ASX Health July Winners: Sector finally catches a bid to rebound 9pc for month

It was a healthy dose of gains for ASX healthcare in July. Pic via Getty

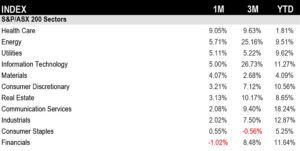

- The S&P ASX 200 Health Care index rose 9.05% in July with rotation into the sector gaining momentum

- Lumos soared 170% in July after six-year exclusive deal valued at up to US$317 million with PHASE Scientific for distribution of FebriDX in US subject to CLIA waiver

- Clever Culture Systems rose 81.3% in July on news global pharmaceutical giant Novo Nordisk purchased one of its flagship APAS Independence instruments for evaluation

The healthcare sector rose 9.05% in July to be the best of the 11 ASX sectors. A turn up for the books to be sure. While remaining the worst performing sector YTD – up just 1.81% – the S&P ASX Health Care index was in recovery mode in July.

The sector was buoyed by a roughly 13% rise in its biggest name blood products giant CSL (ASX:CSL), which drives much of the index.

Morgans’ healthcare analyst Iain Wilkie said there appeared to be a strong sector rotation on the ASX in July.

“During July there certainly was a rotation out of usual strong sectors like financials and more into healthcare and the miners,” he told Stockhead.

“Healthcare has been beaten down for quite a long while now and is starting to look attractive.

“I don’t think there was anything specific in terms of a catalyst to drive the rotation.”

Looking ahead, Wilkie noted the sector may face continued pressure with US President Donald Trump again threatening tariffs “at a very, very, high rate, like 200%” on imported pharmaceuticals.

“Trump has again thrown his weight around but until it actually hits we’ll see,” Wilkie said.

He said US tariffs shouldn’t affect companies like CSL, which is one of the world’s largest manufacturers of plasma products.

“Although the US collects over 60% of the world’s plasma, it lacks sufficient domestic capacity to process it into finished therapies,” he said.

“As a result, imported plasma products are critical to meeting national demand.

“Introducing tariffs on these products would likely be counterproductive as they wouldn’t foster viable domestic alternatives and could drive up costs, potentially limiting patient access and causing harm.”

