Trading with Focus – How to trade with Focus

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

In the Australian stockmarket system, bad trading decisions are considered especially heinous.

In Marketech Focus City, the dedicated traders who pretend to be above these vicious felonies are members of an elite squad known as the Special Victims Unit. These are their stories.…

DUN DUN.

Law and Order: SVU. I mean, what a show! It all kicked off in 1999, and with 501 episodes and counting it really makes me wonder if America might have some societal issues. But if you think this was a disturbing show, you should watch Christopher Meloni (Stabler) in ‘Happy!’, (or ‘Oz’, actually, no…don’t) or pay attention to Ice-T’s acting. That’s really disturbing.

I promised my marketing team that I would lay off the pop culture references and take this a little more seriously, so here I am going to walk you through a trade. How, why, when, what’s it tastes like, does it feel like satin against the skin, how do you set up your stop-losses. All the important things, with no weird references that only I find funny! From……..now.

So I’ve been banging on about A2M for a while now. I like looking for bounce trades in big stocks that have been slaughtered and few have been this badly slaughtered in what is a raging bullmarket. I don’t know what Nuix does and don’t really care to learn, but milk is milk and there are a lot of hippies and people with gut disorders in this fast-paced ‘croissant with turmeric sprinkles’ world, so surely A2M is worth a stab.

Worth a stab for me. A degenerate gambler with no real sense. A ‘Special Victim’ if you may. This isn’t a recommendation that you should buy in too, or even adopt this strategy, and is really only meant to show you how I use our tool-kit and some of the sexy treats that we have for our clients. With real money…because our practice account is good for practice, but some of the best tools are in the real live version.

Ok, lets set the scene. Look at this abomination. You might only see danger signs because the stock has been in freefall from $20 to $5, but I try not to get scared off a fallen hero after its fallen. Scarier to be in a hero when its fully priced – surely!

Blah blah blah profits, outlook, Chinese wars, competitors. This is a $4 billion dollar company that makes money selling a staple item, when Afterpay is a $27b company that doesn’t make anything. But even though it’s been in a freefall, there have been sneaky bounce trades along the way for the nimble.

Dangerous sneaky bounce trades though… but look at the boxes I drew with our drawing tool.

At the bottom there you’ll notice a sell-off after bad news, then some more days of selling, then eventually a bottom. It looks different to the other sell-offs because people are tired of it, not optimistic.

Previously it bounced straight away. But maybe(?) it’ll be a little while before any more bad news comes out and maybe if you squint hard enough you’ll notice a ‘higher low’, meaning this thing might finally be trying to build a base – and there’s even been a couple of good green days. Bouncy!

Eventually the sellers will have sold, degenerates like me will be looking for a trade and there won’t be as much pressure on the sell-side for it to bounce into, and maybe even some very big funds will also be averaging down to try and make their positions look less ugly for the end of financial year. Or short sellers covering. How’s that for lazy DD?

So, I open up our sexy trade planner to try and see where to place my ‘take profits’ and my ‘stop hemorrhaging cash’ points. It’s a little skinny at 10% up and 6% down, but screw it, I’m feeling lucky and it’s a bulllllllllmaaaaaarrrrrkkkkkeeeettttttt!!!!!

Why did I pick these points? Well, I reckon, from many years of ‘scalping the bounce’ that this’ll bounce to at least where it was sold off to after that last bit of news. Insto’s don’t mess around thinking, they have a valuation model, and they sell down to where they think it should be immediately upon the news release. They just plug the new variables in and buy or sell.

Retail gets home from work, cries a little, thinks about whether it’ll bounce for a day or two, then capitulates and usually sell near the bottom. So that’s why I think it’ll bounce back up to that little green cross. In my head anyway.

