Trading with Focus – Last but not least, avoid cliches like the plague

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

I love the old clichéd market commentary. The trend is your friend until the bend in the end. Buy the rumor, sell the fact. Sell in May and go away. The ‘Santa’ rally.

But there is always a year (or so) when you position yourself for one of the greats, like the age-old ‘sell in May’ or the ‘Santa rally’ and it goes against you. Or you buy an oil explorer early with the intention of selling before the well spuds, and it turns out that there were a lot of people thinking exactly the same thing (so you had actually bought the top already and it just continues to fade into the drilling).

This bull market run started at the absolute worst moment in recent history, when the world finally accepted that it was in the middle of the worst global pandemic since polio or smallpox or the Spanish flu. And the biggest threat to the financial markets that we have seen since the GFC, even before we had properly recovered from the GFC.

So the adage ‘you sell when people are greedy and buy when people are fearful’ seemed to fit at the time. But you don’t know the point of maximum fear or greed until afterwards. I was already long and wrong, so I didn’t get the maximum benefit of buying the lows but I did see some of the old underperformers in my doggy portfolio rally to heights I had previously thought fanciful.

So the question now is, are people more ‘greedy’ or more ‘fearful’?

When people are greedy and overconfident it is usually because they have just had a big win, or ten. So they now feel like they are the anointed one, and can do no wrong. So the very fact that they are buying it and that it is currently going up means (in their head) that they are onto the next winner and they start taking bigger risks than they would normally. Selling their banks to buy BNPL.

So then there is this one. ‘It’s a market of stocks, not a stock market.’

