Trading with Focus – Turning up with the right tools

Pic: d3sign / Moment via Getty Images

Turning up to work without pants. Going to an exam without a calculator. Trying to run. Falling. Plane crashes.

Having stress dreams? Welcome to the stock market.

Even though I’ve had these dreams many a time, it’s never happened to me in real life. I never forget to wear pants. I’ve never been in a plane crash. I’ve never been incapable of running whilst being chased by oversized cat-themed furries.

I used to be an investment advisor, and we had the best professional trading platform in the world. I knew the meaning of every flashing light, I could see the patterns within the patterns and I could find any piece of information on any stock with my eyes closed using the muscle memory I’d built up over tens of thousands of hours.

And I was addicted to spec stocks. Still am!

When I left, I lost access to the $1000 a month trading platform and found that there was no substitute. So I started having a new dream.

During scary times (like now, where little makes sense in the world or the market) I’d dream about watching my stocks rally (or crash) and not be able to sell in time.

Punching buttons madly, going from screen to screen. Trying to open a ticket only to have to open another screen to see the price, then getting caught in a Groundhog Day-esque loop where I couldn’t lock in a profit or get out before the crash.

When we launched Marketech Focus we had a very simple goal. Give the trader the right tools at the right price.

Most of the new players are doing it wrong, so its time for a good old-fashioned rant!

If I read another Facebook post recommending a first-time investor use the free market-detail platform from one company combined with the cheapest order-placement from another and a 20-min delayed free charting package, well, I will probably do nothing but smile and greedily rub my hands together.

As a speculative trader I love knowing that there are others out there with less information than me, with slower platforms. It’s nice to think that there is someone on the other side of the trade that doesn’t have the right tools – it might actually mean I am doing the right thing!

But, let me try and be the good guy for once. In my opinion this is the absolute barest minimum set of tools that a trader should have in their day-to-day trading:

- You need to have live ASX pricing, not 20 minutes delayed or pricing derived backwards from CFD’s. How can you possibly be trading fast-moving specs with your eyes in the rear vision mirror? Specs can go up and then back down again within 20 minutes, leaving you holding the bag. And it’s not the Gucci bag.

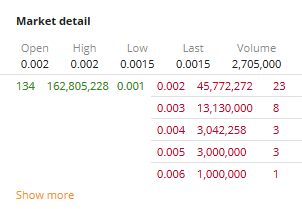

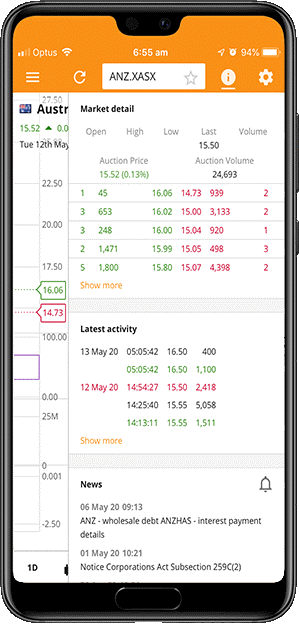

- You’ve got to see the live market depth, seeing the buyers and sellers as they line up and jostle around. How else can you know whether there is a seller trying to game the market with a big sell order a tick above the market price (or if they pulled it at the last minute). You’ve got to see the others in the market and judge them as you would your competition in any fight. Or get flogged.

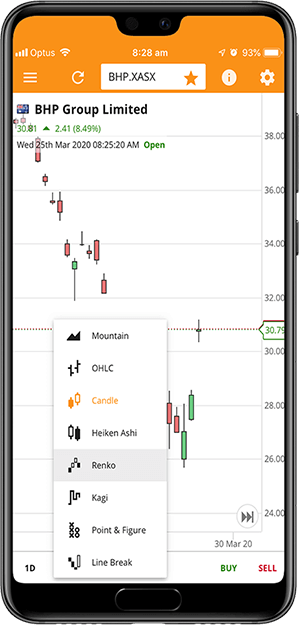

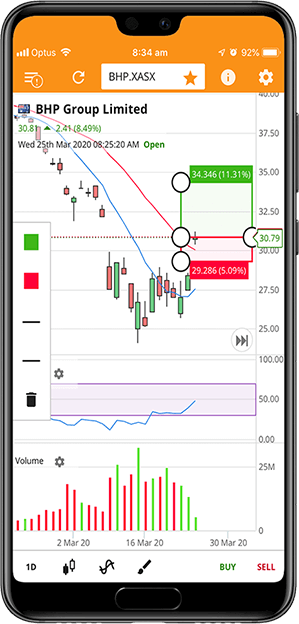

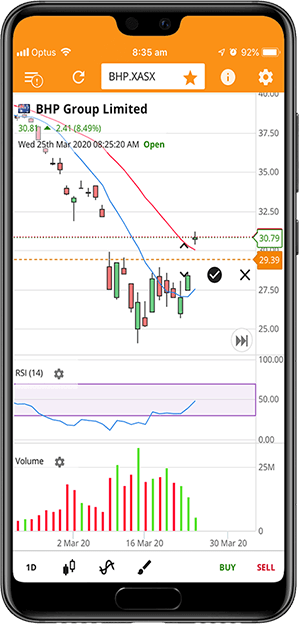

- Live charts, along with some technical indicators and different timeframes. Sometimes you get caught in the day-to-day, and need to see the bigger picture of a long term chart or a weekly pattern. If I didn’t have intraday charts I’d go mad! And candlesticks. And moving averages. And volume. And the Relative Strength Index (RSI). And now that I know what that ATR thing means, that too!

- Put it all in the same place, so you don’t have to flick between screens. Nothing more frustrating than a stock moving wildly and you’re stuck loading up a bunch of different websites.

- And last but not least: Mobile access to all of this! Sometimes you just have to trade at a bar or restaurant. Luckily chicks dig guys being on their mobile phones all the time, especially mid-conversation. (Hold on baby, silver’s on the trot!)

(Oooh, it’s still up 50%!!!!)

So, this is the barest minimum.

At Marketech, we also offer additional functionality including ‘2-click to sell all at market’. There’s also cost-bases ‘on the charts’, orders ‘on the charts’, trading ‘on the charts’, alerts and movers and all sorts of extras.

How much should it all cost?

Well, the free versions of the major online brokerages hardly have any of the features I just outlined above or — once you’ve logged in and loaded their websites and got past the ads for term deposits and credit cards — then the functionality is all over the place.

Marketech has all of it (and more) in our base platform for $45 a month. And we have platforms coming later this year with even more again! There are charting packages alone that cost more than this, and they don’t even allow trading – let alone $5 or zero point zero two of a percent (0.02%) brokerage on trades!

When it comes to trading the market and making consistent money (or at least protecting yourself), you quite literally can never have enough information. If you don’t have $45 a month to spend on a good platform, get out of the market.

Trade Up to Marketech Focus — a high-function trading platform from $45 per month. Instant trading capability for both PC and mobile to keep you on the move.

As a subscriber you will have access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. Go to www.marketech.com.au to set up a free trial.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.