Wine, beer and spirits: The ASX booze stocks that returned double digits in one year

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Australians are some of the biggest drinkers in the world, averaging 11 litres of pure alcohol each year compared to the global average of 6.5 litres.

Only the French and Russians drink more than us, averaging 12L and 11.7L respectively, according to a 2018 data from the WHO.

Various other drinking stats also make for an interesting read.

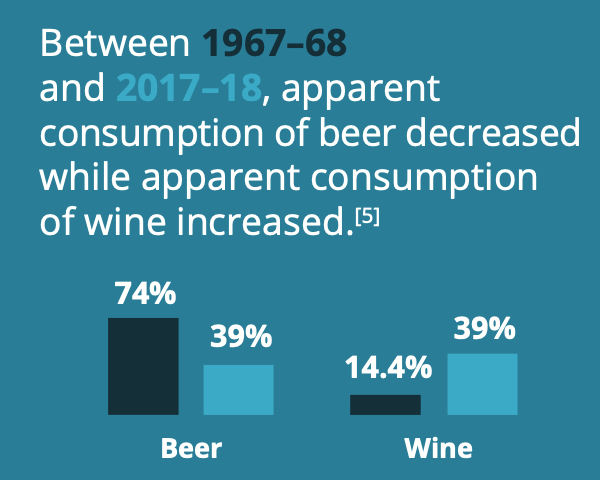

The number of Aussie adults drinking daily (considered alcoholics) has fallen gradually to just 5.4%, while our tastebuds have apparently become more accustomed to fine grapes over the last six decades.

While beers and wines continue to be our favourite drinks, other categories are moving quickly to close the gap.

| Drink | Consumption in Aust |

|---|---|

| Beers | 39% |

| Wines | 39% |

| Spritits and RTD (ready-to-drink) | 20% |

| Cider | 2% |

The shift has attracted a deluge of smaller players into the market, resulting in an exponential growth of suppliers across the industry.

By 2020, Australia had nearly 300 distilleries (versus 30 in 2010), and 700 breweries (versus 70 in 2010).

The government is also throwing its weight behind the industry, with Treasurer Frydenberg announcing a tax relief for small brewers and distillers in this year’s Federal Budget.

From July 1, small brewers and distillers will be able to claim a full refund on any excise they pay up to $350k annually (up from the current $100k), meaning that liquor producers can sell triple the amount before excise tax applies.

Despite the large number of players, there is just a handful of companies that have products in the market, with an even smaller number trading on the ASX – most of which have returned double digits in one year.

| TICKER | COMPANY | PRODUCTS | SHARE PRICE $ | % 1-YEAR RETURN | MARKET CAP $ |

|---|---|---|---|---|---|

| DW8 | Digital Wines | Wines marketplace | 0.055 | 10 | 110 M |

| MBH | Maggie Beer | Beers and dairy | 0.48 | 37 | 168 M |

| GDA | Good Drinks Aust | Beers | 0.087 | 45 | 108 M |

| TWE | Treasury Wines | Wines | 11.41 | 21 | 8,230 M |

| AVG | Australian Vintage | Wines | 0.82 | 47 | 207 M |

| LRK | Lark Distilling | Spirits | 5.44 | 275 | 394 M |

| BEE | Broo | Beers | 0.014 | -30 | 18.5 M |

| UMG | United Malt | Spirits | 4.12 | -8.5 | 1,230 M |

Wine exports’ rocky road

Exports of Australian alcohol beverages are worth $3.6 billion, and account for 1% of the country’s total exports.

60% of all wine produced in Australia is exported – primarily to China (no longer the biggest market), the US and the UK.

Treasury Wines is the biggest exporter, and it had a respectable year considering a huge part of its business was decimated when China slapped on its import tariffs last year.

The 116% ~ 218% import tax had left a $77m profit hole for TWE, and practically wiped out the once lucrative wine exports to China with sales plummeting by 77% overnight.

The shock was exacerbated in March, when China announced it was going to keep those tariffs in place for the next five years.

Commentators said the impact would be devastating because of the time required to develop new markets.

But Treasury moved swiftly, outlining its post-China strategy by pivoting focus to the US markets and its premium Penfolds brand.

The company implemented significant changes to its business model in the US, including divestments that left it with just three brands – Penfolds, Treasury Premium Brands, and Treasury Americas.

A big marketing push fronted by rapper Snoop Dogg also ensured that Americans got acquainted with the brands quickly.

By the end of FY21, TWE’s Americas sales had increased by 23%, offsetting the 15% fall in sales from Asia, as it reported NPAT of $250m, a 2% increase from the previous year.

While this was happening, the other ASX-listed winemaker, Australian Vintage (ASX:AVG), was left largely unscathed as its direct exposure to the China was only 1% of all sales.

AVG’s UK and Australian sales did extremely well, contributing to a record 79% increase in net profit to $19.6m in FY21.

Independent craft beers are all the rage

The Australian beer industry has always been dominated by two giant breweries: CUB (Carlton, VB, Great Northern), and Lion breweries (Tooheys, XXXX Gold).

