ASX Biotech Winners in July: Down but far from out, here’s why biotechs could stage a comeback

Down but far from out, here's why biotechs could stage a comeback. Picture Getty

- The end of pandemic and higher rates have subdued biotech market

- But there are signs now the sector is making a comeback

- We take a look at the ASX Biotech Winners in July

The Covid-19 pandemic had produced windfalls for and attracted fast money to the pharmaceutical sector.

Big pharmas as well as smaller biotechs reaped billions as money rushed in to develop therapeutics and vaccines.

But sentiment shifted around mid 2022.

As the pandemic subsided and inflation began to bite, biotech valuations began to plunge and the IPO window gradually shut down.

The shift has continued to intensify until today, with biotechs now facing reduced capital availability in a landscape of higher rates and tightening credit conditions.

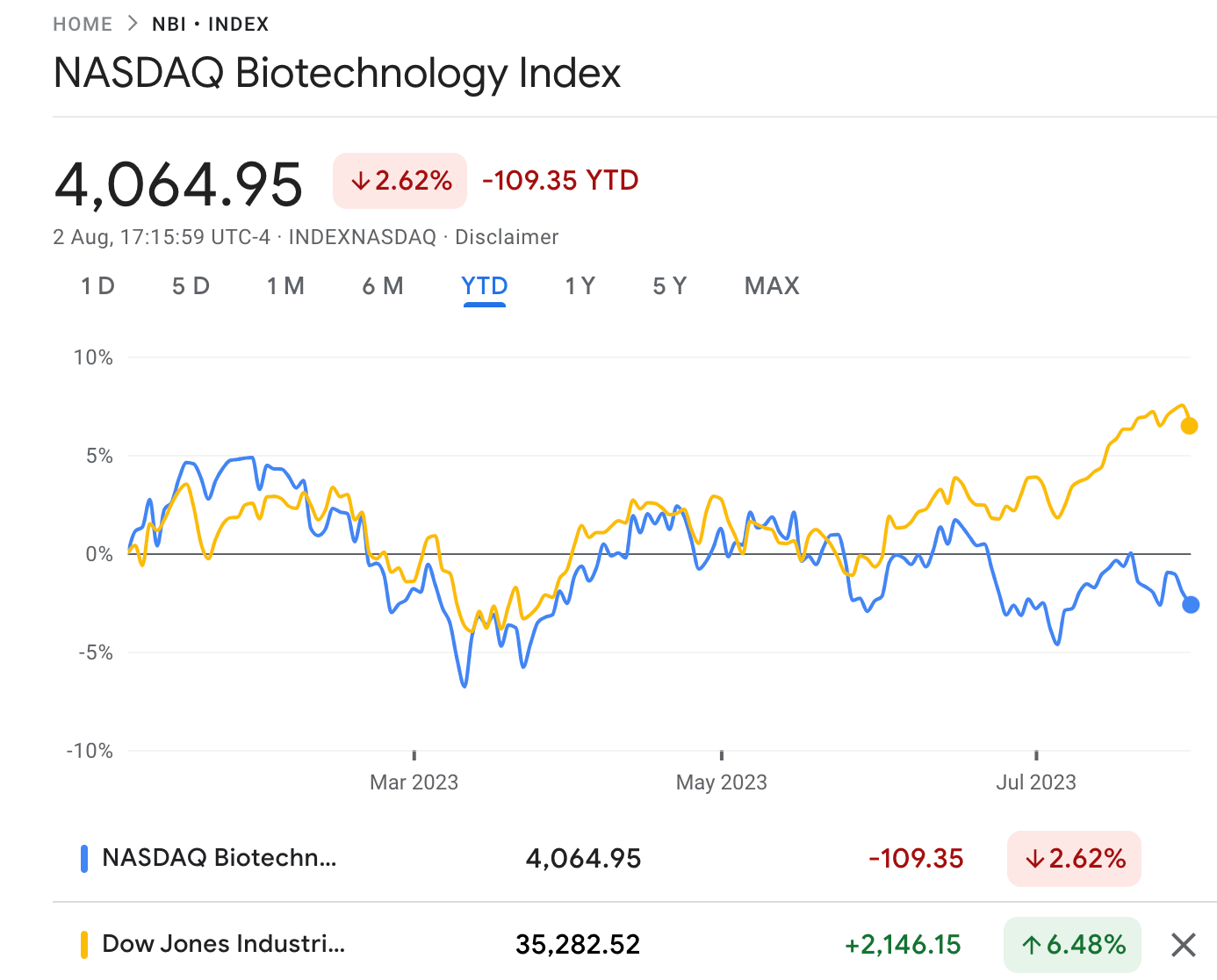

This year, the NASDAQ Biotechnology Index (NBI) is modestly down by around -2%, while the S&P/ASX 200 Health Care [XHJ] is down by -1% so far.

The slowdown has taken a toll on healthcare companies, big and small. In its latest quarterly update, Pfizer said it would launch a cost-cutting program if demand for its Covid-19 products remained muted.

Despite these challenges, experts believe the industry’s capacity to innovate as a whole remains robust.

Consulting company EY says that research & development (R&D) in the sector will continue to fuel innovation for new medicines, but warns that investors should be extremely careful and cherry pick.

“As always, there will be winners and losers within the sector,” said the report from EY.

“But good science leading to differentiated products will always be the key to success in this R&D-driven industry.”

Reasons for optimism

There are indeed signs that things are coming back to life as big institutions re-enter the picture.

US-based ARK fund manager Cathie Wood, for example, loaded up on biotech names as she went on a shopping spree in May.

Some analysts believe this momentum will continue for the remainder of the year and beyond.

RBC Capital Markets says that larger-cap healthcare companies, with revenue resiliency and less binary risk, will likely maintain their rebound for the rest of 2023.

In the smaller end of town, RBC expects even better performance as the year progresses.

“We believe there are select, high-quality, catalyst-driven smaller-cap biotech companies which remain under-appreciated,” said RBC.

Other analysts say that the downturn in biotech IPOs has bottomed out, providing a positive outlook for the remainder of the year and 2024.

Mergers & acquisitions is expected to be a significant driver, but the main reason for optimism is continued scientific innovation.

“Overall, we expect to see an uptick in FDA approvals after a 25% dip in 2022 versus 2021,” said a report from management consulting company, ZS.

ASX Biotech Winners in July

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| LDX | Lumos Diagnostics | 0.05 | 390.91 | $21,958,416 |

