New shareholder bloc rallies for Murray River Group counter-coup

The voting bloc that supported the dumped board of dried fruit maker Murray River Group is preparing to launch a counter coup, as it lifts its stake to almost 20 per cent.

Five entities controlled by tech investor Alex Waislitz now own 19.33 per cent of the company (ASX:MRG), up from 15.73 per cent.

Tiga Trading lifted its stake and and Thorney Opportunities (ASX:TOP) became a substantial holder.

Thorney Investment Group told the Murray River board in December that if moves to upset the status quo succeeded, they “reserve[d] its rights / abilities to take its own actions regarding calling another general meeting or otherwise to redress the effect of those resolutions and/or recommend alternate resolutions for the benefit of the company and its shareholders”.

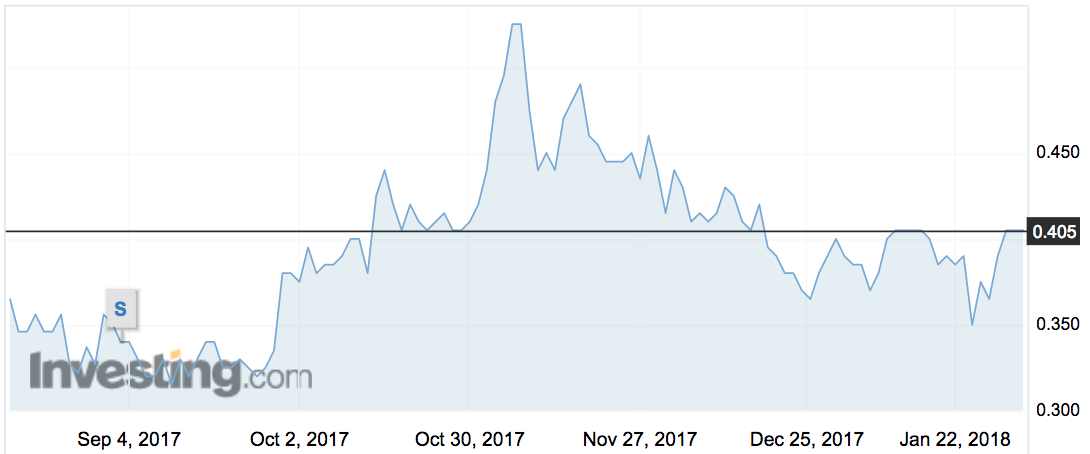

Murray River has been in turmoil since early 2017 when the founders Erling Sorenson and Jamie Nemtsas — who were pushed out — were forced to concede the summer harvest was significantly damaged by storms.

The two founders used their still-significant shareholdings to block all but one of the resolutions put forward at the AGM last year and then a bloc associated with them called a meeting to roll the board.

Two weeks ago the group achieved its aims, removing chairman Craig Farrow, and directors Lisa Hennessy and Dr Ken Carr and replacing with with Andrew Robert Monk as chair, Steven Si, and Keith Mentiplay.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

The trio say they will focus on “managing cash-flow, expanding global sales and creating shareholder value by executing a well-planned, growth-driven strategy”.

They intend to conduct another review of the business, in addition to the one conducted by the previous board in the latter months of 2017, build a China-focused brand, and engage “product specialist services” and use more marketing to “create high demand product lines”.

Murray River shares were flat in morning trade at 40.5c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.