Trading with Focus – The lucrative cup-and-handle breakout trade

Pic: Getty

There is nothing surer in the market than the herd mentality.

Humans are bound by fear and greed, and they surge and froth – one minute with dollar signs in their eyes like a cartoon from the early days of Looney Tunes, then the next sweating actual bullets, also like the early days of Looney Tunes.

Damn those things were racist!

One trade that plays out a lot is the ‘cup and handle’. I initially thought of it as a cup of tea, but that image didn’t overlay very well until I found a picture that was much more appropriate…

Part One; The set-up.

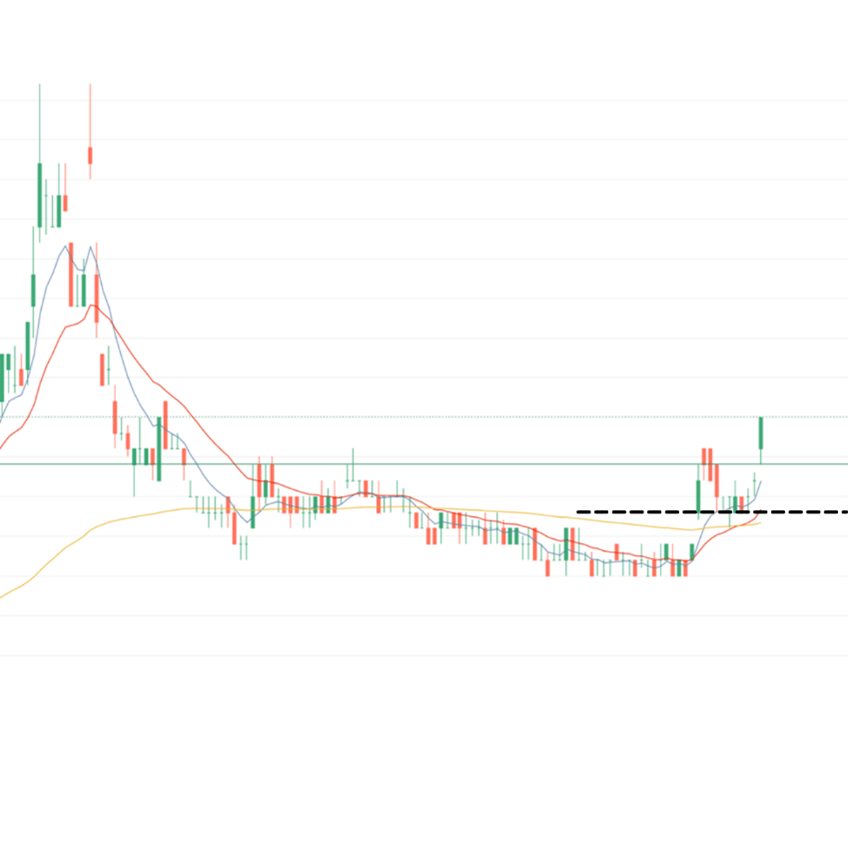

We need a stock that has sold off. That forms the first part of the ‘cup’ as it stabilises at a lower point. Putting in a bottom; which is important as you can’t fill a cup with no bottom.

It can’t be a total dog, there needs to be something in the future that looks better than whatever caused it to sell off in the first place. Some hope. So that once the nervous nellies and the traders and the hot-money is out, the grubby bottom feeders (like me) can start to soak it up.

Things like oil and gas explorers, or possibly even companies doing medical trials, or just stocks that got too far ahead of themselves and sold off.

Something with an underlying value that is hard to quantify exactly, but seemingly uncapped potential.

For technical analysis to make sense – or herd behaviour, which is what it should be called – it also needs to do a lot of volume.

You can’t really trust a handful of people to move in a herd. It can look like a pattern, but it’s much riskier.

Think of two people at a concert bopping their heads, then think of a thousand all doing it at the same time. These technical trades need volume, as if one of those two people stop bopping their head, then the pattern breaks down.

If you’re betting on a percentage of heads bopping, you’ll want more heads.

So the thing bounces along the bottom for a while. People start to hate it. “When will this thing go up!” they cry on Hotcopper. There’s argument and some real hatred being bandied around.

In this case, a bit of news formed the first part of the second stage – the side of the cup.

Part Two. The side of the cup; aka the breakout.

When something finally stops going down or going sideways… then it starts going up. Argue that logic as long as you want!

So the thing goes sideways for a while, the longer the better. Most of the haters are out, but not all. There are a few traders in there sweeping the bottom of the cup. They’re still a bit nervous too. So sometimes the thing breaks out and runs all day and sometimes it is a false break, where people are just happy to take a slightly higher price.

Because I follow the market closely, I thought that this one had legs. It has a big THING happening in the future, but the last time it did a big THING that THING didn’t pay off. So it had volume, failure, hatred, and was starting to show some vague stability.

So I put a price alert above the top of that sideways section, a news alert on the stock, and waited. I wanted to know that the THING was coming, that the buyers were paying up.

