Trading with Focus – Staying ahead of the herd

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Its hard to hate Brad Pitt. He’s done so much good work. Sure he’s done a lot of ‘Brad Pitt with his shirt off’ roles, but he also nailed the crazy guy role in ‘12 Monkeys’ and Mickey in ‘Snatch’ and Jesse James in ‘The Assassination of Jesse James by the Coward Robert Ford’. In fact, scrolling through IMDB (which is the Jaxsta of movies…) its hard to find a role that he didn’t nail.

But, he has been in some terrible movies. And that is a big difference. (‘Troy’ for example, even though I watched it again last night.)

Ever since Rob Zombie (lead singer of Ministry – ‘Jesus Built My HotRod’ fame) popularized the genre, humans have been strangely compelled towards the end-of-days zombie action movies and TV shows and cartoons and even books. George Romero might have had something to do with it too, I guess…

But if I could punch Brad Pitt in the face for choosing to star in World War Z…I would.

I read the book ‘World War Z: An Oral History of the Zombie War’ back when it was first released and it would have to be the best zombie thing ever done, hands down. In fact, even if you don’t like zombies, remove the word ‘zombie’ and insert any other human catastrophe, and the series of stories about the human condition will stick with you for years. A genuinely great book. (Honestly, if you can read a book, you should read this one. The guy who wrote it is actually Mel Brooks son, and having written it, now lectures something along the lines of ‘End of days Disaster Planning’ at West Point, the US Naval College!)

But ‘World War Z’ starring Brad Pitt was a disgrace. Boooo, you suck!

(Nah it was ok, but they shouldn’t have ruined the book by naming a seemingly unrelated movie after it.)

Anyway, one of the things about zombies is that there are seemingly endless versions of them. The slow ones, the brain eating ones, the fast ones, the semi-intelligent ones, the almost super-powered ones. But one thing they all have in common is that they are usually as dumb as a bag of rocks and their relentless desire for getting what they want often sees them moving in herds, and because they have no perceptible concern for their well-being they often pile-up over each other then run off cliffs or the tops of buildings and so forth.

I think you know where I’m going. But I couldn’t very well call the article “How do you know if you are following a brainless herd with little respect for your personal well-being and are about to run off a cliff?”

Maybe you waited too long to see how the Covid stimulus rebound in the market would go before diving in and chased the best returning stocks, and now you’re underwater.

Maybe you read something from an alarmist stock commentator about how ‘banks were dead’ and moved your CBA shares into APT at $150, and now your love of share trading is a hatred.

Maybe you thought gold was coming back as a form of currency because they devalued cash by printing too much of it and bought a gold explorer in West Africa, and they didn’t find gold.

Maybe you genuinely believed that crypto was an investment, because Elon said so, and he’s rich, then after its recent falls you’re thinking everything except property is a scam.

Or maybe you heard a mate, who recently bought a new Mercedes sports car, talking about some placement he was going into and how it was definitely going to be a winner. Then it wasn’t.

Well, you’re not alone. ASIC jumped the gun by about a year and a couple of thousand index points by warning retail investors to be cautious in early 2020. The newspapers went wild with the commentary, and the retail army rose up and screamed in unison “what do you know?!” and proceeded to outperform the institutions. What ASIC didn’t define, because they don’t own a crystal ball, was ‘when’.

Until recently, the way to make money in the stockmarket was to be in the stockmarket. And for anyone who knows the history of the stockmarket, these are scary times for the ‘shit end of town’, where share prices are made up of a bit of cash in the bank and 90% speculation that they’ll do something useful with it. Which means at least 90% downside risk to a lot of stocks, if not more.

You probably already know the imaginary bell started ringing in Feb, when we surely reached peak speculation for this run. Markets and stocks can’t go up for ever, so what do you do now?

Its almost harder than punching yourself in the face to sell a stock at a loss, when you believe soooo much in them and were at one point in profit. Everything inside your head tells you that the fundamental value of the company is still high, and maybe if you hang in there, or even buy more (now that they are on sale), that it will all be alright. But there are stocks that will recover from this recent weakness, and some that will continue to fall.

