War, rates and recession: We unpack everything with David Bassanese and T. Rowe Price

Pic: Getty

The volatile start to the year in financial markets is unlikely to abate soon.

The likelihood of war, record inflation, a looming Fed hike, tightening liquidity conditions, and the unwinding of stimulus — are all the stuff a volatile market is made of.

It’s too early to say whether we’ve entered a post-COVID world, but what’s clear is the pandemic no longer seems to be the dominant driver moving the markets.

The new environment will be difficult to navigate, so Stockhead tries to break it down with an exclusive chat with Betashares Chief Economist David Bassanese, as well expert comments from global fund manager T. Rowe Price.

How would markets react if war breaks out between Russia and Ukaraine?

Bassanese believes that equities could suffer if war does break out.

“Markets could possibly react quite wildly in the immediate aftermath of a Russian invasion of the Ukraine,” Bassanese told Stockhead.

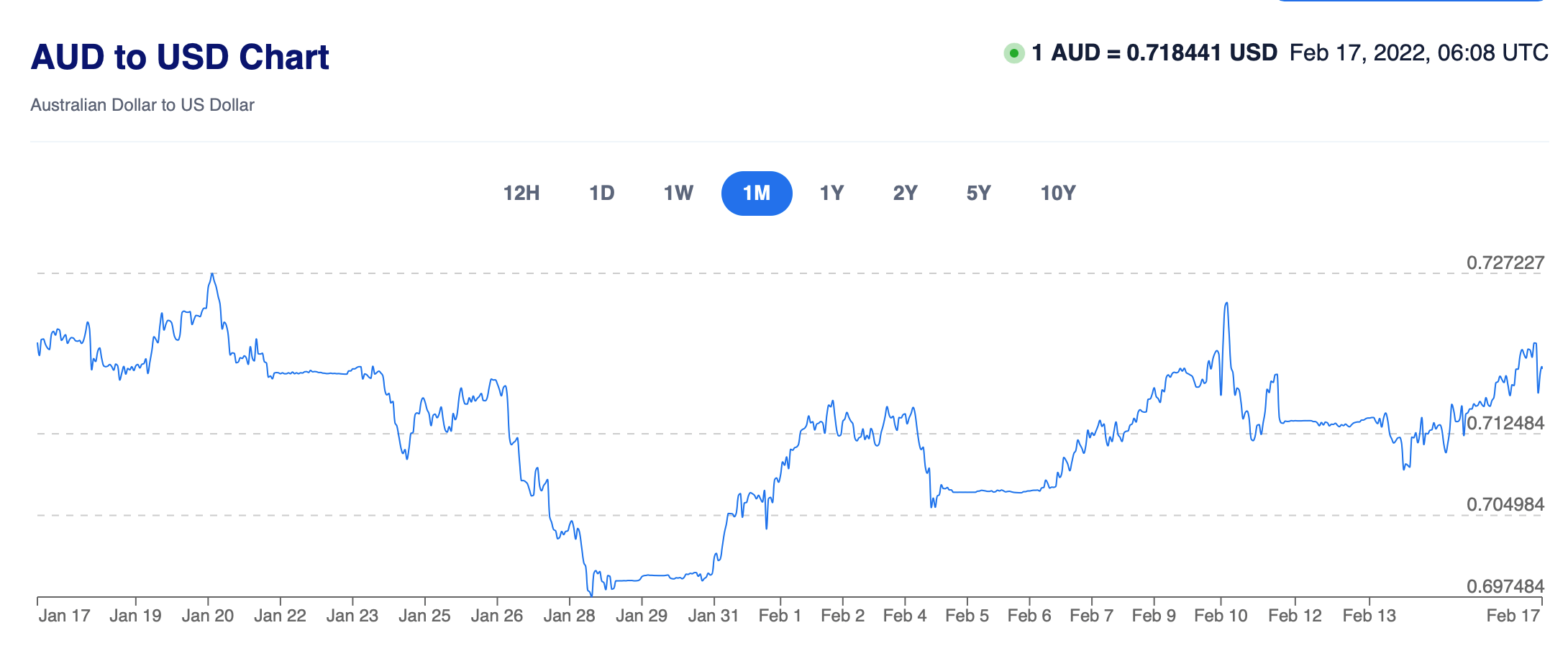

“Equities would likely slump, bonds rally and oil and gas prices would surge. The US dollar might also firm up, and the Aussie drops, quite possibly below US70c.”

