952,042 |

| IMU | Imugene | 0.105 | -19 | 12 | 5 | -38 | $752,754,128 |

| IPD | Impedimed | 0.145 | -6 | 12 | -17 | 104 | $283,263,109 |

| AGH | Althea | 0.040 | 8 | 11 | -15 | -38 | $16,633,846 |

| CHM | Chimeric Therapeutic | 0.030 | -12 | 11 | -29 | -64 | $23,991,632 |

| CVB | Curvebeam Ai | 0.370 | -4 | 10 | $75,015,914 | ||

| AFP | Aft Pharmaceuticals | 3.500 | 6 | 10 | 3 | 4 | $367,031,910 |

| JTL | Jayex Technology | 0.011 | 22 | 10 | 10 | 10 | $3,094,064 |

| 1AD | Adalta | 0.024 | -4 | 9 | -4 | -41 | $13,145,102 |

| DVL | Dorsavi | 0.012 | 0 | 9 | -14 | 0 | $7,159,939 |

| AT1 | Atomo Diagnostics | 0.025 | 9 | 9 | -31 | -53 | $15,980,058 |

| MEM | Memphasys | 0.013 | 0 | 8 | -19 | -2 | $14,698,202 |

| CYP | Cynata Therapeutics | 0.135 | 4 | 8 | 4 | -55 | $24,250,291 |

| LGP | Little Green Pharma | 0.140 | 0 | 8 | -26 | -24 | $42,013,053 |

| ILA | Island Pharma | 0.085 | -11 | 8 | -23 | -53 | $6,907,820 |

| EMD | Emyria | 0.057 | -3 | 8 | -54 | -67 | $20,897,876 |

| SPL | Starpharma Holdings | 0.155 | -5 | 7 | -54 | -78 | $63,828,652 |

| TRP | Tissue Repair | 0.235 | -8 | 7 | -24 | -13 | $13,393,923 |

| FRE | Firebrickpharma | 0.053 | 2 | 6 | -71 | -75 | $6,342,281 |

| SNZ | Summerset Grp Hldgs | 10.070 | 0 | 6 | 7 | 19 | $2,377,956,027 |

| ATX | Amplia Therapeutics | 0.080 | -1 | 5 | -5 | -7 | $15,520,512 |

| GSS | Genetic Signatures | 0.485 | 8 | 5 | -17 | -47 | $77,510,941 |

| ACW | Actinogen Medical | 0.024 | 9 | 4 | -32 | -73 | $59,990,062 |

| ECS | ECS Botanics Holding | 0.024 | 9 | 4 | 0 | -4 | $26,561,536 |

| CAJ | Capitol Health | 0.245 | 9 | 4 | -4 | -23 | $266,452,351 |

| SDI | SDI | 0.755 | -3 | 4 | -8 | -19 | $92,715,113 |

| OCA | Oceania Healthc | 0.690 | 5 | 4 | -2 | -9 | $501,850,341 |

| PME | Pro Medicus | 96.875 | 5 | 4 | 48 | 61 | $10,047,553,287 |

| PER | Percheron | 0.058 | -3 | 4 | -11 | -37 | $52,289,608 |

| ACL | Au Clinical Labs | 2.990 | 3 | 3 | -8 | -5 | $599,447,025 |

| PAR | Paradigm Bio. | 0.380 | -11 | 3 | -61 | -72 | $134,976,832 |

| EBO | Ebos | 33.325 | -3 | 3 | -4 | -21 | $6,401,070,941 |

| CSL | CSL | 285.250 | -2 | 2 | 9 | -1 | $137,531,819,335 |

| OPT | Opthea | 0.485 | -17 | 2 | -15 | -43 | $328,090,274 |

| ENL | Enlitic Inc. | 0.865 | 6 | 2 | 2 | 2 | $60,685,575 |

| VHT | Volpara Health Tech | 1.110 | 0 | 1 | 13 | 56 | $282,355,482 |

| OCC | Orthocell | 0.410 | 1 | 1 | 5 | -1 | $79,706,943 |

| EZZ | EZZ Life Science | 0.615 | 3 | 1 | 23 | 71 | $26,263,575 |

| IME | Imexhs | 0.640 | -1 | 1 | 7 | 31 | $27,268,923 |

| RMD | ResMed Inc. | 25.970 | -2 | 0 | -19 | -17 | $15,729,381,592 |

| AC8 | Auscann Grp Hlgs | 0.040 | 0 | 0 | 0 | 0 | $17,621,884 |

| AHC | Austco Healthcare | 0.190 | 3 | 0 | 12 | 58 | $55,526,506 |

| ANR | Anatara Ls | 0.022 | 0 | 0 | -35 | -48 | $4,029,449 |

| BP8 | Bph Global | 0.002 | 0 | 0 | -50 | -89 | $2,753,345 |

| CDX | Cardiex | 0.121 | 0 | 0 | -18 | -65 | $17,354,743 |

