ASX Health Winners December: Health stocks beat market, look ‘undervalued’ going into 2024

The Health sector index beat the ASX 200 in December. Picture Getty

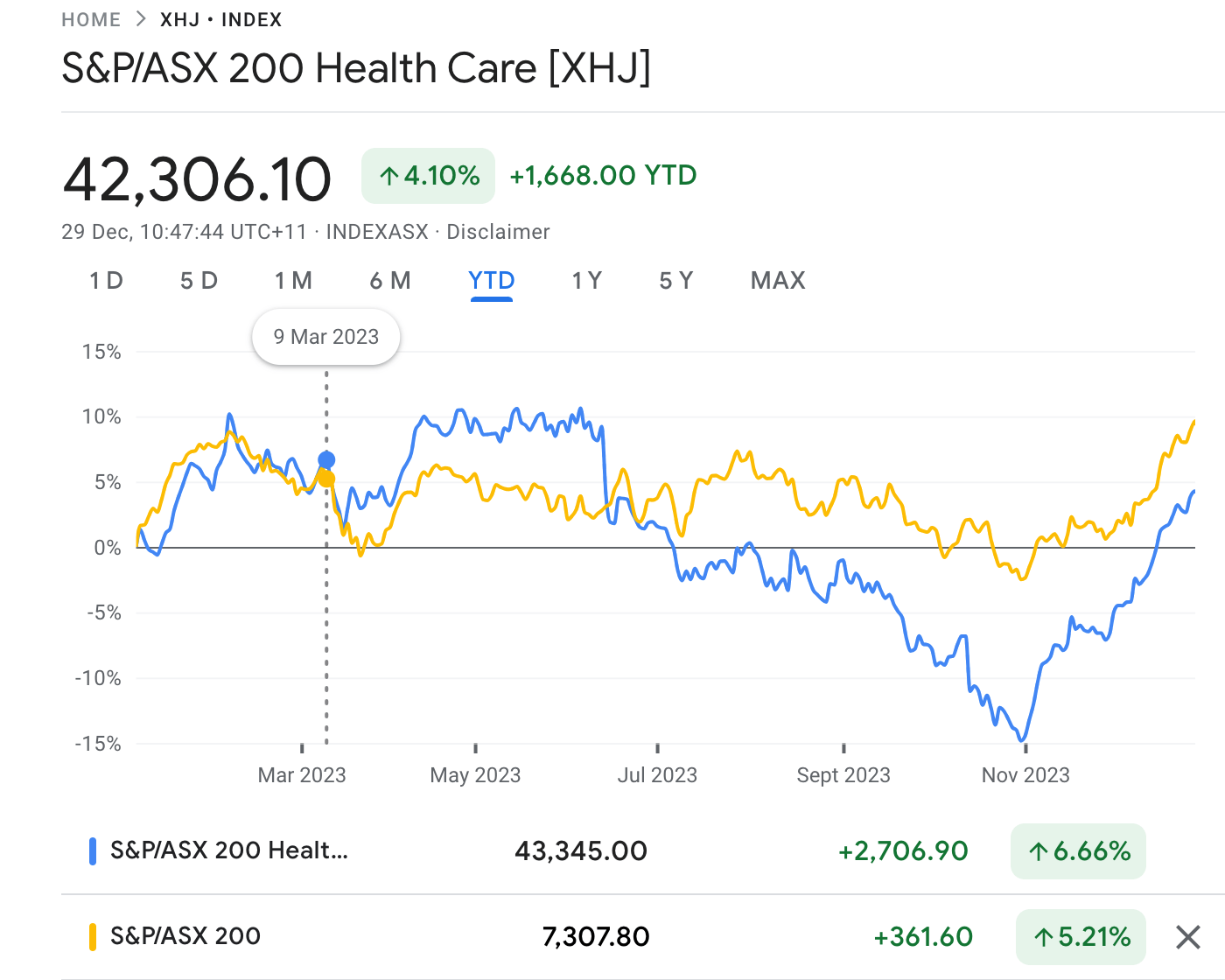

- The Health sector index beat the ASX 200 in December

- But it underperformed the benchmark index over 2023

- We take a look at the best performing ASX health stocks in December

The healthcare sector (ASX:XHJ) had a good month in December, up by over 9% versus the benchmark (ASX 200) return of around 8%.

