ASX Health Winners January: ‘Invest in business not science’, as SHG and PAA top winners list

‘Invest in the business, not science’ and ASX health winners in January 2024. Picture Getty

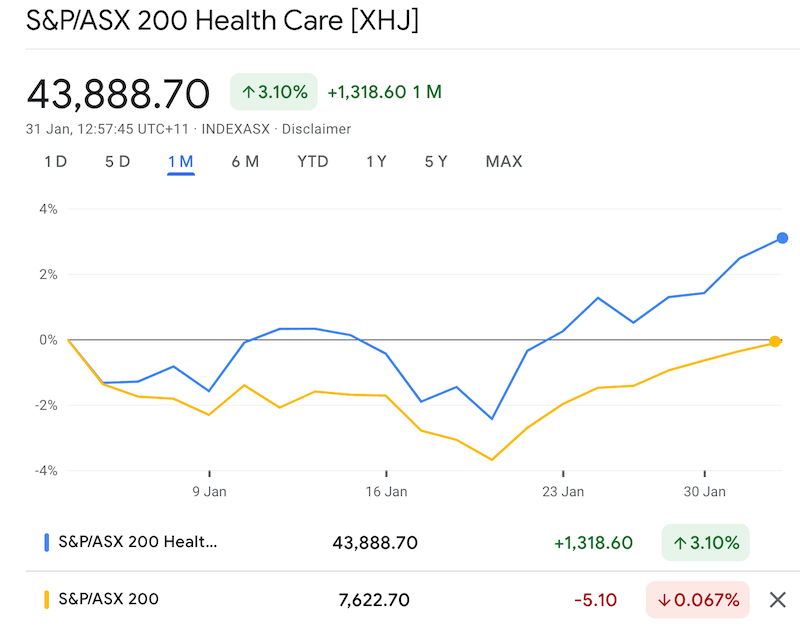

- The ASX Health Index climbed by 3% in January

- Alliance Bernstein says be careful choosing the right health stocks this year

- We look at the ASX health stock winners for January

The S&P/ASX 200 Health Care [XHJ] continues to bounce back, finishing January around 3% higher.

The XHJ index finished 4% higher in 2023, but still trailed the broad benchmark – the ASX 200 index – which gained 9%.

In general, healthcare stocks have underperformed the global market in 2023.

There are few reasons why that happened, but higher interest rates and the market’s obsession with AI-related stocks were two main ones.

Within the healthcare sector itself, there are also major disparities between different segments.

For example, pharmaceuticals and health tech companies have declined modestly, but those in life-sciences or drugs development fell drastically last year.

So what do health investors need to look for in 2024?

According to a note from Alliance Bernstein (AB), investors can find attractively valued health stocks this year by focusing on those that benefit from durable business growth trends.

“These include diagnostics and life-sciences companies that help improve early detection of diseases, and technology companies, which may benefit from introducing AI-driven solutions to healthcare,” said AB.

AB also said that many growth trends in the healthcare sector are driven by the need for efficiency and cost savings in healthcare systems.

“As a result, we think these trends will persist over time, and are unlikely to be derailed by macroeconomic weakness.

“The key to success for equity investors, in our view, is to invest in business, not science.

“That means investors should search for healthcare companies with high-quality businesses and avoid predicting the outcomes of scientific research and development, which is notoriously hard to do.

“Healthcare companies like these are well-equipped to overcome short-term market weakness, and provide equity investors with innovative sources of consistent growth for challenging conditions ahead. “

