Trading with Focus – When to call time on a stock

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Things change. Darling stocks can fail. They don’t always play out how you want. Don’t be afraid to sell.

Dave Chappelle knew when to walk away. Sure, he came back when the time was right and still walked away wealthy the first time, even though he left a lot of money on the table. Daniel Day-Lewis quit recently; bet you didn’t know that (or that he was in Gandhi!) And I’d probably still watch a Gene Hackman movie if he had kept making them, but his last film was in 2004.

Is that sad? Great actors, top of their game, heaps of cash still to be made, heaps of joy still to be shared with adoring fans and cinema-philes? Or is it sadder to watch Nic Cage or Will Ferrall or The Simpsons become parodies of themselves in the chase for cash, forever destroying their legacies?

Well, I’m here to tell you folks, like the Kenny Rogers song, you gotta know when to fold them. At some point a company’s value far exceeds the amount of risk that is justified. You got on, you made bank, and now you’re too worried to sell in case it keeps going up.

I mean by this point, it’s pretty obvious I’m going to have to use a sector or a stock in particular just to make a point. So let me just pick one at random. Oh, I don’t know… (spins wheel) …

Here – what about BNPL, and the darling-est of them all, Afterpay? Anyone heard of them?

OK, full disclosure, I never bought a single BNPL stock, and probably never would. I don’t carry cash anymore, but also, I don’t want any more cards or debt facilities. I use my credit card for the Frequent Flyers points and pay it off every month so it probably doesn’t cost me much anyway.

I’ve never even used lay-by or interest-free terms from Harvey’s. It just seems like I should have the money to buy consumer goods, or not buy them at all.

And this isn’t stock advice, this is just ‘you should think about some of this stuff when investing’.

So the first point is that I didn’t understand the demand-side of the business model, so I had no business buying their shares. I thought, wrongly, that at best it would be an interesting niche. Stick to what you know, I say.

You’ve all seen the chart, but here it is on a weekly again (taken on Marketech Focus, and perfect for sharing your wins by screenshot on social media). If I owned any there would be a blue-line on the chart showing me my costbase.

