Trading with Focus – Started with 50 cents, got rich, have 50 cents again

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

50 Cent aka Curtis Jackson. What a story…

As a young’n he made a mixtape and in that mixtape he mumbled some lines – naming local drug dealers – in a ‘song’. So they shot him nine times. Nearly died, as you can imagine…

Then Eminem found him. Introduced him to Dr Dre. They bought some beats off Nas. Then Dre (who is a true master) took Fiddy’s very average mumblings, a phat beat and produced it into one of the most iconic songs of the time.

Yep, Fiddy takes the win and the glory.

Nearly dead, then almost immediately rich.

His ‘In Da Club’ song (?) has over a billion views on YouTube alone. Even just clicking on it momentarily today, I immediately get cast back to images of a hen’s party group of ‘chubbier and older than they should be, to be doin that, in here’ ladies called Tarryn and Britenay trying to dance provocatively. Shudder…

Mr Cent made over $261m USD between 2007 and 2019, and yet in 2015 he declared bankruptcy with debts of $30m.

Then… again… he bounced back as he still had famous and wealthy friends – and America just be like that.

Now, he is a parody. Well, in my eyes anyway. But in reality, he leveraged the fame, reinvented and staged a comeback each time he looked beat. Acting, directing, helping other mumble rappers. Probably clothing. I only skimmed the rest…

All companies start small. Some of them start small on the stockmarket, and some of them come to the stockmarket after they’re already big. Often it depends on whether they are Curtis Jackson already, and already dropped a mixtape and are already hanging out with Marshall and Dre – or whether they need the money and the fame that an ASX listing can bring to try and become 50 Cent.

Welcome to the Casino end of the market. The shell game. Where previously failed companies and their directors and shareholders want to find something else to do, rather than admitting defeat.

Fortescue was put into a shell once upon a time, as was Afterpay. So were pretty much all of the lithium plays, as the need for industrial lithium in large volumes is very new and future demand is currently thought to probably be more than current expectations of supply probably will be (aka a whole lot of probably’s).

