Benitec shares soar 130pc after signing a massive licensing deal

Benitec Biopharma has achieved the holy grail for biotechs: a licensing deal, this time for its oculopharyngeal muscular dystrophy drug.

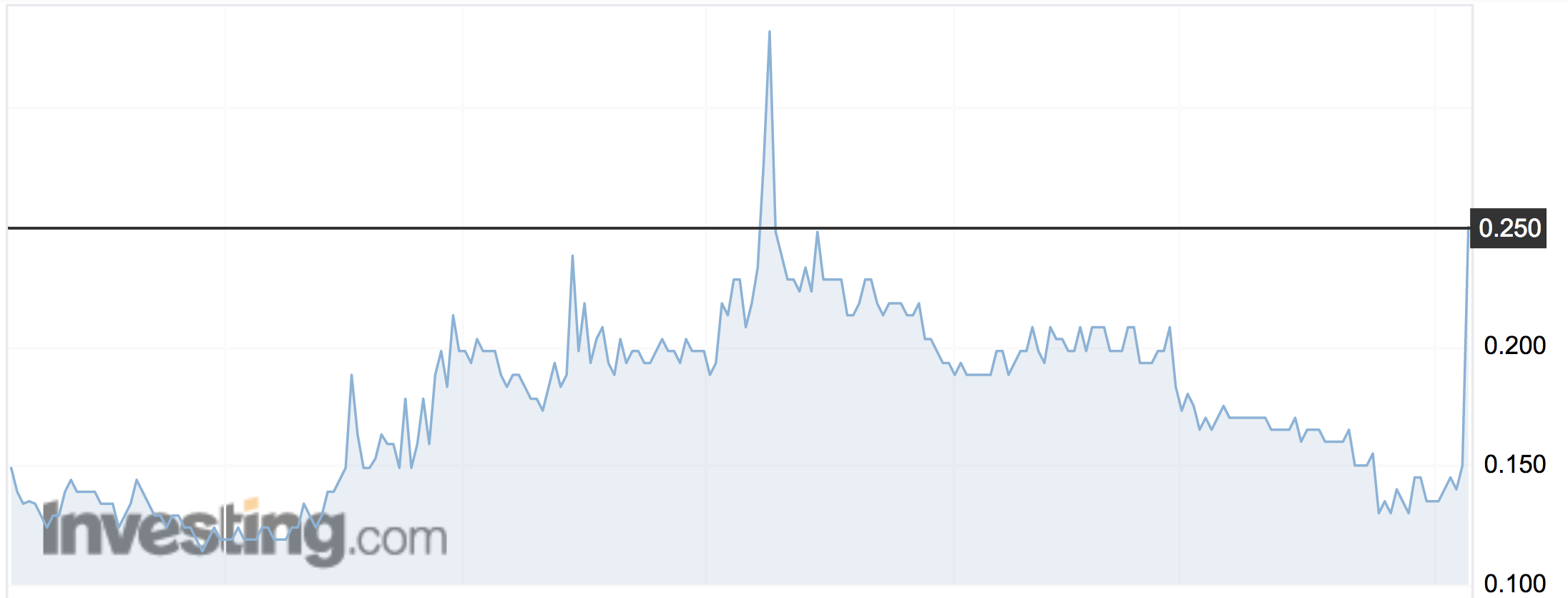

The potentially $US187.5 million deal sent its share price rocketing 130 per cent to an intraday high of 33.5c on Monday before cooling to 30.5c at the close.

About $4.5 million worth of shares changed hands.

Just six months after attaining orphan drug status in the US, Benitec signed away the exclusive global rights to BB-301 to Axovant Sciences to develop the gene therapy treatment.

It (ASX:BLT) receives $US10 million ($13.4 million) in cash upfront and cash payments totaling $US17.5 million once four manufacturing, regulatory and clinical milestones are met, as well as 30 per cent of the profits on sales if it is commercialised.

The total potential value of all the deal for Benitec is $US187.5 million.

This could be a game changer for Benitec, a company worth only $44.6 million. In the half year to December 31 it made $322,000 in revenue.

Stockhead’s biotech columnist Tim Boreham profiled Benitec in March.

The company has been working on oculopharyngeal muscular dystrophy since 2014 and began looking at BB-301 in late 2016.

Oculopharyngeal muscular dystrophy is a rare muscle-wasting disease that is caused by a genetic mutation. Symptoms include drooping eyelids and difficulties swallowing.

Because it is rare, treatment can qualify for ‘orphan drug status’. This gives companies tax breaks and easier regulatory processes in order to incentivise them to develop treatments for otherwise unprofitable conditions and diseases.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Benitec’s treatment is a gene therapy that uses a “silence and replace” method.

It uses Ribonucleic acid (RNA), a molecule involved in sorting out how and which genes express themselves, to run interference with the problem gene while switching on a copy that can express the normal function of the gene.

The arrangement also calls for collaboration on five other drug developments with BB-301, including dementia and ALS.

Axovant is on the hook for up to $US93.5 million in payments if those pass various development and commercial milestones as well.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.