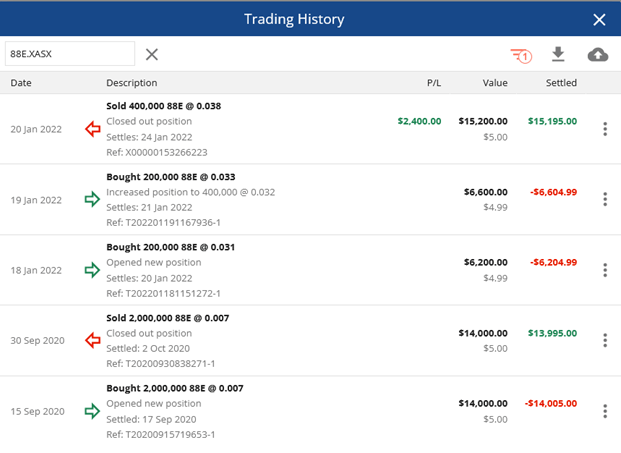

And on the break, I dip in. In this case, about 50% of the eventual amount I wanted to buy if the cup and handle played out. I didn’t pick 50% for any reason, just felt right.

Then, in this case, I was set on that first green candle. I added the dotted line so you can see what I mean.

You should also note the moving averages, with the short-term averages crossing the long-term (yellow) as confirmation that the trend was moving up. Some call that the ‘golden cross’.

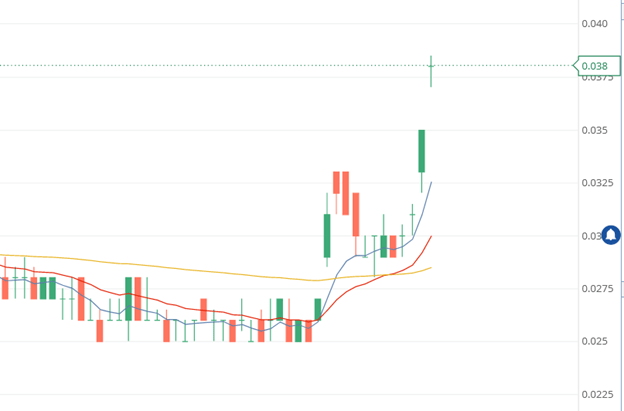

Part Three; The handle.

Now I wasn’t sure if it would keep running or not. So I had some, just in case, but not so much that I would cry if it was a false break.

If it was a false break, I’d probably have to lose a few bucks, stop-loss it out (we also have stop-loss orders) and then rinse repeat again later.

But it followed through. Phew. Then sold off back to the bottom of the first ‘break out candle’, and held around there okay for a couple of days. Started to tick back up, then – the money – another tidy gap up!

Woot woot!

So, being a degenerate gambler, it was time to buy the second break.

It continued to rally during the day on volume. Great sign.

Part Four; the hardest part.

The next day it gapped again.

You can see the alert there on the chart, you can put as many of those on as you want. Because the live prices live-stream, you can even watch the chart move before your eyes and you don’t have to sit there hitting the refresh button like an amateur.

Herein lies the problem. I have taken advantage of fear by buying, now I have to battle the demons of greed.

By this point I’ve made 18% in 12 days. Risking $12k, I’m up over $2k. If you haven’t guessed what this stock is, here’s a hint, they drill for oil in one of the most pristine environments known to man. So, I’m a bit worried that they could get knocked back at any time.

Equally, I left $100k on the table last time I traded them, so I have something to prove to myself, and after Brainchip’s run I know that the crazies are still in charge of the asylum. And last time the crazies took this from 0.7c to 9.7c.

But I never look back, only forwards, and this was a nice little trade. So I now have $2k more to my name than I did before.

Plus, I took a swag of NiCo Resources in the float. And with a couple of nice big wins under my belt I’m feeling a bit more cautious. Whenever I start looking at sports cars it’s time for me to be taking a bit off the table…

So that’s that. And that’s why we put those trading features in our platform, so you could do that too. Because that’s what the pros use to take your money, and some of you are still trading on delayed data with line charts.

For only $45 a month, and with $5 trades up to $25k, maybe you’re selling yourself short.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market, you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

Marketech Focus subscribers also get 2-months free access to the ‘Marcus Today’ newsletter to help you with your investing and trading goals.

Go to www.marketech.com.au to set up a free trial – you will be astounded by the simplicity and tools that this technology gives For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Online Trading Pty Ltd (ACN 654 674 432), an Authorised Representative (1293528) of Sanlam Private Wealth Pty Ltd (AFSL 337927), and a Stockhead advertiser at the time of publishing.

All information and material contained herein is general in nature and does not consider your financial situation, investment needs or objectives.

The information does not constitute personal financial advice, nor a recommendation or opinion that a security or service is appropriate for you.

You should seek independent and professional tax and financial advice before making any decision based on this information.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.