Trading with Focus – Instagram reality vs market reality

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Why does seemingly every new trader want to pay top dollar for fad stocks, when all I want are good companies that have been sold off?

Am I wrong? Tesla cars are probably fine examples of electric motor vehicles. Afterpay is probably a fine example of new lending. Do I want to pay all-time highs for companies whose profits are yet to justify such valuations? Aren’t there much less risky ways to make money?

I saw some comment from a famed stockmarket commentator yesterday who said he didn’t, and never would, own bank shares, that the world had changed. But flip open a chart of Bendigo Bank, and you’d see a stock that has risen 50% in two months.

What sort of returns is this guy getting that a 50% return in two months isn’t good enough?! A beaten down, but historically highly profitable long-standing sector thrown out with the bathwater…forever?

Because of what? Because banks are dead due to BNPL or the internet? Nah, that’s just pandering.

That was one of the most stupid and irresponsible things I have heard from a market commentator in at least the last 12 hours. Look, if you’re chasing fads to be cool with the Instagram-set that’s fine, just own it. You’re not an investor, you’re a follower.

I missed the whole BNPL rally, but no way would I chase it. You know why? Because every single fad that the market has ever chased has ended in serious losses. And no-one tells you when it ends, and the best way to cure this stupid FOMO thing you apparently all have is to lose all your money and run away.

Anyway, big deep breath as I remember I make a lot of money trading off others’ stupidity…

So, let me talk about gold for a moment, and the twisted logic that I use when looking at a trade. Don’t follow me in on this trade blindly, I’m not an analyst, and I am just as likely to exit it this afternoon as hold it. Cash is cash, and there’ll be another trade, I’m already up about a grand and brokerage is only $5 so I’m up a grand in a day, which is more than I spend in a typical day.

This is just a ‘how to trade using the tools you should have and probably don’t’ and ‘what to look at because no-one really tells you that you need to look at things’, and all based on my opinion only.

Gold’s up a bit over the last year or five. Money was printed, people thought that inflation would rise as the value of money dropped due to the increase in supply, they thought that stimulus would keep coming and coming and coming and maybe there’d even be a civil war in the US.

Apart from the initial rounds of money printing, none of the other stuff has happened. It still might though. But as a result, the gold price is down a bit from its high but has a generally positive outlook.

So my gold logic is this. If there are enough crazy people in the world to believe that crypto will replace cash, then there are enough crazy people to think that gold will also replace cash, probably more so because it’s inert, whereas crypto all dies after the first EMP.

And gold is still hard to find, and when it’s found, most of it is hoarded and the rest is used in stuff that is hoarded, like jewelry and whatnot.

The US and others will have to stimulate the economy with more money printing, so the gold price is likely to take another run somewhere between here and the Bidenator moving into his new home, regardless of whether we ever see inflation again.

But it hasn’t happened again – yet – so, as a result, gold miners have come off the boil. Gold explorers have too, but they aren’t valued based on anything other than the number of speculators in their market; whereas a producer, with pro

fits, has an underlying value that institutions spend a lot of time calculating. A baseline where a buyer should emerge.

Sometimes, if they’re big enough, they are in an index, and there are a lot of huge index funds that have to maintain certain weights of certain stocks in their portfolio. There aren’t anywhere as many institutional portfolios that have to maintain weight of an explorer, so when all the speculators bail they don’t have an underlying buyer.

As a result, the fund manager and his researchers – who also want to get fees for providing research and friendly access to the management of the company they cover and be seen in a good light when it comes to the capital raisings – will usually all come up with a valuation that is pretty close to everyone else’s valuation. Like I said, a baseline.

You can’t slap a sell on a stock if you want to get 6% in fees from their next $50m capital raising. So, what this means is – in a stable environment, where the market isn’t in panic mode, where the underlying gold price is relatively ‘stable to positive’ and there are no massive production fails out of left field, in that instance a gold producer can be one of the best trading stocks on the ASX.

Look at this chart. LOOK AT IT!

If you only used the RSI over the last however many years, buying it when the RSI was bouncing off the bottom, and selling it when it bounced off the top you’d have pulled maybe three to six big earns. Tick.

Take out COVID and it’d be even sexier as a chart, but like everything, the COVID bounce was the best one.