| CTQ | Careteq | 0.028 | -7 | 0 | -24 | -54 | $6,595,324 |

| EPN | Epsilon Healthcare | 0.024 | 0 | 0 | -4 | 4 | $7,208,496 |

| GLH | Global Health | 0.115 | -4 | 0 | -8 | -43 | $6,675,697 |

| HXL | Hexima | 0.018 | 0 | 0 | -25 | -10 | $3,006,713 |

| IVX | Invion | 0.005 | 0 | 0 | -38 | -44 | $32,108,161 |

| MDC | Medlab Clinical | 6.600 | 0 | 0 | 0 | -15 | $15,071,113 |

| OSL | Oncosil Medical | 0.009 | 0 | 0 | -31 | -75 | $17,770,870 |

| REG | Regis Healthcare | 3.170 | -1 | 0 | 45 | 69 | $948,259,995 |

| TD1 | Tali Digital | 0.001 | 0 | 0 | 0 | -67 | $3,295,156 |

| TRU | Truscreen | 0.020 | -9 | 0 | -23 | -49 | $9,240,557 |

| UCM | Uscom | 0.041 | 0 | 0 | -13 | -18 | $7,811,876 |

| SHL | Sonic Healthcare | 31.410 | -1 | -1 | -12 | 0 | $15,069,986,596 |

| FPH | Fisher & Paykel H. | 21.930 | -2 | -1 | -4 | -2 | $12,788,804,636 |

| IDX | Integral Diagnostics | 1.900 | 1 | -1 | -39 | -42 | $445,927,641 |

| VLS | Vita Life Sciences.. | 1.735 | -8 | -1 | 11 | 19 | $93,160,737 |

| AHI | Advanced Health | 0.098 | -11 | -1 | -55 | -15 | $22,452,812 |

| RHC | Ramsay Health Care | 49.930 | -3 | -1 | -11 | -26 | $11,327,190,596 |

| OIL | Optiscan Imaging | 0.081 | -5 | -1 | -8 | -41 | $68,497,946 |

| ARX | Aroa Biosurgery | 0.740 | -8 | -1 | -18 | -36 | $254,146,637 |

| PNV | Polynovo | 1.540 | -2 | -2 | -3 | -41 | $1,045,702,618 |

| IMR | Imricor Med Sys | 0.540 | 5 | -2 | 38 | 69 | $91,215,792 |

| VIT | Vitura Health | 0.265 | 10 | -2 | -49 | -50 | $152,606,554 |

| BMT | Beamtree Holdings | 0.225 | 0 | -2 | -8 | -30 | $64,463,811 |

| VTI | Vision Tech Inc | 0.225 | 0 | -2 | -2 | -37 | $11,785,224 |

| ZLD | Zelira Therapeutics | 0.900 | -2 | -2 | -42 | -17 | $10,212,440 |

| SIG | Sigma Health | 0.953 | 1 | -2 | 27 | 63 | $1,247,666,261 |

| AYA | Artrya | 0.205 | -15 | -2 | -11 | -41 | $16,123,044 |

| COV | Cleo Diagnostics | 0.165 | -8 | -3 | $12,597,000 | ||

| CAN | Cann | 0.097 | 0 | -3 | -19 | -55 | $41,133,585 |

| MVF | Monash IVF | 1.330 | -1 | -3 | 11 | 34 | $514,317,989 |

| MSB | Mesoblast | 0.285 | 0 | -3 | -78 | -69 | $289,372,538 |

| BDX | Bcaldiagnostics | 0.099 | 0 | -3 | 41 | 65 | $24,660,637 |

| RCE | Recce Pharmaceutical | 0.483 | -7 | -4 | -26 | -25 | $97,776,894 |

| TRJ | Trajan Holding | 1.158 | -7 | -4 | -33 | -41 | $179,614,980 |

| IXC | Invex Ther | 0.078 | 8 | -4 | 70 | -47 | $5,711,692 |

| COH | Cochlear | 288.280 | -3 | -4 | 25 | 37 | $18,663,851,967 |

| HGV | Hygrovest | 0.048 | -4 | -4 | 17 | -31 | $10,094,909 |

| NC6 | Nanollose | 0.022 | 0 | -4 | -61 | -63 | $3,495,500 |

| MX1 | Micro-X | 0.105 | 7 | -5 | -5 | -22 | $54,396,732 |

| NYR | Nyrada Inc. | 0.021 | 0 | -5 | -45 | -86 | $3,276,183 |

| IDT | IDT Australia | 0.100 | -5 | -5 | 52 | 25 | $36,905,344 |

| RAC | Race Oncology | 0.795 | -6 | -5 | -50 | -58 | $132,882,809 |

| ANN | Ansell | 23.810 | -5 | -5 | -14 | -18 | $2,946,670,147 |

| MAP | Microbalifesciences | 0.195 | 0 | -5 | -35 | -40 | $77,965,029 |

