Trading with Focus – It’s a very fine line…

Pic: DKosig / iStock / Getty Images Plus via Getty Images

One synonym for the word ‘manipulation’ is ‘use’. Another is ‘control’.

Depending on the context they can all sound fairly innocuous. However, market manipulation is a crime potentially punishable by jail time and massive fines – and surely you don’t want that!

Coming from a good God-fearing family, I knew from a very early age the difference between right and wrong. I was naughty, in so much as I was always toeing the line to see how far I could push it, but generally speaking I was not a bad kid.

I never actually stole anything, and never took schoolyard violence beyond a few dead-legs to worthy recipients (who invariably paid me back in spades). Adultery was just for adults. And, if my memory serves me correctly, I never actually murdered anyone. None that they could prove anyway…

But this one time I found myself in a place that had gaming machines and you could win cold, hard cash and there were flashing lights everywhere! There was one of those machines that you feed coins into, and the coins built up and up until finally they would get pushed off the edge – and you get paid out.

For aspiring coin-ionairre’s this was El Dorado.

The desire to ‘get paid out’ was obviously very high, so without further thought I gave that machine an almighty whack hoping to roll a few coins off the edge and into my pockets.

Immediately the alarms started screaming and the kids around me went into full narc-mode. The finger pointing alone was enough to have me duck for cover and work my way to the nearest exit, as the burly security guard worked his way through the crowd towards the machine. This wasn’t the first time some kids thought it a good idea to help ‘luck’ along.

I was sporting the full nerd-pack at that age (and, if I’m being honest, still to this day) being a sight-disabled fashion-denier and sports-non-enthusiast. So I had a good cover and was unlikely to go down for the crime if I high-tailed it. I bailed and can still hear the accusatory alarms blaring in my memories.

Being around money all of the time really is a test of one’s morals. But I can assure you, the regulator may not get every single crook in the market, but when they do they make them pay to set an example!

So, what are some of the signs that there’s a bit of crookedry going on in the stocks you follow? And more importantly, how do you make money from recognising the market grifters and bluffers that operate around the fringes of the small cap sector?

The chatrooms are as good a place to start as any. Well, a good place to start to understand manipulation anyway. You should always check out the mood, and look at the posters that seem to hang around to work the crowd. I guess people mostly go to chatrooms to share opinions, but it’s a bit like trusting a used car salesman to sell you a great car even though he’s paid on commission.

There can be some really good analysis from people in chat forums. Maybe they go there to make themselves seem smarter and go fishing for likes, and maybe they don’t and are just genuinely excited about the company they are invested in and want to share knowledge. But unless you know that person’s track record, how do you put any faith in it?

What if they are being super-positive because they just want a bump in the share price to sell into? And same goes for Mr Negative, bagging out the company and the Directors for some alleged indiscretions.

Maybe that guy is actually a buyer, and wants to buy them artificially cheaper, breeding fear to incite a seller to sell. Then watch him flip his opinions when he gets his fill!

(I just checked into the Facebook groups to see if there was any nefarious activity I could dob on, but it is still a pre-school of “what’s good today?” and “looking for next big thing” kids bemoaning that they were fleeced by some poster or another. This is where candy is either being taken or handed over willingly.)

Some company directors also seem to have the misfortune of being on boards of companies that seem to regularly attract questionable trading activity AND flocks of chatroom positivity in the run up. Surely it’s just bad luck, but the share price action before an announcement always seems to pre-empt positive news.

Sometimes they accidentally drill next to a pre-existing discovery hole from a decade ago, or accidentally buy tenements off their private family holdings each year with a mixture of cash and shares…

You can build your own list of these unlucky directors over time, but normally you’ll hear about their companies as ‘tips’. I once knew of a company director that would work the room looking for those wearing expensive watches and spruik the joys of (his) share ownership to those that obviously had some disposable capital!