How ASX biotechs performed in July

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | MARKET CAP |

|---|---|---|---|---|

| PAB | Patrys Limited | $ 0.002 | 181.8% | 6.9 |

| LDX | Lumos Diagnostics | $ 0.073 | 170.4% | 55.4 |

| NSB | Neuroscientific | $ 0.235 | 170.1% | 79.8 |

| NXS | Next Science Limited | $ 0.140 | 109.0% | 41.7 |

| NOX | Noxopharm Limited | $ 0.110 | 103.7% | 30.7 |

| CMB | Cambium Bio Limited | $ 0.425 | 102.4% | 8.2 |

| DVL | Dorsavi Ltd | $ 0.028 | 86.7% | 27.3 |

| ICR | Intelicare Holdings | $ 0.013 | 85.7% | 6.3 |

| CC5 | Clever Culture | $ 0.029 | 81.3% | 56.9 |

| EMD | Emyria Limited | $ 0.049 | 75.0% | 28.1 |

| CU6 | Clarity Pharma | $ 4.370 | 74.8% | 1,471.5 |

| HMD | Heramed Limited | $ 0.012 | 71.4% | 10.5 |

| MX1 | Micro-X Limited | $ 0.083 | 69.4% | 54.0 |

| TTX | Tetratherix Limited | $ 5.020 | 66.2% | 131.7 |

| CAN | Cann Group Ltd | $ 0.016 | 60.0% | 9.8 |

| NYR | Nyrada Inc. | $ 0.370 | 54.2% | 77.8 |

| VBS | Vectus Biosystems | $ 0.06 | 50.0% | 3.2 |

| CSX | Cleanspace Holdings | $ 0.760 | 46.2% | 59.5 |

| MSB | Mesoblast Limited | $ 2.380 | 43.8% | 3,046.3 |

| AVE | Avecho Biotech Ltd | $ 0.005 | 42.9% | 15.9 |

| HIQ | Hitiq Limited | $ 0.020 | 42.9% | 9.9 |

| AYA | Artryalimited | $ 1.025 | 42.4% | 116.7 |

| ANR | Anatara Ls Ltd | $ 0.007 | 40.0% | 1.5 |

| ATH | Alterity Therap Ltd | $ 0.014 | 40.0% | 128.9 |

| CBL | Control Bionics | $ 0.040 | 37.9% | 12.1 |

| EYE | Nova EYE Medical Ltd | $ 0.150 | 36.4% | 41.2 |

| IBX | Imagion Biosys Ltd | $ 0.015 | 36.4% | 3.0 |

| IPD | Impedimed Limited | $ 0.047 | 34.3% | 93.4 |

| RCE | Recce Pharmaceutical | $ 0.388 | 33.6% | 108.4 |

| NTI | Neurotech Intl | $ 0.020 | 33.3% | 21.0 |

| VFX | Visionflex Group Ltd | $ 0.00 | 33.3% | 6.7 |

| AT1 | Atomo Diagnostics | $ 0.018 | 28.6% | 14.2 |

| AHC | Austco Healthcare | $ 0.370 | 27.6% | 137.0 |

| TRP | Tissue Repair | $ 0.240 | 26.3% | 14.5 |

| SOM | SomnoMed Limited | $ 0.815 | 25.4% | 171.8 |

| 1AD | Adalta Limited | $ 0.003 | 25.0% | 2.8 |

| ADR | Adherium Ltd | $ 0.005 | 25.0% | 9.0 |

| BIT | Biotron Limited | $ 0.003 | 25.0% | 3.3 |

| CUV | Clinuvel Pharmaceut. | $ 12.970 | 25.0% | 617.5 |

| FRE | Firebrickpharma | $ 0.077 | 24.2% | 17.5 |

| CMP | Compumedics Limited | $ 0.315 | 23.5% | 66.3 |

| NEU | Neuren Pharmaceut. | $ 17.290 | 22.5% | 2,150.6 |

| ILA | Island Pharma | $ 0.170 | 21.4% | 40.8 |

| ATX | Amplia Therapeutics | $ 0.240 | 20.0% | 111.9 |

| DOC | Doctor Care Anywhere | $ 0.125 | 19.0% | 47.7 |

| EBR | EBR Systems | $ 1.410 | 18.0% | 514.6 |

| LTP | Ltr Pharma Limited | $ 0.340 | 17.2% | 60.6 |

| PAR | Paradigm Bio. | $ 0.355 | 16.4% | 136.1 |

| LGP | Little Green Pharma | $ 0.115 | 16.2% | 35.1 |

| M7T | Mach7 Tech Limited | $ 0.380 | 15.2% | 89.3 |

| ALC | Alcidion Group Ltd | $ 0.115 | 15.0% | 154.4 |

| NC6 | Nanollose Limited | $ 0.077 | 14.9% | 24.1 |

| CYC | Cyclopharm Limited | $ 1.040 | 14.3% | 113.4 |

| SPL | Starpharma Holdings | $ 0.100 | 13.6% | 43.9 |

| MVF | Monash IVF Group Ltd | $ 0.800 | 13.5% | 309.8 |

| SNT | Syntara Limited | $ 0.060 | 13.2% | 97.6 |

| CSL | CSL Limited | $ 270.900 | 13.1% | 128,514.7 |

| PME | Pro Medicus Limited | $ 321.890 | 12.9% | 33,058.3 |

| CVB | Curvebeam Ai Limited | $ 0.080 | 12.7% | 33.2 |

| IMM | Immutep Ltd | $ 0.270 | 12.5% | 385.3 |

| MVP | Medical Developments | $ 0.610 | 11.9% | 64.8 |

| TRJ | Trajan Group Holding | $ 0.800 | 11.9% | 121.9 |

| GLH | Global Health Ltd | $ 0.076 | 11.8% | 4.5 |

| VIT | Vitura Health Ltd | $ 0.07 | 11.3% | 47.0 |

| PIQ | Proteomics Int Lab | $ 0.360 | 10.8% | 57.3 |

| IRX | Inhalerx Limited | $ 0.042 | 10.5% | 9.0 |