For the year however, the XHJ was below the benchmark, up 4% vs ASX return of 9%.

Analysts at Janus Henderson believe the sector is undervalued, and will be entering the new year with compressed valuations just as innovation picks up and a post-COVID reset winds down.

And that should make for a positive outlook, say Janus Portfolio Managers Andy Acker and Dan Lyons.

“Looking ahead, we think the road could begin to smooth out,” wrote Acker and Lyons.

“Attractive valuations, numerous medical advances, and positive long-term demographic trends have put the sector into a position of unusual strength in our view – with the potential to reward long-term investors.”

Eddie Yoon, Sector Portfolio Manager at Fidelity, agrees, saying that looking ahead, the performance of healthcare stocks may be heavily influenced by the direction of the broader economy and the current starting point of valuations.

“While I can’t be sure of where the economy is headed, the low starting point of valuations may be a positive for the sector,” Yoon said.

He added that wherever the markets are headed next, the healthcare sector can offer a combination of defensive and growth characteristics that may be attractive in a variety of scenarios.

“My focus remains on the long term—that is, trying to invest in the most innovative areas of health care, where Fidelity’s research insights may help deliver material value over time,” he said.

Meanwhile, Morgan Stanley says its cautious strategy leans toward safer, defensive sectors with appealing valuations.

“Healthcare sparkles here, historically excelling in late business cycle stages and in times of declining but above-average inflation – a scenario mix we’re likely to see in the coming months,” wrote analysts at MS.

“Despite their defensive nature, it [the healthcare sector] isn’t recession-proof, and could struggle if the economy faces a severe downturn.

“And, in a scenario where the economy gains momentum, it might lag behind more cyclical sectors on a relative performance basis,” said MS.

