Trading with Focus – Not the ‘I told you so’ edition

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

There certainly is a thick layer of smug roiling around in the media commentary at the moment…

But this isn’t that.

I’m not going to wade into the Meghan Markle debate, squealing about how going on Oprah is not very likely to reduce the paparazzi’s interest in your personal life, if indeed that was what you were hoping to achieve. (If indeed…snort…oops…)

But if I was going to voice an opinion, I’d probably have recommended they read the memoirs of the Queens abdicated uncle, Edward VIII, and learn a bit about how once you leave the Royal Family and the country for the new American missus that you’ll never, ever, ever get back in.

And my word, how he wanted to!! (or just watch The Crown on Netflix, like I did…)

Equally, I’m not going to make a make a big deal about how Burger King in the UK tweeted yesterday, on International Women’s Day, that…and I quote:

”Women belong in the kitchen.”

Take a beat, wipe up your spit-take, let that sink in.

Now quite obviously they were talking about the importance of female participation in their workforce (you misogynist) and clarified it immediately, but, as they should have, I’m just staying out of the whole thing.

So there is also no point me making light of the recent collapse of all the ‘meme-stocks’, and being all smuggy. Being known as ‘meme-stocks’ is probably painful enough for their management and cheering for the return of sanity to the markets is not a good way to make friends or influence people, some of whom are still billionaires.

But I will use it to make a point.

The GME squeeze was probably the sign. It will probably be the thing that we look back and say to ourselves, “huh, I guess at the time it should have been obvious and I should have done something about it, maybe tidy up my portfolio?”.

I started my stockmarket journey back in 2002, and as we were heading towards the war with Iraq we tumbled through a 2 year bear market. No-one called the bottom, it wasn’t like the GFC or COVID because there was also no real reason for the markets to turn around. Sure, there was a recovery when the WMD’s didn’t go off, but the rise of Chinese demand for mining took quite a while to really prime our pumps.

That was a massive, global, possibly unrepeatable event, where China moved its people from farms to cities and needed the raw materials to make iPhones. But it’s a great piece of market history that you can learn from, and should have looked into before getting caught up in (APT at $160 CRO at 21c Z1P at $14 VUL at $14) the recent retail unwind sell-off.

During the mining boom some teams built solid mining businesses that would continue into the future, like Fortescue, and some would fail miserably even though they were ‘also in iron ore’. Everything went up, but nothing actually stayed up at its peak unless it was taken over for cash. Everything in that boom had an inflated value as the retail investors would chase anything with the word ‘mining’ in it. And they came back to some sort of fundamental ‘value’ at some point, and in some cases that value was zero.

In the case of FMG it took 11 years to get back to their earlier, hype-inflated, retail-driven peak.