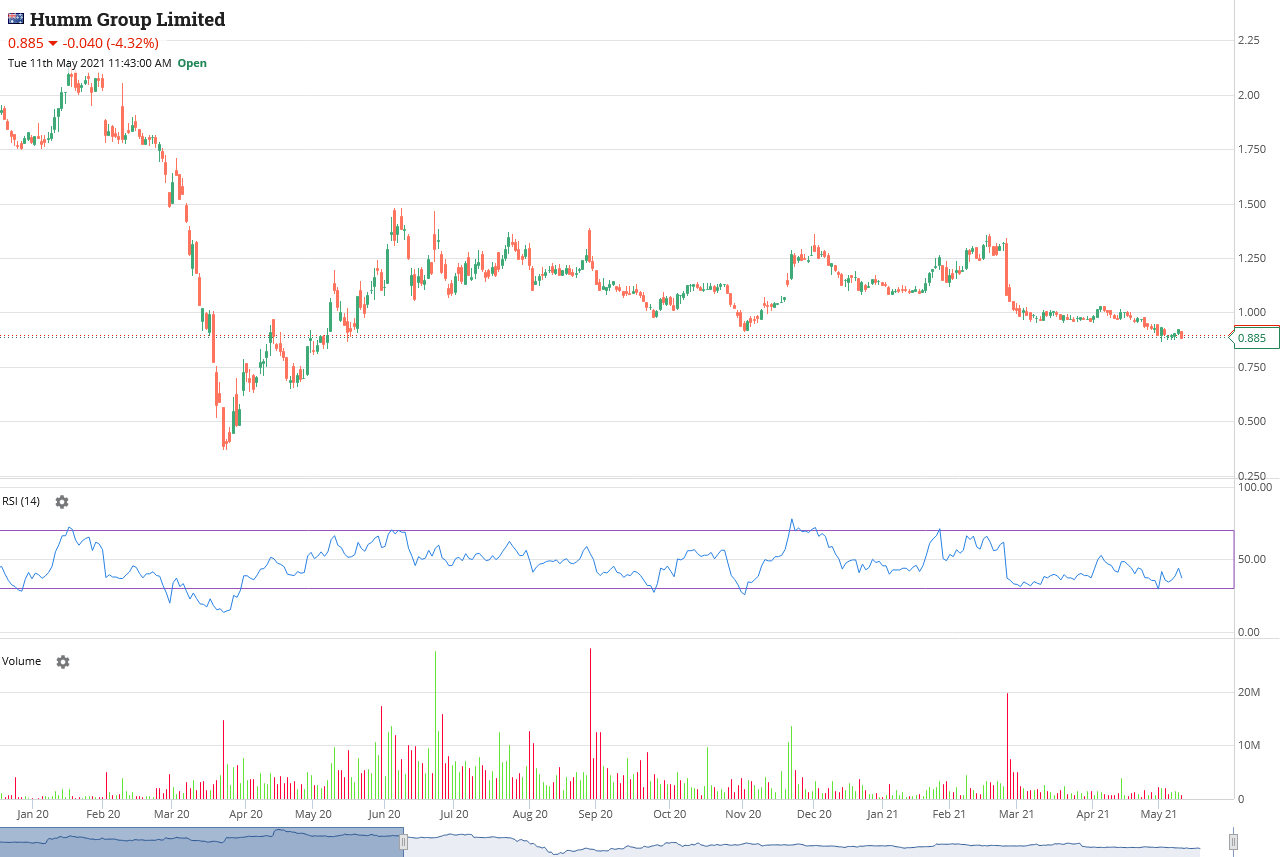

I’ll bet the shareholders of Humm (the old Flexigroup) thought that being ‘in the BNPL space’ made them comparatively undervalued, and with each subsequent dip there would have been people loading in more, believing that this time was the ‘real bottom’.

Nope.