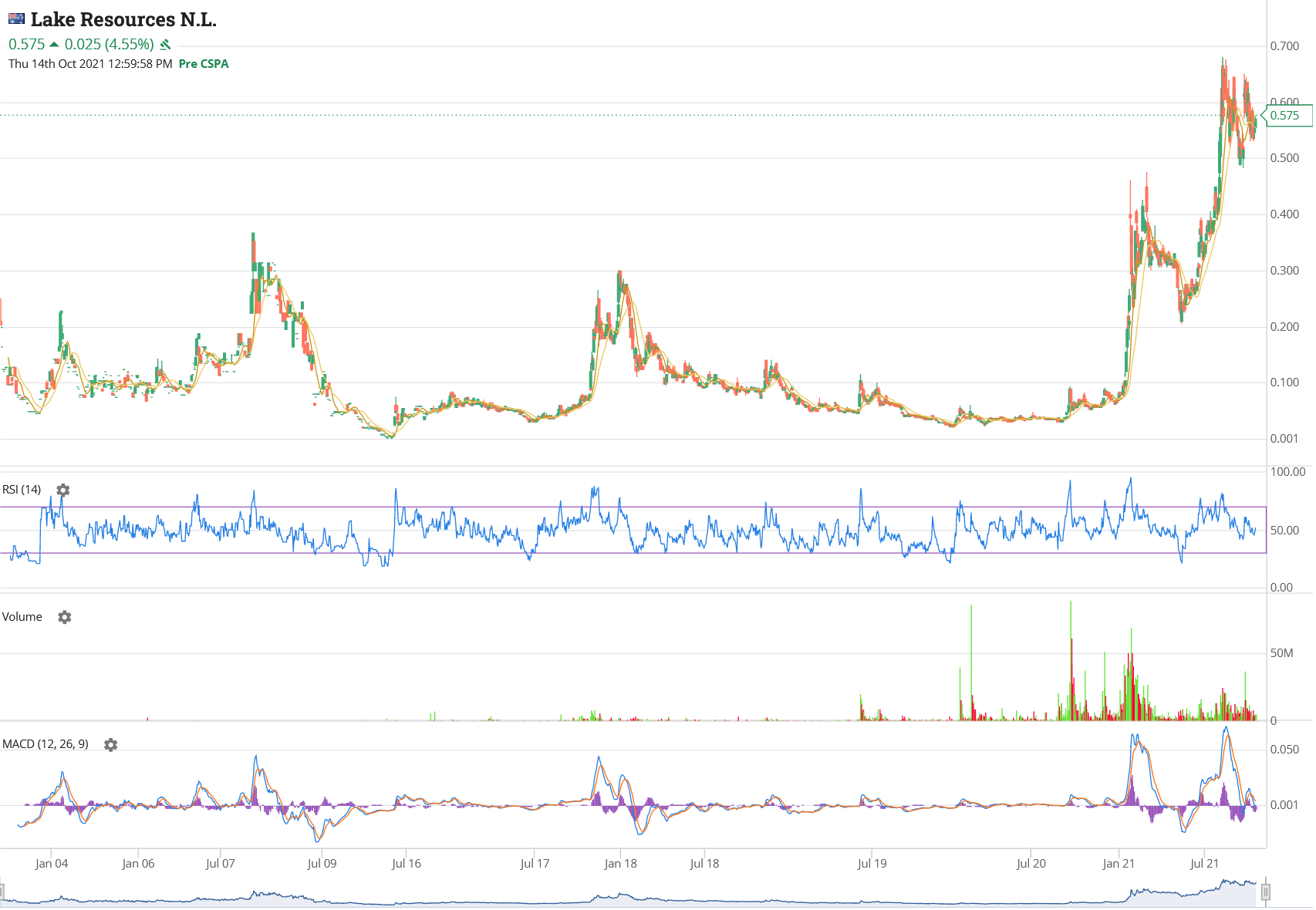

I mean, seriously, look at Lake Resources since 2001!

(Lakes Resources chart from 2001 to 2021 – Source: Marketech Focus)

This stock has had so many different projects, different management teams, capital raisings, it has to be the King of the Phoenixes!

Yet, like Fiddy, it rose again. It found another ‘right project at the right time’ and has gone to new all-time highs on the back of lithium. You can’t scroll in on the photo above (because this is just a snapshot from the Marketech Focus trading platform), but at one time you could have had your fill of shares at almost the lowest price-tick of them all!

It traded at 0.2c, but you wouldn’t have got many. However on the 16th of September 2014 you could have bought 2.3m shares in Lake Resources at 0.5c, which is about $11500 plus bro.

That shareholding would have been worth almost $700,000 by the end of 2017. Nice.

Not quite ‘rich’, but as Fiddy would say “isnvtbungg plibbertng sma”, which in non-mumble translates to ‘yeah but I aint dead yet’.

What would you have done? Sold it? Hung on because you didn’t want to pay the tax?