Here are the ASX Biotech Winners for December 2023

Swipe or scroll to reveal the full table. Click headings to sort

| Code | Name | Price | % Month Change | Market Cap |

|---|---|---|---|---|

| ATH | Alterity Therap | 0.007 | 133.33 | $16,814,162 |

| EYE | Nova EYE Medical | 0.265 | 89.29 | $36,219,490 |

| NEU | Neuren Pharmaceut. | 25.200 | 66.34 | $3,195,641,124 |

| PSQ | Pacific Smiles Grp | 1.500 | 63.93 | $245,756,185 |

| CMP | Compumedics | 0.300 | 62.16 | $53,148,884 |

| BPH | BPH Energy | 0.047 | 56.67 | $47,192,640 |

| CU6 | Clarity Pharma | 1.880 | 49.21 | $496,944,400 |

| S66 | Star Combo | 0.145 | 45.00 | $19,587,032 |

| VHT | Volpara Health Tech | 1.105 | 44.44 | $279,811,739 |

| NXS | Next Science | 0.330 | 43.48 | $96,259,384 |

| DXB | Dimerix | 0.200 | 42.86 | $85,215,978 |

| ALA | Arovella Therapeutic | 0.125 | 40.45 | $109,084,829 |

| ILA | Island Pharma | 0.098 | 34.25 | $7,964,310 |

| PYC | PYC Therapeutics | 0.105 | 28.05 | $410,615,385 |

| OPT | Opthea | 0.550 | 27.91 | $371,172,835 |

| PAA | Pharmaust | 0.110 | 27.91 | $41,147,216 |

| DOC | Doctor Care Anywhere | 0.060 | 25.00 | $22,731,819 |

| LBT | LBT Innovations | 0.010 | 25.00 | $12,596,770 |

| M7T | Mach7 Tech | 0.795 | 24.22 | $191,746,882 |

| PNV | Polynovo | 1.670 | 23.70 | $1,152,688,694 |

| PGC | Paragon Care | 0.225 | 21.62 | $153,609,681 |

| CBL | Control Bionics | 0.046 | 21.05 | $6,374,352 |

| IMM | Immutep | 0.350 | 20.69 | $410,147,923 |

| ADR | Adherium | 0.054 | 20.00 | $18,005,759 |

| BOT | Botanix Pharma | 0.180 | 20.00 | $278,486,036 |

| CHM | Chimeric Therapeutic | 0.036 | 20.00 | $23,226,899 |

| PAR | Paradigm Bio. | 0.465 | 19.23 | $147,247,454 |

| ARX | Aroa Biosurgery | 0.850 | 18.88 | $298,794,020 |

| IIQ | Inoviq | 0.695 | 18.80 | $62,572,717 |

| RCE | Recce Pharmaceutical | 0.530 | 17.78 | $102,869,441 |

| PBP | Probiotec | 2.905 | 17.14 | $236,651,111 |

| ADO | Anteotech | 0.036 | 16.13 | $79,071,928 |

| 1AD | Adalta | 0.024 | 14.29 | $12,619,298 |

| PAB | Patrys | 0.008 | 14.29 | $16,459,579 |

| IBX | Imagion Biosys | 0.365 | 14.06 | $11,426,293 |

| OSL | Oncosil Medical | 0.009 | 12.50 | $17,770,870 |

| ONE | Oneview Healthcare | 0.235 | 11.90 | $157,310,524 |

| NTI | Neurotech Intl | 0.066 | 11.86 | $58,854,790 |

| VTI | Vision Tech Inc | 0.250 | 11.11 | $12,823,483 |

| CTE | Cryosite | 0.610 | 10.91 | $29,773,833 |

| NC6 | Nanollose | 0.022 | 10.00 | $3,495,500 |

| LDX | Lumos Diagnostics | 0.070 | 9.38 | $33,691,003 |

| SOM | SomnoMed | 0.495 | 8.79 | $53,752,741 |

| CYP | Cynata Therapeutics | 0.125 | 8.70 | $22,453,973 |

| EXL | Elixinol Wellness | 0.013 | 8.33 | $7,594,459 |

| CAJ | Capitol Health | 0.233 | 8.14 | $245,136,163 |

| IMU | Imugene | 0.108 | 7.50 | $752,754,128 |

| ATX | Amplia Therapeutics | 0.080 | 6.67 | $15,520,463 |

| IPD | Impedimed | 0.138 | 5.77 | $278,204,839 |

| IDT | IDT Australia | 0.105 | 5.00 | $36,905,344 |

| AT1 | Atomo Diagnostics | 0.022 | 4.76 | $14,062,451 |

| NYR | Nyrada Inc. | 0.022 | 4.76 | $3,432,191 |

| TLX | Telix Pharmaceutical | 10.030 | 4.26 | $3,237,266,830 |

| EZZ | EZZ Life Science | 0.645 | 3.20 | $27,544,725 |

| VLS | Vita Life Sciences.. | 1.780 | 3.19 | $95,853,244 |

| AGH | Althea Group | 0.039 | 2.63 | $15,049,670 |

| OCC | Orthocell | 0.400 | 2.56 | $79,706,943 |

| MVF | Monash IVF Group | 1.305 | 1.95 | $512,369,815 |

| AC8 | Auscann Grp Hlgs | 0.040 | 0.00 | $17,621,884 |

| AHC | Austco Healthcare | 0.195 | 0.00 | $57,462,416 |

| AN1 | Anagenics | 0.019 | 0.00 | $7,196,779 |

| BIT | Biotron | 0.098 | 0.00 | $89,325,275 |

| BWX | BWX | 0.200 | 0.00 | $39,997,500 |

| BXN | Bioxyne | 0.011 | 0.00 | $20,918,099 |

| CDX | Cardiex | 0.121 | 0.00 | $17,354,743 |

| JTL | Jayex Technology | 0.009 | 0.00 | $2,531,507 |