| IDT | IDT Australia Ltd | $ 0.098 | 10.1% | 40.7 |

| NUZ | Neurizon Therapeutic | $ 0.170 | 9.7% | 81.2 |

| PGC | Paragon Care Limited | $ 0.400 | 9.6% | 653.8 |

| RHY | Rhythm Biosciences | $ 0.059 | 9.3% | 17.4 |

| 1AI | Algorae Pharma | $ 0.006 | 9.1% | 10.1 |

| CTQ | Careteq Limited | $ 0.012 | 9.1% | 2.8 |

| AHX | Apiam Animal Health | $ 0.565 | 8.7% | 103.0 |

| ARX | Aroa Biosurgery | $ 0.630 | 8.6% | 224.3 |

| OCC | Orthocell Limited | $ 1.275 | 8.5% | 309.7 |

| MAP | Microbalifesciences | $ 0.092 | 8.2% | 47.4 |

| PSQ | Pacific Smiles Grp | $ 1.670 | 8.1% | 269.9 |

| PNV | Polynovo Limited | $ 1.290 | 7.9% | 858.4 |

| RMD | ResMed Inc. | $ 42.450 | 7.9% | 61,930.3 |

| PTX | Prescient Ltd | $ 0.047 | 6.8% | 38.7 |

| REG | Regis Healthcare Ltd | $ 8.370 | 6.8% | 2,545.6 |

| TYP | Tryptamine Ltd | $ 0.03 | 6.7% | 44.6 |

| SDI | SDI Limited | $ 0.883 | 6.3% | 104.6 |

| COH | Cochlear Limited | $ 318.520 | 6.0% | 20,541.2 |

| RHC | Ramsay Health Care | $ 38.770 | 5.7% | 8,808.5 |

| IDX | Integral Diagnostics | $ 2.670 | 5.1% | 1,001.8 |

| IMC | Immuron Limited | $ 0.064 | 4.9% | 16.9 |

| OCA | Oceania Healthc Ltd | $ 0.660 | 4.8% | 461.5 |

| EBO | Ebos Group Ltd | $ 37.250 | 4.7% | 7,552.6 |

| RAD | Radiopharm | $ 0.023 | 4.5% | 54.4 |

| ACW | Actinogen Medical | $ 0.024 | 4.3% | 76.3 |

| IIQ | Inoviq Ltd | $ 0.385 | 4.1% | 43.5 |

| AGH | Althea Group | $ 0.026 | 4.0% | 21.4 |

| IME | Imexhs Limited | $ 0.300 | 3.4% | 15.8 |

| CYP | Cynata Therapeutics | $ 0.155 | 3.3% | 37.3 |

| SHL | Sonic Healthcare | $ 27.610 | 3.1% | 13,532.2 |

| FPH | Fisher & Paykel H. | $ 34.090 | 1.4% | 19,481.0 |

| CTE | Cryosite Limited | $ 0.750 | 0.7% | 36.6 |

| VLS | Vita Life Sciences.. | $ 2.26 | 0.4% | 124.4 |

| ACR | Acrux Limited | $ 0.016 | 0.0% | 7.0 |

| BP8 | Bph Global Ltd | $ 0.002 | 0.0% | 2.1 |

| EMV | Emvision Medical | $ 1.740 | 0.0% | 150.1 |

| EOF | Ecofibre Limited | $ 0.020 | 0.0% | 7.6 |

| EPN | Epsilon Healthcare | $ 0.024 | 0.0% | 7.2 |

| NAN | Nanosonics Limited | $ 4.050 | 0.0% | 1,196.3 |

| OSX | Osteopore Limited | $ 0.011 | 0.0% | 2.6 |

| TD1 | Tali Digital Limited | $ 0.001 | 0.0% | 4.2 |

| TRI | Trivarx Ltd | $ 0.008 | 0.0% | 5.0 |

| TRU | Truscreen | $ 0.016 | 0.0% | 12.3 |

| ACL | Au Clinical Labs | $ 2.760 | -0.7% | 536.1 |

| CGS | Cogstate Ltd | $ 1.730 | -0.9% | 292.9 |

| MYX | Mayne Pharma Ltd | $ 4.950 | -1.0% | 405.4 |

| ANN | Ansell Limited | $ 29.950 | -1.1% | 4,410.5 |

| AFP | Aft Pharmaceuticals | $ 2.400 | -1.2% | 259.6 |

| RGT | Argent Biopharma Ltd | $ 0.080 | -1.2% | 4.7 |

| RAC | Race Oncology Ltd | $ 1.160 | -1.3% | 198.9 |

| SNZ | Summerset Grp Hldgs | $ 10.300 | -1.3% | 2,513.8 |

| HLS | Healius | $ 0.770 | -1.9% | 548.2 |

| ALA | Arovella Therapeutic | $ 0.098 | -2.0% | 117.7 |

| BMT | Beamtree Holdings | $ 0.245 | -2.0% | 72.6 |

| ONE | Oneview Healthcare | $ 0.245 | -2.0% | 185.7 |

| 4DX | 4Dmedical Limited | $ 0.235 | -2.1% | 136.2 |

| COV | Cleo Diagnostics | $ 0.380 | -2.6% | 48.8 |

| RHT | Resonance Health | $ 0.038 | -2.6% | 17.5 |

| AVH | Avita Medical | $ 1.670 | -2.6% | 217.6 |

| SIG | Sigma Health Ltd | $ 2.890 | -3.3% | 32,726.4 |

| PYC | PYC Therapeutics | $ 1.240 | -4.2% | 729.1 |

| IXC | Invex Ther | $ 0.085 | -4.5% | 6.9 |

| OIL | Optiscan Imaging | $ 0.105 | -4.5% | 87.7 |

| ZLD | Zelira Therapeutics | $ 0.41 | -6.8% | 4.9 |

| MDR | Medadvisor Limited | $ 0.075 | -7.4% | 43.8 |

| BDX | Bcaldiagnostics | $ 0.058 | -7.9% | 20.5 |

| GSS | Genetic Signatures | $ 0.330 | -9.6% | 76.1 |

| CDX | Cardiex Limited | $ 0.036 | -10.0% | 18.7 |

