Trading with Focus – Short term trading ideas

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

There are a few different ways you can come up with trading ideas, and then successfully enter and exit them without emotion. Let’s review a couple.

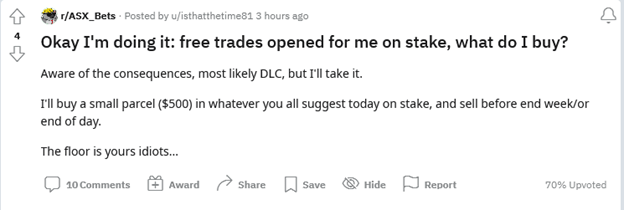

- Chat rooms, where people don’t use their real names.

- By listening to professionals who have undergraduate degrees in law and economics, an MBA, a Graduate Diploma in Applied Finance, a Diploma in Technical Analysis (ATAA) and a Certified Financial Technician (IFTA) accreditation and regularly appear on the podium of the Stockpicker of the Year Award, as judged by the Australian Stockbrokers Foundation.

In the first instance, we have such honorable mentions as… this guy’s strategy:

In the second instance, I’ll use Chris Conway of ‘Marcus Today’ as an example. And because he’s not a bad-looking rooster either, he can also be seen regularly (talking way too much sense) on serious investing shows such as Ausbiz TV. And if it’s good enough for Kochie…

And that’s just in the spare time that he has in between putting out three daily newsletters of advice, opinion, research, portfolio recommendations and more, with the rest of the team at Marcus Today.

In there, he offers a number of ‘trading tips’ as just a part of the mix. And he runs a historical win/loss so you can see if he is any good over time. And their subscribers are more likely to be more serious hitters flinging real dough, than say, the aforementioned DLC guy.

At the end of the day it’s up to you, dear reader, and I’m sure the DLC customer/investor seeking reddit tips and using a free trading app has a place too – probably more so at Randwick though.

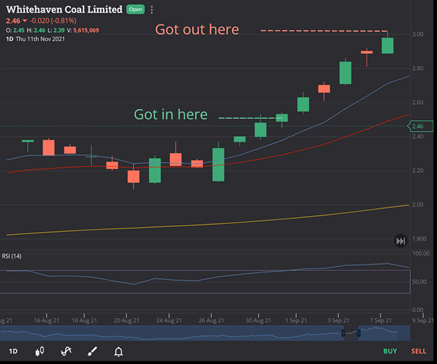

I’ll run some examples using a couple of Chris’s past trades.

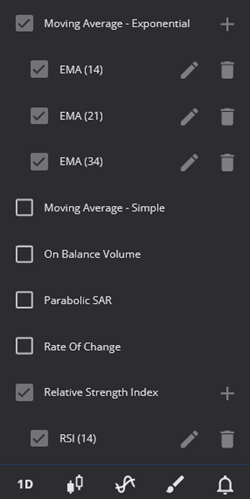

Chris often talks in terms of the RSI and the 3EMAs. So what are they? (And why wouldn’t I just lazily cut and paste his words…)

“The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. The range of values an RSI can take ranges from 0 to 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. An RSI Buy signals only occur, however, when the value of the RSI crosses back above the 30 line.”

Q: And how do you calculate and overlay the RSI on your price charts in Marketech Focus?

A: There’s a button you click that turns it on and off.

But it’s not just that you have the RSI, it’s how you use it.

And he goes on:

“3EMA is a simple, easy-to-understand trend following a template designed to highlight stocks which are trending across multiple timeframes. Trend alignment is the key. The strategy will identify short- to medium-term timeframe opportunities (i.e. day/weeks to weeks/months).

As the name suggests, the template uses 3 EMAs (exponential moving averages) which need to be in a certain configuration for a stock to pass the ‘test’.”

Q: So, just another button in Marketech Focus?

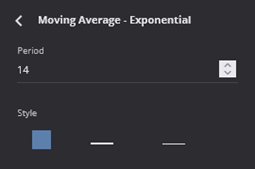

A: Yes, this one also requires you to press a button. But because Chris runs 3 different moving averages to see the short, medium and long-term trends then you’ll need to add a second and third moving average by clicking the + sign. Then, click the crayon button to adjust the time period (over which the average is moved), and probably, the colour, and possibly, even the line style!

And then, again, it’s not just having it, but knowing how to use it…and all this makes more sense if you do it for yourself, using our free two-week live-streaming trial that you can access through our website.

Please note, these are not the timeframes of the moving averages that Chris uses! And for that you will have to read on….

So firstly, he has a strategy.

