AdAlta soars after getting orphan drug designation for its shark-based drug

Getty Images

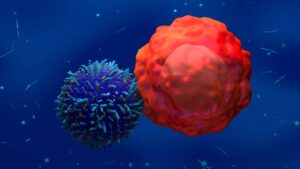

AdAlta (ASX:1AD) has soared to a one-and-a-half year high after its lead drug candidate — a molecule inspired by shark antibodies — received orphan drug designation in the United States for the treatment of a rare lung disease.

The US Food and Drug Administration designated AD-214 as an orphan drug in the treatment of idiopathic pulmonary fibrosis, a condition where the lung tissue becomes scarred for an unknown reason.

The orphan designation, which follows a previous one for AD-214’s predecessor molecule AD-214, makes AdAlta eligible for certain tax credits and market exclusivity if the drug is approved.

AD-214 is currently in phase 1 trials.

At 10.15am, Adalta were up 25.7 per cent to 22c, their highest level since July 2019. (But still only giving the Melbourne biotech a market cap of about $43 million).

Elsewhere in the ASX biotech space, Opthea (ASX:OPT) announced it had finalised the designs of its two Phase 3 clinical trials to treat wet age-related macular degeneration (AMD), a condition that occurs when abnormal blood vessels develop in the eye, causing blurry vision.

The two pivotal trials will each enroll about 990 patients and evaluate how well Opthea’s OPT-302 biologic works in combination with two existing medications, compared to treatment with those drugs alone.

Opthea said it is on track to begin the trials this quarter and to report results from them in the first half of 2023.

If the results are favourable, Opthea said it would ask for drug approval in the United States and Europe.

The company hopes that OPT-302 might be adopted for use in combination with either of the two existing treatments: Novartis and Genetech‘s Lucentis or Regeneron‘s Eylea.

Those drugs had combined sales of $US11.9 billion ($15 billion) in 2019.

At 10.29am, Opthea shares were flat at $1.69.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.