$90 million wipeout: OncoSil Medical plummets after British Standards Institute says no

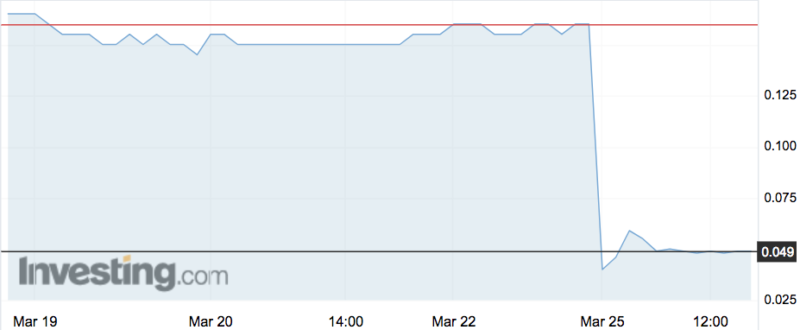

Shares in OncoSil Medical (ASX:OSL) have plummeted as much as 87 per cent today, wiping nearly $90 million from the company’s market cap, after it was denied CE mark certification.

OncoSil is a medical device company and was hoping to receive CE marking for its eponymous product from the British Standards Institute (BSI).

The OncoSil product is a targeted radioactive phosphorous isotope implanted directly into a patient’s pancreatic tumours via an endoscopic ultrasound.

The company has been seeking CE mark approval since 2015, and told Stockhead a year ago that it believed it would secure the CE mark “in the coming months”, after it had submitted further data confirming its safety and efficacy.

But today it announced bad news: the BSI’s Clinical Oversight Committee, after reviewing all that data, had determined that “insufficient clinical benefit has been demonstrated to recommend approval” at the current time. That committee will now send its recommendation to BSI’s Medical Device Group for final determination.

Shares dropped to a six-year low of 2.1c on the news, from Friday’s close of 16c. That took its market cap from $100.9 million down to $13.2 million.

It is not the first time that a biotech company has either flown or sunk on news. Another medical device company, ResApp (ASX:RAP), is also awaiting CE mark and FDA approval, telling Stockhead it is “quietly confident” it will avoid what has just happened to OncoSil.

“Although the Company is still assessing the feedback to determine the next steps, on its initial assessment it is extremely disappointed with the determination given the strong data package that was presented,” OncoSil said in a statement to the ASX.

“The company will look to clarify the issues with BSI and update the market when a course of action has been formulated.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.