Where’s the Beef? It’s sizzling in Emerging Markets earnings

Picture: Getty Images

With superior GDP growth expectations, trading at discounted valuations, and the expectations for stronger earnings growth going forward, it’s clear to Martin Currie that the beef is now in EM.

Alastair Reynolds, portfolio manager at the active equity manager Martin Currie – part of Franklin Templeton – lays out why the Emerging Markets (EM) outlook is a compelling asset class story.

Back in the ’80s, an American fast food chain made the memorable slogan, “Where’s the beef?” to imply that its competitors were not providing enough substance – in this case – beef!

“The question we get most often is ‘what’s the catalyst that’s going to drive EM forward?’ In this case, we’d like to use this easy to remember analogy and highlight “the beef” for the asset class-earnings growth,” says Reynolds.

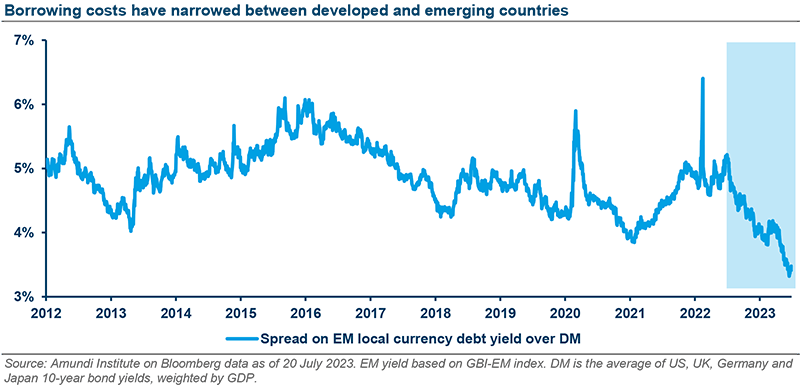

According to Colchester Global Investors, local currency denominated emerging market bonds extended their run of strong performance throughout July, (alongside some positive returns from risk assets and commodities markets).

“Lower than expected inflation in the US and investor expectations of an end to the Federal Reserve’s interest rate hiking cycle continued to drive the US dollar lower,” Colchester noted in its recent Emerging Markets Bond Fund update.

The JP Morgan GBI-EM Global Diversified Index returned 2.9% in US dollar unhedged terms over the month of July, taking the year to the end of July performance comfortably into double digits at 10.9%. In USD hedged terms, the monthly return was lower at 0.6% and 4.9% over the year, highlighting the healthy appreciation of emerging market currencies against the US dollar.

Riding the long-cycle

Reynolds notes one of the interesting aspects of EM earnings – how critical it is for driving asset class performance throughout longer-term cycles.

“When we look at EM’s performance versus Developed Markets (DM) over the long term, we see that relative earnings growth is a major driver of EM’s outperformance. For example, the 35-year earnings per share (EPS) compound annual growth rate (CAGR) for the US has been 6.4%.

“What we’ve observed historically is that during strong outperformance periods for EM equities, the earnings growth is double-digit (strong on both an absolute and relative basis). Fortunately, we are right at a key turning point and the case for EM earnings outpacing DM is strong, in our view. It’s driven by higher growth rates (GDP) and less margin pressure as inflationary forces abate.

“Furthermore, for technology companies in EM, it’s also supported by strong market positioning and structural growth drivers such as artificial intelligence (AI). Emerging markets are expected to deliver higher earnings growth (relative to DM) over the next 12 and 24 months.

“In particular, the major EM constituents – China, India, South Korea, and Taiwan are set to deliver explosive earnings growth over the next two years.”

Monica Defend, the head of the Amundi Institute as well as its chief strategist, is also upbeat on EM.

She says resilience and a growth advantage over DMs make emerging countries an ‘attractive destination’ for the second half of 2023.

“The effects of monetary tightening are seeping through to the real economy, contributing to lacklustre growth, particularly in developed economies. The US economy may suffer a mild recession towards the end of this year, while European growth should fall below potential as the continent grapples with the sticky core inflation that is constraining consumption.”

By contrast, Amundi says emerging countries are enjoying a far more favourable macroeconomic outlook.

“We are forecasting a 4% average growth rate for emerging markets in 2023, in contrast to 1.1% for advanced economies. Asia is driving a significant portion of growth, despite recent weaknesses observed in China.

“The size of the region’s market, labour prices, and government policies aimed at enhancing the business climate – tax incentives and streamlined regulation – continue to attract foreign investors, bolstering Asian economies’ prospects.”

Divergence between earnings and share prices in China

Reynolds says that recently MC has observed ‘strong earnings delivery’ from two key areas in the Chinese stock market:

1) Chinese digital economy stocks and 2) Chinese financials – namely insurance companies.

“There is a positive divergence between fundamental earnings delivery (relative to MSCI EM) and the stock performance (relative to MSCI EM) using the two largest Chinese benchmark holdings in the MSCI EM (Tencent and Alibaba).

“When we see such a divergence between share prices and stock earnings, we view this as an opportunity for fundamental, bottom-up investors. We have increasing confidence in the profitability of these quality growth companies in EM.

Where’s the cheese and/or beef?

“While acknowledging the difficulty of predicting growth in 2023, the International Monetary Fund (IMF) has just published its forecasts for DM and EM. The IMF expects that EM will outgrow the advanced economies, forecasting 4.0% GDP growth for EM and 1.2% for DM. Global growth is estimated at just under 3.0% for 2023.

“Within that, China and India are expected to be key drivers of this, contributing to approximately 50% of that growth projection.”

Where’s the valuation?

Given this terrific combo of GDP/macro growth and earnings growth, Reynolds believes EM offers a once in a generation opportunity in terms of a reasonable absolute and relative valuation.

The asset class is trading at a 35% discount to MSCI World. Using a medium-term outlook, the MSCI EM Index is trading at 10x P/E versus the MSCI World Index at 15x.

“The beef may have been in DM over the past decade, but that does not mean it will continue and the current backdrop in EM looks exciting. With superior GDP growth expectations, trading at discounted valuations, and the expectations for stronger earnings growth going forward, it’s clear to us the beef is now in EM,” noted Reynolds.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.