Here are the ASX Biotech Winners for January 2024

| Code | Name | Price | % Month Change | Market Cap |

|---|---|---|---|---|

| SHG | Singular Health | 0.094 | 147.37 | $13,283,165 |

| PAA | Pharmaust Limited | 0.200 | 66.67 | $75,068,291 |

| ACR | Acrux Limited | 0.072 | 63.64 | $20,274,169 |

| CMP | Compumedics Limited | 0.390 | 39.29 | $69,093,550 |

| ACW | Actinogen Medical | 0.030 | 36.36 | $73,833,923 |

| LBT | LBT Innovations | 0.015 | 36.36 | $18,901,067 |

| MDR | Medadvisor Limited | 0.290 | 34.88 | $159,461,104 |

| ALA | Arovella Therapeutic | 0.150 | 30.43 | $137,752,185 |

| NTI | Neurotech Intl | 0.090 | 30.43 | $80,314,973 |

| CU6 | Clarity Pharma | 2.420 | 27.37 | $637,684,639 |

| CTE | Cryosite Limited | 0.725 | 19.83 | $35,386,933 |

| AVH | Avita Medical | 5.060 | 17.95 | $307,260,278 |

| PNV | Polynovo Limited | 1.933 | 16.77 | $1,314,893,391 |

| RMD | ResMed Inc. | 29.085 | 14.33 | $17,636,157,905 |

| EBR | EBR Systems | 0.695 | 13.93 | $211,844,323 |

| TLX | Telix Pharmaceutical | 11.375 | 12.85 | $3,770,862,646 |

| EMV | Emvision Medical | 1.910 | 12.68 | $144,220,657 |

| EYE | Nova EYE Medical Ltd | 0.270 | 12.50 | $52,426,246 |

| PAB | Patrys Limited | 0.009 | 12.50 | $18,517,026 |

| RHY | Rhythm Biosciences | 0.135 | 12.50 | $27,642,824 |

| CYP | Cynata Therapeutics | 0.140 | 12.00 | $25,148,450 |

| IMR | Imricor Med Sys | 0.615 | 11.82 | $103,884,652 |

| TRP | Tissue Repair | 0.245 | 11.36 | $13,672,963 |

| MVP | Medical Developments | 0.850 | 11.11 | $73,790,962 |

| AGN | Argenica | 0.565 | 10.78 | $56,020,214 |

| MVF | Monash IVF Group Ltd | 1.438 | 10.58 | $553,281,473 |

| FCG | Freedomcaregrouphold | 0.160 | 10.34 | $3,940,845 |

| GSS | Genetic Signatures | 0.480 | 10.34 | $91,376,495 |

| MX1 | Micro-X Limited | 0.115 | 9.52 | $54,476,139 |

| PIQ | Proteomics Int Lab | 0.980 | 9.50 | $126,965,838 |

| AT1 | Atomo Diagnostics | 0.024 | 9.09 | $14,701,653 |

| GLH | Global Health Ltd | 0.130 | 8.33 | $6,385,449 |

| AHX | Apiam Animal Health | 0.310 | 6.90 | $54,901,661 |

| LDX | Lumos Diagnostics | 0.078 | 6.85 | $36,097,503 |

| CAJ | Capitol Health | 0.250 | 6.38 | $266,452,351 |

| EBO | Ebos Group Ltd | 34.910 | 6.21 | $6,679,211,573 |

| SNZ | Summerset Grp Hldgs | 9.900 | 6.11 | $2,272,529,405 |

| PME | Pro Medicus Limited | 101.380 | 5.79 | $10,567,740,576 |

| ZLD | Zelira Therapeutics | 0.950 | 5.56 | $9,815,289 |

| DOC | Doctor Care Anywhere | 0.065 | 4.84 | $23,831,746 |

| VLS | Vita Life Sciences.. | 1.865 | 4.78 | $102,046,010 |

| TRU | Truscreen | 0.022 | 4.76 | $9,240,557 |

| NYR | Nyrada Inc. | 0.023 | 4.55 | $3,588,200 |

| SIG | Sigma Health Ltd | 1.050 | 4.48 | $1,615,547,474 |

| ACL | Au Clinical Labs | 3.010 | 4.15 | $613,575,406 |

| VTI | Vision Tech Inc | 0.260 | 4.00 | $11,785,224 |

| CSL | CSL Limited | 298.020 | 3.97 | $143,353,093,082 |

| IDX | Integral Diagnostics | 1.970 | 3.41 | $464,605,238 |

| AFP | Aft Pharmaceuticals | 3.360 | 3.38 | $352,350,634 |

| MAP | Microbalifesciences | 0.180 | 2.86 | $71,967,719 |

| DXB | Dimerix Ltd | 0.210 | 2.44 | $95,336,015 |

| ONE | Oneview Healthcare | 0.240 | 2.13 | $170,698,654 |

| PEB | Pacific Edge | 0.100 | 2.04 | $81,127,134 |

| FRE | Firebrickpharma | 0.051 | 2.00 | $9,305,230 |

| REG | Regis Healthcare Ltd | 3.300 | 1.54 | $984,384,185 |

| IXC | Invex Ther | 0.082 | 1.23 | $6,162,616 |

| COH | Cochlear Limited | 302.300 | 1.22 | $19,737,955,109 |

| FPH | Fisher & Paykel H. | 22.030 | 0.92 | $12,946,474,830 |

| VHT | Volpara Health Tech | 1.115 | 0.91 | $283,627,353 |

| SDI | SDI Limited | 0.730 | 0.69 | $86,771,837 |

| SHL | Sonic Healthcare | 32.220 | 0.44 | $15,350,166,748 |

| AC8 | Auscann Grp Hlgs Ltd | 0.040 | 0.00 | $17,621,884 |

| AGH | Althea Group | 0.039 | 0.00 | $15,445,714 |

| ATX | Amplia Therapeutics | 0.080 | 0.00 | $15,520,512 |

