Trading with Focus – How to bounce trade like a BOSS!

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Back during the great, short mining boom of 2009 to 2013, when a large amount of money was being made on the ASX, a young Calvin Harris rocked many a stockbroker and trader on Australian dancefloors.

Probably in the Canadian nightclubs too, as they also had a mining boom, but their dancefloors probably still lay down mash-ups of the ‘I wear my sunglasses at night’ guy and Avril Lavigne whilst everyone says very polite things to each other about ice hockey.

One of his catchier songs (featuring the bird that is famous for singing about her milkshakes enticing young gentlemen into the yard) is a song called ‘Bounce’. It had some great trader lyrics that resonate with one of my favourite trades – the bounce trade.

“No way to stop it, now you wish that you could (Bounce)

When the weekend comes I know I feel alive (Bounce)

You will be the last thing on my mind (Bounce)

No regrets, do you know what that means (means, means, means, means, means)” (DROP! Keyboards, french horns, whistle etc)

Great tune.

Anyway… I’ll keep the BS short this time because there’s a bit more to get through if you’re going to get through all my key takeaways.

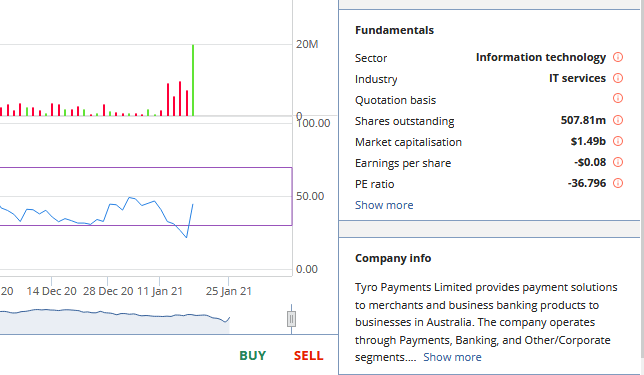

You probably read about Tyro getting spanked. Here’s a snapshot of what they do, from the fundamental information section of the new Marketech Focus trading platform that is taking the world by storm!

If you want to know more about them or look at their live prices or play around with the charts, just go to our website and register for a free trial. I’d throw in some free milkshakes of my own, but you do not want that.

Two weeks access, no commitment apart from using your email address to create a log-in, live streaming pricing, solid value.

So exactly what happened to Tyro doesn’t really matter now, and I didn’t really read the announcements, and the bounce is already in. And the stock is up nearly 30% on the day.

So how do you find the next one?

First though, I need to state, this is a high-risk trading strategy for degenerates. It’s not a buy and hold, you’ll lose sleep and money quite a few times and it’s something you need to be on the ball with.

In, and out. Don’t do it unless you can take a few financial punches, and shrug them off.

So let’s do some good old-fashioned ‘looking in the rear vision mirror’ so that you can understand how this played out.

First, Tyro‘s a $1.5b company, but still unprofitable, so like Afterpay they are highly speculative even though they are big. But it’s these massive, high risk, unprofitable tech plays that can swing from the beloved “I’ll never sell this stock” to the hated “OMG how am I down so much” changes in sentiment that provide the backdrop for a great bounce opportunity.

You just need for them to get spanked first, then wait for the right catalyst. It’ll happen to Afterpay one day, mark my words… no way they’ll overtake Macquarie, surely?

Tyro has failed to breach that $4.50 price point three times in the last year. Triple tops are believed by many to be a foreteller of doom. Dr Google, that trading wizard, highlights that a triple top is a fairly common technical indicator, indicating that the stock is no longer rallying and will potentially lead to a decline.

Some really solid market science there; it’s not going up so it will probably go down.

Equally, the tops all coincided with a spike in the RSI, which is the ‘relative strength indicator’ that the Doc believes is an indicator that a stock is overbought, which is a scientific term for ‘it went a bit too high’. Or low.

