Trading with Focus – Something about supply chains

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

I don’t really get into wrastlin’ but I do love the idea of it.

The massive-est blokes, wearing dress-ups, spending years perfecting the art of looking like they are hurting each other – but without hurting each other.

Mostly…

Having watching G.L.O.W. (Gorgeous Ladies of Wrestling) on Netflix, starring my crush Alison Brie, I think that I can now speak confidently as a professional wrastlin’ commentator (maybe even get a YouTube account?).

Wrastlers practice and practice and practice – it is so well rehearsed as to be almost a dance. And no-one should get seriously hurt.

The crowd goes wild with every hit and every manouevre, believing right to the end that any fighter could emerge the winner – and it’s fun! Each blow seems to be inflicting damage, so that the damage seems to accumulate. And the winner should be the one inflicting the most blows, so the crowd can choose sides based on how many blows they think each fighter has doled out.

They’re bantering between each other, having fun all the while – “the guy dressed like an army man will win” – “No, it’s the one with the cut-off denims”…”look out, here comes a 70’s Middle Eastern stereotype!”

But no, it is all decided by the powers-that-be well before. The whole season is scripted in the same way as a TV mini-series, with love scenes and betrayals in the cut-scenes between the fights. And as long as everything goes according to plan, the crowd will stay on the edge of their seat, not actually begging for blood, but feeling a ‘lite’ version of the animal intincts that we feel watching a schoolyard tussle.

And everyone in the business of wrastlin’ makes a lot of money. They take it off the crowd. They take it off the advertisers and networks and merchandisers. The ones at the top get the most, then it trickles all the way down.

But then, something does not go to plan. A chair that was supposed to snap over the shoulder hits the kidney and he goes down hard, or the 140kg of beefcake does a double front flip off the ropes, slips slightly, and lands on his noggin.

The ‘fighter’ is injured. The expected winner does not win. The cut-scene where he was supposed to propose to the vanquished’s girlfriend cannot proceed. He can’t participate in the three-way smackdown with the old ladies that were going to jump in.

This is actual disruption, not the pretend kind that I keep seeing…

The crowd is unsure what to do next. No winner. Someone actually hurt. Real risk, leading to real pain. What was just fun and games is now actually a bit scary, because something came out of left field that no-one saw coming.

The viewers who were supporting the now-injured beefcake turn off the TV, the advertisers see lower viewing numbers and reduce their spend, the ‘cheating girlfriend scenes’ are cut meaning the actor and her manager and agent don’t get paid. The insurance rates go up. The merchandisers see a drop in sales. The flow-on effects of what seemed to be a simple error are huge!

No one saw it coming. So the effects were much higher than if they’d been rehearsed, or considered, or positioned for.

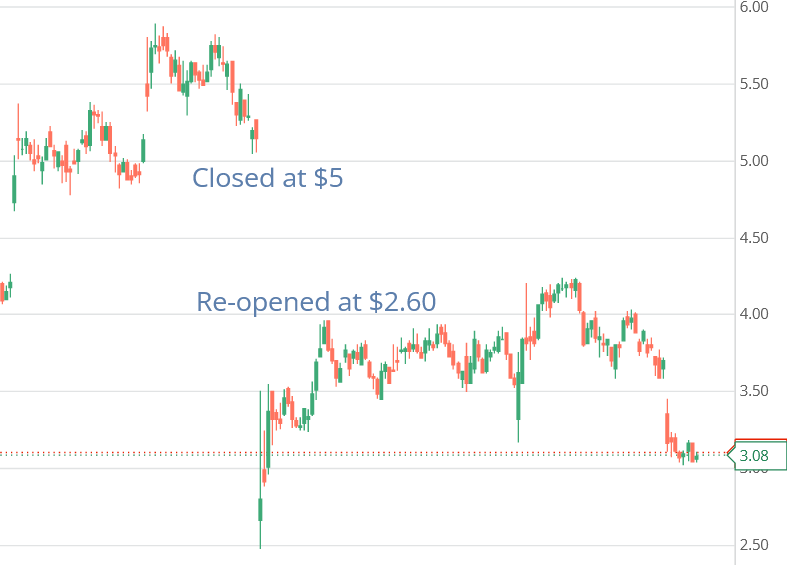

Like this….

(Source: Marketech Focus trading platform – Showing the effect on a stock in an upward trend, with unexpected bad news)

The more time you spend in the stockmarket, the more you start looking for the next big risk. There’s a bit of a sport for it at the moment, because this overheated, supercharged market pulled back a bit recently.

So everyones looking at bond yields and iron ore prices and profits and making rational arguments for each of them being the possible catalyst for a sell-off, or as headfakes that are a normal part of a bullmarket throwing up ‘buy the dip’ signals.