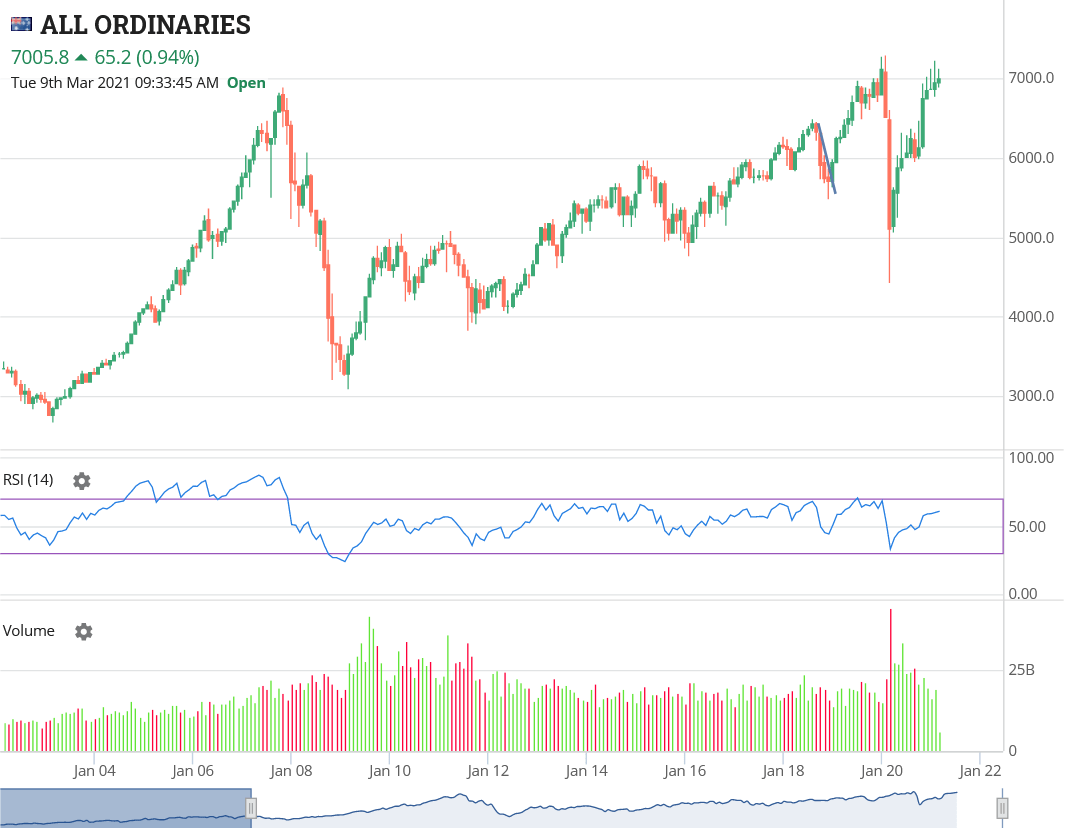

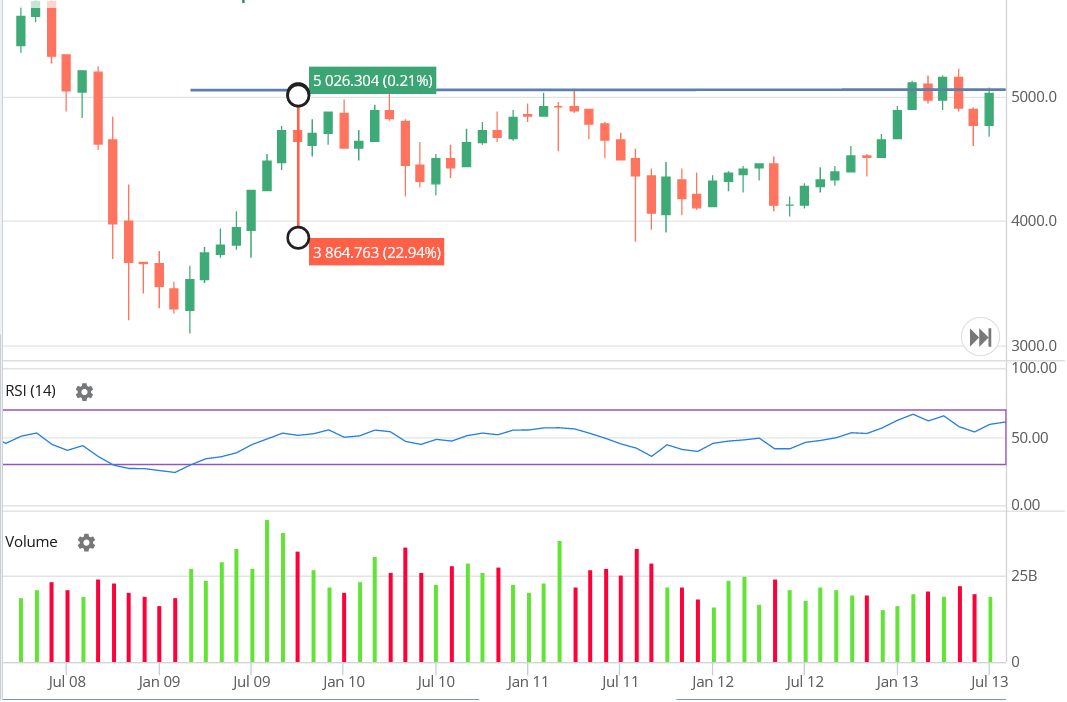

Now let’s scroll in a little to what happened after the GFC.

This is the ‘All Ordinaries’ on a weekly chart, just to filter out a bit of noise. After the initial rebound, which was very quick indeed, and had a lot of people thinking it was safe to get back into the market again, it faffed around for 4 long years before finally breaking out. And at one point it was 23% lower than the peak of that first rally.

The whole market, even with the GFC off the table, historically low interest rate and a mining boom back in full swing was still moving around with huge swings and took four more years to get out of that trading range. All we’ve done in the year since COVID was go up.

Now, over those first few years after the post-GFC rebound, the volumes started to drop-off (see at the bottom of that chart). When the market isn’t trending upwards, small players either lose interest because they are sick of losing money, or they just hang on and hope for the best.

