Trading with Focus – Who’ll get short-squeezed on the ASX next? You, probably

Pic: d3sign / Moment via Getty Images

It’s on the news, it’s on billboards in Times Square, kids going from poor to rich overnight, everyone’s doing it – maybe you should be a squeezer too?

Long story short, in my opinion the answer is no. But if you are betting that there is some global movement that will end with the poor winning over the rich, you’re probably already a bit of a squeezer.

Gamestop (GME) is a $30 billion company, silver is a $2 trillion market. Bit of a difference, but when there’s enough talk of a thing happening it actually does happen, and a lot of silver related stocks have seen a kick.

The irony is that this will just leave a whole new group of young investors licking their wounds, as the latest reddit strategy involves never selling – ‘diamond hands’ is what they call it – but the seasoned investor will take the trade, bank the profit and wait for the next opportunity.

It’s never different, ever, seriously – so run with the bulls, but get out in time.

But regardless, understanding ‘shorts’ is the first step. Be aware that they actually do form an important part of market stability before you start running with the mob looking for evil manipulative shorters to burn at the stake. Oops, I probably shouldn’t say Stake, it’s too soon…

Even if they are sometimes associated with nefarious activity, they are usually there capping excessive rallies, pointing out those companies that are heavily flawed and covering it up. But more importantly, when the market is collapsing and the typical shareholder is in panic mode, a short-seller has to ‘close’ their position, meaning that they are a buyer when no-one else is. So they can actually add stability to a market and removing them would increase volatility and risk.

So they are only betting the stock price is overvalued, or ‘hedging’ their position, whereas you are only betting the stock is undervalued – in order to make money. So who’s the bad guy?

Anyway, the ASX publishes a list of shorted stocks:

https://www.asx.com.au/data/shortsell.txt

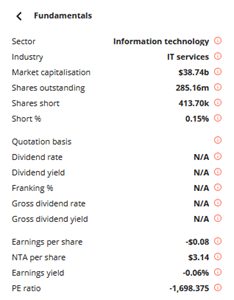

And our data supplier publishes short data for our ‘Fundamentals’ within the Marketech Focus app. I’m not sure how current it is but it’s pretty irrelevant anyway, so no-one should really care – but we do have it.

As you can see, even a company with net assets of $3 against a share price of $136, one that is bigger than Telstra but loses money, even that company only has a 0.15% short position.

ASX shares generally can’t be shorted too hard, as first you have to find someone to lend you the stock, on a stock you are allowed to short, and you have to have a short selling account at a full-service broker.

All this ‘140% short position’ rubbish can’t happen in Australia. You can’t just sell (naked short), you have to actually have the stock to sell (covered short) which you borrow, for a fee. So you don’t want to be wrong for long!

There is unlimited loss on a short sell position as share prices can go up forever, and as we are currently seeing, can go up very quickly. But the most you can make as a short-seller is the value of the stock you borrowed, so it’s a bit of a mug’s game to start with.

But if you really want to gamble you can trade CFDs, which are the metaphorical cigarettes of the market…

And then you have to convince the world that your firm’s analysis (that the stock is overvalued) is correct, assuming you get any airtime on your opinion in the first place. Sounds like a lot of work for a limited payoff!

Also, Robinhood allows the untrained to buy large amounts of ‘out of the money’ options for free and sometimes ‘on tick’ (lending them the money), which we don’t have as easily accessible in Australia. And call/put options aren’t usually available on smaller companies that would be affected by the buying, so you can’t expect the large numbers of small highly-leveraged investors to move markets.

Or maybe Aussies just don’t move in herds as well as Americans. They certainly seem to love a good ol’ frenzied mob, rioting against the man!

But there are other ways of benefiting, as seen from the rally in silver benefiting all the silver stocks (except MYL, where sovereign risk has played out at the critical time) for a day. But will this follow through, or be a flash in the pan?

GME is one thing, but the silver market is huge and harder to enter and therefore much harder to distort. And speculative stocks rely on someone else buying your shares higher, so a lot of rallies get heavily sold into and then you’ll end up with uneducated fearful first timers rushing into a stock. That just means when it doesn’t keep going up they’ll panic sell, and you could end up seeing your stable investment collapse in the aftermath.

So, what do you do? Well, if you want to chase the short-squeeze trade (even if it’s not really a short-squeeze trade but more of a fear that there might be a short-squeeze, meaning that hedge funds and rich, seasoned investors push the price up), then you’re going to need an exit plan.

Last week I spoke about a couple of very simple strategies for picking your exit, so here’s one more!

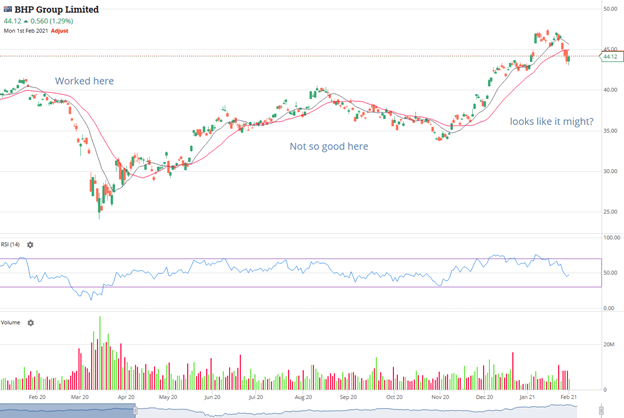

Let’s talk about moving averages. I mentioned the importance of ‘seeing past the waves to the horizon’ last week too, and I liked that analogy, so I’ll run with it again. The moving averages do just that, they take an average of a certain number of days rather than just the current price. They smooth out the volatility to give you a better look at the longer term trends.

You can read up on the right timeframes to set on your moving averages on Google, and adjust them depending on the stock – as a longer term investor will have different timeframes to a short term investor. Luckily all of our indicators are easy and quick to adjust, and your settings will feed across your various devices.

There are also simple moving averages, exponential moving averages, and the MACD, which goes as far as showing the relationship between moving averages! All the math is done for you, read up what they do online, flick the button on the app and then look to see if the patterns hold for that stock.

When a short-term moving average, the short-term trend, crosses over the long-term moving average, which is the long-term trend, there is an indication that a bigger trend change is occurring. But like everything, it’s not always right and you’ll get a different outcome with different stocks over different timeframes, which is why they are called indicators, not guarantees.

See what I mean on this BHP chart? It seems to highlight trend changes correctly on the bigger movements, but wasn’t so good when the stock was going sideways. There were too many false entries and exits. But the recent rally would have given you a good entry, so if it holds on, it should give you a good exit and a good return too.

So maybe the spike in silver stocks (if they continue) or lithium or whatever is volatile enough and obviously trending one way or the other. So then the moving average cross should at least give you reason to consider bailing after a big run, when a change in direction is being highlighted? Or maybe you’re “holding forever” which is your prerogative, even if it seems like a roll of the dice.

There’s a lot of chatter about the large numbers of retail traders in the market, and that has always been a sign that the top is near. It’s entertaining to watch, but the markets always reward the educated investor so make sure you use all the tools at your disposal… or get a new set of tools!

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC. You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.