Both are owned by Japanese brewers Asahi and Kirin respectively, and easily command 80% of the domestic market share.

But now, new challengers are popping up in the form of small independent brewers, which have become an ever-expanding segment.

In the last decade alone, the number of independent and craft breweries in Australia have multiplied to over 700 brewers.

Good Drinks Australia (ASX:GDA) is one of the top local independent brewers that’s riding on this boom.

It’s the home of well-known brands such as Gage Roads Brewing Co, Matso’s Broome Brewery, Atomic Beer Project, Alby, Hello Sunshine and San Miguel.

The WA-based company has just come off a record FY21, with earnings skyrocketing by 1,683% to $10.7m.

“Our target is about 20% growth, so for the the upcoming full year we expect to still deliver around 20-25% growth level for our brands,” John Hoedemaker, CEO of Good Drinks, told Stockhead in a recent interview.

Hoedemaker said that he wants to sell more of GDA brands and less of contract brewing, as they generate much higher gross profit margins.

The company also said it wants to scale nationally, and has identified the East Coast as a potentially untapped market.

“The other pillar to our strategy is a national and expanded sales team. So we’ve been busy over a number of years now, investing ahead of the revenue curve and building our sales force,” Hoedemaker explained.

Part of the expansion strategy also involves acquiring local venues along the East Coast, with the latest being the $4.5m purchase of Joe’s Waterhole in the popular Sunshine Coast tourist town of Eumundi.

GDA is now working on converting that venue to an exciting brewpub for its Matso’s brand.

A recent survey shows that Aussie consumers were purchasing less mainstream beers and more craft beers, with 93% agreeing that ‘Australian independent breweries need to be supported more than ever.’

But Hoedemaker says the industry is dynamic and undergoing rapid changes because people are always looking for new and different experiences.

New trending products like seltzers for example, are flocking fast into the market.

Seltzers have seemingly won over the Gen Z and Millennial drinkers, with sales in the US expected to triple by 2023, and gaining fast ground in Australia.

Lion has jumped on this opportunity by bringing US brand White Claw into Australia last September.

Spirits market is catching up

Australian spirits market is also growing at a strong pace, with the market valued at $3 billion and expected to reach $4 billion by 2025.

In this category, you have liquors such as whisky, vodka, gin, rum, brandy and the rest.

The potential for growth has drawn a number of enrtrepreneurs into the category, including Aussie cricket legend, Michael ‘Pup’ Clarke.

Clarke has recently joined Australian Boutique Spirits (ABS) – a Western Sydney based, family-owned distillery that develops a range of Australian made spirits – as an equity investor and ambassador.

He’ll be promoting the newly launched direct-to-consumer platform Bevmart, an exclusive online marketplace that sells ABS-branded spirits, liqueurs and RTD drinks.

Speaking exclusively with Stockhead, Clarke says that he’s always had a connection to Western Sydney after growing up in the suburbs of Liverpool.

“Happily, the ABS distilleries are out in the Western Suburbs where I grew up as a kid, so it allows me to get back to those roots and spend more time out there,” said Clarke, who’s kept himself busy between cricket commentating duties and product endorsements since retiring in 2015.

He decided to join ABS as he always wanted to partner with a liquor brand that shared his values, so the decision to become an ambassador was a natural fit.

“I love their goals and values to be honest, the guys at ABS want to be the best in their field, and I think Australia will really love their product.”

ABS was founded by Raj Beri, a serial entrepreneur in the spirits industry who has a track record of bringing spirits products to markets both in Australia and the US.

“I also love the fact that we’re distilling it ourselves, because you can see it and touch and that allows you to be super-connected.”

“The guys at Bevmart are open to try new things, add their own touch, and introduce new products to the market,” Clarke explained.

Another distiller that’s been willing to bring new products to the market is Lark Distilling (ASX:LRK).

The company recently acquired Pontville Distillery and Estate, an iconic distillery located 30 minutes north of Hobart at Pontville in a deal worth $40m.

Pontville will be Lark’s third working distillery in Tasmania, and will increase the in-house production of Lark’s whisky from 193,000 litres to 576,000 litres a year.

“We’re effectively buying the liquids at $49 a litre, and selling them at $216 a litre,” Lark’s CEO, Geoff Bainbridge, told Stockhead recently.

The acquisition is also expected to provide Lark with early access to the single malt export market beginning in FY23, much sooner that it could have done alone.

“If we were to capitalise on that demand momentum organically, we would have to wait five to eight years,” Bainbridge explained.

Australian based distilleries have found huge success overseas, especially with the single malt whisky market where our products can be found pretty much anywhere globally.

Tasmania’s Hellyers Road Distillery is currently Australia’s number one seller of single malt whisky worldwide, with its main presence in Europe. The country has indentified the North Asian markets of China and Japan as its next frontier.

Domestic consumption is rising and imports of Scotch whisky have also grown rapidly, as we’ve now become a top 10 global export market destinations for Scotch.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.