Donut King and Gloria Jeans owner Retail Food Group could close up to 450 stores

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Retail Food Group may be forced to close more than a third of its Australian operations over the next three years according to Investment bank UBS.

UBS said additional closures — beyond those announced this week — would likely focus on food outlets in RFG’s network of franchised stores, including Michel’s Patisserie, Donut King and Gloria Jeans. The number of closures could reach 450 by 2020, UBS believes.

Analysts from the bank have also downgraded their earnings forecasts and put a sell-rating on the company’s stock (ASX:RFG), with a target price of 90c.

It follows the closure of 66 outlets in the six months to December 2017 — a period in which RFG posted a net loss after tax of $87.8 million and went into a trading halt when it reported results last week.

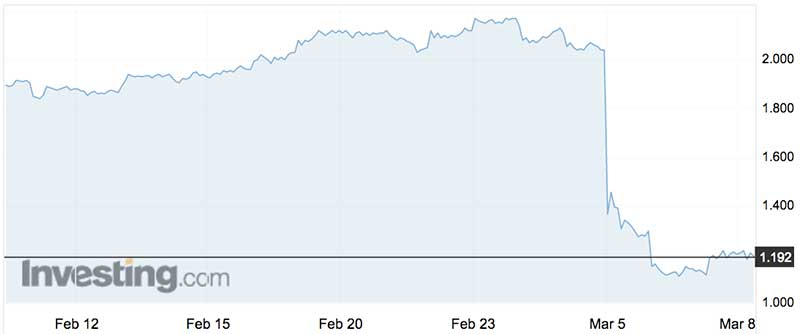

After resuming trade this week, shares in RFG have slumped by around 40 per cent.

In addition, the company is facing a possible class-action lawsuit for exploitative practices of franchisees.

In announcing its results, Retail Food Group said it has decided to close between 160 and 200 Australian outlets by the end of the 2019 financial year due to high rents and declining shopping centre performance.

UBS now expects around 460 stores will be closed domestically over the next two to three years — which is more than one third of the domestic portfolio.

Those falls are expected to be partially offset by growth of around 100 stores in the company’s international division across China and the Middle East.

“RFG has cited pressure in major shopping centres, particularly as an increasing amount of floor space is dedicated to competing food offerings. Michel’s, Donut King and Gloria Jeans are heavily skewed to shopping centre outlets,” UBS said.

“We expect the closures to accelerate and go beyond those initially identified by RFG given the deterioration in underlying performance and pressure with the Michel’s structure, in particular.”

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

UBS also flagged the likelihood that RFG will have to add a provision on its balance sheet to comply with updated international accounting standards in the 2019 financial year.

Under the new standards, RFG will be liable for the lease payments of franchisee stores, should they come under financial hardship.

The analysts concluded that RFG may consider a shift in strategy following the challenges faced by its franchise model.

“Over time, we believe RFG may consider granting Master Franchise Licences for its Australian brands to move further towards a distribution business rather than a franchise manager.”

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.