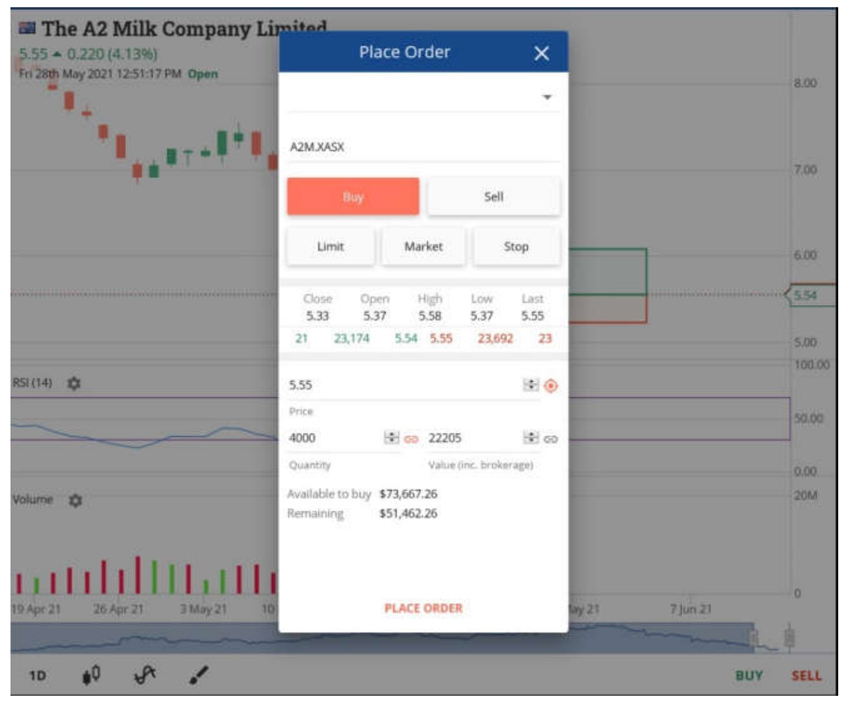

So first to place a trade. When you open up a buy ticket, it shows first on the chart. Then you can drag the trade to where it makes most sense, or just choose ‘market’ and it’ll pay the money.

Do you see, do you see?

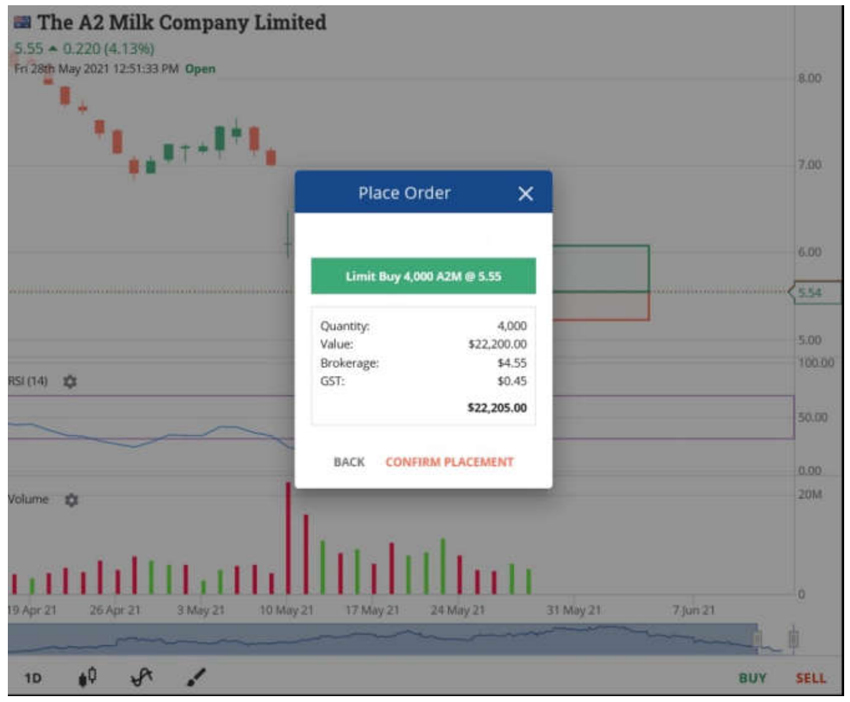

Then, you have to choose the number of units, and whether it’s a limit, market or stop loss order. In this case I don’t have any, and want to buy them now, so ‘market’ it is, and let’s have a decent swing. The ticket shows you the top-line of the market, the amount of cash you have available and how much you’ll have left afters. Handy! (oops, took a screenshot of a limit order, but whatever…)

Look at that brokerage! What are you paying? And this is on my own HIN, with my own Macquarie account where I earn interest. To match that price you’d need to pool your assets into an ironically named ‘trust’ account and hope that they are still there when you go to get them out…

