Avita is a slow burn for investors as spray-on skin approaches US debut

Professor Fiona Wood was a director of Avita from 2002 to 2016. Pic Getty

Immortalised by Perth-based queen of burns Prof Fiona Wood, regenerative skin house Avita Medical is finally eyeing an entry into the US market — a decade after its Recell treatment started to be approved in 16 other countries.

As with so many biotech plays, Avita (ASX:AVH) has been a slow burn indeed, having had several strategy and management revamps.

Despite all the hope and promises, Avita stock is trading at close to decade lows.

But Avita is not without friends, with a pending US approval decision looming as a pivotal moment in the company’s chequered history.

Formerly Clinical Cell Culture, the company changed its name to Avita in June 2008 after a merger with Visiomed and a 10-for-one share consolidation.

At one time Avita did a line in respiratory products such as the Funhaler, an asthma spacer pitched at encouraging young ‘uns to take their medication through “auditory and visual” devices, complete with bells and whistles for children who didn’t like breathing.

(At $50 it didn’t compete well with the standard $20 spacer for kids who did like breathing.)

Now, it’s all about Recell.

“I believe the technology is so good and so under-valued that we are in a great position,” says CEO Dr Mike Perry.

Management merry-go-round

True to Avita’s sharper US focus, a management cleanout last year saw the three most important acronyms – CEO, CFO and COO – replaced.

A former war correspondent, chief executive officer Adam Kelliher survived a bullet during the Balkans war and for two years ran Avita with “energetic service”.

But last year he handed in his flak jacket because he was unwilling to relocate to the US.

A Novartis exec, Dr Perry moonlighted as an Avita director from 2013 and then retired from his day job in April last year.

Given his experience in US commercialisation and distribution, Dr Perry was the right bloke in the right spot.

Recell unpeeled

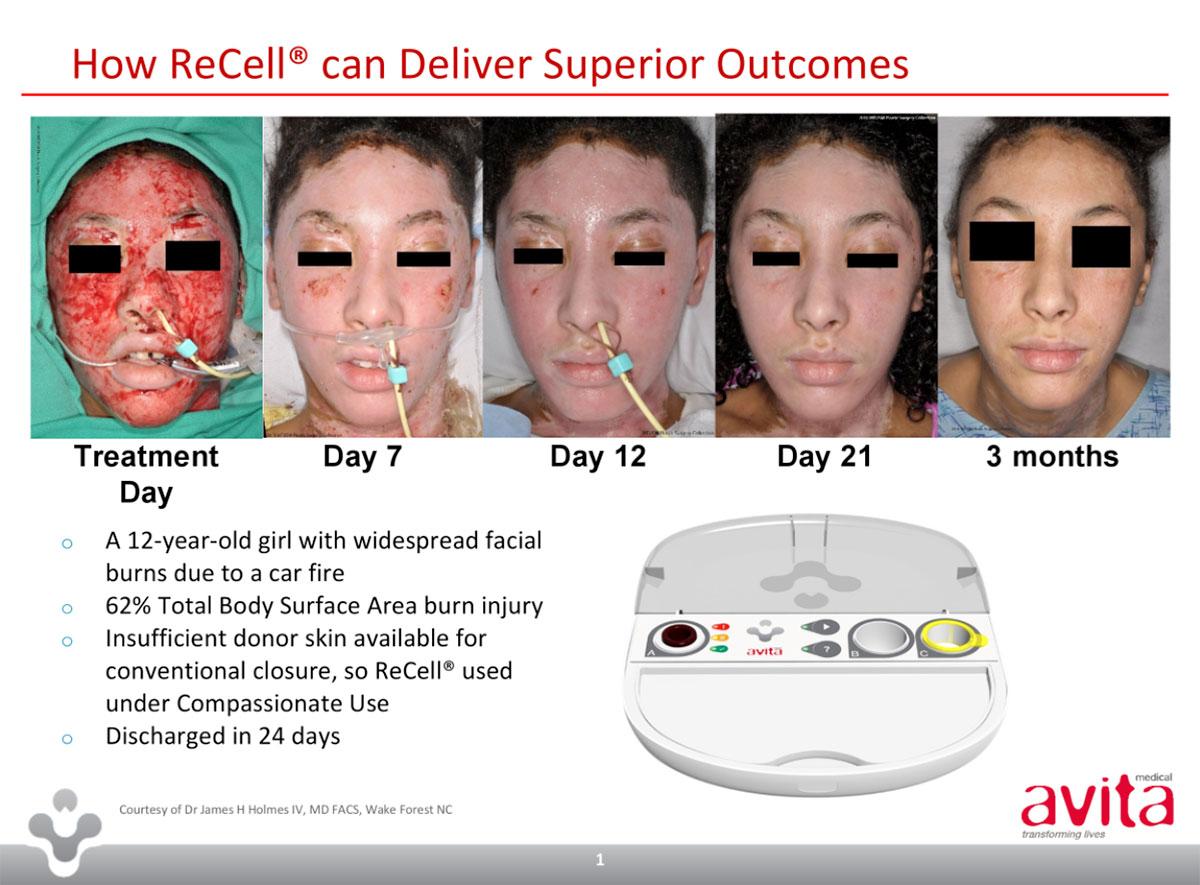

Seeing as you asked, Recell is a rapid cell harvesting device that enables surgeons to treat skin defects using patients own cells collected during surgery.

