MGC Pharma to sell MGC Derma business to strategic partner

Pic: Oscar Wong / Moment via Getty Images

Special Report: MGC Pharma has signed an agreement with Canadian cannabis investment company Cannaglobal to grow the MGC Derma business globally.

Under the deal, MGC (ASX:MXC) will buy the 49 per cent of MGC Derma it doesn’t own and then sell it in exchange for C$12.5m in Cannaglobal equity, making MGC Derma a cornerstone investment in Cannaglobal’s portfolio of brands.

The deal also includes an exclusive five-year supply agreement for the provision of MGC Pharma’s cannabidiol (CBD) and cosmetics raw materials to Cannaglobal to make MGC Derma products, with an upfront order and payment of a $C1 million ($1.1 million).

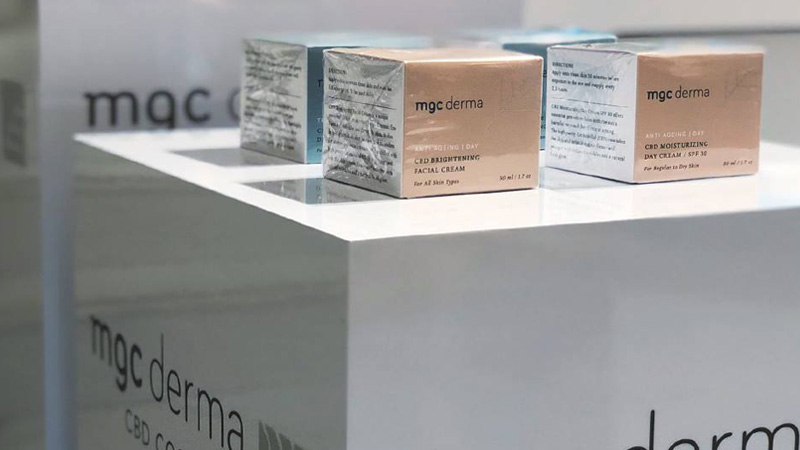

MGC Derma has a range of cannabinoid-based skincare products and recently sealed a deal to sell 18 products through global retailer Harvey Nichols.

The deal provides MGC with the opportunity to combine MGC Derma’s operations with the muscle of Cannaglobal, which provides global retail distribution, branding and marketing firepower and a clear path to accelerated global sales.

MGC told investors it will continue growing the MXC Derma brand in the UK whilst the Cannaglobal team targets the huge North American market, enabling MGC to focus on its goal to become one of the leading bio-pharma operators in the European medicinal cannabis industry.

That includes developing its GMP-grade pharmaceutical product pipeline and constructing its large European based seed-to-pharma commercial operations in Malta.

Introducing a new CEO

Cannaglobal’s founders and major shareholders are leaders in the Canadian cannabis industry and as part of the agreement, Cannaglobal is appointing a new face to head up MGC Derma.

Hugh Winters will join as CEO, bringing 40 years’ experience in professional management, as CEO of large private and public companies and as an entrepreneur owner.

Mr Winters has deep credentials in the beauty sector, serving as President of Azure Beauty Inc. a distributor for L’Oreal, consultancy firm Beauty.ca Inc, and investment company Rosecrest Capital.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

MGC cofounder and managing director Roby Zomer said the deal was exciting for the company and provides a huge opportunity to quickly ramp-up sales of MGC Derma’s products and the chance to become a globally-recognised brand.

“To be specifically sought out by Cannaglobal, based on the power of the MGC Derma brand and product range is a true honour and provides strong commercial validation of what we have been able to build in the Derma side of the business,” he said.

“Strategically, MXC will continue to benefit from the on-going success of MGC Derma, as the exclusive supplier of CBD and cosmetics raw materials required to manufacture Derma’s products.”

“Importantly, the transaction will allow the management team to focus MXC’s resources on the pharmaceutical side of our business, as we continue to build out our seed-to-pharma operations and conduct research and development to develop additional cannabis-based medications in the future.”

MGC is buying the 49 per cent share of MGC Derma from Dr M. Burnstein Ltd.

It will pay for it by forgiving all of Burstein’s share loan repayment of $1.2 million, an exclusion from any future funding obligations, and exclusivity to provide cosmetics raw material and products development to MGC Pharma for CBD and Cannabis based cosmetics products.

This special report is brought to you by MGC Pharma.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.