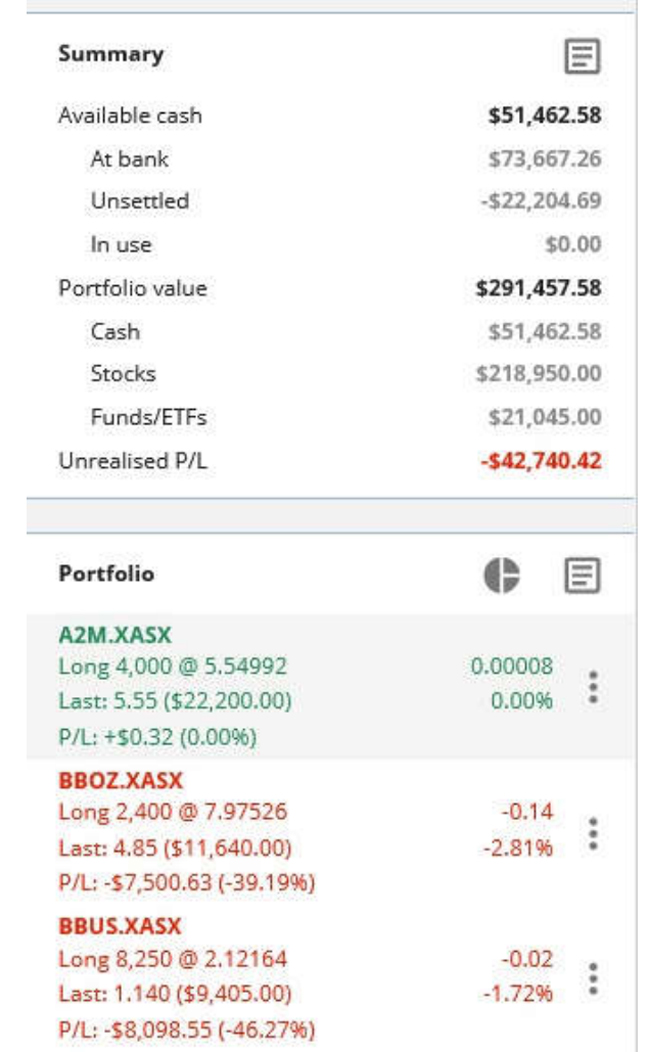

Here’s the trading summary portfolio view on the LHS, as a ready reckoner. Open orders show underneath the portfolio when you scroll down, but I rarely leave orders on. I’m a buyer or a seller today; tomorrow I could be dead and the cat’s home administrators do not want to be left to unwind all the bad decisions that I left in the market through the probate and will process.

Now don’t you worry your pretty little head about those geared bear funds. I am going to be happy to keep losing money on them, like a hedge, as it means all my other stuff in this portfolio is probably going up, and I will probably top them up again when the market looks shaky. It will be nice to be making money on something on the way back down!

But have a look at the data points in this portfolio view – cash at bank, cash available, unsettled, and ‘in use’ (which means open orders). That’s also just the ‘unrealised loss’. I can actually trade ok, so my realised gains are pretty decent this year. I am not really a buy-and-hold guy (unless they are losers), because…special victims unit.

Same thing, but in our expanded portfolio view screen (where those geared bears look waaay uglier for some reason…). The main view is for your ready reference whilst in the thick of the trading day, this one is for viewing in the time you have to scratch your chin and say hmmm. (I’m not showing you all of my shares because I don’t need to be judged or have my positions debated publicly, but you get the idea. Don’t worry, I believe they are all going to make me rich regardless of their current weakness!)

Here it is in one of our pie-charts with pretty colours and pieces that pop out slightly when you click them – which we offer by code, sector, industry or asset type. Sexxxxxy!! (Go silver go!) Not sure that I’ve ever owned a ‘consumer staple’ before – what a day! Great for checking your diversification.

Up next is the trade screen, where I can make sure I actually bought it and it lines up with my contract notes. In the top-righthand corner is where you can download a CSV file for all of your trading so you can do up your tax return, and the little cloud is where you can connect your Sharesight account if you want some flash portfolio reports.

That’s right, you enter your Sharesight account number into the Marketech platform and it automatically updates your portfolio reports for you. Science….

(We let you choose the tax reports that you want, if you want them, rather than making you pay for something in higher brokerage that you may not want. Fee-for-service is sexxxxxxxxxxxy!! And, Sharesight starts from $0 a month! Can’t be beat!)