| CBL | Control Bionics | 0.046 | 0.00 | $7,851,350 |

| CDX | Cardiex Limited | 0.121 | 0.00 | $17,354,743 |

| DVL | Dorsavi Ltd | 0.012 | 0.00 | $7,159,939 |

| EPN | Epsilon Healthcare | 0.024 | 0.00 | $7,208,496 |

| IMM | Immutep Ltd | 0.345 | 0.00 | $416,092,096 |

| JTL | Jayex Technology Ltd | 0.009 | 0.00 | $2,531,507 |

| MDC | Medlab Clinical Ltd | 6.600 | 0.00 | $15,071,113 |

| NC6 | Nanollose Limited | 0.022 | 0.00 | $3,495,500 |

| PER | Percheron | 0.059 | 0.00 | $54,092,698 |

| SNT | Syntara Limited | 0.020 | 0.00 | $15,794,954 |

| TD1 | Tali Digital Limited | 0.001 | 0.00 | $3,295,156 |

| UCM | Uscom Limited | 0.041 | 0.00 | $7,811,876 |

| VBS | Vectus Biosystems | 0.300 | 0.00 | $15,962,808 |

| VFX | Visionflex Group Ltd | 0.008 | 0.00 | $11,335,930 |

Singular Health (ASX:SHG)

SHG has been riding high since announcing a binding enterprise licence order for 5,000 annual licences of the 3Dicom Patient software in the US.

The licences were purchased by TechWorks 4 Good on behalf of US Veterans, to enable greater understanding and portability of medical records of Vets.

Whilst details of the deal is confidential, SHG said that the revenue generated from this order exceeds the total direct-to-consumer sales of the 3Dicom software in the 2023 calendar year of ~$50,000 by more than 40%.

The company’s shares are currently on voluntary trading halt until February 2 pending an announcement.

PharmAust (ASX:PAA)

PharmAust has received approval for an Open-Label Extension study of monepantel, in patients with Motor Neurone Disease (MND)/Amyotrophic Lateral Sclerosis (ALS).

All Phase 1 MEND Study patients have expressed interest in continuing treatment and participating in the study. The study is expected to commence in February.

Read more here: PharmAust gets ethics committee green light for open-label MND extension study

Compumedics (ASX:CMP)

Compumedics has also been in the winners’ circle after saying that it expects strong results for H1.

Unaudited revenues for H1 FY24 are expected to be a record H1 result of approximately $26m, 35% higher than pcp.

Sales orders taken for H1 FY24 were also a record H1 result of $30.3m, which is 74% higher than pcp. Compumedics expects to return to profitability in H1 FY24

Actinogen Medical (ASX:ACW)

ACW has enjoyed a solid run off the back of news that a human Positron Emission Tomography (PET) study, confirming high levels of the company’s Xanamem target occupancy in the brain at safe, well tolerated, and biologically active doses, has been published in the Journal of Alzheimer’s Disease.

The company says the study confirms that Xanamem is a brain-penetrant inhibitor of the tissue cortisol synthesis enzyme, 11β-HSD1, with high levels of target occupancy at doses as low as 5mg.

LBT Innovations (ASX:LBT)

LBT has been rising since its AGM in late November, where management provided an update on the company’s goals in 2024.

LBT CEO Brent Barnes said the expectations in 2024 include completion of the product development project with AstraZeneca, with a global rollout in second half of the year.

In January, the microbiology diagnostic equipment manufacturer announced a partnership with AstraZeneca and Thermo Fisher to speed up the development of LBT’s APAS AI software platform for microbial testing in the pharmaceutical sector.

MedAdvisor (ASX:MDR)

MedAdvisor delivered strong H1 FY24 growth of 18%, with operating revenue of $75.5 million, exceeding its guidance range of 10-15% growth.

In Q2, MDR saw continued diversification across its vaccine and chronic disease programs in both ANZ and the US.

Demand for digital patient engagement solutions from pharmaceutical manufacturers also remained strong, supported by a solid pipeline for digital programs from a diversifying client base.