Then, once he has his strategy in place he probably has a target price to get out – or at least a set of parameters under which he would – but he has also made a decision about how much he is prepared to lose well before hitting the buy button.

If it were me, I’d recommend putting in a news alert to ping your mobile phone (while you’re off teaching your remedial art history class or whatever you do – in case something comes out of left field like ‘MD of mining company finally arrested for falsifying exploration data’).

Then, I’d put in a higher price alert in case it got close to that profit target – and a price alert below, in case it started to go south.

Or…I’d put in a conditional order higher, to sell if it got up there, and also a conditional (or stop) order below- in case it tanked. That way I wouldn’t have to worry myself about doing that troublesome task in the future – and I could go about my busy day knowing that now I am one of the bots on the ASX that everyone frets about.

He absolutely crushed this one, about 20% over 5 days!

(I would probably have thought to myself: “…Hmmm, it’s already run, I’ve probably missed it. And people hate coal.” And then missed it.)

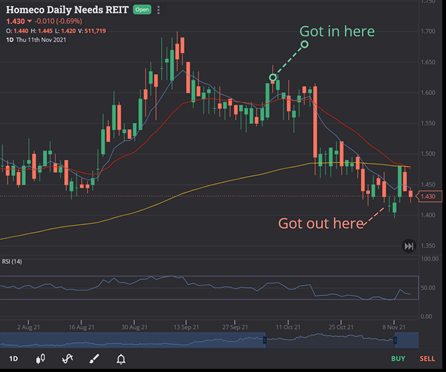

And to prove that this is not biased reporting, he recommended stopping out of this next one (where I would probably have thought “It’ll be ok, just oversold, should get some yield support, there’ll be a switch back into defensives”, and then I would have hung on and put just another trading stock into my disgraceful bin of ‘now they’re long termers’. So if, like me, you mostly suck at taking your own advice, then maybe just follow a licensed professional’s advice?).

Spewing…

But anyone can get it wrong from time to time, just like a Formula One driver can crash. It would be more questionable if he didn’t. The trick (in my opinion) to trading is to get it right more often than wrong, because if you stick to a strategy and it keeps being wrong then you probably have the wrong strategy.

But you should at least have a strategy…

And to get out when you should get out, not changing strategy halfway through a trade.

As they say – don’t fall in love with a trade, because trades don’t love you. And they’ll hurt you if you let them. (Or, you can marry good girls like Wesfarmers, but only date the fast ones like Whitehaven? I probably can’t say that…)

I think we can assume that he gets more right than wrong, on the basis that he regularly appears on the podium of the Stockpicker of the Year Award, as judged by the Australian Stockbrokers Foundation. And if that wasn’t enough proof, he got 37 right out of 50 in the year up to April 2021 for a win rate of 74% weighted by size of gain/loss.

Not that past performance is any indication of future performance, but as one of our low-cost online brothers say in their ads – “The market waits for no-one!” (how is that slogan even legal?!)

Anyway, so, for $70 a month, how many trades do you think he would have to get right enough to justify the cost? Never mind – that’s rhetorical.

And for the sake of saving $45 a month, how many trades like this would you miss because you’re using old data, with no alerts or charting or trading tools, or maybe just some old click to refresh website thing..? Withdrawn – rhetorical.

Are you still hanging on to find out what Chris’s EMA timeframes are, or how he decides when to take profits/stop-losses or what his latest trade ideas are?

Well, pop over to our website, open yourself an account, subscribe for $45 a month, get live-streaming and a whole lot of other pro-tools as well as trades from $5 on HIN, and we’ll throw in a couple of months of ‘Marcus Today’ for free, $190 in value!

Non-conflicted long- and short-term advice combined with non-conflicted low-bro trading on HIN and a professional level trading platform with live-streaming that’s easy to use. Or, keep rolling your strategy like the DLC customer on r/ASX_Bets?

Surely…c’mon. That’s rhetorical too!

And, again, for the third week in four… we have more big news coming next week!!

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market, you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

Marketech Focus subscribers also get 2-months free access to the ‘Marcus Today’ newsletter to help you with your investing and trading goals.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Online Trading Pty Ltd (ACN 654 674 432), an Authorised Representative (1293528) of Sanlam Private Wealth Pty Ltd (AFSL 337927), and a Stockhead advertiser at the time of publishing.

All information and material contained herein is general in nature and does not consider your financial situation, investment needs or objectives.

The information does not constitute personal financial advice, nor a recommendation or opinion that a security or service is appropriate for you.

You should seek independent and professional tax and financial advice before making any decision based on this information.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.