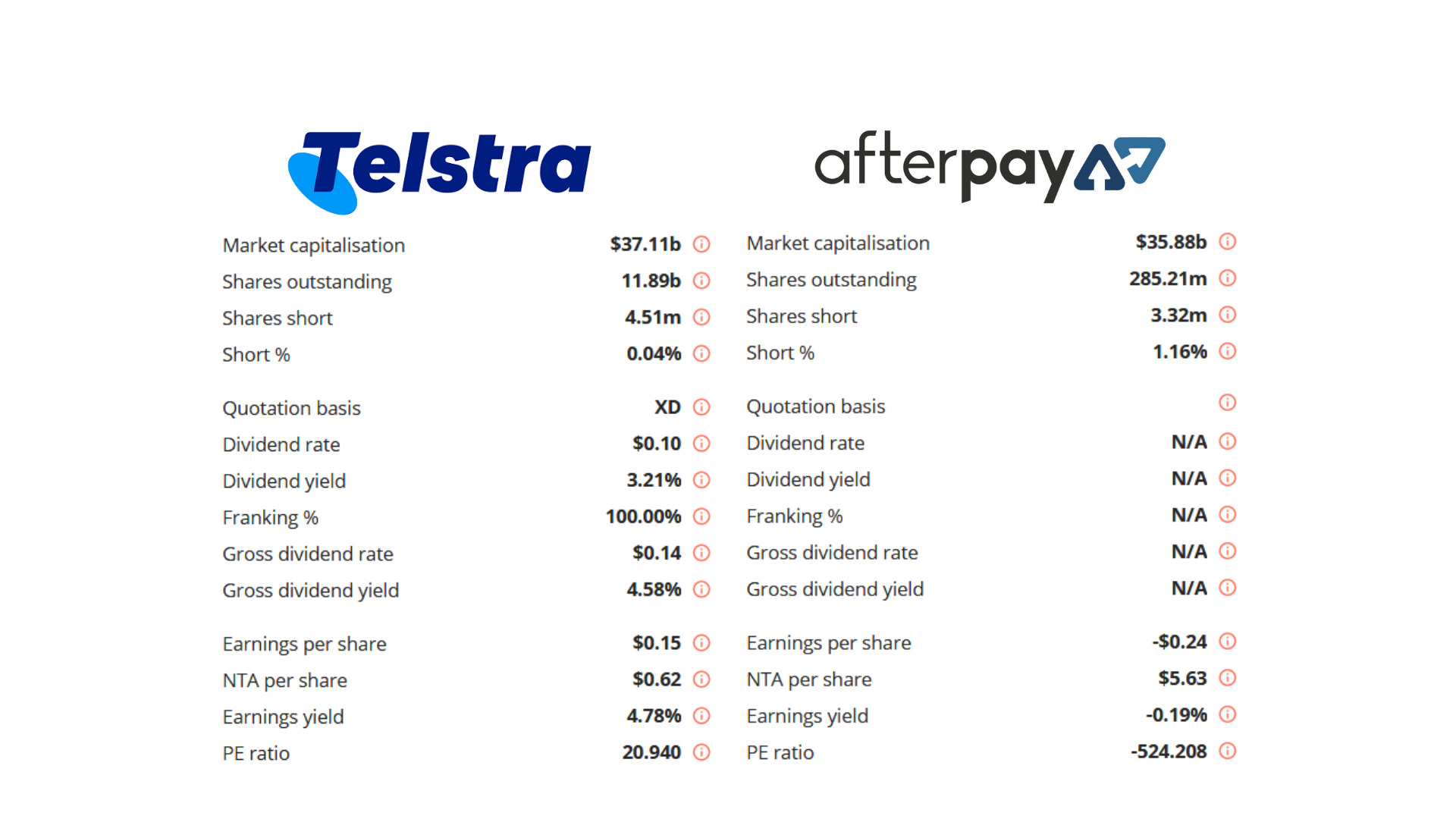

Now Afterpay is about the same size as Telstra. So, let’s compare the pair…

The ‘market capitalisation’ means they are big. Not Microsoft big, but Top 10 or 11 on the ASX on any given day. Telstra pays a dividend, Afterpay doesn’t – I mean who cares though right? When APT has gone from $8 to $160, a dividend would have meant nothing. But APT does trade on a negative PE, meaning they don’t make ANY profits.

Alright, so maybe APT are growing a lot faster than TLS!

No doubt. Telecommunications is a mature business, and Buying Now and Paying Later is fresh and new. Sort of. And APT have increased their customer base by over 100% since this time last year and started flogging their wares in the US of A. Not Telstra though.

So APT aren’t profitable with 13 million active clients, but will they double their client base again this time next year? And what is the amount of revenue they need to make to start being profitable?

According to their recent FY report (available in the news section at the click of a button to read or download on ‘probably the best share trading platform on the market’) they were losing 1% of transactions, now they are losing 0.7% on transactions. So at that rate they’d need what, 30.3 million active clients to get to breakeven? That’s nearly 8.5% of the combined number of people in Australia and the US!

Seems like a lot. But keep in mind I’m not claiming this is the case. I’m not an analyst, I barely skimmed the report and it might not mean that, I’m not saying that you should rush out and sell your BNPL stocks. All I’m doing is posing questions you should be asking yourself about any of your investments, all of the time.

Be your own Devil’s Advocate. I’ve been wrong on BNPL for as long as it’s been around, so don’t take my advice, because this isn’t that.

So what about the Moat?

In ancient times, we used to dig holes around our castles to keep marauders out and chuck crocodiles in them. Where they all came from I know not (I certainly don’t remember seeing crocodiles in Europe or the UK).

In business we look for companies that control their own domain with unassailable technology IP or hopefully, some sort of virtual monopoly. The Big 4 banks, for example, are hard to knock off as they are somewhat protected by the government. Amazon is unassailable due to its size.

So what about Afterpay’s moat? I dunno, but it feels like there are a lot of new companies offering a similar service popping up every week or two. Some will fail, some will take market share. I mean, it’s a pretty simple business yeah?