Remember, these indicators often work just because people believe them to do so, and the first book a noob will read is ‘Technical Trading for Dummies’, so the more noobs there are, the more technical trends work. And there sure are a lot of noobs at the moment…

Woody, with hints of trader blood

So this highly speculative, profit-less, massive technology ‘growth’ company had a few hiccups, in so much as a large number of their EFTPOS terminals went on the blink, or something like that. As someone that runs a tech company, few problems scare me more than that lovely green flashing light flicking to red (BTW, it hasn’t happened yet, just in my nightmares).

So, the company started drifting off the overbought RSI, and started dropping out of a post-COVID uptrend around the time that Sydney copped another lockdown. Less trips to the mall equals less EFTPOS transactions I guess. But then, things started to speed up the sell-off when the tech problems kicked in. Oof.

For a connoisseur of the bounce, this is the sort of company you would then want to load onto your watchlist. Traders’ blood in the streets is like fine champagne to a bounce mercenary.

So the next thing you would want is to have a clear understanding of when the absolute worst moment is in, and what could form the catalyst for a rebound. Because at some point you’ll need to decide whether this company is going to go broke or recover from a bad experience.

Short-sellers were circling and putting out their opinion to the financial press, so headlines were (probably) starting to question their ability to survive – because no-one loves bad news like the people that sell advertising wrapped around news articles, so they stick in the boots where they can.

The stock drop then starts to speed up, down from a high of $4.50 to $3 already, then a slight flutter before the bounce traders favourite indicator occurred; total, panicked capitulation. The stock gets slammed another dollar and is in freefall. Facebook tip groups would be squealing!

Notice that the stock is now ‘oversold’ on the RSI. And goes into a trading halt. Something either very bad is about to happen – and shareholders are going to cop some more of the same pummeling – or perhaps not so bad – and the stock might just have a violent rebound.

This is the time to have your news alert set. Here’s a snapshot of an alert from Marketech Focus, the ‘help-iest’ trading butler on the market, that also happens to have very, very low brokerage rates (even though your stock is on HIN and even though it has live pricing, not that nasty old pooled trust/delayed pricing stuff like a lot of them do these days).

I run a lot of alerts, volume, price, news. Mainly because I have a job, and can’t stare at the screen all day. It’s not an email alert, because you probably get too many emails already, it’s not an SMS alert, because they usually charge you 50c for each one of those even if you don’t notice it. It’s a free notification from our app, because that’s how technology works nowadays. You don’t even have to open your phone to see it, and it cuts through the noise of less important things, like work.

So today, armed with an RSI that is oversold, a bundle of short sellers that are itching to rebuy the stock (that they have sold without owning it and have to give back), a solid period of raw capitulation, a seemingly endless stretch of negativity from the media (well, a few days probably, I wasn’t paying attention) and a halt to trading for a few days, then surprise, surprise, the company releases a positive update to remind you that their world is not ending.

Even without the tech performing at its peak, they are still processing more transactions than this time last year. They are getting the EFTPOS terminals back online, this isn’t the end, it’s probably just a glitch. They directly address the “false” claims of the short-sellers, and now the media immediately flip-flop and start renaming them as ‘short-selling vultures’ probably. The stock reopens.

