Trading with Focus – Stereotypes

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Whilst still chuckling at the picture of Abe Simpson, I remind myself to be verrrrrrry careful with this topic.

There is a fine line between comedy and offense. I don’t know when, or how, but at some point, over the last 20 years, that line moved. A lot. And I don’t know where it is anymore, or who decides.

I’m going to say that a lot of it is obvious in hindsight, like when you look back at the way you behaved at Xmas and someone says, “that wasn’t cool”, and immediately a light goes on in your head, and you think “yeah, you’re right, I was out of line”.

Not me though, I was a saint at Xmas. Always have been….

I was already judging a lot of the Simpsons characters back in the day before the general population caught up. But I had to watch it over and over again, and quote it, just to make sure I understood every nuance of how it negatively portrayed stereotypes, from race, to parents, to older men and fat little kids. Every single character went beyond caricature.

I was just pretending to laugh. I swear.

Yet even though we look back at how stereotyping has negatively affected people in the past, we still repeat the same mistakes – only we now force stereotypes onto different groups of people.

We see it now online and in the socials, where you can still be a bully and be socially irresponsible. reddit and Facebook memes about ‘Karens’ are pretty funny until you realise there are still normal, friendly people with the name Karen that have been caught up in it. People will stereotype anything for a laugh, right up until the Karens form a political party and storm Capitol Hill. No, wait…

But in some cases, the stereotyping is more subtle and did not come into being because someone on reddit thought it was funny. The person or people who create or perpetuate the stereotype can even do it without knowledge that they are doing it, but it is just as insidious. If not more so.

The stereotype that I am building up to is the ‘Millennial’.

According to some random webpage I found after googling it, they are somewhere between 22 and 38 years old, lazy, poorly prepared and lack aspiration. They don’t stick at things. And they have a sense of entitlement.

But, like all generations, there is some overlap with the next lot, the Gen Z kids. They are alleged to have the attention span of a goldfish and are addicted to technology, especially the social medias that allow them to all peacock around on the internet, flitting from shiny fad to shiny fad. TikTokTwat.

But, for every Abe Simpson there is a Dr Anthony Fauci, and I know some Millennials that will put anyone to shame with their work ethic. (Still a bit sketchy on Gen Z though.)

I was asked the other day if our trading platform is for beginners, by someone associated with the media, and I nearly went off on a rant about how inappropriate a question it was, quickly remembering not to make enemies in the media.

Then I remembered why they were asking, and it’s not really their fault. They only know what they know from all the other recent additions to the share trading world; in fact, almost every addition to the share trading world since IRESS launched online.

I can only guess they assume that for something to be suitable for a beginner in the stockmarket that a trading platform must be basic, and come with pretty colours and so little information as to need no explanation.

It’s because all of the recent trading platforms in the market have been de-tuned, have had functions removed, and data removed and really snappy advertising campaigns downplaying the risk component of the risk/reward trade-off in share trading. As if YOLO-ing is a valid strategy and FOMO-ing is cured by buying shares with no profit at their highs!

One avenue to make a share trading platform cheaper includes removing live ASX pricing – so they did! You can’t sell people’s trading information to high-frequency traders in Australia (as they do at Robinhood), and allow them to front run your clients. But you can pool all their money and shares, as the younger players probably don’t remember Opes Prime.

And scrape all the interest from their bank accounts.

But some of it is because they think younger people are too lazy to learn, and more interested in being cool and being part of the latest fad, than being serious about investing. Don’t immediately understand something? Pull it out, put in a pretty picture or some youngster lingo and give Boomers some stick!

(Don’t understand how brakes work? Get rid of em! Damn Boomer-brakes!)

Now, apart from being cringey for the product provider, and insulting to the younger generation that they are trying to appeal to, that is just fantastic news for a couple of major reasons.

- They don’t actually provide the tools and data to trade properly, which means a Marketech trader has an advantage. Charts are weak, data is light, more often than not their share prices are 20 minutes older than yours…

- Their entire business model is based around these supposedly ‘don’t stick at things’ traders actually sticking around and continuing to trade in a weaker or flat market, meaning that at some point they’ll probably be Xinja’d. Better hope that the accounting is solid on those pooled trusts if they get wound up. Marketech traders have their own HIN and their own bank account to go wherever they please, whenever they please.

How is Marketech Focus any different, I hear you asking?

Our product was designed to take all of the information that you need and make it easily accessible. We didn’t just turn it off or remove it because it’s hard to learn.

Millennials can drive cars, right? They can also learn how charts work and how to place trades without everything being simplified down to a meme.

We made it cheaper by partnering with third parties rather than trying to do it all ourselves. We do the platform, OpenMarkets do the settlement, Macquarie do the banking.

Sharesight can do your tax reporting if you want it, but we aren’t forcing the cost of a tax report on every user, regardless of whether they want it. Fee for service, baby! Only pay for the things you want.

Technology lets us take higher level functions and redesign them to be much easier to use and understand – and cheaper, and more mobile. Well, it let us do it anyway… but we spent six years building our platform and we’re still working on improving it to be the way our users want it to be.

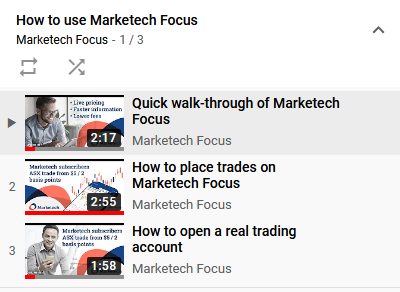

Here’s how the platform works for those of you that want to learn some things by watching a video.

Hyperlink: https://www.youtube.com/watch?v=R0Q45QiFy2E&list=PLZVoeW0G3o8god3ZVH-715brF3BS6s2eo

So, if you’re not just buying shares because Elon Musk is cool, if you’re not trying to lose money for reddit karma, if you’re actually serious about making money and protecting yourself, we present Marketech Focus – the memeless, rocketless, non-YOLO platform for the serious investor of any age!

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC. You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.