Since the talk of war began earlier this year, the Aussie dollar has gone through a gradual decline from a 72 handle to a 71 handle.

“That said, I suspect within a day or two markets should settle down. After all, Ukraine represents a tiny part of the global economy (less than 0.5%). Provided the dispute is contained to just Ukraine, it should not derail global economic growth,” Bassanese added.

But he reckons the likely immediate escalation in oil and gas prices would not help global growth nor inflation outlook.

“Though at least with regards to oil, we may see OPEC step up production if there are restrictions imposed on Russian oil exports,” Bassanese said.

Where could oil and gold prices go to in the event of war?

“Oil could easily break above US$100/barrel on the news, but thereafter it will depend on what sanctions would be imposed on Russian exports, and how OPEC in turn responds with its own production,” said Bassanese.

But ultimately, oil prices are dictated by OPEC today after the US shale oil producers ceded control a few years ago.

According to Bassanese, OPEC is now exercising its market power by letting prices push higher.

“But when push comes to shove, I think oil prices will only go as high as global economy will allow them to go,” he said.

“I don’t see them going to US$150 level for example.”

Gold prices would also likely rise according to Bassanese, both due to higher oil-induced inflation fears and risk-off safe haven flows.

“The only danger to gold would be a stronger US dollar, and a more general flight to liquidity or cash by some investors,” he said.

For Aussie gas exporter and farmers, war might actually even be a boon.

“Disruptions to Russian gas supplies and Ukrainian agricultural output could hike prices and open more markets for Australian exporters, at least over the short-term,” Bassanese explained.

“Instability in the region could also encourage European markets to diversify their sources of supply, which would provide benefits to us over the longer-term.”

Against this volatile backdrop, could we go into a recession?

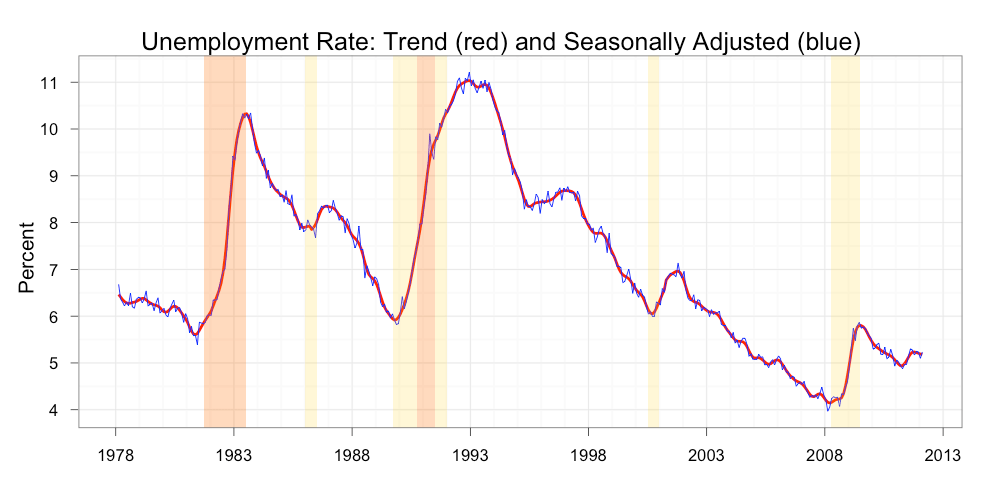

“I think there is a a risk the US could go into recession at some stage over the next couple of years,” said Bassanese.

