Cannabis play Cronos delivers record quarter with $18m in cash receipts, sets up for long-term market leadership

Cronos Australia has once again delivered record quarterly growth, solidifying its leadership position in the Australian market. Image: Getty

Cronos Australia has once again delivered record quarterly growth, solidifying its leadership position in the Australian market.

Following a massive first half in which a profit of $3.37m was achieved, medicinal cannabis company Cronos Australia (ASX:CAU) has continued its strong form in Q3 to deliver record sales.

Cronos reported for the third-quarter FY22 of over $18m and YTD$46.6m, as it assumes a market leadership position going into the last quarter.

The company also recorded net positive cash flows from operations for the first nine months of FY22 of over $10.5 million, bringing its total cash position to $13.6 million at quarter end.

These solid results have largely been driven by sales of medicinal products through the online CanView platform. During the quarter, a record 125,500 products were sold through the platform.

“As the only profitable pure-play medicinal cannabis company listed on the ASX, we have achieved another record quarter,” commented CEO, Rodney Cocks.

“We enter the last quarter of the 2022 financial year in a position of market leadership in Australia, with more than $13.6 million in cash and look forward to delivering for shareholders with our full year results,” he added.

Rise of the CanView platform

BHC’s CanView platform was launched in June 2020, allowing users to access, prescribe and order from the widest range of medical cannabis products – all from one streamlined, compliant and free-to-use online platform.

The platform now offers a portfolio of more than 130 discrete medicinal cannabis products for patients to nearly 3,000 pharmacies Australia-wide.

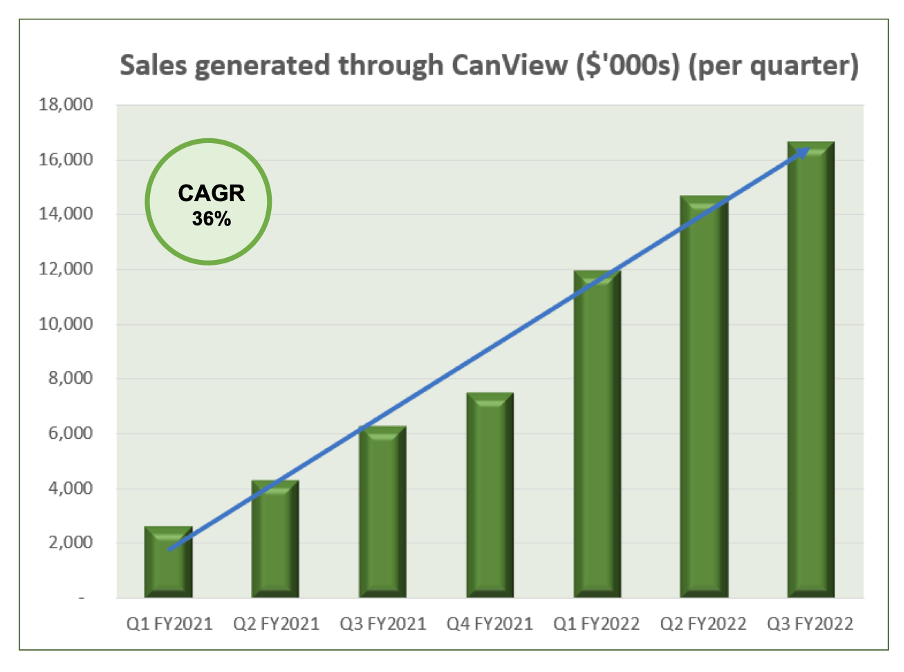

Since launch, quarterly sales growth on the platform has increased incrementally, with a compound growth (CAGR) of 36%.

Total units sold on the platform in the quarter were 125,500 units, generating cash receipts of $16.5+ million for the quarter. CanView’s rapid growth can be seen in 52,000+ units sold and $7.5m+ in cash receipts in the month of March alone.

The platform also added 26 new doctors to a total of nearly 700, and 79 new pharmacies for a total of close to 3,000 during the period.

Even better – CanView 2.0

Cronos says it is now well-advanced with the rollout of the next and significantly improved iteration of the CanView platform.

Known internally as “CanView 2.0”, the new version will provide a number of important upgrades, features and improvements.

This includes an improvement in the dispensing software used by pharmacies, which will streamline processes and reduce double handling.

The new version also allows users to receive prescriptions and TGA approvals directly from doctors and prescribers prescribing through the CanView platform.

For suppliers, CanView 2.0 has increased the compliance features, including those for TGA reporting requirements.

Other key achievements during the quarter

Sales of Cronos’ own Adaya range of medicinal cannabis products continued to grow in the March quarter, with record sales of $561,279 in March alone.

The growth reflects an annualised run rate of more than $6.5 million, as compared to $1.2 million for the full 2021 financial year.

Meanwhile, following the successful completion of the merger with CDA Health in December last year, considerable progress has been made to integrate the two businesses.

Specifically – finance, payroll, human resources, IT, distribution and inventory management, systems and processes have been added, refined and updated across the nine separate locations where the company operates.

The majority of these programs are expected to be completed before the end of the current financial year.

“Our record quarter with $18 million in cash receipts and year-to-date positive operating cashflow of $10.5 million are underpinned by the successful merger and integration with CDA Health, and the hard work of our exceptional team,” said Cocks.

“Our strategy moving into the 2023 financial year sets Cronos Australia up for sustainable, profitable growth,” he added.

This article was developed in collaboration with Cronos, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.