The market always has to climb a wall of these sorts of fears.

The effect of all of those factors are largely known. We’ve always had interest rates and bond yields, and they are live-streamed 24/7, and the massive enthralled crowd constantly argues about them – and bets each way to create a normal market. Same with commodity prices. And company profits, especially the large ones that matter are largely telegraphed by management to the market and the analysts that follow each company like a hawk.

So its rarely the ‘knowns’ that create a big correction. We’ve known about the likelihood of coming inflationary pressure, and we’ve known about artificially low interest rates having to go back up one day. They are the cheographed ‘flying elbow’ and the well-practiced ‘piledriver’. We look out for them, and they are potentially dangerous – but the market has ways of telegraphing these to us well in advance.

What I am starting to read about, more regularly, but rarely as a leading headline, is supply chain disruption. I’m busily looking out for stories about the effects of interest rates and Chinese growth as I know them well enough to be worried about them, and they are as typically concerning as they always are. And there are lots of headlines about them.

But ‘supply chain disruption’ has the potential to be the ‘slipped off the top rope and landed on his noggin’.

Think about it.

Twiggy realised the importance of rail in getting his ore to port. It was so important that he build his own rail network, so he didn’t have to rely on someone else’s – he wouldn’t even trust the government lines. He wouldn’t trust the roads. Billions spent on infrastructure to ensure delivery. To port.

But what if the ships didn’t come to carry it all off to China?

In that event iron ore prices wouldn’t mean a thing because they couldn’t get the iron ore off the train at the port. Then the train can’t go back for more. Then the mine can’t keep producing. Then the workers get laid off. And so forth.

And in that scenario, at the other end, once they run through their stockpiles China wouldn’t be able to make as much steel. It wants more, but there is limited supply, so the price goes up – crazily. But if the ships don’t deliver the product from Australian ports, it doesn’t matter what the price is to Australian iron ore producers. They couldn’t deliver their ore, so they can’t get paid.

Then, due to a lack of steel, China couldn’t build cars, let alone deliver them. So we don’t have new cars to replace the old. So the price of new cars goes up, until we run out, because we don’t make many cars here any more. And the price of old cars would rocket too (more so!), but getting parts becomes harder and harder.

And China can’t build without steel, so their building industry is screwed (more so), and Australia doesn’t make enough steel of its own, so the Australian building industry is screwed too. And without new supply, the price of houses goes through the roof. More so.

The flow-on effects of a serious break in the supply chain would be enormous, even if this isn’t the actual disruption (but just an example).

With globalisation, the supply chain became the single most important issue to the global economy, because we have to move things from one country to another.

There hasn’t been a real break to the global supply chain that I can think of since World War 2, with globalisation having only taken off in the years since, and having been largely protected since. We’re starting to read about the flow-on effects of Brexit to Britain, who voted for it because they were against more immigration, but are now suffering from food and oil shortages.

Now, I’m not saying this is going to happen. Things can, and often do, sort themselves out. Maybe the governments of the world do have a plan to deal with these risks, or at least ‘plan to plan’. But with the pandemic having come and done its thing, we haven’t really seen any flow-on disruption yet.

Volatility in share prices, sure, but serious disruption of the global economy? No.

I regularly get pshawed by the millenial audience when I start banging on about risk, and whether its appropriate for direct share investment to be advertised to people who were five years old when the last major global shock hit the market. They bought into this last sell-off, so they are likely doing pretty well and taking on more risk than they should. And being experts at things is easy, when it’s easy.

“Let them buy shares, old man. We’re democratising the share market,” they probably say… And that’s okay, because maybe the best way to learn about risk is not to watch wrestling on TV, but to jump off the top rope yourself, with no training, and no safety gear until you fall off.

And having fallen off, what then? Not sure how cool I am with an entire generation being suckered into a high-risk investment class, at one of the highest risk times many of us have encountered, in a calm market at all time highs. Although it may not have any direct effect on me (it’s not like they owe me any money) the flow-on effect of a million Australians losing half their money in the stockmarket wouldn’t leave me unscathed.

And it seems easy to buy shares, and cheap, but there’s a reason professional traders have a trading platform and not just a simple website that you can buy and sell shares on…

Even if you practice and practice and practice, you will still find that you can get badly hurt. And that has flow-on effects to others. So maybe a proper trading platform is the safety gear, and maybe you need one that is focussed on data and pro-tools, and not just lowest price.

Or maybe you still need some advice, and just having a trading platform isn’t enough either..?

(We have a big couple of weeks coming up for Marketech, with a big platform update filled with user-requested features and something even more exciting in the wings – so go and trial it now or you might get caught in the queue.) Also; (You call that disruption? I’ll show you disruption bwaorhwaahwaaa….!)

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Online Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.