Trading with Focus: Where to get good advice

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Apart from the cold-hard cash, there is little I like more about trading the stockmarket than getting it right. And then humble-bragging to my friends. And its compounded by a factor of 10 if they told me I was wrong to buy this fabulous new investment.

I have a lot of friends that ‘play’ the market and we love nothing better than to sneak a few “waddya-punting”s into our serious discussions about the life changing events of our times (amongst other serious convos, like “waddya-watching”s and “waddya-getting-fatter”s).

Some of my mates that trade are professional stockmarket advisers, some run listed companies. Because I have a good network of experienced (and degenerate) punters I am very lucky to never be short of a good idea.

No, scratch that…I’m never short of people telling me to check out the stock they think is going to be good. Usually because they already bought it. And if it’s gone up since they bought it, they are especially convinced that I’m an idiot for not backing them in.

And, every single time, without a lie, like a muscle memory thing or a nervous tick – my auto-response is “Is it though?”. And I make that face, like in the above picture with Thor. (I’m often told how much I look like a famous movie star too…)

If you’ve read a few stockmarket articles, or looked at research, you would see warnings about ‘Personal Advice’ this, and ‘General Advice’ that slapped all of the place.

The breakdown is this simple; if you pay a professional to look at your personal financial situation and come up with a strategy for your own individual circumstances – taking into account your tax, super, and your tolerance for loss (or losing money) – then that is ‘Personal Advice’. Everything else I call ‘Talking your Own Book’.

There are probably about two to two and a half thousand companies listed on the Australian Stock Exchange at any given time, if I’m to guess.

And it would be generous if I were to say there were 50 that stand out as good long term buy-and-hold, set-and-forget companies.

As in, companies that have been around forever, have always been well managed, always put shareholders first and over a longer period of time have rewarded their investors with dividends and capital growth. Like Wesfarmers. (This is not advice, but dayum, what a company!)

The rest of them are companies that could be described as ‘buy at the right time and hope like hell that you can sell at the right time too in case they have some bad luck, some bad management or the bottom falls out of the market for the thing they sell’. Or the shorter version; ‘speculative’ shares.

Blue-chips are great, and you definitely should have them in your portfolio and not be solely punting in the rubbish end like I do (not advice – you do you).

But lordy-me, there is nothing worse than hearing someone brag about their fully franked Telstra dividend cheque! It’s like a cross-fit guy or an MLM mum at a…well, any social event I guess.

So, if you don’t have a group of ‘friends’ to argue with about the next big thing, where do you get ideas from? I honestly don’t know.

So instead, I’m going to pick fault with some of the other options (except the good people at Stockhead obviously) thereby creating healthy debate (and hopefully not new enemies).

Research

Funny story: Did you know that insider information used to be legal? Yep, no lie. Then the Poseidon boom (this is back in the 70’s) came and went.

Those with the freshest inside information took the money and ran and the last person to hear about it was left holding the bag.

So ‘they’ (the regulators) started pretending that they could create a level playing field by legislating that it was now illegal to know something that wasn’t known by the ‘general market’ and to trade using that information.

Wow. How does that even work?! I mean, I get the illegal nature of it, but what a massive grey area. The whole reason a stock moves around is due to the differences in the amount of information people have.

Is an article with 200 readers a ‘wide enough reach’ to say that its ‘generally known’? Is Twitter? If everyone knew everything there wouldn’t be volatility or opportunity.

(Don’t be trading genuine insider info though; if you get the driller drunk and work him for drillhole grades at the Palace Hotel in Kalgoorlie then ASIC will definitely charge your dumb ass and you’ll be in THE Big-House, not A big house.)

Also, a reminder; the stock market’s primary role is supposed to be to allow companies access to capital. So you’re a CEO in need of a few million to get your business up and running, you go to a broking house, dangle a 6% fee in front of them (based on the amount of money they raise for you) and then have them promote the absolute bejeesus out of you to get you ‘dat monaee’.