So this is cool (the ‘order details’ on that image above). I placed the order at 12:52. Before a milli-second has even passed, the order router has tried to buy the cheapest stock on Chi-X, got dick, checked the centre-point for all that ‘dark pool’ stock and picked up a few cheaper units at $5.545, then swept it to the ASX to fill the order. How good is that? High-frequency traders and people using delayed pricing be damned!

If I’d amended the order, or if the order was rejected for some reason all of that detail would be listed here too (note: ignore all the cancelled test orders, this is a new feature and we had to make sure it worked – because there was no instruction manual).

So now let’s put in our automated ‘sell-with-a-profit’ and our automated ‘get-me-the-eff-out-with-a-loss-before-it-gets-bigger’. You could obviously put in a normal sell higher, but then it would be ‘committed’ and if you then put in a stop loss the stock would already be ‘in the market’ and would fail.

So, whack in a trigger near your target price, whack in your target price and voila! As usual, you can move your trigger and your sale price around on the chart like a pro!

Then, repeat the process with your stop loss and sit back and wait for the games to begin! You can see the cost-base as the green line, and the two trigger/sell orders in the dotted red lines. Don’t like where they are? Slide them on the chart. And if you change your mind, click the green line and click the bin icon to ‘sell-all-at-market’! So fast, so easy, so sexxxxxxxy!

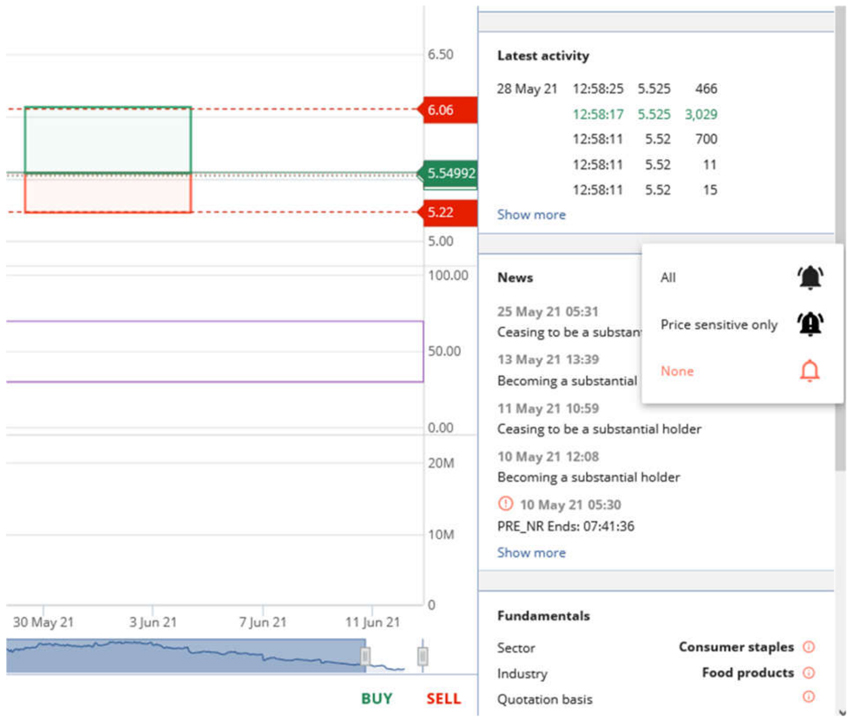

Now to make sure you don’t get blindsided by a piece of company news that you weren’t expecting, stick in a news alert. Then, when some news comes out you’ll get a mobile notification as a warning. There’s a delay on reading the actual article because the price of ASX live news feeds is too damn high, so (shhh…) pop over to the ASX website for free live news once your alert pops. How’s that for monopoly power, it feels so Telstra-y.