Arovella Therapeutics (ASX:ALA)

Arovella has entered into a global, exclusive licence with University of North Carolina Lineberger Comprehensive Cancer Center to incorporate the novel armouring cytokine technology (IL-12-TM) for its CAR-iNKT cell platform.

The technology was developed by Professor Gianpietro Dotti, a pioneer of CARiNKT cells, and was recently published in the prestigious peer-reviewed journal Nature Communications.

When the IL-12-TM technology was tested on mice with neuroblastoma, and the mice were assessed four weeks after dosing, investigators found that CAR-iNKT cells containing IL-12-TM were at much higher numbers in the bloodstream (>10 times) than CAR-iNKT cells that did not contain IL-12.

Investigators also found that approximately 75% of the mice were still alive 60 days after treatment for the IL-12-TM group, while all mice in the group treated with CAR-iNKT cells lacking IL-12 had died.

And here are the ASX Biotech Losers for January 2024

| Code | Name | Price | % Month Change | Market Cap |

|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.017 | -57.50 | $4,019,500 |

| IBX | Imagion Biosys Ltd | 0.165 | -53.52 | $5,713,146 |

| CVB | Curvebeam Ai Limited | 0.250 | -39.76 | $55,755,071 |

| EOF | Ecofibre Limited | 0.105 | -34.38 | $37,887,390 |

| NAN | Nanosonics Limited | 2.930 | -33.41 | $890,318,339 |

| BP8 | Bph Global Ltd | 0.001 | -33.33 | $1,835,563 |

| ICR | Intelicare Holdings | 0.016 | -33.33 | $3,757,192 |

| AHI | Advanced Health | 0.084 | -32.80 | $20,521,387 |

| AMT | Allegra Medical | 0.031 | -31.11 | $3,707,942 |

| IRX | Inhalerx Limited | 0.020 | -31.03 | $3,795,339 |

| ARX | Aroa Biosurgery | 0.575 | -30.72 | $212,933,669 |

| PYC | PYC Therapeutics | 0.077 | -30.00 | $283,697,902 |

| ATH | Alterity Therap Ltd | 0.005 | -28.57 | $22,867,957 |

| HMD | Heramed Limited | 0.017 | -26.73 | $5,461,491 |

| MXC | Mgc Pharmaceuticals | 0.350 | -26.32 | $15,348,071 |

| CHM | Chimeric Therapeutic | 0.026 | -25.71 | $21,874,753 |

| ALC | Alcidion Group Ltd | 0.056 | -25.33 | $71,151,081 |

| PAR | Paradigm Bio. | 0.318 | -25.29 | $131,470,941 |

| AVE | Avecho Biotech Ltd | 0.003 | -25.00 | $11,092,540 |

| HIQ | Hitiq Limited | 0.017 | -22.73 | $5,981,364 |

| OSL | Oncosil Medical | 0.007 | -22.22 | $11,847,247 |

| ADR | Adherium Ltd | 0.044 | -21.43 | $17,005,439 |

| TRI | Trivarx Ltd | 0.024 | -20.00 | $8,113,888 |

| OSX | Osteopore Limited | 0.036 | -18.18 | $5,577,071 |

| CAN | Cann Group Ltd | 0.080 | -17.53 | $34,205,823 |

| IIQ | Inoviq Ltd | 0.550 | -17.29 | $47,389,632 |

| RAC | Race Oncology Ltd | 0.695 | -17.26 | $110,754,646 |

| MEM | Memphasys Ltd | 0.010 | -16.67 | $13,438,587 |

| OPT | Opthea Limited | 0.475 | -16.67 | $308,206,015 |

| ENL | Enlitic Inc. | 0.725 | -15.70 | $52,067,506 |

| 4DX | 4Dmedical Limited | 0.605 | -15.38 | $242,347,956 |

| AVR | Anteris Technologies | 16.250 | -15.14 | $287,116,388 |

| GTG | Genetic Technologies | 0.115 | -14.81 | $12,695,897 |

| MYX | Mayne Pharma Ltd | 5.270 | -14.31 | $450,893,726 |

| CTQ | Careteq Limited | 0.025 | -13.79 | $5,888,682 |

| HLS | Healius | 1.413 | -13.61 | $1,016,493,860 |