Then you pay them a retainer for ‘corporate services’ for a few years, and probably gift them a bunch of options as well, to ‘align their interests with yours’ (aka – getting your share price to go up so they can buy boats).

But these brokerage houses also want to write research. And they are being paid, but they need to be seen as independent. So they separate the research department from all of the people that are paid to help the company’s share price go up (and who also have a vested interest), but only send it to their clients first – then later, to everyone else.

These separations between the sales team and the research team are called ‘Chinese Walls’, because only Genghis Khan breached the Great Wall of China (until it fell down, and he wasn’t punting the wall-market). Except they don’t really work because last I checked most walls had doors.

So, whenever you see research, especially paid or from the ‘promoters’, take a bit of extra salt when you’re making your investment decision.

Chat rooms

When the internet was first invented, it gave us an opportunity to better society and become a more connected hive-mind dedicated to the enhancement of the human species.

It also gave share traders a place where lazy, angry (possibly drunk) and definitely biased traders would go to fight with genuine newcomers looking for ideas, behind a fake name. Screams ‘genuine quality content’, doesn’t it?

The best thing about stock related internet chatrooms is that it reminds you that there is more to the market than reasoned and sensible opinion.

Some of the best comments are usually along the lines of: “I think this stock is going up and I will not suffer any other opinion”.

Then if it comes off a bit they get more convinced and call for everyone to “stop selling or top up” because “this thing is going to the moon! And you’ll be disappointed when we are having our $1 party”. Then they get angrier as it goes lower. Then they call for management to be sacked.

As a trader I usually look at those forums that contain a lot of happy friendly participants as a stock that has probably already run; the ‘backslapper brigade’.

A stock that contains a lot of anger probably has a lot of share price walls to climb, as the “I’m going to hold this stock forever” crowd will probably sell into any bounce as their losses shrink.

You need the chat-room participants’ souls to be completely broken by the terrible decision they made buying that stock (usually after it bagged 10 times, and not often before), to the point where they have completely given up and stopped even posting any discussion on it. Then its worth a look.

Like a troll hiding under a bridge you wait in the darkness, forever lonely, hoarding your cash…waiting to pounce…

(And for the love of all that is good, if you are reading this and you do regularly comment on these chatrooms; I beg of you, please don’t change. As in poker, I love reading ‘tells’ from the other side of the table and if you remove all of your obvious textbook emotion how am I going to take advantage? And I’m a terrible poker player, so make it easy on me yeah?)

So – and again this is not advice – think of companies on the market as more than just stock prices. If someone tells you about a stock, ask yourself if they are actually just bragging about their recent win, and if they are compelled to tell you it’s probably already gone up a lot.

Research is paid advertising, chatrooms are free advertising and they work to drive up the price, so get in early. As a trader you don’t want to pay top dollar for a diamond at Tiffanys, you want to find the one that looks like a warn-out marble and sell it for more once it’s had some polish – so you’ll have to dig.

Ask yourself, if it’s being advertised by thousands of people, is it likely to be cheaper or more expensive..? If everyone already loves it now and has loaded up, who’s going to be left to buy it off you?

When you read ‘research’, have a look and see if it’s paid research or not and when it was released, as you need to stay informed right up to the minute to get the best bargains.

And if the stock is already known, talked about in chatrooms, turns up on ‘Today Tonight’ as the ‘next big thing’ or on the ‘most talked about stocks’ lists on chatrooms, maybe you’ve missed the boat. The advertising worked and you’re competing at an auction after all, but now there’s a whole lot of bidders.