| 1ST | 1St Group Ltd | 0.01 | 100.00 | $12,752,921 |

| BDX | Bcaldiagnostics | 0.14 | 92.86 | $16,331,365 |

| ME1 | Melodiol Glb Health | 0.01 | 57.14 | $29,574,091 |

| TSN | The Sust Nutri Grp | 0.01 | 50.00 | $1,266,866 |

| MEB | Medibio Limited | 0.00 | 50.00 | $7,725,891 |

| IVX | Invion Ltd | 0.01 | 50.00 | $41,740,609 |

| AVE | Avecho Biotech Ltd | 0.01 | 50.00 | $12,972,982 |

| NYR | Nyrada Inc. | 0.04 | 46.43 | $6,396,357 |

| DOC | Doctor Care Anywhere | 0.06 | 43.18 | $23,098,461 |

| NTI | Neurotech Intl | 0.06 | 42.50 | $49,812,840 |

| M7T | Mach7 Tech Limited | 0.87 | 39.52 | $199,207,786 |

| MVP | Medical Developments | 1.05 | 35.48 | $90,620,434 |

| ZNO | Zoono Group Ltd | 0.05 | 34.21 | $9,686,311 |

| ADR | Adherium Ltd | 0.00 | 33.33 | $19,997,633 |

| RGS | Regeneus Ltd | 0.01 | 28.57 | $3,064,369 |

| AT1 | Atomo Diagnostics | 0.03 | 27.27 | $16,964,330 |

| CU6 | Clarity Pharma | 0.89 | 27.14 | $162,058,126 |

| ALC | Alcidion Group Ltd | 0.12 | 26.32 | $152,168,286 |

| DXB | Dimerix Ltd | 0.08 | 25.81 | $30,268,605 |

| EZZ | EZZ Life Science | 0.62 | 24.00 | $26,477,100 |

| CYP | Cynata Therapeutics | 0.16 | 24.00 | $27,842,927 |

| RHT | Resonance Health | 0.05 | 23.81 | $23,964,303 |

| TRU | Truscreen | 0.03 | 23.81 | $10,832,692 |

| HCT | Holista CollTech Ltd | 0.01 | 20.00 | $3,345,601 |

| PCK | Painchek Ltd | 0.03 | 20.00 | $38,939,686 |

| CYC | Cyclopharm Limited | 2.39 | 19.50 | $220,421,366 |

| GLH | Global Health Ltd | 0.16 | 18.52 | $9,287,926 |

| DVL | Dorsavi Ltd | 0.01 | 18.18 | $7,236,601 |

| GSS | Genetic Signatures | 0.62 | 18.10 | $88,911,718 |

| TRP | Tissue Repair | 0.30 | 18.00 | $13,800,205 |

| NSB | Neuroscientific | 0.10 | 17.28 | $12,869,833 |

| ACR | Acrux Limited | 0.05 | 16.67 | $14,120,597 |

| BIT | Biotron Limited | 0.03 | 15.38 | $26,156,402 |

| ATX | Amplia Therapeutics | 0.09 | 14.47 | $16,878,503 |

| HGV | Hygrovest Limited | 0.05 | 11.90 | $9,674,288 |

| AN1 | Anagenics Limited | 0.02 | 11.76 | $6,946,779 |

| OCC | Orthocell Limited | 0.39 | 10.00 | $74,975,167 |

| CDX | Cardiex Limited | 0.17 | 9.68 | $24,389,139 |

| EPN | Epsilon Healthcare | 0.02 | 9.52 | $6,007,080 |

| AMT | Allegra Orthopaedics | 0.06 | 9.09 | $6,058,634 |

| OPT | Opthea Limited | 0.60 | 9.09 | $270,952,472 |

| OSL | Oncosil Medical | 0.01 | 8.33 | $23,710,094 |

| SHG | Singular Health | 0.04 | 8.33 | $5,093,426 |

| VHT | Volpara Health Tech | 0.81 | 8.00 | $214,932,770 |

| IDT | IDT Australia Ltd | 0.07 | 7.94 | $22,803,987 |

| NC6 | Nanollose Limited | 0.06 | 7.84 | $8,188,750 |

| ZLD | Zelira Therapeutics | 1.62 | 7.28 | $18,268,920 |

| ZLD | Zelira Therapeutics | 1.62 | 7.28 | $18,268,920 |

| MEM | Memphasys Ltd | 0.02 | 7.14 | $14,392,806 |

| PSQ | Pacific Smiles Grp | 1.45 | 7.01 | $231,393,810 |

| S66 | Star Combo | 0.12 | 6.82 | $15,872,250 |

| LCT | Living Cell Tech. | 0.02 | 6.67 | $26,162,331 |

| BOT | Botanix Pharma Ltd | 0.14 | 5.77 | $191,861,570 |

| IPD | Impedimed Limited | 0.19 | 5.56 | $393,662,404 |

| IMU | Imugene Limited | 0.10 | 5.49 | $623,034,794 |

| SDI | SDI Limited | 0.87 | 5.45 | $103,413,011 |

| PYC | PYC Therapeutics | 0.06 | 5.36 | $223,972,028 |

| RSH | Respiri Limited | 0.04 | 5.26 | $33,543,367 |

| CHM | Chimeric Therapeutic | 0.04 | 5.26 | $21,176,118 |

| PAB | Patrys Limited | 0.01 | 5.00 | $21,602,882 |

| RAC | Race Oncology Ltd | 1.29 | 4.90 | $217,696,821 |

