Biocurious: Cracking the code on Paradigm’s valuation enigma

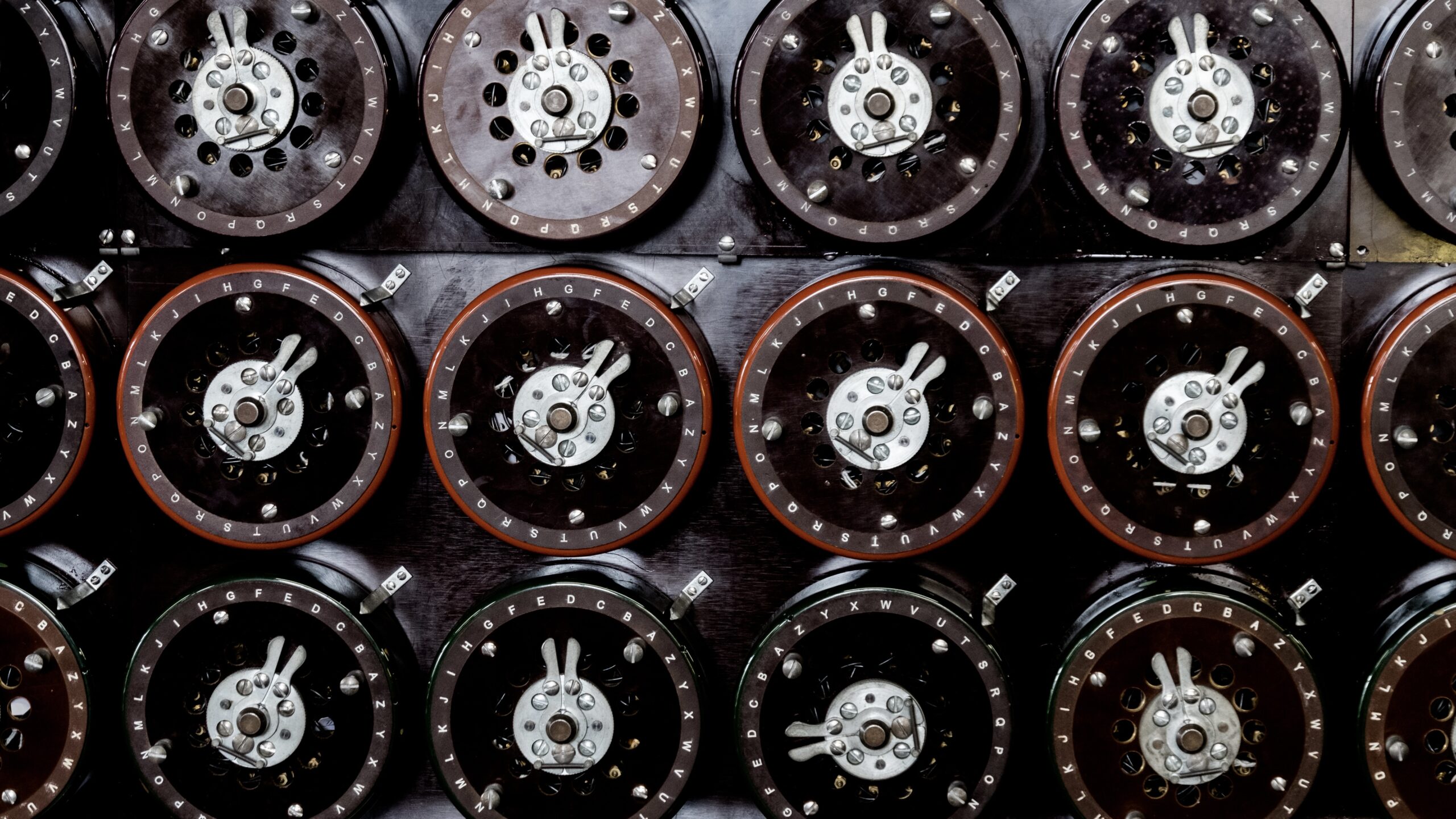

The famous 'Bombe' machine at Bletchley Park used for deciphering German encrypted 'Enigma' messages. Pic: Getty Images

Biocurious is renowned healthcare and biotech journalist Tim Boreham’s weekly deep dive into the complex, challenging and often inspiring world of medtech innovation on the ASX.

- Paradigm Biopharmaceuticals’ shares are trading near record lows despite good tidings from the US regulator

- The company acknowledges that trial delays and funding costs are weighing on some investors

- Paradigm’s addressable knee osteoarthritis market is estimated at US$27 billion, assuming only 10% penetration

Valuation wise, Paradigm Biopharmaceuticals (ASX:PAR) is what Winston Churchill referred to as a riddle wrapped in a mystery inside an enigma.

Of course the wartime British PM was referencing Russia and not the developer of a better treatment for knee osteoarthritis (OA) – but he would have, had his balanced champagne-and-cigar diet bestowed the gift of eternity beyond his indecently generous innings of 90.

Knee OA afflicts about 70 million people in the company’s target markets of the US, Europe, Canada and here.