But at that point I’m more than happy to do you a favour, as I have a few I can sell you…

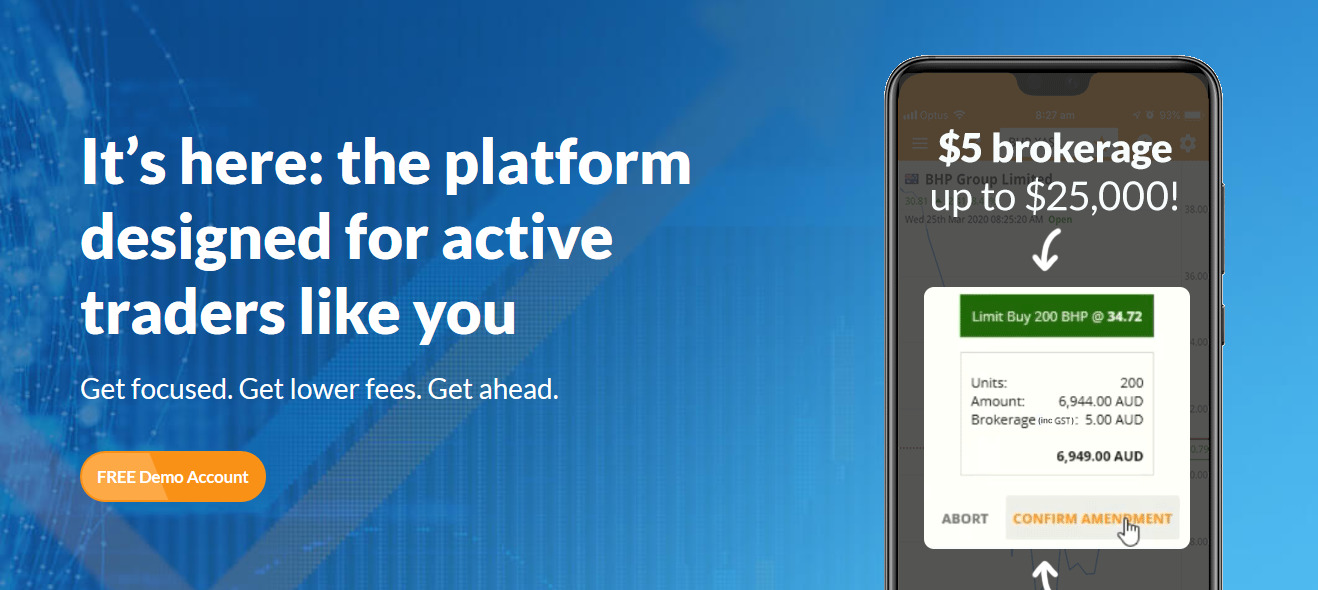

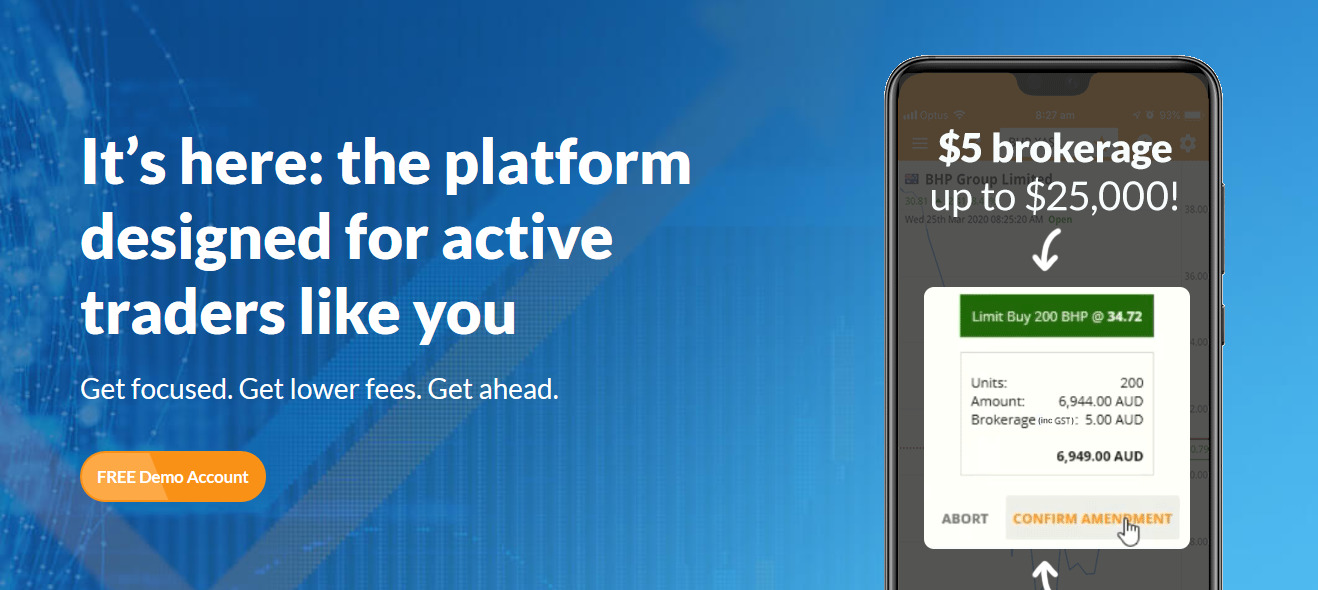

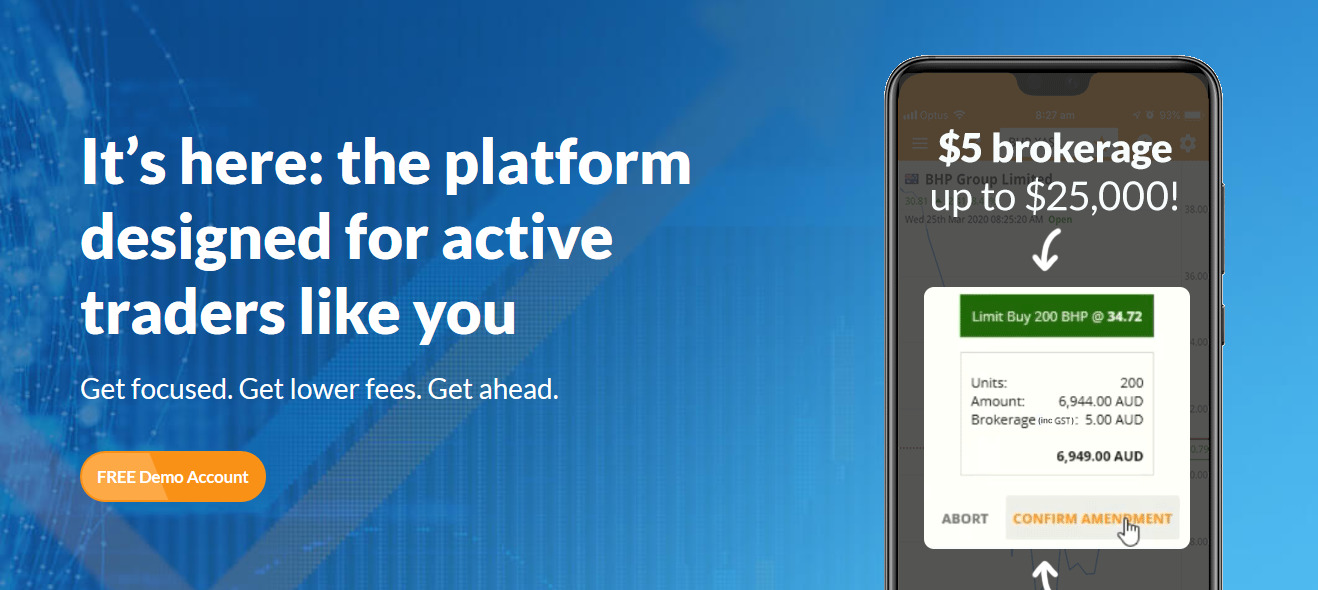

Trade Up to Marketech Focus — a high-function trading platform from $45 per month. Instant trading capability for both PC and mobile to keep you on the move.

As a subscriber you will have access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. Go to www.marketech.com.au to set up a free trial.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.