| RHY | Rhythm Biosciences | 0.43 | 4.88 | $96,708,739 |

| PAA | Pharmaust Limited | 0.08 | 4.11 | $26,506,895 |

| CTE | Cryosite Limited | 0.65 | 4.00 | $31,726,216 |

| MVF | Monash IVF Group Ltd | 1.19 | 3.49 | $471,458,156 |

| AHC | Austco Healthcare | 0.18 | 2.94 | $50,888,279 |

| NEU | Neuren Pharmaceut. | 12.54 | 2.37 | $1,607,384,085 |

| AGH | Althea Group | 0.04 | 2.33 | $17,034,255 |

| PXS | Pharmaxis Ltd | 0.05 | 2.04 | $38,141,922 |

Lumos was the best performing biotech stock over the past week and month, with its share price rocketing higher by 4x.

Lumos surged after receiving US FDA approval to market its FebriDx rapid, point-of-care test in the US, which could see a reduction in antibiotic use.

The clearance allows FebriDx to be marketed in the US for use by healthcare professionals as an aid in the diagnosis of bacterial acute respiratory infections.

FebriDx is already registered in the UK, Europe, Canada, UAE, Brazil, Turkey, Pakistan, Singapore, Malaysia and Australia.

Now read: Lumos CEO on how LDX came back from brink of death to rise 8x, and what to expect next

1st Group rallied after announcing the completion of its strategic restructure.

The company said the restructure has led to record customer receipts, significantly lower overheads, and a much-strengthened balance sheet in Q4.

Recruitment is now underway for a new chief operating officer and chief financial officer in Q1 FY24, as part of a revamped leadership team focused on continued Australian expansion and international growth opportunities.

BCAL rose after announcing breakthrough results and major steps towards commercialisation of its breast cancer diagnostic test.

A clinical study the company sponsored with Precion Inc. in North Carolina has achieved an impressive sensitivity of 90% and a specificity of 85.5%.

These results are also consistent with the findings of earlier studies conducted in Australia using a different mass spectrometry platform.

The company now expects first sales in the second half of 2024.

Melodiol is making good progress on securing the key European Good Manufacturing Practice (EU GMP) licence that will allow it to export cannabis to the lucrative markets of Australia and Europe.

The company is working with leading North American regulatory and scientific cannabis consulting agency CannDelta to advance the licensing process for EU GMP.

Invion announced the granting of an Australian patent for Photosoft , which includes the lead compound INV043.

This patent builds upon previously granted patents to the technology in Australia and other territories that Invion has exclusive rights to.

The new patent extends the intellectual property protection for Photosoft for around another two decades until at least late 2041, with the original patents set to expire in 2033.

This comes as Invion prepares to commence clinical trials using INV043 before the end of this calendar year.

Neurotech has received HREC (ethics) approval and Clinical Trial Notification (CTN) scheme clearance by the Therapeutic Goods Administration (TGA) for its Rett Syndrome clinical trial.

The Phase 2 clinical trial will examine the effects of daily oral treatment of NTI164 on 14 Rett Syndrome patients initially and will be conducted across three centres in Australia.

Patient recruitment is expected to begin this quarter, and the preliminary (top-line) results of the trial are anticipated in Q1 CY2024.