| MDC | Medlab Clinical | 6.600 | 0.00 | $15,071,113 |

| ME1 | Melodiol Glb Health | 0.002 | 0.00 | $9,457,648 |

| SHG | Singular Health | 0.038 | 0.00 | $5,369,790 |

| TRI | Trivarx | 0.030 | 0.00 | $10,142,360 |

LBT Innovations (ASX:LBT)

LBT has been rising since its AGM in late November, where management provided an update on the company’s goals in 2024.

LBT CEO Brent Barnes said the expectations in 2024 include completion of the product development project with AstraZeneca, with a global rollout in second half of the year.

In January, the microbiology diagnostic equipment manufacturer LBT announced a partnership with AstraZeneca and Thermo Fisher to speed up the development of LBT’s APAS AI software platform for microbial testing in the pharmaceutical sector.

The software is said to allow the speed up of laboratory processing of clinical samples by utilising AI to scan for microbial contamination.

In addition, LBT expects additional pharmaceutical companies to commence validations in 2024, which will build the company’s sales pipeline.

Neuren Pharma (ASX:NEU)

Neuren soared last week after announcing positive results of its Phase 2 results of NNZ-2591 in children with Phelan-McDermid syndrome (PMS).

NNZ-2591 was given to all patients in the study as an oral liquid dose twice daily, with escalation in two stages up to the target dose of 12mg/kg during the first six weeks of treatment, subject to independent review of safety and tolerability data.

NEU says significant improvement was observed by both clinicians and caregivers from treatment, across multiple efficacy measures.

NEU also says NNZ-2591 was safe and well tolerated, with no clinically significant changes in laboratory values or other safety parameters during treatment.

Seperately, the company said the last subject to be screened this week will complete the enrolment of subjects into its Phase 2 clinical trial of NNZ-2591 in Angelman syndrome (AS).

Top-line results from the trial are expected to be available in Q3 2024.

The Phase 2 trial will have enrolled children between aged 3 to 17 years at three hospitals in Australia. The study will examine the safety, tolerability, pharmacokinetics and efficacy of NNZ-2591 over 13 weeks of twice-daily oral liquid doses.

NNZ-2591 is a synthetic drug which is is under development by Neuren for the treatment of Rett syndrome, fragile X syndrome, Phelan-McDermid syndrome, Pitt Hopkins syndrome (genetic disorders), Prader-Willi syndrome, as well as Angelman Syndrome.

Intelicare (ASX:ICR)

ICR has been rising after executing a non-binding Memorandum of Understanding (MoU) with Bolton Clarke as a precursor to a Strategic Partnership Agreement.

Bolton Clarke is Australia’s largest independent not-for-profit aged care provider, supporting more than 130,000 people at home and in its 88 residential homes and 38 retirement villages.

ICR also executed a binding Reseller Agreement with JNC Technologies to deploy the InteliCare platform to JNC’s client Hardi Aged Care.

The contract value is expected to be $1.8 million in hardware implementation, and on full deployment will generate in excess of $0.5 million in annual recurring SaaS fees with an initial term of three years, representing InteliCare’s largest commercial deployment to date.

Pacific Smiles Group (ASX:PSQ)

Dental clinics network, Pacific Smiles Group, provided an update on its trading performance as of the close of business on 20 December.

Patient fees came in $141.1m, a 10.5% increase YoY, and same centre patient fees also increased 9.7% YoY.

PSQ has also provided guidance for FY24.

Patient fees for the full year are expected to come in the range of $293m to $297m, and Underlying EBITDA in the range of $26m to $28m.