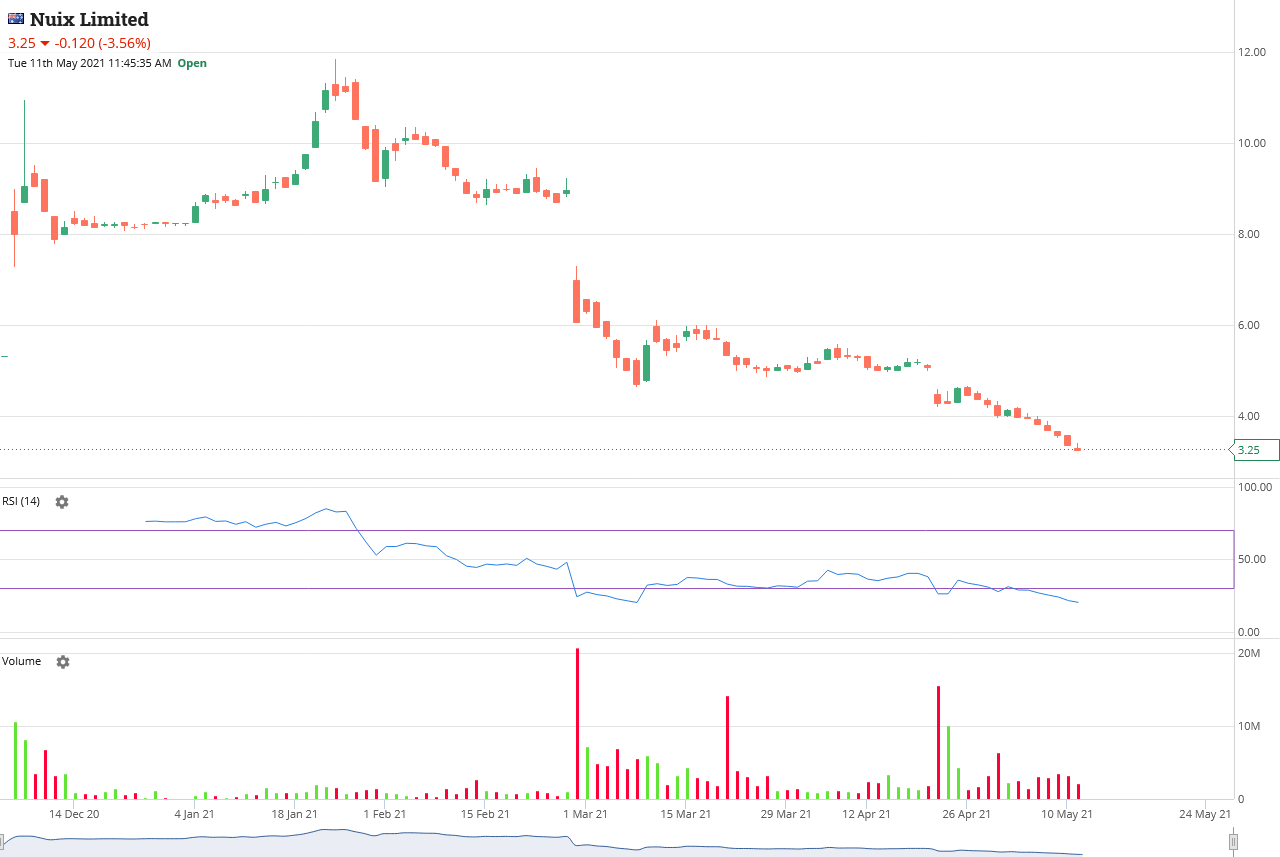

How about the people who loaded into Nuix or Adore Beauty, as they were big famous IPO’s, and all the IPO’s had (until recently) been coming out of the gate strong and never looking back.

Nope.

‘All the weak hands are getting shaken out.’

This is a beauty. The poster child is GME in the States, where the reddit gang are all quoting such new gems as “apes together strong”, but it could be used to explain why any recent meme stocks will rebound at some point – and somehow you, by not being one of the sellers when you were in profit (or at least with less loss), somehow this makes you one of the wise.