| CGS | Cogstate | 1.300 | -12 | -5 | -21 | -37 | $224,493,820 |

| HIQ | Hitiq | 0.018 | -10 | -5 | -14 | -44 | $6,285,329 |

| PIQ | Proteomics Int Lab | 0.810 | -5 | -5 | -6 | -26 | $99,091,124 |

| CYC | Cyclopharm | 1.855 | -4 | -5 | -15 | 16 | $174,078,203 |

| CUV | Clinuvel Pharmaceut. | 15.620 | -3 | -5 | -12 | -37 | $769,453,595 |

| M7T | Mach7 Tech | 0.695 | -1 | -6 | -24 | -6 | $166,421,822 |

| VBS | Vectus Biosystems | 0.300 | 7 | -6 | -30 | -62 | $15,962,808 |

| RSH | Respiri | 0.027 | 0 | -7 | -18 | -48 | $28,616,461 |

| PYC | PYC Therapeutics | 0.091 | -4 | -8 | 30 | 47 | $335,958,042 |

| EOF | Ecofibre | 0.110 | -15 | -8 | -35 | -57 | $39,781,760 |

| NAN | Nanosonics | 4.150 | 0 | -8 | -13 | -10 | $1,250,685,286 |

| AVR | Anteris Technologies | 18.050 | -4 | -9 | -7 | -29 | $329,904,007 |

| MYX | Mayne Pharma | 5.350 | -8 | -9 | 18 | 32 | $455,147,441 |

| 1AI | Algorae Pharma | 0.010 | -17 | -9 | -38 | -22 | $16,612,402 |

| LTP | Ltr Pharma | 0.300 | -6 | -9 | $22,529,756 | ||

| IIQ | Inoviq | 0.600 | -9 | -10 | -32 | -10 | $54,751,128 |

| PCK | Painchek | 0.036 | -3 | -10 | 33 | 9 | $51,690,579 |

| VFX | Visionflex | 0.009 | 13 | -10 | 80 | 0 | $12,752,921 |

| PTX | Prescient | 0.062 | -3 | -10 | -25 | -52 | $49,929,827 |

| TRI | Trivarx | 0.026 | -7 | -10 | 30 | 30 | $8,790,046 |

| HLS | Healius | 1.350 | -11 | -11 | -51 | -56 | $994,711,849 |

| IMC | Immuron | 0.075 | -4 | -11 | -4 | -1 | $17,084,876 |

| MXC | Mgc Pharmaceuticals | 0.430 | -12 | -11 | -89 | -96 | $19,294,718 |

| NOX | Noxopharm | 0.075 | -9 | -12 | 108 | -44 | $23,379,036 |

| AMT | Allegra Medical | 0.044 | -2 | -12 | -20 | -44 | $5,262,885 |

| PGC | Paragon Care | 0.210 | -7 | -13 | -19 | -30 | $140,252,318 |

| RHT | Resonance Health | 0.052 | -9 | -13 | 4 | -10 | $24,278,432 |

| 4DX | 4Dmedical | 0.635 | -13 | -14 | -6 | 61 | $250,165,632 |

| IRX | Inhalerx | 0.025 | -4 | -17 | -29 | -58 | $4,744,174 |

| ALC | Alcidion | 0.065 | -7 | -22 | -35 | -59 | $87,260,759 |

| NSB | Neuroscientific | 0.038 | -5 | -22 | -64 | -61 | $5,639,590 |

| ICR | Intelicare Holdings | 0.018 | -22 | -25 | 38 | -18 | $4,226,841 |

| OSX | Osteopore | 0.034 | -26 | -29 | -56 | -74 | $5,731,989 |

| IBX | Imagion Biosys | 0.240 | -25 | -37 | -70 | -73 | $7,671,939 |

| SNT | Syntara | 0.017 | 0 | -37 | -69 | -73 | $14,132,328 |

| GTG | Genetic Technologies | 0.125 | -7 | -38 | -58 | -58 | $14,427,156 |

| RHY | Rhythm Biosciences | 0.110 | 0 | -41 | -78 | -89 | $25,984,254 |

| ATH | Alterity Therap | 0.004 | -11 | -43 | -38 | -64 | $15,245,305 |

| ME1 | Melodiol Glb Health | 0.001 | 0 | -50 | -89 | -95 | $4,728,824 |

Nova EYE has been rising since announcing that it has grown its US sales revenue up 65% to US$5.1 million for the six months ended 31 December 2023, compared to the pcp.