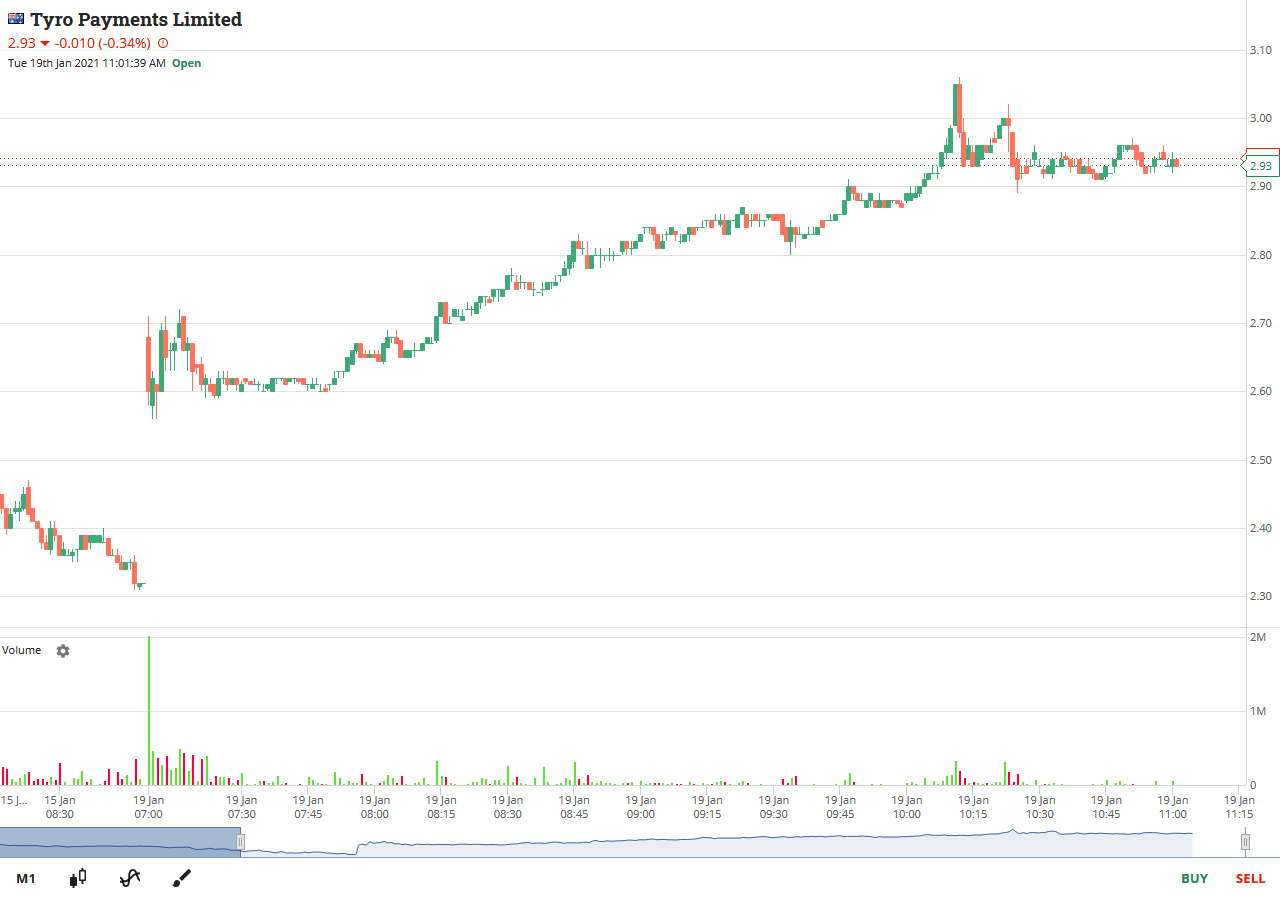

So, according to the intraday chart the stock opens strong, and rallies hard. Unless the short-sellers have some new claim they can roll out today, the herd is against them and they are probably taking a bit off the table, meaning they have to buy back that stock alongside the normal punters, who are looking for oversold stocks to buy on a catalyst. Twice the demand, when a lot of sellers have already sold, so the path of least resistance is up.

Here’s the one-minute intraday chart on Marketech Focus with live pricing. (You got live streaming intraday technical charts on your PC and phone? ‘Course you do.)

So, at this stage, the stock is up from $2.60 to $2.90 intraday, meaning a $10k trade would be worth $11,200 less brokerage. Take off the cost of brokerage, which would be $10 ($5 for each leg) if you were trading at Marketech, and boom, you’ve made yourself a new stimulus cheque in a day.

Bounce!

High risk stuff. Be careful. Use your charts and alerts and new understanding of crowd behaviour, and decide what you are prepared to lose beforehand if you are wrong because this trade doesn’t play out like this every time, otherwise I’d be floating around on my mega-yacht, not working long hours trying to entertain you in between pitching our product.

But here goes, one more time….

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC. You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.