Additionally, PSQ said the board has assessed the $1.40 in cash per share takeover offer from Genesis Capital submitted earlier this week.

Despite acknowledging that the share price performance of Pacific Smiles has been disappointing, the board considers that the offer is “opportunistic and materially undervalues Pacific Smiles”, and has therefore rejected the proposal.

Nova Eye Medical (ASX:EYE)

Nova Eye has been rising since announcing that five MACs (Medicare Administrative Contractors) have deferred the proposed USA reimbursement changes from 23 December 2023, to January 29, 2024.

The deferral by all five MACs is a positive outcome for the near-term sales of the company’s iTrack portfolio of canaloplasty devices, which continue to be strong since the US launch of iTrack Advance in May.

As a quick background, in November EYE reported that four additional MACs have proposed LCD (local coverage determination) changes on Medicare reimbursement of minimally invasive glaucoma surgery (MIGS) procedures in the US.

This would have hit Nova Eye particularly hard, as “approximately 40% of the company’s global revenues are derived from health care facilities located in the 38 states covered by these four MACs,” according to a release from EYE.

But a fortnight later, EYE advised that the final draft of the LCD, issued by the US National Government Services (NGS), has been deferred from December 23 to March 23, 2024.

The NGS administers insurance reimbursement claims of healthcare facilities in the states of New York, Connecticut, Rhode Island, Massachusetts, Vermont, New Hampshire, Maine, Minnesota, Illinois, and Wisconsin.

NGS said the the deferral is to “allow more time to make decisions regarding comments received”.

Reimbursement coverage of canaloplasty surgeries in the 38 US states covered by the five MACs beyond January 29, 2024, will now depend on whether the proposed LCDs are implemented.

Compumedics (ASX:CMP)

During the month, medical devices company Compumedics said it has received two new MEG orders totalling $9.3 million in China.

MEG is a neuro-imaging device for mapping brain activity by recording magnetic fields produced by electrical currents occurring naturally in the brain, using very sensitive detectors.

The orders today were made by Tsinghua and Tianjin Universities in China. These sales are via Compumedics’ long-term Chinese distributor for the company’s brain research technology.

The MEG systems will be shipped to both Tsinghua and Tianjin Universities in FY25, due to the lead times associated with production of the MEG systems.

One order is for two single-helmet MEG systems, and the other is for a dual-helmet MEG system. Both will be configured for hyperscanning (measurement of two subjects simultaneously to study their interaction).

Clarity Pharmaceuticals (ASX:CU6)

Clarity says the first patient has been dosed in the registrational Phase 3 prostate cancer trial (called CLARIFY) with Cu-64 SAR-bisPSMA.

The aim of the CLARIFY trial is to detect regional nodal metastases in participants with prostate cancer prior to radical prostatectomy.

The final results from the CLARIFY trial are intended to provide sufficient evidence to support an application to the FDA for the approval of the 64Cu-SAR-bisPSMA product in pre-prostatectomy patients.