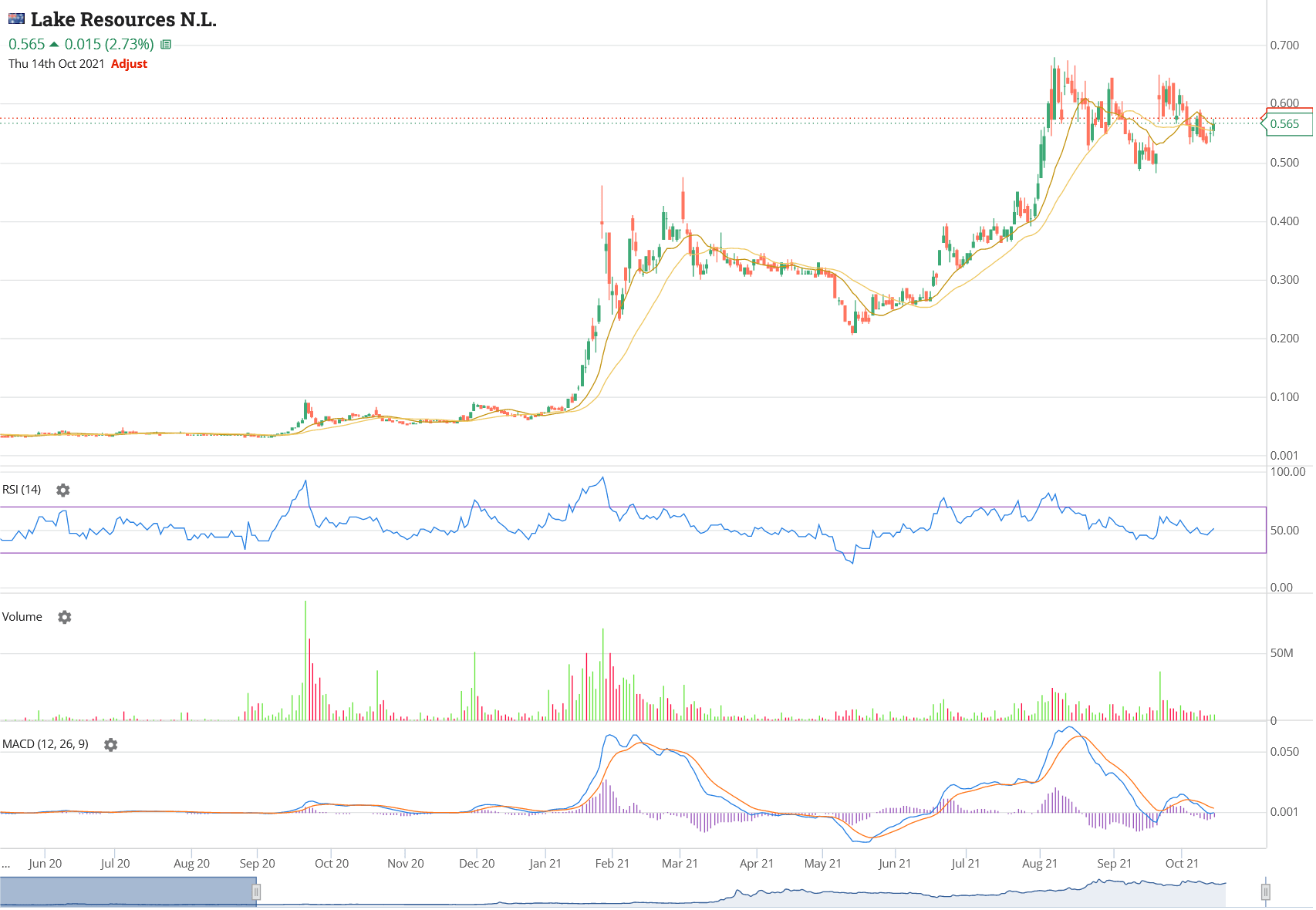

(Lakes Resources chart from 2011 to 2021 – Source: Marketech Focus)

The next step for our Lake Resources shareholder/almost millionaire was another re-reinvention, and sadly, another dip.

By the end of 2019, that shareholding had shot up from $11500 to $700,000, but then shot back down to $50k. Still a tidy profit, but damn.

What would you have done then? Sheesh!!

Anyways, like Fiddy, Lake Resources rose again. Recently, they peaked at 68 cents. So that shareholding would now be worth $1.64m!!!!!

(Lakes Resources chart from 2020 to 2021 – Source: Marketech Focus)

From $11,000 to $700,000, back to $50,000 and now $1.6m – now that, my friends, that…is a wild ride!!

So where to now for Lake Resources and our maybe-plucky millionaire?

Well on one hand, according to financial services lore – historical returns are not a good indicator of future returns. And on the other hand, 50 Cent is still grinding, still hustling, and maybe he’s not ready to stop reinventing his brand, taking on the big risks, putting it all on the line, so maybe Lakes has a few more surprises for us all too.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Online Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.