The enigma is that Paradigm’s share valuation has kept plunging despite its progress on nearing a pivotal phase III trial for its repurposed drug candidate – a crucial step in obtaining US marketing approval.

Paradigm on Monday said it was confident of submitting a long-awaited investigational new drug (IND) application – permission to trial an unapproved drug – to the US Food & Drug Administration (FDA) by the end of the month.

This followed extensive discussions with the agency, which has approved the company’s favoured dosing regimen.

The company expects to enrol the first patient in the March 2025 quarter.

Such developments normally spark some joy but investors wiped 15% off the share price, to 22 cents at the time of writing. The stock hit a record low of 18 cents last month and in early 2020 the shares peaked at $3.90.

Teaching an old drug new tricks

Paradigm’s 60-year-old drug candidate is called pentosan polysulfate sodium (PPS), trademarked as Zilosul, having been used for conditions including thrombosis.

Co-founded by executive chairman Paul Rennie, Paradigm acquired 25 years of exclusive PPS human-use rights from its sole manufacturer, Germany’s Bene Parmachem.

The stock listed on the ASX in August 2015, having raised $8 million at 35 cents apiece.

PPS inhibits cartilage-degrading enzymes – thus preventing further damage – and there’s some evidence it may even improve joint quality.

About 1400 patients have been administered Zilosul to date, via avenues including the local Therapeutic Goods Administration’s (TGA’s) special access scheme and two earlier phase II studies.

Many participants – notably former footballers and basketballers – attest to the life-changing results.

Delays, funding concerns weigh on investors

Of course investors who sell – including a large fund – are not stupid. As the chicken who crossed the road said: “I have my reasons”.

One culprit is the inordinate delays in getting to this point. As far back as 2019 the company was targeting an IND in 2020, with a marketing approval submission slated “as early as” 2021.

Another concern is the need to raise funds for the study, with investors anticipating a capital raising on the back of a weak share price. Or else they fear that other treatments will leapfrog Paradigm’s.

“Given the abundance of drugs available to people suffering from osteoarthritis, investors may be forgiven for believing the company is going after an established, saturated market and therefore cannot disrupt it,” posits Pitt Street Partners in a company-sponsored note.

“However, this is not the case. The vast majority of treatment options available for osteoarthritis require frequent administration and/or [have] reduced effectiveness over time.”

‘All systems go’ to blockbuster status

Paradigm’s share price belies the company’s enthusiastic investor backing – including from those who have had the experimental treatment.

Long-time advocate David Baker, a principal of Adelaide brokerage Baker Young says that given Zilosul’s potential to change the life of OA sufferers, the FDA had to be confident that any side effects would be minimal.

“Paradigm has been able to demonstrate that this is not a problem, and it’s all systems go towards a blockbuster of the near future,” he says.

Paradigm estimates the trial will cost $US40-50 million, based on enrolling about 450 candidates (the earlier expectation was 600 participants, half of them in a placebo arm, but trial efficiencies have whittled this number).

“Having the green light from the FDA will be positive for the funding discussions taking place,’’ says Paradigm’s investor relations head Simon White (a former AFL footballer who has undergone the treatment).

White notes that big-ticket OA drugs with other mechanisms of action have failed to make the grade.

Eli Lilly and Pfizer’s tanezumab program was discontinued at phase III in 2021, after the FDA cited safety concerns.

In 2022, Regeneron Pharmaceuticals pulled the plug on an experimental OA treatment called fasinumab, also for safety reasons.

“OA has been tough one for a lot of larger companies so the question is ‘how can we do it’,” White says.

“But we know our mechanisms of action stands up for pain reduction and improving the joint and we have a huge amount of data to back that up.”

Everything old is new again

There’s also a rich history of non-OA repurposed drugs becoming blockbusters.

Who could forget angina-turned erectile dysfunction drug Viagra? Spravato – ketamine – was a veterinary anaesthetic and is now being used legally for treatment-resistant depression (and, er, an illicit party drug).

Even Thalidomide – the catastrophic morning sickness drug – has been re-invented in benign form as the multiple myeloma and leprosy treatment Thalomid.

Paradigm now has to wait for the FDA’s 30 day review period for what it hopes to be the official trial go-ahead. In the meantime the company is corralling Australian trial sites and negotiating with contract research organisations to conduct the trials on its behalf.

If the results are positive the company expects to file a new drug application in 2026 or early 2027 – but like Cup Day fascinators some slippage can be expected.

US$27 billion addressable market

Pitt Street Partners cites Paradigm’s addressable market at US$27 billion, which assumes 10% market penetration and a per-treatment cost of US$2500.

Of that, US$6.2 billion derives from the US (30 million sufferers) and US$10.8 billion in China (as many as 100 million).

While the US clearly is the most important market, the company has a faster route to revenue by way of TGA provisional approval, which is available to drugs that meet an unmet need and demonstrate efficacy above and beyond any current treatment.

Paradigm recently filed an initial determination application and the process is ongoing.

In the meantime – and to borrow from Winston again – it’s a case of blood, toil, tears and sweat because few drugs get to market on a seamless, linear timeline.

While Paradigm Biopharmaceuticals is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.