More headaches for Murray River Organics as property values are downgraded

Health food maker Murray River Organics has reported this morning that its properties in the Sunraysia region have lost $1.5 million in value.

An independent valuation by Colliers found the value of its Sunraysia properties had declined from $34.1m to $32.6m, a 4.2 per cent drop.

Sunraysia is a region on the border of NSW and Victoria that’s well-known for its sunshine and produce such as grapes, oranges and grain.

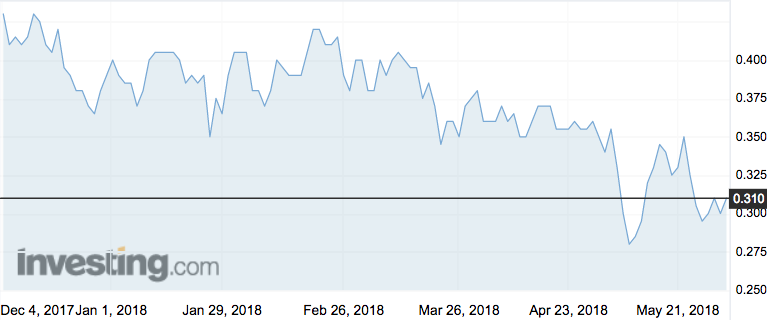

Murray River (ASX:MRG) has been suspended from trade since June while it undertakes a strategic review after going through a rough patch.

In early May the company announced that it would miss its harvest target for the second consecutive year; by late May the results were in and the yield was slightly less than the disappointing 2017 haul.

Murray River is now undertaking an action plan called “Project Yield” that “seeks to address the underperformance of MRO’s farming assets”. The benefit of any changes would be realised over the next two growing seasons.

The group’s chairman Andrew Monk was spruiking good times ahead in April, days after the company appointed Valentina Tripp, a leader with “a track record of success in turnarounds” as CEO.

In July, Ms Tripp told investors in an ASX announcement: “We are finally addressing the systemic underperformance of our farms. While we have been shocked by the findings of our review, they go some way to assist us in understanding and explaining the poor yields and conditions found.

“With the changes in management, new disciplines and accountabilities, we are confident that we will deliver improved performance.”

At the time, Murray River said the review had uncovered “evidence of potentially improper conduct.

“As a consequence, a number of staff have left the business and the company is continuing to investigate matters.”

Murray River Organics has been asked for comment.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.