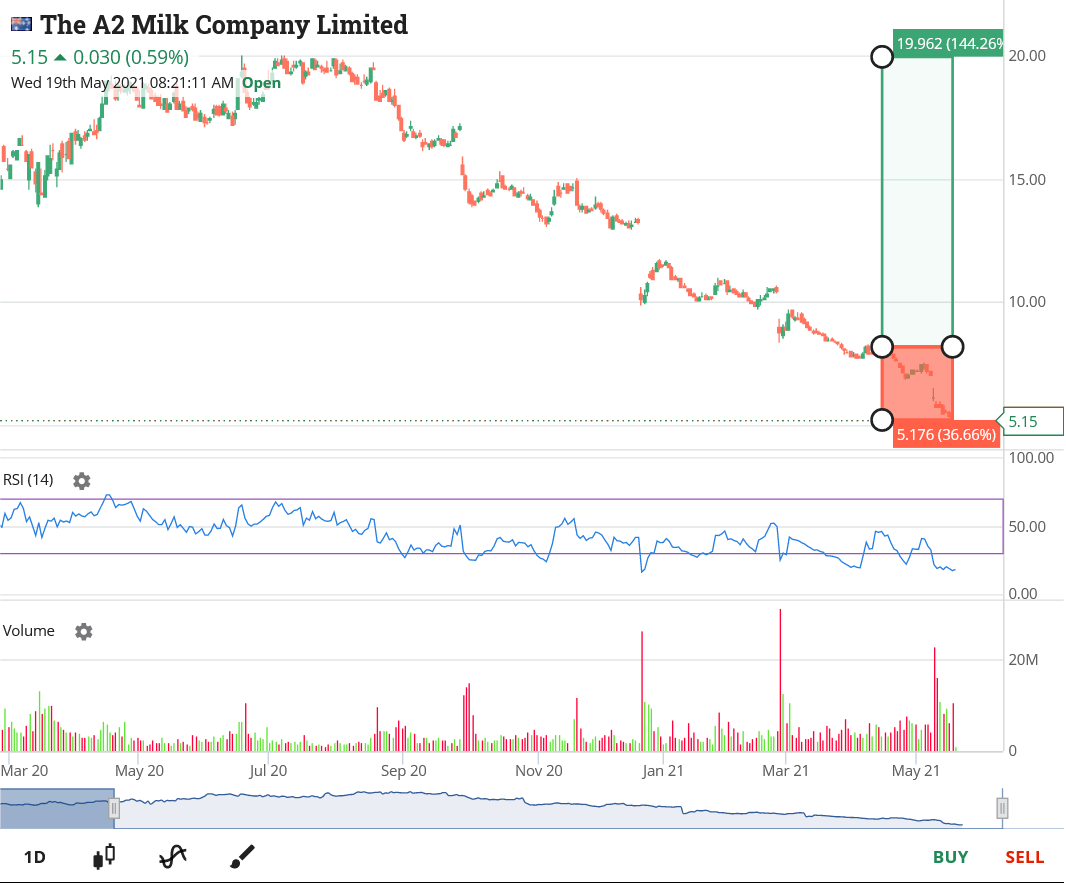

About a month ago, and remembering that I’m not recommending anything to anyone, I wrote about A2M Milk. They had gone from market darling at $20, to doggy-goes-woofalot at $8.24. Something about China and management. Even after falling that low, they have continued to weaken, so if you had sold then, you would not have suffered through losing another third of your holding value.

Look at this awesome trade-planning calculator that we have, making it so easy for me to make my point!

At the time I thought there might have been a good bounce trade in A2M. It was generally hated, being torn apart by the financial media and well below its highs. And, it actually makes money, its just that it has stopped growing at the rate it was. But once a stock stops being a high-growth darling, you have to wait for all the zombies to jump off first, because otherwise you’ll end up at the bottom with a load of zombies continuing to pile on top of you. I ran a few technical indicators at the time and there was no sign that peak fear had been reached.

A while back the ASX and ASIC did nothing to as the floodgates were opened up for first time traders, and yet have been progressively making it harder to get advice. You can now buy $100 worth of shares for $5 in a pooled trust and you’ve got FinTockfluencers telling people about how they got rich by buying shares, when really, people who can only afford to buy $100 worth of a share shouldn’t be buying shares and someone with pimples shouldn’t be allowed to recommend stocks, unless you suffer from adult acne and a pizza-addiction like I do.

So now you are chasing momentum in the market for good quality investments – in a market full of people who don’t know what a downturn feels like, can’t afford to lose money, don’t know what they are doing, and don’t have the capital to buy more if the price pulls back. Who panic at the bottom and buy more at the top.

Zombie alert.

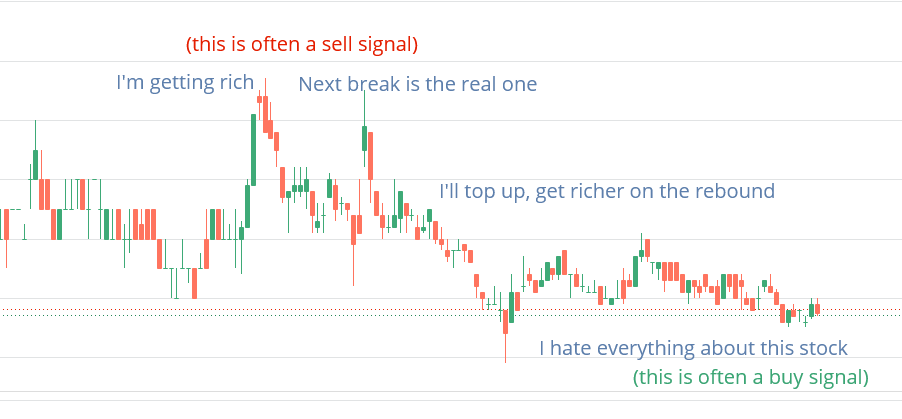

Here’s how that thought process works:

In a zombie movie, there are always some fairly strong constants. Avoid the cities. The shops on the main highways have probably been looted already. Look for the small out of way towns that no-one has noticed, and always be prepared to run. Maybe start thinking like that with this market.

So the headline stocks have all run, which is what makes them headline stocks in the first place. Until they get the A2M/Nuix-type headlines of ultra-negativity, which then makes them a bit more interesting and you almost have to look for the ‘apologies to shareholders’ kind of news. Because after falling off a cliff you probably shouldn’t be so afraid of falling off a cliff, but waiting for the falling zombies to thin out.

Its probably going to get harder from here. For all of us. The easy money has probably been made. You will now need to be more vigilant and more fundamentally skewed. Companies that make profit are more likely to recover. Companies that pay stable dividends are more like to be bought on weakness, especially while term deposits are 0.2% pa. Because there is way more money in the combined SMSF bank accounts than there is in all of the bank accounts of the people talking about stocks on reddit or Facebook.

So be careful, because even zombies can bounce.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.