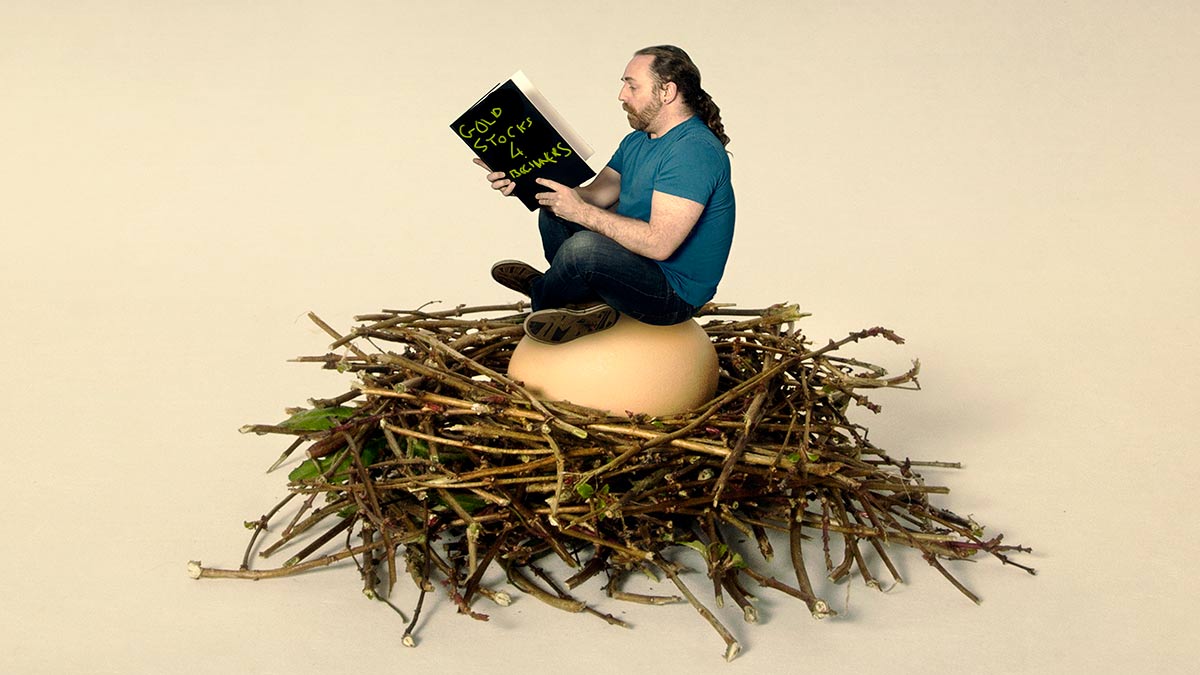

Want to build your nest egg? Here are 5 things expert investors look for in high quality ASX gold stocks

Pic: Stockhead, Scott MacBride, Moment/Via Getty Images

Hedley Widdup is veteran stock picker at Lion Selection Group (ASX:LSX), a specialist fund focused on the junior mining and exploration sector.

He knows what a great gold company looks like.

He also knows what a bad one looks like and, without naming (many) names, has provided five factors punters should consider before pouring money into a company.

1. An average gold project in a good location > outstanding project in a dodgy one.

Sometimes you find the best returns aren’t made off the best geology.

People talk about ‘jurisdictional risk’, which is basically the risk that arises from doing business in a foreign country.

The biggest aspects of jurisdictional risk are corruption, the protection of local legal systems, and things like personal safety, Widdup says.

Based on protection of law and personal safety places like Australia, Canada, and North America are wonderful jurisdictions to do business in.

In contrast other jurisdictions, like those in Africa and South East Asia, can be mineral rich but very risky.

Here are two examples from Lion Selection’s own history.

Many years ago, Lion was a very large shareholder in a company called Catalpa which had a gold project in WA called ‘Edna May’.

Edna May is a low grade ~1.5g/t orebody in an immensely accessible spot roughly halfway between Kalgoorlie and Perth, Widdup says.

“You could be on the highway and chuck your coffee cup out the window and it would land in the pit. It is not very far from infrastructure,” he told delegates at the recent Australian Gold Conference.