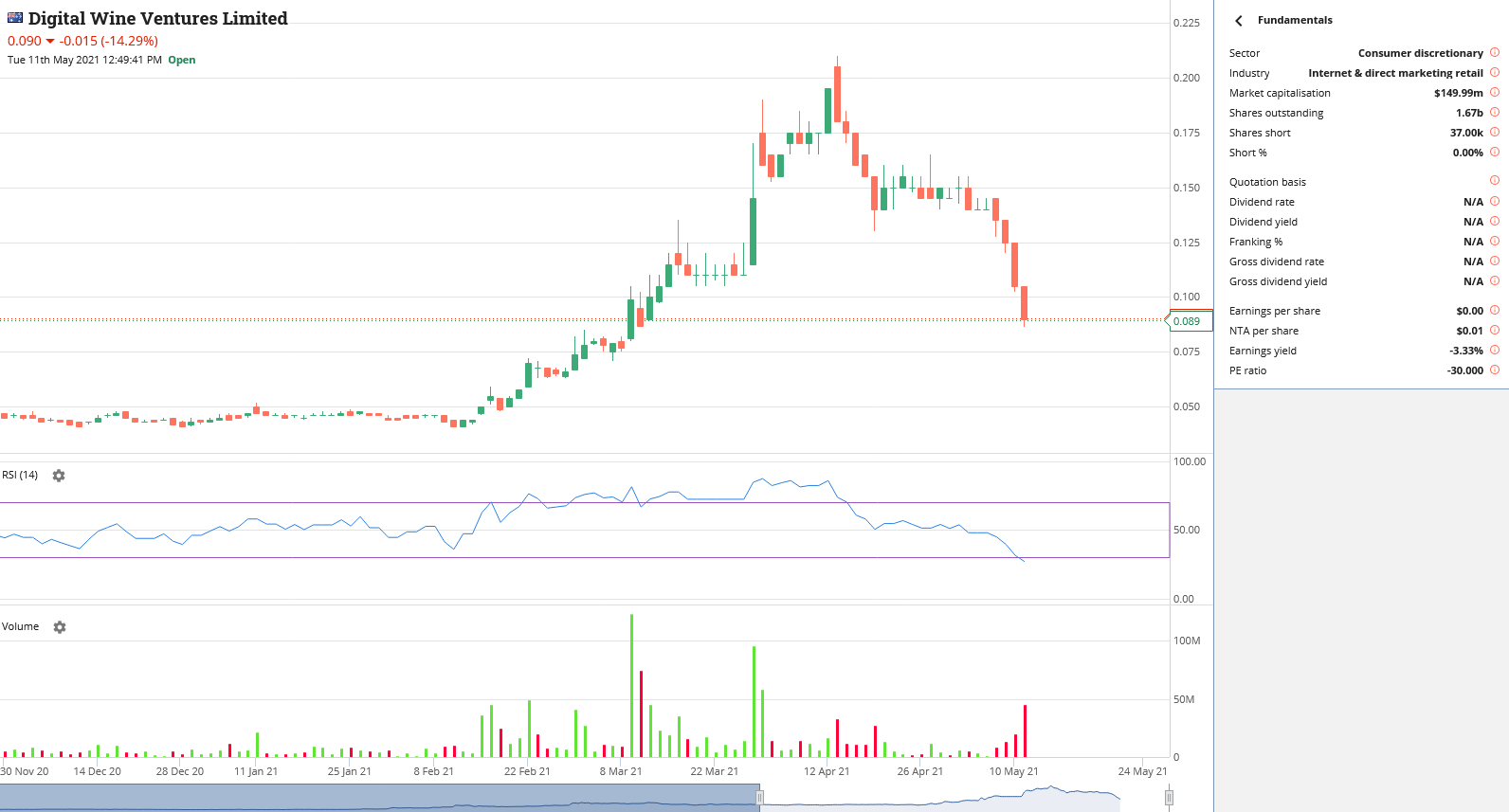

Is this DW8 chart just ‘weak hands’? Or is it a stock that massively overshot on the upside and is now suffering from both a sell-off and a heavily skewed meme-stock shareholder base that are panicking after buying it at its highs and now can’t get out quick enough?

I’m sure it’ll see some dividend yield support soon.

No…

Wait…

What do you mean it doesn’t make money..?

So, there are still quite a few clichés that actually make sense.

‘Markets can stay irrational longer than you can stay solvent.’

This was highlighted in the years before COVID, when a junior explorer would raise money to drill a deposit, make a discovery, but the stock would fall lower as the announcement of the bonanza results marked the longest time before the next announcement. It’ll happen again.

‘When the tide goes out, you see who’s swimming naked.’

I love this one, but it hurts hard when it happens. What they are talking about here, as an example, are the property trusts that went into a trading halt during the GFC and never came out because they were over-geared. Some did though, like Bunnings Warehouse, where they had a solid business with stable gearing levels. But it was the heavily geared ones that had performing better than average before the debt markets shut, as they had been the ‘darlings’. Or every mining explorer after the mining boom ended.

If it turns out that the BNPL sector is overcrowded, or if it turns out that they were relying on a quirk of legislation to exist, or that they were relying on low interest rates…then it’ll be the lower ‘growth’ more sensible lenders that survive. Maybe that’s when Humm will shine!