Individual, out of favour yet fundamentally sound businesses would stagnate and fall as the buyers were not there, even though the value was. And the more ‘retail’ a stock was, the more weakness it suffered. Then there was dilution of value (in the unprofitable companies) through an endless need for new capital or ‘cracks in the foundation‘ that ground them away year, after year…

So, we’ve just had a massive rally, but this time there weren’t the same number of bombs going off in our top stocks as there were during the GFC where every company that had borrowed money was dealt a serious body blow as they had to raise equity at market lows. WES was one of the last, from memory it was around $14 a share after falling from over $40 for no real reason, except that people knew they were going to need to raise it. Every bank was being crushed by defaults, so it’s a bit different this time around, but not all that different really. It rarely is.

This time around it was a pandemic, and Qantas copped it, but Telstra didn’t. Flight Centre copped it, but Wesfarmers profited. There was a tail wind from stimulus, and heaps of retail investors entered the market for the first time, but the outcome is always the same. Retail investors driving momentum beyond fair value. Both up, and down.

So what comes next?

Well, this is where it gets tricky. No-one knows for certain, but its worth looking at the past. It was good to see the Dow rally when the Nasdaq got spanked, as that looks a bit more like switching from overvalued tech back to conventional companies. At least it wasn’t cash being sucked out of the market and a coordinated market crash.

But the retail investor; you, me, everyone on Reddit and those Facebook stock groups, everyone who wants to make money right now (today!!) and can’t imagine having to wait a whole year for a 4.5% fully franked dividend, anyone who has a full-service broker but isn’t an institution, anyone with an SMSF that buys direct stocks – they’re all just people with a finite amount of investible cash. And they have just had a great year. And they want to protect that money.

I’ve got a few bits of ugly and red in my portfolio. Overall I had a great year though, but still, I don’t like the red. But I’m also seasoned, and understand that I could lose a lot more value than ‘just the profits I’ve made this year’ in the stocks I trade. I also (being an idiot of sorts) keep a log showing my highest net worth and date each time I crack a new high, and spend 99% of my life internally berating the bad choices that have me existing under that line. (Don’t do that, for the love of god don’t.)

If only the market had given me a sign…like GME or bond yields or Elon Musk or a Top 20 stock with no profits or…oh dear, so obvious. (Slaps forehead)

So keep in mind that there has just been a large change in an underlying determinant of the stock market returns since the start of COVID – being the bond yield, which is sort of like the average water level of the ocean rising, except that it drags down the value of every other investment in relation to it. Like a tree near the shore, slowly dipping underwater. So maybe look at some new trees to move to.

Also consider that there have never been as many retail or new investors in the market, and more importantly, due to the wonders of the internet and social media, they are telling you what they all own! How great is that! (It is not great, it is terrifying, but if we are moving our society towards a hive-mind I guess we’ll have to wind up the stockmarket at some point anyway.)

We have now seen a whole year of a massive recovery rally, so for that whole year, up until GME was sold off, the strategy was to run with the retail money. Valuations were out the window, stocks were going up because they were moving like a herd in the direction of ‘buy, especially the dip’.

So now that many may have copped the biggest financial slap in the face that they have ever seen, perhaps the herd will thin out a little, or perhaps the herd will run in the other direction in order to protect itself, because ‘sell, especially the rally’ is still a direction and the herd acts to protect the herd.

Afterpay and others may bounce here, and you might get a good trade. But there’s no yield support, so you won’t get a wizened SMSF investor that’ll buy a few for the divvie. The register has to be chocka-block with small first time traders who have not yet seen a company in the ASX Top 20 drop nearly 40% in the space of a month; they all started after the last drop. These companies are going to have to prove the profitability of their business, and quick.

But, who really knows, not me certainly. I was right last week and nailed the call, but I’m not a seer of the all-things. That was just luck, but it’s Marketech Focus that educates my guesses (a great quote stolen from The Economist magazine).

Keep an eye on the volumes, look for the intra-day rebounds, then see whether the market follows through on the recovery bounce. Or look for different sectors that are unloved. Or even take a bit of time to chill. Things just changed a lot.

Maybe use this downtime to see what’s up with our live-streaming pricing (and to get off the old webpage-refresh merry-go-round). Maybe check out our better charts and better app (maybe even best charts and best app?). Maybe do the math on how much brokerage you’d save (our average trader saved $540 last month against the rates at Commsec). Or maybe its time you put your stocks on HIN, and your cash in your own bank account with interest – because trustees are just people too (and a lot of people are pretty shifty!).

While you’re checking it out remember this; we wouldn’t have built our trading platform the way that we built it if you didn’t need it to be that way. But also tell us if you think it can be better!

And if some time in the future you still haven’t checked it out and you’re still giving away money and missing trades, well, as Mallory Archer once said, “You don’t need a smug ‘I told you so’ from me…and smug it would be, because tell you I most certainly did.”

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.