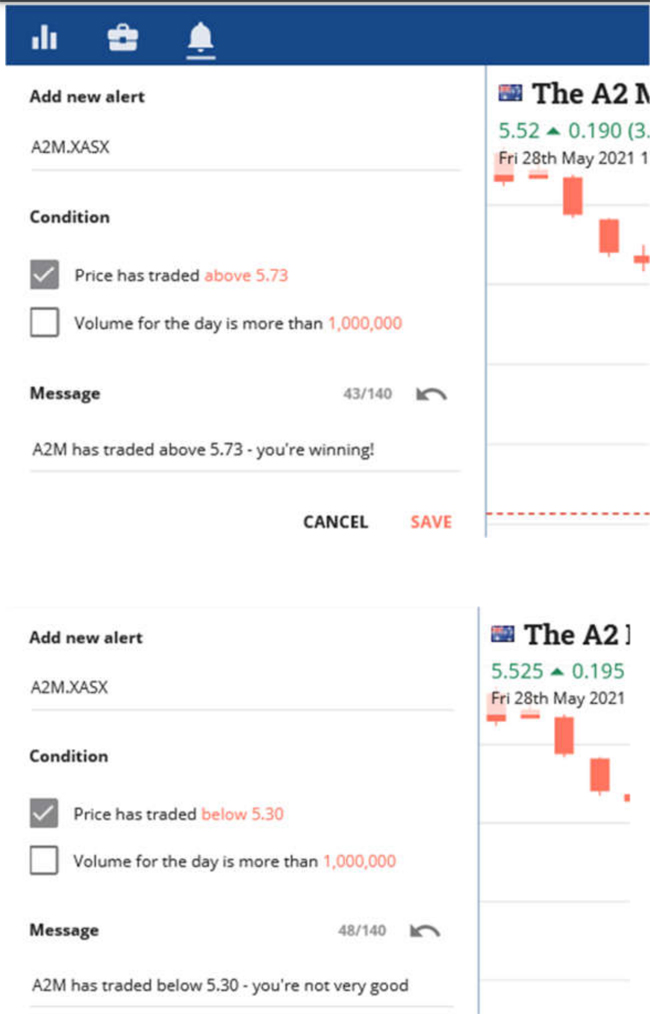

Then it’ll show in your alerts section on the left-hand side, with all of your other ones, as well as the price alerts that you can set. I’ll put one above and below the price so I can get excited or depressed once it’s started to move in one direction, because I can almost guarantee you that I will bail out with a $1000 profit, but will let my losses run.

That is because I am a ‘Special Victim’ when it comes to trading…but, luckily I can even send myself little personalized messages on the alerts to remind myself.

Well, that’s about it for that! I’m an A2M enthusiast, a consumer staple owner and its Friday, the 28th June. Its getting late in the day. I am getting thirsty and know that I’ll still have to work over the weekend, because I have a ridiculous work ethic and, like money, Marketech never sleeps!

So I’ll check back in with A2M come Tuesday when my article is due to be submitted and either celebrate my jaggy win that had little to do with skill – or tell myself that although this trade didn’t pan out that the strategy was sound, and that it was that the market that was wrong…again.

Monday 31st May, 6.10am

DUN. DUN.

I roll over to a ping of news and hope that its some positive drill results or a takeover offer for my biggest shareholding, but to my surprise it’s A2M responding to the media coverage of a pending lawsuit that they know nothing about… Someone was working over the weekend!

So the market responds early, but builds up all day, which can show that sellers are getting tired of selling. When a stock responds in the opposite way to what you would expect, it is usually a sign…of something. Like when a market darling gets a sell-off over what would seem to be good drill results.

Here is the intra-day (1 minute) chart.

Tuesday, 1st June 2021 – A2M trade update…

DUN. DUN.

Pre-open looked solid. The kids on reddit have figured out that there might be a class action and are busily slagging it off and talking about getting involved because they lost their lunch money. Another good sign.

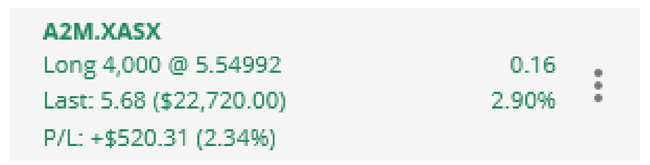

Opens hard, up over 3% within minutes. Here’s the portfolio view now – should I take the $500 and run?

I’m going to say yes, I probably should – because this all happened very quickly. $500 in 2 days is about $60k a year annualized, just off a $22k investment from a bounce in a stock that I know little about, and entered because I thought it had hit ‘peak hate’.

I love the stockmarket. But, I am also a special kind of victim so I’ll probably hang in there and lose it on the next piece of bad news.

And finally, in closing, please don’t trade like I do, but definitely Trade with Focus.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.