And Here are the ASX Biotech Losers for December 2023

| Code | Name | Price | % Month Change | Market Cap |

|---|---|---|---|---|

| GTG | Genetic Technologies | 0.135 | -46.00 | $16,158,414 |

| NSB | Neuroscientific | 0.040 | -43.66 | $5,784,195 |

| NOX | Noxopharm | 0.071 | -38.26 | $20,748,894 |

| BP8 | Bph Global | 0.001 | -33.33 | $2,753,345 |

| TD1 | Tali Digital | 0.001 | -33.33 | $3,295,156 |

| SNT | Syntara | 0.022 | -26.67 | $18,282,139 |

| MXC | Mgc Pharmaceuticals | 0.500 | -25.93 | $18,245,816 |

| RGS | Regeneus | 0.003 | -25.00 | $919,311 |

| RHY | Rhythm Biosciences | 0.135 | -22.86 | $26,537,111 |

| 4DX | 4Dmedical | 0.710 | -22.83 | $281,436,336 |

| HXL | Hexima | 0.018 | -21.74 | $3,006,713 |

| IRX | Inhalerx | 0.029 | -21.62 | $5,503,242 |

| AMT | Allegra Medical | 0.045 | -21.05 | $5,980,551 |

| UBI | Universal Biosensors | 0.185 | -17.78 | $39,288,345 |

| AHK | Ark Mines | 0.195 | -17.02 | $8,577,504 |

| HCT | Holista CollTech | 0.010 | -16.67 | $2,788,001 |

| EPN | Epsilon Healthcare | 0.024 | -14.29 | $7,208,496 |

| IVX | Invion | 0.006 | -14.29 | $38,529,793 |

| PTX | Prescient | 0.067 | -14.10 | $52,345,787 |

| AVE | Avecho Biotech | 0.004 | -12.50 | $11,092,540 |

| MX1 | Micro-X | 0.105 | -12.50 | $54,396,732 |

| ZNO | Zoono Group | 0.044 | -12.00 | $8,890,665 |

| RNO | Rhinomed | 0.030 | -11.76 | $8,571,591 |

| OIL | Optiscan Imaging | 0.083 | -11.70 | $69,333,287 |

| ZLD | Zelira Therapeutics | 0.905 | -11.27 | $10,212,440 |

| VFX | Visionflex Group | 0.008 | -11.11 | $11,335,930 |

| GSS | Genetic Signatures | 0.440 | -10.80 | $62,381,608 |

| MEM | Memphasys | 0.011 | -10.75 | $12,436,941 |

| IMC | Immuron | 0.076 | -9.52 | $17,312,674 |

| MDR | Medadvisor | 0.210 | -8.70 | $112,120,614 |

| TRP | Tissue Repair | 0.210 | -8.70 | $11,719,683 |

| TRU | Truscreen | 0.021 | -8.70 | $8,820,532 |

| 1AI | Algorae Pharma | 0.011 | -8.33 | $18,273,642 |

| SDI | SDI | 0.725 | -8.23 | $86,177,509 |

| GLH | Global Health | 0.115 | -8.00 | $6,965,944 |

| CYC | Cyclopharm | 1.900 | -7.77 | $181,605,909 |

| DVL | Dorsavi | 0.012 | -7.69 | $7,159,939 |

| ICR | Intelicare Holdings | 0.026 | -7.14 | $6,105,437 |

| RHT | Resonance Health | 0.058 | -4.92 | $27,546,683 |

| CAN | Cann Group | 0.100 | -4.76 | $41,566,570 |

| VBS | Vectus Biosystems | 0.300 | -4.76 | $16,494,902 |

| OSX | Osteopore | 0.043 | -4.44 | $7,126,257 |

| ACW | Actinogen Medical | 0.022 | -4.35 | $48,453,512 |

| ALC | Alcidion Group | 0.072 | -4.00 | $98,000,545 |

| RSH | Respiri | 0.030 | -3.23 | $31,796,068 |

| RAC | Race Oncology | 0.885 | -2.75 | $138,875,117 |

| MVP | Medical Developments | 0.750 | -2.60 | $64,728,914 |

| PCK | Painchek | 0.038 | -2.56 | $54,562,278 |

| ACR | Acrux | 0.043 | -2.27 | $12,454,132 |

| PIQ | Proteomics Int Lab | 0.860 | -2.27 | $105,207,860 |

| HGV | Hygrovest | 0.051 | -1.92 | $11,146,462 |

| ANP | Antisense Therapeut. | 0.059 | -1.67 | $52,289,608 |

| CGS | Cogstate | 1.485 | -1.66 | $254,483,452 |

| RAD | Radiopharm | 0.070 | -1.41 | $26,386,376 |

| BDX | Bcaldiagnostics | 0.099 | -1.00 | $25,163,916 |

The views, information, or opinions expressed in the interview in this article are solely those of the analysts and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.