ASX Biotech Losers in July

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| MXC | Mgc Pharmaceuticals | 0.00 | -60.00 | $11,677,079 |

| BNO | Bionomics Limited | 0.01 | -38.89 | $17,624,825 |

| BP8 | Bph Global Ltd | 0.00 | -33.33 | $2,669,460 |

| ADO | Anteotech Ltd | 0.03 | -27.50 | $63,073,217 |

| ACW | Actinogen Medical | 0.03 | -27.50 | $52,671,312 |

| LBT | LBT Innovations | 0.02 | -23.33 | $8,050,143 |

| AHK | Ark Mines Limited | 0.25 | -19.35 | $11,060,466 |

| NOX | Noxopharm Limited | 0.04 | -16.28 | $10,520,566 |

| VTI | Vision Tech Inc | 0.21 | -16.00 | $6,660,616 |

| CGS | Cogstate Ltd | 1.39 | -15.76 | $240,728,744 |

| ONE | Oneview Healthcare | 0.22 | -15.38 | $145,030,113 |

| CBL | Control Bionics | 0.08 | -13.79 | $7,680,669 |

| CAJ | Capitol Health | 0.24 | -12.96 | $249,927,796 |

| RNO | Rhinomed Ltd | 0.06 | -12.86 | $17,428,901 |

| IRX | Inhalerx Limited | 0.04 | -12.50 | $6,641,843 |

| PTX | Prescient Ltd | 0.07 | -12.35 | $57,174,155 |

| ANP | Antisense Therapeut. | 0.05 | -11.86 | $45,160,468 |

| UBI | Universal Biosensors | 0.23 | -11.54 | $48,844,970 |

| PBP | Probiotec Limited | 2.50 | -10.71 | $203,308,515 |

| BXN | Bioxyne Ltd | 0.02 | -10.00 | $28,524,681 |

| PAR | Paradigm Bio. | 0.90 | -9.09 | $256,041,362 |

| BPH | BPH Energy Ltd | 0.02 | -8.70 | $20,465,181 |

| CMP | Compumedics Limited | 0.17 | -8.33 | $29,231,886 |

| OSX | Osteopore Limited | 0.08 | -8.33 | $11,928,735 |

| MDR | Medadvisor Limited | 0.23 | -8.00 | $125,340,664 |

| ALA | Arovella Therapeutic | 0.05 | -8.00 | $41,360,886 |

| EXL | Elixinol Wellness | 0.01 | -7.69 | $5,483,896 |

| SOM | SomnoMed Limited | 0.89 | -6.81 | $73,655,790 |

| RAD | Radiopharm | 0.10 | -5.71 | $23,213,365 |

| RAD | Radiopharm | 0.10 | -5.71 | $23,213,365 |

| IIQ | Inoviq Ltd | 0.81 | -5.29 | $74,535,149 |

| NXS | Next Science Limited | 0.55 | -5.17 | $118,134,574 |

| TLX | Telix Pharmaceutical | 10.73 | -4.37 | $3,484,574,369 |

| PGC | Paragon Care Limited | 0.23 | -4.26 | $148,352,834 |

| MX1 | Micro-X Limited | 0.12 | -4.17 | $59,388,874 |

| 1AD | Adalta Limited | 0.02 | -4.17 | $10,155,105 |

| VLS | Vita Life Sciences.. | 1.50 | -3.85 | $79,852,826 |

| PNV | Polynovo Limited | 1.49 | -3.40 | $1,083,665,419 |

| KZA | Kazia Therapeutics | 0.16 | -3.13 | $36,631,828 |

| IHL | Incannex Healthcare | 0.10 | -3.00 | $158,701,036 |

| VBS | Vectus Biosystems | 0.43 | -2.27 | $22,871,493 |

| ARX | Aroa Biosurgery | 0.91 | -2.16 | $312,229,616 |

| PIQ | Proteomics Int Lab | 0.85 | -1.74 | $102,316,589 |

| IMM | Immutep Ltd | 0.31 | -1.59 | $368,064,925 |

| OIL | Optiscan Imaging | 0.08 | -1.25 | $65,968,223 |

| ILA | Island Pharma | 0.09 | -1.05 | $7,639,236 |

| RCE | Recce Pharmaceutical | 0.62 | -0.80 | $109,626,401 |

| 4DX | 4Dmedical Limited | 0.67 | -0.75 | $232,964,486 |

At Stockhead we tell it like it is. While Neurotech and Melodiol Global are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.