“This is because their unemployment rate is currently very low, and wages growth very high. So the US is already showing late cycle tendencies (of a recession).”

Bassanese thinks that unless wages growth slows down from where it is at the moment, we’ll have to be prepared for two eventualities – a soft landing or a recession.

“My base case is not a recession, but the US unemployment rate is at a point that suggests we’re closer to the end of the cycle than the beginning,” he said.

Global fundie T. Rowe Price agrees with that assessment.

“As the economy is expected to slow, inflation continues to fuel higher costs. Wages, for example, look set to remain high,” a note out of the fundie said.

“The more permanent inflation becomes, the bigger dent it will have on consumer confidence and, ultimately, on consumer spending and corporate profits,” it concluded.

Could the Fed engineer a soft landing?

The current debate in the market is whether the Fed will start off with a 25bp or 50bp hike in March, and that itself is causing some of the volatility.

Although the Fed clearly needs to raise rates to combat inflation, it’s difficult to anticipate how aggressive its hiking cycle will be.

“I don’t think they will go with a 50 basis point hike, that would be too much of a jolt and I don’t think it’s necessary,” Bassanese said.

“At the moment, economists are competing against each other as to who has the most aggressive Fed forecasts, and I think that’s a bit silly. Nobody can be absolutely clear but for me, I believe there’ll be at least three and possibly four US Fed hikes this year,” he said.

Whatever the Fed decides, T. Rowe Price reckons a Fed hike would not impact equity markets too adversely.

“We can observe that Fed rate hikes alone do not usually derail financial markets,” says the T. Rowe Price note.

“Analysis shows that out of the 21 rate‑hiking cycles since 1974, the US equity market has delivered a positive return 17 times — an 81% hit rate — in the 12 months after a rate hike,” it concluded.

If a recession does happen, how low could we go?

“If it’s just a correction without a recession, I think the market’s fall could be limited to 10 to 20%,” Bassanese said.

“In a correction like that, it would just be a valuation adjustment because what would pull the markets down is the P/E ratio if earnings do hold up.”

Under that scenario, what we would see is a rotation where Energy and Financials may show some positive gains, and the high growth Tech sector may fall.

“But if it was a deeper bear market like more than a 20% fall and the talk of recession builds, then very few stocks could offer a safe haven as they will all be under pressure,” Bassanese explained.

“Under that recession scenario, defensive stocks like consumer staples, utilities, health care may do relatively better. But generally speaking in a bear market, all stocks face downward pressure.”

T. Rowe Price argues the supportive factors that pushed equities to record levels in 2021 are now waning.

In response to the Fed’s policy update, the Treasury yield curve has now flattened to levels not seen since 2019–2020.

“The shrinking spreads indicate that investors are becoming more pessimistic, and are skeptical that the Fed can raise rates as much as it would like without crossing the line from slowing to damaging the economy,” said the T. Rowe Price note.

“While it is too early to talk of a recession, the possibility of an economic slowdown beyond what has been priced in to financial markets seems to be increasing.”

Where should investors park their money right now?

Bassanese reccomends the newly listed BetaShares Australian Composite Bond ETF (ASX: OZBD).

OZBD aims to track the Bloomberg Australian Enhanced Yield Composite Bond Index.

This index takes an approach by weighting bonds on the basis of their risk-adjusted income potential rather than debt-weighting.

It aims to provide investors with higher returns than the most commonly used Australian fixed income benchmark, the AusBond Composite Index (AusBond).

OZBD also aims to maintain an overall duration and credit profile that is similar to that of the AusBond index.

“We believe the OZBD ETF is a smarter way to have fixed income exposure, because we’ve optimised the yield for given risk dimensions,” he explained.

“We’re not saying now’s the time to invest in bonds or invest in this index. What we’re saying is to the extent you need bond exposure in your diversified portfolio, this is just a smarter way to do it.”

The OZBD ETF currently has a management fee of 0.19% per annum.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.