This is despite uncertainties in the month of November and December in relation to the Medicare reimbursement for the Company’s iTrack portfolio, caused by local coverage determinations (LCDs) proposed by five (5) Medicare Administrative Contractors (MACs).

However, the withdrawal of the LCDs on 29 December 2023, and the confirmation of continued reimbursement coverage for the company’s iTrac portfolio provides a clear runway for higher sales growth.

ADR rose after announcing the first purchase order agreement of 1,750 of its Hailie Smartinhaler sensors to a major US hospital system, Intermountain Health.

Intermountain includes 33 hospitals, 385 clinics with more than 12,000 associated physicians. Intermountain is a leader in outpatient respiratory care with around 300,000 chronic obstructive pulmonary disease (COPD) and asthma patients.

However, Adherium announced this week that its CEO, Rick Legleiter, has tendered his resignation and provided six months’ notice to enable a smooth transition to new leadership.

SHG has beeb riding high since announcing a binding enterprise licence order for 5,000 annual licences of the 3Dicom Patient software in the US.

The licences were purchased by TechWorks 4 Good on behalf of US Veterans, to enable greater understanding and portability of medical records of Vets.

Whilst details of the deal is confidential, SHG said that the revenue generated from this order exceeds the total direct-to-consumer sales of the 3Dicom software in the 2023 calendar year of ~$50,000 by more than 40%.

Compumedics has also been in the winners’ circle after saying that it eepects strong results for H1.

Unaudited revenues for H1 FY24 are expected to be a record H1 result of approximately $26m, 35% higher than pcp.

Sales orders taken for H1 FY24 were also a record H1 result of $30.3m, which is 74% higher than pcp. Compumedics expects to return to profitability in H1 FY24.

Shares of Neurotech were bid up after the company announced the completion of recruitment for its Phase 2/3 NTIASD2 clinical trial in December.

In total, 56 patients were enrolled, all with level 2 (requiring substantial support) or level 3 (requiring very substantial support) autism.

The trial will study the treatment of NTI’s proprietary lead drug formulation NTI164, derived from a unique cannabis strain with low THC and a novel combination of cannabinoids, including CBDA, CBC, CBDP, CBDB and CBN.

Radiopharm announced in late December that it has received Human Research Ethics Committee (HREC) approval from the Hollywood Private Hospital in Perth, WA that will see it become the second Australian site for its RAD 204 Phase 1 therapeutic study.

The RAD 204 Phase 1 clinical trial will will evaluate the safety and efficacy of the novel radiotherapeutic in patients with advanced PD-L1 positive non-small cell lung cancer (NSCLC), the most common type of lung cancer.

At Stockhead we tell it like it is. While Neurotech is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.