Chocolates may soon be luxuries as cocoa prices surge; and how investors can take advantage of this

Food & Agriculture

Food & Agriculture

We’ve read all the buzz about gold, silver, and copper prices shooting through the roof lately.

But what’s been flying under the radar is the cocoa price surge.

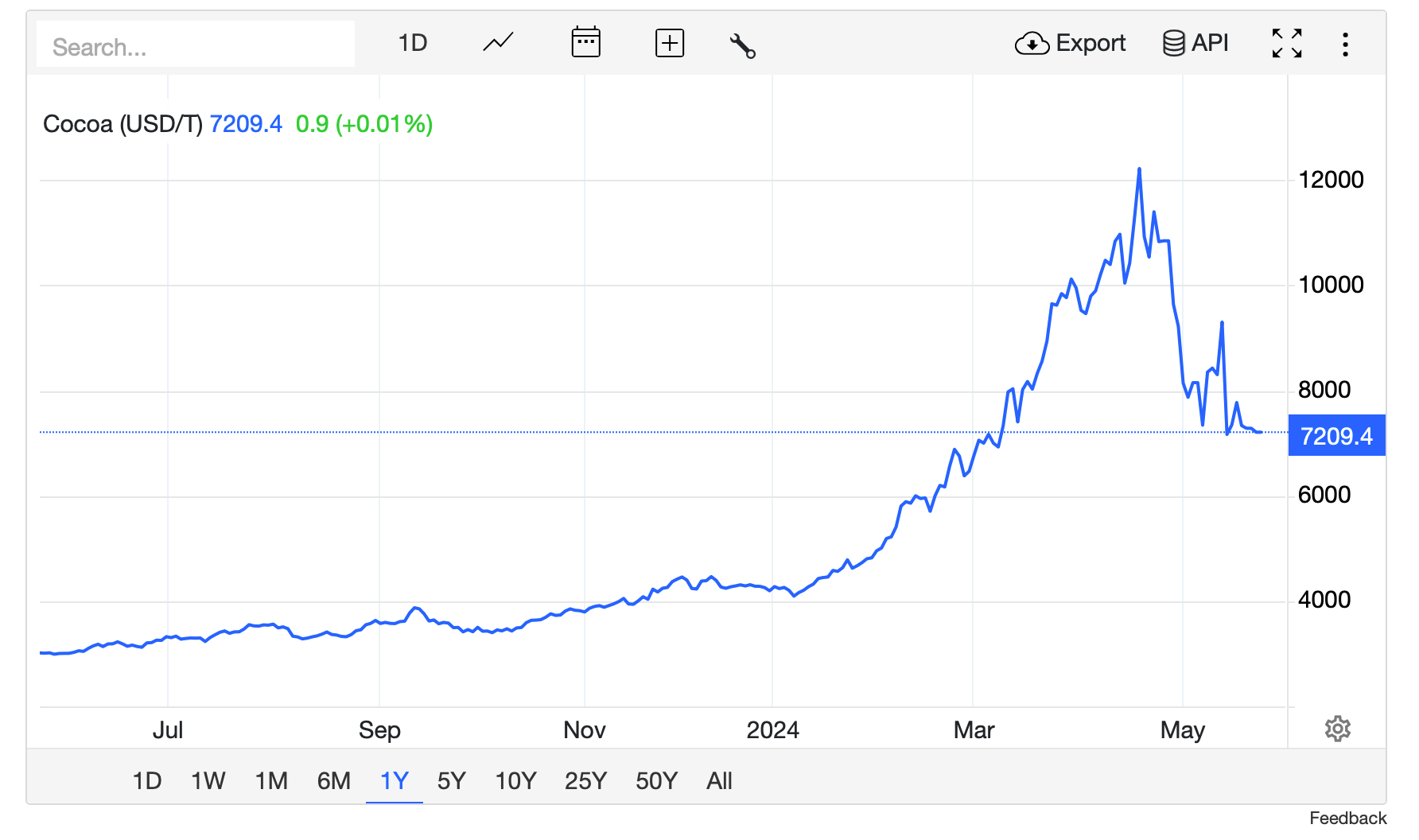

Cocoa prices have been steadily climbing for the past two years, but in 2024, they’ve hit a whole new level.

