Biocurious: When it comes to accurate measuring, the sky’s not the limit for Trajan

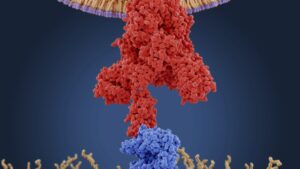

When it comes to accurate blood readings, Trajan's efforts are off the planet. Pic via Getty

- Trajan is zeroing in on new applications for its precision scientific tools and consumables, including ‘forever’ chemicals and blood micro sampling

- Management has contingency plans if Donald Trump’s tariffs start to bite

- Founder Stephen Tomisich has “mixed feelings” about Trajan’s ASX listing

Many ambitious companies reach for the stars with their strategic plans, but for analytical services house Trajan Group (ASX:TRJ) there’s a more literal element as it strives to measure human and other samples with pinpoint accuracy.

To enhance understanding of how drugs work in zero gravity, SpaceX recently sent up a crew with Trajan’s micro blood sampling units.

“It allows a person in any remote setting – and space is as remote as it gets – to take an analytically credible sample,” says Trajan co-founder and CEO Stephen Tomisich.

Astronauts are staying in space for much longer, which is not just a reference to the two who were rescued after an unplanned extended stay on the International Space Station.

“While it’s not a huge market, it’s an interesting thing to talk about.”

Back on Earth and Trajan has its work cut out, with burgeoning demand for accurate sampling in the pharmaceutical, food and environmental sectors.

Trajan through the centuries

Tomisich founded Trajan in 2011 with his scientist wife Angela, using the time-honoured financing method of remortgaging and maxing out the credit cards.

(Trajan was named after the unusually philanthropic Roman emperor who ruled between 98 and 117 AD).

Trajan makes analytical consumables and tools, as used in the biological, environmental and food-testing sectors.

One example is glass tubing with an internal diameter of five microns: one-tenth the width of a human hair.

The couple acquired the anatomical pathology consumables business Grale Scientific, before following up with six more acquisitions.

Trajan listed on the ASX in June 2021, raising $90 million.

The IPO was predicated on more acquisitions and the company duly saluted, purchasing the Kentucky-based Chromatography Research Supplies (CRS) for $US43 million ($64 million) in 2022.

Trajan’s revenue is skewed to chromatography and mass spectrometry. Chromatography involves separating the components of a liquid or gas so they can be quantified.

Mass spectrometry is about detecting and separating components of a sample by identifying ions based on their mass-to-charge ratio.

“Sometimes people misinterpret Trajan as growing through acquisition only,” Tomisich says.

“The reality is our success is organic growth.”

Personalised medicine presents ‘disruptive’ opportunities

Trajan’s ‘disruptive technology’ arm is zeroing in on two key areas.

In micro sampling, Tomisich says demand will emanate from the move to personalised healthcare, which requires precise administration outside of the uniformity of a centralised clinic.

Trajan already claims to be a world leader in that business, competing with bigger rivals.

The FDA recently granted approval for Trajan’s micro biopsy device, which already is used for research purposes.

“The breadth of application is much broader than we originally thought,” he says.

“The tech came out of The University of Queensland with an initial focus on melanoma and other skin cancers,” Tomisich says.

“But now it used for other skin conditions, parasitic infections and several RNA [genetic] applications.”

“Forever” chemicals are everywhere

Tomisich says when there’s a problem that requires new standard or regulation, there’s a need to measure.

One huge problem to calibrate is the spread of dangerous ‘forever chemicals’ – called PFAS – into our soil, water and bodies.

“We had some PFAS revenue in first half,” he says.

“It’s a growing area of need and we participate in quite diverse ways”.

The company currently is measuring PFAS levels in blood and has devised an automated system to measure soil PFAS.

PFAS testing material must not have contaminants such as Teflon tips in a syringe, which can give false readings.

In the food sector, there’s an imperative to detect impurities in edible oils which are found throughout the food chain.

The company is partnered with food companies such as Cargill and Nestle to ensure facilities comply with regulations, such as a European directive to detect mineral oils that may leak from agricultural or packing machinery.

Disconcertingly, authorities discovered that Chinese tankers carrying petrochemicals were then used to transport cooking oil.

“Trajan can detect these contaminants in small amounts,” Tomisich says.

Post pandemic hangover

Trajan’s reported record revenue for the December half was $81 million, up 6% on the previous corresponding period.

Normalised underlying earnings almost doubled to $7.9 million, while net profit of $2.5 million compared with a previous $4.5 million loss.

The numbers defied an 18.7% decline in pharmaceutical sector revenue, which has experienced a “post pandemic hangover”.

This is partly because suppliers and labs boosted their inventories early in the pandemic and are still running them down.

The softness has been evident for about six quarters, also experienced by analytical science giants such as Danaher and Thermo Fisher.

“Like us, they are reporting a bit of life has come back into the sector,” Tomisich says.

“The underlying demand never went away.”

Trajan’s tariff tactics

Trajan gleans about half of its revenue from the US, where Donald Trump’s actions are the antithesis of being measurable and predictable.

Still, Trajan’s strategy is well-calibrated – just as it was during the pandemic when it formed a small team to assess the risks and countermeasures.

“We approach the global scenarios with a level of maturity and good practice and it’s the same with a change to the US administration,” Tomisich says.

Trajan believes it is well insulated from any tariff threats, because it has four manufacturing sites in the US (in Texas, Connecticut, North Carolina and Kentucky).

The company also has plant in Malaysia (Penang), Germany, (Sprockhovel) and Ringwood in eastern Melbourne (where it is headquartered).

“We have a good understanding of materials, assemblies and products we bring into the US and where they originate from,” Tomisich says.

“Equally, we understand what we export out of the US.

“During the pandemic, we showed that if one site was compromised, we were able to flex and ramp up activities at alternative sites.”

He adds the company won’t make any knee-jerk reactions to measures that “might be here on Tuesday and gone on Thursday.”

It’s lonely on the ASX

Tomisich admits to “mixed feelings” about the company’s decision to list on the ASX.

“We are the only company in our sector on the ASX and it is lonely out there,” he says.

“One reason is that investors have no comparatives to understand how the world views our sector.”

Most of Trajan’s peers are listed in the US, where typical valuations are 18-25 times earnings before interest tax, depreciation and amortisation (ebitda).

“In Australia we are valued at eight times ebitda, even though we are a critical player in the global industry.”

Trajan’s shares are now almost half the value of their $1.70 a share listing price, even though the company’s revenue and earnings have doubled since.

“There’s a reason why our peers end up in US ownership: we don’t get valued [properly] here,” Tomisich says.

“I have to consider all options to ensure that all shareholders – including myself with 51% of the stock – realise the intrinsic value of the business.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.