| RNO | Rhinomed Ltd | 0.026 | -13.33 | $7,428,712 |

| RSH | Respiri Limited | 0.026 | -13.33 | $27,556,592 |

| MSB | Mesoblast Limited | 0.270 | -12.90 | $269,065,693 |

| M7T | Mach7 Tech Limited | 0.690 | -12.66 | $168,868,733 |

| 1AD | Adalta Limited | 0.022 | -12.00 | $12,619,298 |

| SPL | Starpharma Holdings | 0.150 | -11.76 | $61,769,664 |

| NSB | Neuroscientific | 0.039 | -11.36 | $5,061,170 |

| CGS | Cogstate Ltd | 1.285 | -11.07 | $233,919,133 |

| RAD | Radiopharm | 0.066 | -10.81 | $26,844,416 |

| TRJ | Trajan Group Holding | 1.105 | -10.53 | $168,959,854 |

| IPD | Impedimed Limited | 0.130 | -10.34 | $263,030,030 |

| 1AI | Algorae Pharma | 0.009 | -10.00 | $16,612,402 |

| IVX | Invion Ltd | 0.005 | -10.00 | $25,698,129 |

| PTX | Prescient Ltd | 0.056 | -9.68 | $45,903,228 |

| RCE | Recce Pharmaceutical | 0.485 | -9.35 | $103,378,695 |

| CYC | Cyclopharm Limited | 1.750 | -9.09 | $167,961,942 |

| BMT | Beamtree Holdings | 0.215 | -8.51 | $61,612,339 |

| EZZ | EZZ Life Science | 0.595 | -8.46 | $26,690,625 |

| AYA | Artryalimited | 0.220 | -8.33 | $16,909,533 |

| RHT | Resonance Health | 0.055 | -8.33 | $24,579,111 |

| BOT | Botanix Pharma Ltd | 0.175 | -7.89 | $265,784,353 |

| HGV | Hygrovest Limited | 0.049 | -7.55 | $10,305,219 |

| LGP | Little Green Pharma | 0.130 | -7.14 | $40,512,587 |

| LTP | Ltr Pharma Limited | 0.325 | -7.14 | $22,881,784 |

| OIL | Optiscan Imaging | 0.078 | -7.14 | $65,156,583 |

| NOX | Noxopharm Limited | 0.066 | -7.04 | $19,287,705 |

| PGC | Paragon Care Limited | 0.210 | -6.67 | $143,591,658 |

| HXL | Hexima | 0.017 | -5.56 | $2,839,674 |

| PCK | Painchek Ltd | 0.035 | -5.41 | $47,383,031 |

| ILA | Island Pharma | 0.090 | -5.26 | $7,720,504 |

| NEU | Neuren Pharmaceut. | 23.660 | -5.25 | $3,055,648,881 |

| OCC | Orthocell Limited | 0.390 | -4.88 | $79,706,943 |

| ANR | Anatara Ls Ltd | 0.021 | -4.55 | $3,525,768 |

| CSX | Cleanspace Holdings | 0.315 | -4.55 | $25,515,172 |

| IDT | IDT Australia Ltd | 0.105 | -4.55 | $36,905,344 |

| IMU | Imugene Limited | 0.105 | -4.55 | $752,754,128 |

| IME | Imexhs Limited | 0.640 | -4.48 | $27,268,923 |

| NXS | Next Science Limited | 0.325 | -4.41 | $106,468,713 |

| ECS | ECS Botanics Holding | 0.022 | -4.35 | $24,348,075 |

| BDX | Bcaldiagnostics | 0.091 | -4.21 | $22,899,163 |

| BIT | Biotron Limited | 0.093 | -4.12 | $85,716,173 |

| VIT | Vitura Health Ltd | 0.245 | -3.92 | $141,089,078 |

| EMD | Emyria Limited | 0.050 | -3.85 | $18,698,099 |

| RHC | Ramsay Health Care | 50.690 | -3.65 | $11,531,387,469 |

| ANN | Ansell Limited | 24.380 | -3.18 | $3,069,552,561 |

| COV | Cleo Diagnostics | 0.170 | -2.86 | $10,374,000 |

| AHC | Austco Healthcare | 0.195 | -2.50 | $56,390,913 |

| CUV | Clinuvel Pharmaceut. | 15.600 | -2.50 | $774,466,322 |

| UBI | Universal Biosensors | 0.195 | -2.50 | $44,597,581 |

| IMC | Immuron Limited | 0.076 | -1.30 | $17,312,674 |

| OCA | Oceania Healthc Ltd | 0.645 | -1.15 | $469,120,971 |

| PBP | Probiotec Limited | 2.870 | -1.03 | $233,398,175 |

| PSQ | Pacific Smiles Grp | 1.445 | -1.03 | $230,595,900 |

| SOM | SomnoMed Limited | 0.495 | -1.00 | $53,752,741 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.