| PER | Percheron | $ 0.009 | -10.0% | 10.9 |

| AGN | Argenica | $ 0.680 | -10.5% | 86.1 |

| OSL | Oncosil Medical | $ 1.070 | -10.8% | 20.2 |

| ECS | ECS Botanics Holding | $ 0.008 | -11.1% | 11.0 |

| PEB | Pacific Edge | $ 0.085 | -11.5% | 75.9 |

| IVX | Invion Ltd | $ 0.096 | -12.7% | 8.2 |

| EZZ | EZZ Life Science | $ 2.030 | -13.2% | 99.1 |

| TLX | Telix Pharmaceutical | $ 21.050 | -13.8% | 6,991.3 |

| AVR | Anteris Technologies | $ 5.130 | -16.4% | 179.8 |

| DXB | Dimerix Ltd | $ 0.470 | -18.3% | 285.1 |

| SHG | Singular Health | $ 0.300 | -18.9% | 93.5 |

| IMR | Imricor Med Sys | $ 1.225 | -19.4% | 324.2 |

| MEM | Memphasys Ltd | $ 0.004 | -20.0% | 7.9 |

| PCK | Painchek Ltd | $ 0.035 | -22.2% | 66.3 |

| CHM | Chimeric Therapeutic | $ 0.003 | -25.0% | 11.4 |

| VHL | Vitasora Health Ltd | $ 0.03 | -28.2% | 46.4 |

| UCM | Uscom Limited | $ 0.01 | -31.3% | 2.9 |

| UBI | Universal Biosensors | $ 0.02 | -31.4% | 7.2 |

| IMU | Imugene Limited | $ 0.270 | -38.9% | 77.2 |

| BOT | Botanix Pharma Ltd | $ 0.150 | -53.1% | 289.3 |

Patrys (ASX:PAB) rose ~182% in July after announcing a solid June quarter including a board restructure, $300,000 capital raise and actively pursuing partnering and licensing opportunities for both of its oncological cell therapy deoxymab assets.

In July Patrys also announced a fully underwritten, pro-rata non-renounceable entitlement offer of three fully paid ordinary shares for every four shares held at an issue price of $0.001 per Share, together with on free-attaching new share for every four shares applied for and issued, to raise up to ~$1.78m.

Lumos Diagnostics (ASX:LDX) rose more than 170% in July after landing a landmark six-year distributor deal worth hundreds of millions of dollars to sell its rapid point-of-care diagnostic FebriDx in the US market.

The FebriDx product is a simple test able to differentiate between bacterial and non-bacterial acute respiratory infections. The lucrative US licensing deal with Hong-Kong based PHASE Scientific could see Lumos net up to to US$317m (~A$487m), and has been described as one of the largest distribution deals of its type to be done by an ASX-listed point-of-care diagnostics company.

Adelaide-based Clever Culture Systems (ASX:CC5), rose 81.3% in July after announcing global pharmaceutical giant Novo Nordisk had purchased one of its flagship APAS Independence instruments for evaluation.

The machine will be delivered to Novo’s central team in Denmark, where it will undergo a full-scale evaluation to assess its suitability for deployment across Novo’s global manufacturing network.

The APAS Independence uses AI technology to automate one of the most time-consuming parts of microbiology, analysing agar plates for contamination.

READ: Big pharma takes notice as Novo Nordisk puts Clever Culture’s APAS to the test

Radiopharmaceutical group Clarity Pharmaceuticals (ASX:CU6) was up 74.8% in July after completing a large $203m institutional placement at a 15% premium to the company’s 15-day average price, to fund their clinical program.

Executive chairman Dr Alan Taylor told Stockhead the “fast, well executed and sizeable” placement was to a small group of local institutional investors “close to the company”.

“I have never done a deal that fast,” Taylor said.

“A week ago, I would have said we were not doing a capital raising, but there was a lot of interest from a very concentrated group [of shareholders].”

At Stockhead, we tell it like it is. While Lumos Diagnostics and Clever Culture Systems are Stockhead advertisers, the companies did not sponsor this article.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.