So how big is the market? Is everyone using it? Am I compelled to use it because it replaced cash?

Nope. I have never Afterpay-ed anything in my life, but the fact that I called it ‘Afterpay-ed’ means that it is worthy of some sort of high-value. They have become a verb. But at $37b for an unprofitable company that is getting a lot of competitors into its sector, I want more than verbiage.

For anyone that has lived through a mining cycle you know that undersupply can become oversupply very quickly. Maybe we are approaching ‘peak BNPL’ and soon punters will want to see profits. Or not, who knows. But is that sort of risk something you’ve considered?

What about macro-economic change?

What happens if interest rates go up? I noticed that there is a lot of talk about bond yields. The bond yields and interest rates have been artificially low since the GFC. With all the money that has been pumped into the market, does that mean all these BNPL business models have been getting it easy?

And if that changes, will it get harder? I don’t know, but if I was holding stocks with this sort of recent outperformance I’d want to know!

What about legislation; it’s still ‘lending’ right?

Well, again, that’s recently been in the press. Because it is such a new kind of debt, there was no oversight body or legislation about how they should be managed in Australia. But that’s changing. These things have all popped up under the radar, were asked politely to build their own ‘code of conduct’ and sort of bottled it. So the regulator came in and gave a set of new orders for them to follow.

Now believe me, when the regulator comes marching into an industry with a red pen and clipboard it is usually a problem for the companies operating within it. Ask AMP how their managed funds business liked the new FASEA or AFSL legislative requirements. (Not so much.)

What about the share registry? Who owns this stock?

Straight to the Annual Report for this one. We haven’t seen a Top 20 update to the market since the Annual Report in August 2020, but we have seen Blackrock trade in and out, as well as Mitsubishi, who were in very early.

So some of the biggest institutional shareholders are trading in and out. Like a speccy share!

What about the directors – long and strong? They sold a whole lot in the mid-$60s in July (half the current price), and recently did the charitable thing (that everyone should do!) and gifted a charity a bunch of shares and sold down some stock to donate.

Twiggy, on the other hand, gets dividends. And then donates some of that to charity – or even buys some more FMG shares. But FMG makes money and the only way to get bulk cash from an unprofitable company is to sell some. Or borrow against it, god forbid!

The Wrap

First. Apologies to anyone that owns shares in, that is employed by or otherwise associated with Afterpay. This isn’t a takedown piece. This is a column for small share traders, those speculating with smaller amounts of money who are possibly very new with investing and are starting to chant “200 dollars” as they draw a line in the share price trajectory, and seemingly expect past performance to indicate some sort of future performance.

All I’m trying to do is get people to consider their investments, and ask the hard questions. Will this stock continue to rally after the recent ~30% fall from highs? Given its backstory, is the potential for growth sufficient to justify that sort of volatility and risk?

So when looking at an investment, the charts have told you what has happened to the share price. The fundamentals allow you to compare between companies. The company news has told you what has been going on in terms of shareholder movements and growth.

You need it all. You need to be able to read all the data, and look at all of the available information. And compare to what has happened in the past, and consider what might change in the future. Don’t just look for the cheapest way to buy shares on the market after reading a chatroom, throw your money into a pool and then hope for the best.

You have to remember that you aren’t going to ever pick the top, unless you have the same luck as a Lotto winner. Get on the bus at the right stop then get off when it’s YOUR stop. Not your mates, not reddits.

And don’t worry if it keeps going up as there are thousands of different stocks on the ASX. Why pick the one that’s already done exceedingly well. Maybe use this newfound knowledge to find one that hasn’t run yet. Is APT likely to double again? Maybe. But is maybe good enough for you..?

And we have it all on Marketech Focus, probably the best all round trading platform in Australia. (With accounts on HIN and Macquarie Bank accounts with your name on them where you keep your interest, with low rate of brokerage, all of the features you need to closely follow the market including live-streaming pricing and technical charts, an app with all the features of the PC version).

So don’t be afraid to sell. No-one else seems to be.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.