It means surgeons can prepare a small quantity of cells on site, rather than sending a biopsy to the lab.

In effect, the donor area is multiplied 80 times, and less skin is needed from one part of a body to heal another part.

The result of this autologous harvesting is a spray-on skin, so let’s call Avita the WD-40 of burns care.

From 2008, Recell was approved for use in 16 jurisdictions including Europe, Canada, Brazil, Japan, Australia and New Zealand.

Recell shot to fame after Prof Wood, a former Avita director, used the spray-on technique to treat the Bali bombing burns victims in 2002. Prof Wood was a co-founder of Avita in 2002 and remained on the Board until 2016.

Globally 7000 patients have been treated to date, with no safety problems.

US here we come

Avita’s focus on the US is not surprising, given it’s a $US5.7 billion ($7.3 billion) burns market.

In September last year Avita filed a pre-marketing approval application (PMA), with US Food and Drug Administration approval “anticipated” by October this year.

The treatment already has compassionate-use status in the US, with 80 patients treated to date.

The PMA application is supported by two randomised and controlled US-based clinical trials.

The first compared Recell alone versus standard of care for spilt thickness skin grafts for second degree burns patients. The 102-patient effort saw a 97.5 per cent reduction in donor skin required.

The second was for third degree burns patients and compared Recell with mesh and skin graft, or split thickness graft alone. In these cases, an average of 32 perent less donor skin was required.

It BARDA be good

Avita has a powerful and deep pocketed partner in the US: the Biomedical Advanced Research and Development Authority (BARDA). BARDA stockpiles medicines for mass disasters and supports biotechs with potentially useful drugs and devices.

In September 2015, BARDA chipped in $US16.9 million for pre-approval clinical program and then in June 2016 stumped up a further $US8 million for an economic model.

The agency then came good for $US24.3 million of paediatric research in September last year.

Last year, BARDA ordered $US7.5 million of Recell kits and potentially could order $US30 million more, depending on the agency’s view of how much stock is needed to cover any impending disaster.

Or more to the point, how much it can afford.

Avita is also working on a reimbursement strategy with US funders.

“Our pricing studies are ongoing,” Dr Perry says. “We still haven’t locked in a US price but are confident we will get reimbursement (either under existing codes or a new code).”

Dr Perry says it’s one of the few times in his storied career when he has overseen a new product that both greatly improves the standard of care, but also reduces treatment costs.

Avita’s numbers

Avita has been an enthusiastic capital-raiser over the last decade, with the latest whip ‘round in November pulling in $16.9 million via a $4.5 million private placement and $12.4 million rights issue.

The deal enabled long-time holder Hunter Hall (now Pengana) to exit, thus obviating a share overhang. But at a rock-bottom 4.5c a share, the placement didn’t exactly please remaining investors.

With $11 million in the bank, Avita may need to find more of the folding stuff, but Dr Perry says any raising is likely to be modest.

Avita shares are popular with retail investors, who account for 60 to 70 per cent of the register. Management loves ’em to bits but the trouble is they take profits every time the stock looks like having a sustained run.

Frustrated, management is mulling re-domiciling to the Nasdaq, citing superior valuations. For example, US stem-cell burns house Renovacare is valued at $US300 million, without yet undertaking clinical trials.

But plenty of Australian companies have been re-rated by the better-informed US investors and it’s nearly always downwards.

What’s the US market worth?

Seeing as you asked again, here’s a handy guide: there are about 500,000 US burns patients a year, with perhaps 15,000 suitable for Recell treatment.

Dr Perry says the average patient requires three to three and a half kits, so let’s say 50,000 kits a year. Multiply that by an average cost of $US5,000 to $US8,000 per kit and that equates to a $US250 million to $US400 million market.

Avita is also exploring areas such as venous leg ulcers, diabetic foot ulcers and repigmentation, as well as regenerative cell and gene therapies.

Dr Boreham’s diagnosis

After years of frustrating investors, Avita now looks more focused as it pursues the US market.

BARDA’s backing helps, although ongoing support is never assured (as holders in the ’flu drug house Biota, formerly Aviragen and now Vaxart, would attest).

Investors should be aware that Avita has stiff competition, whether it’s crusty surgeons opting for the good ol’ skin grafts or the lattice style-products developed by the likes of ASX counterpart Polynovo (which BARDA also funds).

Given Recell is already widely used globally, Avita should be performing much better share price wise.

If it doesn’t, the company will either try its luck on Nasdaq, get taken over or become a pot stock.

Disclosure: Dr Boreham is not a qualified medical practitioner and does not possess a doctorate of any sort. Fortunately, his only personal experience with burns has been sideburns in the 1970s and an occasional scolding from Mother.

The content of this article was not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

This article originally appeared in Biotech Daily

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.