It was successfully developed and became one of the foundational assets of mid-tier miner Evolution Mining (ASX:EVL).

Off the back of this long-life project EVL was able to deal into a lot of the assets which made it the company it is today.

But Edna May is not a stunning project, Widdup says.

“Edna May will never shoot the lights out. The owners won’t thank me for saying that, but what they would point out is that Edna May has always managed to keep the lights on,” he says.

“That project was nothing special but generated wonderful rates of return for its owners.”

Widdup contrasts that with a project Lion Selection just sold out of.

“We sold a ~33% interest in a gold project in Indonesia called Pani,” he says.

“Wonderful geology. The resources are almost 5Moz, but holes drilled since that was done indicate 10Moz without even breaking a sweat.

“It would be low strip mine with easy metallurgy and it will make tonnes and tonnes of money. But the problem is – it is not in Australia.

“And for that reason, a lot of investors are unprepared to give a good valuation.”

It is far easier for a mining company to stand up and say ‘buy this WA project’, Widdup says.

“In fact, I don’t even have to sell WA to you at all,” he says.

“Meanwhile, if it a good Indonesian project I would have to stand here for 10 minutes to sell you on Indonesia itself.”

2. Is grade king? It’s complicated.

You often see a company MD stand in front of a crowd and say ‘grade is king’.

This well-worn proverb assumes that higher grades are important above all else to the economics of a potential mining operation.

Grade probably is king – all else being equal — but investors must be very careful not to be blinded by the headline numbers, Widdup says.

“So many high-grade deposits have a high-grade pod over here, a little pod right over there; and in developing the mine from one to the other companies run out of money,” he says.

“It doesn’t matter how high your grade is if it is too expensive to extract.”

READ: When it comes to gold deposits, grade is NOT king

3. Metallurgy is VERY important.

After the ore is mined it must then be upgraded or concentrated and processed into metal.

This stage is called metallurgy.

“Metallurgy with gold is usually very easy, but I want you to be looking for deposits where you get around 95% ROM [run of mine] recovery,” Widdup says.

“Exceptionally large projects, like De Grey’s (ASX:DEG), can get away with lower recoveries because they will be doing things on a large scale which will generate savings.

“In that case, you can trade down to the lower 90%’s.”

But if an explorer or miner tells you they can only get 60% recovery you need to be looking at their costs very, very closely, Widdup says.

“There are gold projects that do work at 60% recovery, but they don’t last very long, typically,” he says.

4. How many ounces you got per vertical metre?

Widdup not only looks at the ounces in the ground (the total resource) – he evaluates ‘ounces per vertical metre’.

“[De Grey technical director] Andy Beckwith referred when he said the Hemi deposit is sitting at ~10,000oz per vertical metre,” he says.

“That means if you excavate the top metre of the deposit you have dug up 10,000oz.

“If it is closer to 1,000oz – which is around the benchmark to what becomes economic – then you are having to move an awful lot of material to liberate those ounces.

“So, the more densely packed the gold is in a vertical sense often the better you can be in terms of extracting that profitably.”

5. Find a champion to invest in.

This is probably one of the most critical factors is selecting a high-quality stock investment, Widdup says.

“Most people talk about good management teams. I talk about a champion,” he says.

“There are about 600 companies listed on the ASX who explore for some sort of commodity. A lot are gold.

“And every single one of them will tell you they have a good management team.”

In some cases, they are correct but mostly, they aren’t.

Many exploration management teams often don’t recognise, or pretend not to recognise, that their project is a heap of garbage.

“Now they can’t be blamed for that. It is their job to be promoting something – that’s what they have been asked to do,” Widdup says.

“But at the end of the day, those companies probably won’t be successful.”

But every now and again a company has a champion — someone who attracts the talent and points them in the right direction.

“I think the qualities of champion are a central person who holds everything together and attracts good people, because they are a good person,” Widdup says.

How do you discover that person?

Often it is best to meet them in person — at a conference, for example — before making a judgment, Widdup says.

“Do you think they know their job, and do you think they are being honest with you?”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.