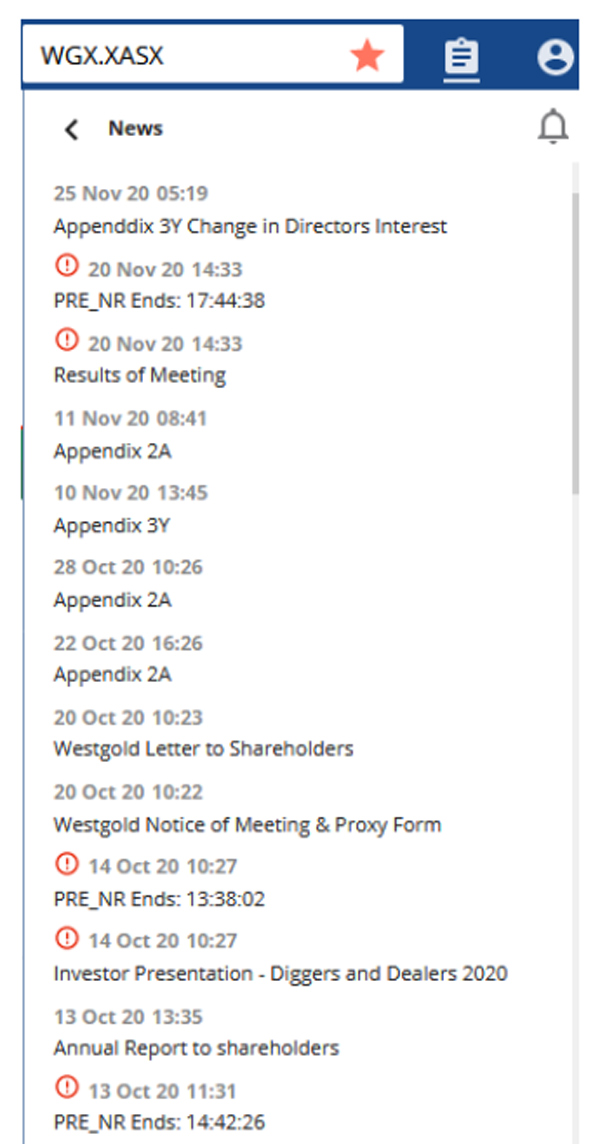

So let’s check out the company info, see if there’s anything that adds or subtracts from the value. It’s on the RHS of the Marketech platform and app, under ‘news’ and the live-streaming full depth:

What? WA? That’s perfect, no Covid there.

Very friendly mining jurisdiction, lots of transport options, lots of ore treatment options, lots of mining know-how. Not in Mozambique or some place where the local militia have helicopter gunships. Tick.

So, is there a reason it’s off, and what’s their outlook? I always start by flicking through all the news the company has released to the ASX.

First I dig into the Annual Report – straight to the back pages, Top 20 shareholders. Insto, insto, insto, insto, founder/Exec Chairman, insto and so forth. What I love seeing is that the Top 20 shareholders of this billion-dollar company own 87% of the stock! And some big names in there, like Blackrock. Tick.

Next is that Diggers and Dealers presentation, for some commentary about the outlook and what’s really going on. Can’t lie too much at Diggers as you’ll never get asked back!

No debt. Heaps of cash. A bunch of high-quality mines with a growth profile and leverage to the gold price and a depletion of reserves strategy. Disclosure of environmental issues, and native title and even some info on the number of women in the workforce! Tick.

Ok, final piece of news, the old Appendix 3Y, change of Directors Interest notice (and that’s the ASX’s spelling mistake, not ours). Now mostly you’d see these from directors who are extremely positive about the outlook of their company, but really had to buy a house on the beach and a boat to go with it, so they sold down a chunk. But no, the Executive Chairman has bought stock recently, and not an

insignificant amount, to add to his already not-insignificant holding! Tick.

So, just a quick repost of this slide:

See the dotted line on the chart? That’s the last price. See the dark green solid line? That’s my costbase of the shares I bought, and if I flicked over to my super fund (that is linked to the same subscription) you’d see I picked some up there too.

When I want to sell them, I click on that line and confirm that I want to sell them and it smacks the market, or I move it on the chart to where I want to sell it, especially if I am trading charting patterns.

Probably only cost me $5 in brokerage too, unless its over $25k, then it’ll only cost 0.02%.

Remember that South Park episode where Cartman has to sing “Come Sail Away” all the way through every time he hears the first line? I’m like that whenever I say gold, so here goes:

Gold (gold). Always believe in your soul. You’ve got the power to know, you’re indestructible, always believing. You are gold (gold).

Weren’t Spandau Ballet the best? You know what’s better? Making money because you have the right information at your fingertips and not pretending that buying a fundamentally cheap company, like a bank or a producing miner is a flawed strategy just because currently high tech company valuations mean that everything has changed.

Nothing has changed. Nothing will change. The stock market always reverts to value, and value is ultimately derived from profits. So buy things that make money, and only those things that you understand.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to live-streaming prices, brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.