The cocoa futures contracts doubled in the first three months this year, smashing records in March to reach historical highs of nearly US$10,000 per metric ton.

On 19 April, cocoa futures contracts in New York hit an intraday record high of US$12,200 per metric ton.

Prices have come down since, but analysts believe they won’t stay there for long.

Well it’s a mixed bag but the main reasons for the rally are global supply shortage, chronic underinvestment in cocoa farms, and investors stirring the pot with speculative trading.

Climate change is wreaking havoc on crops in West Africa, the main source of about 80% of the world’s cocoa. According to the International Cocoa Organization, we’re looking at a nearly 11% decline in global cocoa supply for the 2023/2024 season as a result.

Other deep-seated issues are also contributing to the problem, notably the chronic underinvestment in cocoa farming.

Presently, most cocoa farming is in the hands of small-time farmers who are dealing with low earnings and not enough cash to put back into their farms – which has led to diminishing yields over time.

“Cocoa represents a market where producers yield a commodity of significant value but receive a disproportionately low portion of the overall value chain,” said a recent research report out of J.P. Morgan.

“Consequently, the rate of replanting remains minimal, resulting in the ageing of cocoa trees.”

Adding to the mix, what started as a supply-side problem has got even worse now as speculation in the futures market pushes cocoa prices even higher.

“Non-commercial investors now hold over 60% of total open interest across cocoa futures and options in the New York market, which is an historical high,” said J.P Morgan.

For consumers like us, the upshot to all this is that we’ll be paying more for our chocolates, which will also come in smaller sizes.

And even if prices come down a bit, experts believe they’re probably going to stay up there for a good while yet.

This is because chocolate companies often lock in prices and stash away cocoa supplies way ahead of time.

So, even though we are seeing new record-high futures right now, the full effect on what you see on store shelves hasn’t kicked in just yet because we are still at the old prices.

“Over the next year or two, they [chocolate companies] will probably pass on more cocoa inflation, and consumers will see higher prices for their chocolate as a result,” said J.P. Morgan.

Cocoa futures are primarily traded on two major commodity exchanges: the Intercontinental Exchange (ICE) in New York, and the London International Financial Futures and Options Exchange (LIFFE).

Can Aussies trade these contracts?

Yes, you basically need to find a trading platform that offers access to US and London markets.

Then you need to decide if you will trade the actual cocoa futures or if you will use a derivate such as a CFD (contract for difference).

For more on CFDs read here: Contracts for Difference (CFD): The ultimate user’s guide for the modern trade

Online brokers like FXCM, Avatrade, IC Markets and CMC Markets should allow you to trade those contracts.

Unfortunately on the ASX, the only ETF that invested in cocoa, the BetaShares Commodities Basket ETF Currency Hedged (ASX:QCB), was delisted in 2021.

That ETF held positions in a whole bunch of soft commodities like cocoa, corn, wheat, soybeans and sugar.

So for those still interested in getting exposure to the cocoa market through stocks or ETFs, your best bet is to go to the US and European markets.

Nestle (SWX: NESN), Hershey (NYSE: HSY) and Mondelez International (NASDAQ: MDLZ) are three major stocks you can trade on those markets.

Surprisingly, there are no cocoa-focused ETFs listed in the US. The last one to offer that was the iPath Bloomberg Cocoa Subindex Total Return ETN (NYSE:NIB), but it got delisted in June 2023.

There is one cocoa ETF in London however, which is the WisdomTree Cocoa ETF (LSE:COCO).

The COCO ETF tracks the Bloomberg Cocoa Subindex, and provides investors with a synthetic exposure to the price of cocoa.