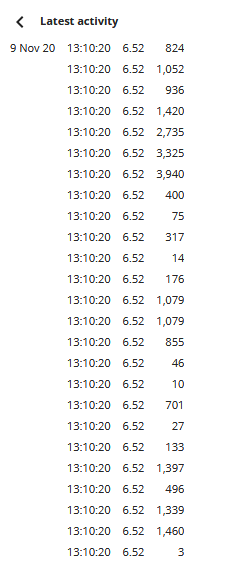

Live expandable market depth, where you can see each individual order at each individual price point. I could not trade spec shares without it. Why? Well, the main reason is that you can see the trends of buyers and sellers if you pay enough attention. And if you are patient and allow yourself an equal amount of belief and disbelief that every trade in the market is genuine, you can start to notice little ‘tells’.

Now, I am not saying that there is anything suspicious about this, but I have often noticed how a large line of stock sitting just out of the market (ie: a price point or two above or below the market) will be removed the moment the market gets too close and they are at risk of transacting.

It’s almost as if that extraordinarily large line, that would appear to add pressure and weight to the sell-side, was only there to try and give the impression that sellers outweighed buyers? Or vice versa.

Now why on earth would someone want the market to think that??! (Seriously, don’t make me spell it out…)

I couldn’t be bothered trawling for a perfect example of this as there are 2500 or more stocks in the market, but the following snapshot of the market depth (from the new Marketech Focus) could be either bad trading or ‘designed’ to put some appearance of pressure on the market.

It could also be none of those things… I didn’t look too hard.

Why say it is bad trading? Well, if you are a genuine seller you probably shouldn’t just slam all of your large holding on the market in one line. Maybe you should consider feeding it in, dribs and drabs or you could push the market down and sellers will back off. It’s one holding almost the size of the average of a whole trading day on this stock!

The market depth is like a negotiation, never let them smell your desperation.

If it’s specifically designed to push the stock down, to try and accumulate more at a lower price, then it is manipulation. But, that’s very hard to prove. Could it be they just changed their mind?

Guess we’ll see tomorrow if it’s still hovering, or miraculously disappeared.

You can also sometimes see layering (a series of large lines) in the same way, but more often than not if you are quite obviously layering the bid/ask you will get a phone call from your broker asking what you are up to, and telling you that ASIC called and want to know how genuine your orders are.

Their licence is a lot more valuable to them than you are as a client, so you would probably find yourself thrown under a bus on something that obvious!

In the same vein, you’ll often see a bunch of smaller trades, much smaller than the ‘marketable parcel’ that your broker forces you to buy. Chatrooms are awash with the conspiracies of smaller, ‘unmarketable trades’ so let’s start with the most oft-discussed scenario.

The rise of AI has seen a growth in super-bots that are somehow better traders than we all are, and they manipulate the prices with small trades to, I don’t know, something-something with the thing? (shakes fist)

OR, is it a broker who allows institutions to average their larger buys and sells out over the day using a program that rolls a few shares out at a time?

The other one you notice is likely to be the 1 share parcels. This is, more often than not, one leg of a crossing in the market – where a broker has matched up their own client as the buyer and seller of that stock.

Where it may actually be some sort of algorithm bot is around technical price points. These evil robots just love screwing with the tech-traders and they stab at technical price points to see if they have any more real orders behind them. (Although, it’s probably just a really good trader and not a bot, but I kinda like the evil money-bot idea.)

So, a final summary.

Chatrooms – don’t believe everything you read

Tips – could be good, could be bad, depends on whether the market has already acted on the so-called upcoming event. If the giver of a tip worked in a car yard (or has an expensive watch), probably best avoided.

Directors – could be good, could be bad, could be serially unlucky. Just like any human, because, well, they are human.

Depth stacking – could be a genuinely bad trader, or could be something nefarious. Or could be they just really, really wanted that stock to be sold but changed their mind at the last minute…

Small trades – definitely a bot trying to steal your money one share at a time! Rise up! Go smash the toaster before it gets in on the act!

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC. You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.