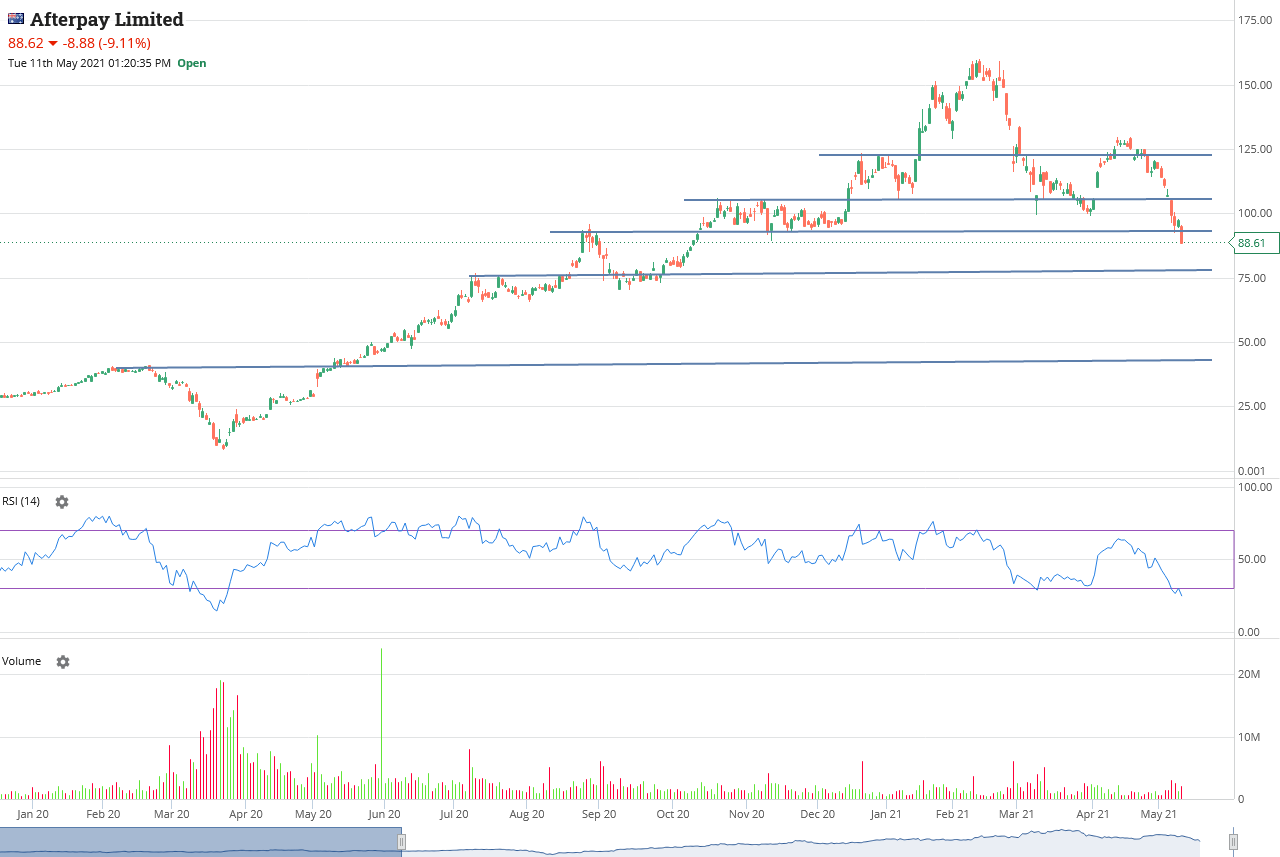

In the meantime, here’s some very basic lines of support in APT. Don’t forget, there’s no dividend support and its still a $26b company even after the fall. With management taking profits. And legislative risk. And if they list in the US, where you can naked short sell, the first piece of US research put them somewhere around $40 a share.

‘Bulls make money, but pigs get slaughtered.’

You see all the time in a bullmarket where people start complaining that their “worst performing share has only doubled in value”. Then they sell their underperformers to switch into the better performing stocks, aka selling at the lows and buying at the highs.

Don’t be piggy. Take a profit. Pay the tax man. Buy yourself something nice. Wait for the next opportunity, don’t force it.

‘This time it’s different, because…’

It’s not different, I’ve said this before. It’s never different, it always reverts back to the norm. Each stockmarket investment you make is one part ‘a company’, and one part ‘a reflection of human behaviour’. Until humans can remove emotion from their investments it will continue to be the same. Starts with fear, then greed, then fear again.

Some people will buy early and look like/think they are heroes when it rallies. Some people will follow the trend. Then some people will pay top dollar in a massively inflated market due to fear of missing out. Then, once everyone who was going to buy has bought…it stops going up.

People will then try to lock in their profits, then people who over-paid go into panic mode, then eventually everyone who was going to sell has sold…and it can bounce. But with less people to buy again…this time around. People may be stupid, but they only let their fingers get burnt so often.

‘It’s time in the market, not timing the market’

Broadly speaking (in my very personal opinion) this is bullshit. It’s just something financial planners spout when you have a bad year in managed funds…

Everything is a trade in the direct share market, but mainly because you keep buying the wrong things for a long-term hold. But to make it worse and riskier, at the moment we have masses of speculators driving large growth stocks (read as: not profitable) to unbelievable levels, and this adds a high risk to the whole market.

Big does not make better, and some of the companies I have highlighted above are now massive enough that people may have thought that they were blue-chips just based on their size. When they are specs, at best.

Everything is about timing, so stop reading this and go and get yourself a real trading platform with streaming prices in real-time.

Because…if you are punting speculative shares thinking they are blue-chips and the tide turns, you’ll “need to get cool about a bunch of stuff really quickly” otherwise you’ll be taking the money you have left to put down half the deposit that you would have had onto a house that’s gone up in value in a suburb you don’t want to live in. And that kid that sold his dogecoin because he had mastered his own ‘greed’ and saw the market signs will still be driving around in a Lambo wondering how you couldn’t know that most of these big wins was based on luck…

And some final ones to round out the page: Don’t fall in love with a stock, never try and catch a falling knife, If you can’t sleep; sell, only buy what you can understand, the market never moves in a straight line, if you haven’t got $45 a month for Marketech Focus to get the data and tools you need to trade – get out of the market.

(I think Warren Buffett might have said that last one?)

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.